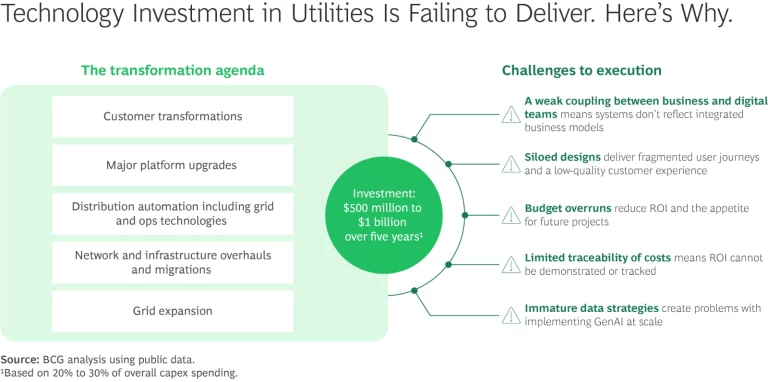

Electric utilities such as distribution system operators and retailers are investing heavily in tech-driven change—many have spent $500 million to $1 billion over the past five years. Major platforms such as customer care and billing, finance, supply chain, enterprise asset management, and network management are being renewed and upgraded, each a substantial program with associated risk. Yet the return from this once-in-a-lifetime investment is patchy at best.

Energy companies need a clear strategy with three focus areas to unleash the true value of their investments. This strategy will also accelerate their shift from asset-heavy monopolies to agile, customer-centric service providers.

Stay ahead with BCG insights on energy

The So What

Companies distributing or retailing electric power face many challenges. They are at the sharp end of decarbonization, with regulators pushing for a rapid reduction of emissions. At the same time, customers expect increasingly seamless digital experiences, while investors demand capital efficiency. Traditional models for these firms are crumbling. For instance, customers now generate and sell power back to the grid, turning simple supