Canada is embarking on one of the greatest defense buildups in its modern history. The government has announced it intends to triple defense spending, amounting to more than C$1.2 trillion (US$900 billion) in total spending over the next decade. The spending surge will create opportunities for companies across Canada’s industrial base, including for many that never considered themselves part of the defense sector. And it is poised to be a potential catalyst for economic growth and innovation.

Canada can capture these opportunities—and ensure that strengthening its defense capabilities returns the greatest economic benefit—by broadening its industrial base. Priority programs such as destroyers, submarines, and military aircraft represent both a chance to expand the capacity of domestic prime contractors and to embed more domestic companies into the value chains of contractors from allied nations. The public and private sectors will need to collaborate closely to align investments to ensure Canadian industry builds the needed capabilities and scale.

The New Defense Spending Blueprint

Canada’s defense budget is entering a transformative phase. The government’s goal is to invest 5% of GDP on defense by 2035, from just 1.4% in 2024. Canada is already moving toward this target by boosting defense spending by $9 billion to reach 2% of GDP in 2025. Planned increases would amount to an additional $540 billion investment over the coming decade, which would be nearly double the 2024 projection.

Although the specifics still need to be designed, the blueprint calls for structural changes in the way Canada spends on defense. They include:

- A sharp increase in the share of funds dedicated to equipment, from 19% now to 35% by 2030, with an emphasis on destroyers, submarines, and air defense systems.

- Around $285 billion in investment in infrastructure—both “dual use” and specifically for the military—from Arctic seaports and northern logistics hubs to upgraded telecom networks and electrical grids, based on our analysis.

- A willingness to use defense spending to develop Canadian industries, implemented by a new dedicated defense procurement agency.

Defense platforms are expected to account for around $550 billion of the new spending blueprint over the next decade. While details have yet to be released, our analysis suggests that naval programs, led by River-class destroyers and an upcoming renewal of Canada’s submarine fleet, will remain the largest single area of spending.

Defense platforms are expected to account for around $550 billion of the new spending blueprint over the next decade.

Canada will also be spending significantly on space and air capabilities. Priorities include modernizing the North American Aerospace Defense Command and focusing on intelligence, surveillance, and reconnaissance programs in the Arctic. Land and missile systems will likely receive relatively less emphasis, although there will be new opportunities in next-generation armored vehicles and ground-to-air systems.

Opportunities Across the Industrial Base

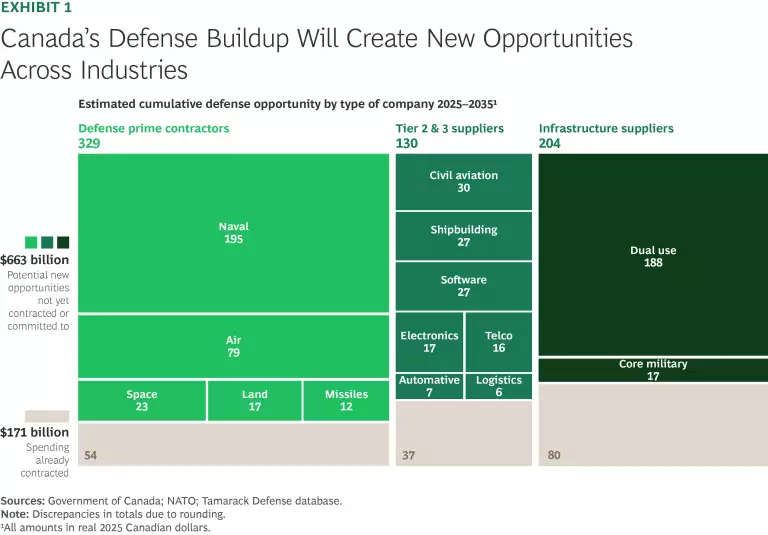

The new defense spending blueprint will create significant opportunity for Canadian businesses—from traditional defense contractors to technology startups and infrastructure builders. We estimate that nearly 85% of the defense platform spending is still “white space” that remains to be contracted. What’s more, 30% of that spending may be addressable by nondefense companies, which can serve in the supply chains of defense prime contractors.

Infrastructure is another high priority. Canada intends to meet a new North Atlantic Treaty Organization (NATO) investment target of 1.5% of GDP on dual-use infrastructure serving both military and civilian functions, for a cumulative $250 billion over the next decade. Based on stated priorities, we expect that major new projects will include northern roads and logistics hubs, a deep-water Arctic port, and infrastructure to support mining, refining, and transporting critical minerals. Investment in military-specific infrastructure, such as housing for the Canadian Armed Forces, is also expected to more than double on a yearly basis, reaching $35 billion to 2035.

Three types of companies are poised to seize the opportunities in the defense sector. Defense primes—major contractors responsible for designing, integrating, and delivering complete defense platforms, Tier 2 or Tier 3 suppliers of specialized equipment and components, and infrastructure firms. (See Exhibit 1.)

Defense Primes. Canada’s space prime contractors are well positioned to take advantage of new spending. So are naval contractors. Other domains, such as aircraft, land-based systems, and missiles, are primarily served by foreign prime contractors, although some of that work is done through the Canadian operations of companies such as General Dynamics and Bell Textron.

Securing local production for these global programs will be critical for Canada to maximize the direct and indirect economic impact of spending on platforms. This will also create opportunities for domestic suppliers to participate in global platform value chains. The ramp up in spending also creates an opportunity to stimulate the development of a few new national champions over the next decade.

Stay ahead with BCG insights on the public sector

Tier 2 and Tier 3 Suppliers. An estimated $170 billion in defense equipment spending through 2035 will be accessible to subsystem providers, dual-use technology firms, and companies that specialize in services such as maintenance, repair, overhaul, simulation, and training. As in Europe’s military buildup, these opportunities also extend to nondefense firms. Leading Canadian aerospace, software, and logistics companies that already participate in global prime supply chains are particularly well positioned to win business.There is also significant potential for smaller, emerging firms, especially those driving advancement in such leading-edge priorities such as drones, autonomous control, and connectivity. By becoming embedded into global prime supply chains, such companies can gain access to opportunities several orders of magnitude larger—provided they can meet defense-specific certification, security, and capacity requirements.

An estimated $170 billion in defense equipment spending through 2035 will be accessible to subsystem providers, dual-use technology firms, and companies that specialize in services such as maintenance, repair, overhaul, simulation, and training.

Infrastructure Providers. The third major opportunity stream—valued at roughly $250 billion—comes from dual-use infrastructure investment. Engineering, construction, energy, and telecom firms already operating at the national level are well positioned to capture this opportunity. The greatest potential lies in new projects, including northern roads, deep-water ports, and logistics hubs designed to strengthen supply chain resilience and Arctic sovereignty. These investments will not only underpin defense readiness but also generate enduring economic and social benefits across Canada. What qualifies as “dual use” is not yet clearly defined, however. As the investment framework takes shape, it will be essential to ensure that the designation enables speed and coordination—rather than additional complexity that delays delivery.

Actions for Maximizing Canada’s Economic Benefit

Canada’s defense spending surge is likely to balance three national objectives: delivering world-class military capability, maximizing value for taxpayers, and strengthening domestic industrial sovereignty. (See Exhibit 2.)

Achieving this balance will require making tradeoffs. For example, Canadian prime contractors may have world-class capabilities but higher cost structures due to limited scale, while low-cost providers may lack the capabilities of international primes. Striking the right balance will also require deliberate strategy and sustained coordination between the public and private sectors. This will be critical in determining whether the new defense spending blueprint can translate into executable projects.

For Canada to achieve its national objectives, we see three central sets of actions that the public and private sectors can take to support them.

1. Co-develop a ten-year strategic public-private roadmap. Canada can develop a transparent roadmap over the next decade for new defense spending while providing guidance for industry. This clarity will enable companies to raise capital, expand their capacity, and scale up their operations.

Public Sector Actions:

- Produce detailed projections of future defense demand and spending so companies can align their investment and capability-development plans. Refresh the roadmap every two to five years.

- Coordinate with economic development institutions, along with the newly announced Defence Investment Agency, to align industrial development with anticipated defense needs. Coordinate resources planning, such as labor force strategies and ensuring access to materials.

Private Sector Actions:

- Shape corporate strategies and mobilize resources to align with Canada’s defense demand and to fill industrial gaps.

- Clearly articulate the benefits of embedding Canadian companies more broadly into the defense ecosystem in terms of the economy, job market, national security, and development of stronger domestic capabilities. Companies can present their value proposition to the federal government, both individually and as part of industry clusters.

2. Anchor global programs in Canada. Canada’s defense budget, even after recent increases, represents only around 1% of NATO equipment spending and 10% of US spending. Therefore, Canada has limited ability to build defense national champions with demand alone. Instead, the opportunity lies in participating in global programs by leveraging Canada’s strong industrial expertise in certain areas, such as aircraft manufacturing, space robotics, and microsatellite platforms.

The opportunity lies in participating in global programs by leveraging Canada’s strong industrial expertise in certain areas, such as aircraft manufacturing, space robotics, and microsatellite platforms.

Public Sector Actions:

- Map out Canada’s defense industry ecosystem to identify and support both established companies and emerging ones to become globally competitive in portions of platform value chains. Identify key technologies needed to meet future global priorities in which Canadian industry is differentiated.

- Form partnerships with allies to identify programs where Canada can contribute critical capabilities and play a strategic role globally. A joint review of past defense programs can help identify winning strategies and vulnerabilities of past approaches.

- Strengthen the accountability of foreign vendors that have fallen behind in meeting their obligations to contribute to Canada’s economy under the Industrial and Technology Benefits program.

Private Sector Actions:

- Secure partnerships with prime contractors and other members of the defense ecosystem to integrate into targeted programs.

- Work with policymakers to identify and shape opportunities for domestic companies to participate in defense platform supply chains.

- Collaborate with academic institutions to develop talent and R&D for technologies needed for advanced defense systems.

3. Unlock critical enablers. To gain access to the defense market, Canadian firms likely need to navigate complex rules, lengthy approval processes, and limited access to capital. This makes the endeavor costly, time-consuming, and risky, which can deter new entrants, hinder innovation, and reduce resilience by concentrating production to a very narrow pool of suppliers. Breaking down such market barriers is essential.

Public Sector Actions:

- Streamline procurement processes by adopting an outcome-based approach, simplifying procedures, and accelerating onboarding programs for small and midsize enterprises.

- Accelerate access to capital for defense projects by simplifying grant and contribution policies, strengthening accountability for outcomes, and aligning public and private funding with clearly articulated priorities.

Private Sector Actions:

- Secure resources for success by ensuring access to talent, capital, and critical inputs to capture market opportunities and enable rapid scaling.

- Upgrade processes and facilities to meet defense standards and obtain necessary certifications and security clearances.

- Collaborate with the public sector to promote and support social acceptability of defense investments.

In addition to fortifying national security, the defense spending surge is a historic opportunity for Canada to transform virtually its entire industrial base, upgrade infrastructure, enhance resilience, and position domestic companies to be global players in an array of next-generation sectors. Achieving this potential will require planning and coordination among the public and private sectors to ensure that investments are aligned with future defense needs and that the greater funding generates maximum benefit to the Canadian economy.

The authors would like to acknowledge the contributions of Luc Cassivi, Nancy Chahwan, Andreanne Leduc, Adam Gordon, Eliot Vincent, and Christine Wurzbacher to this article.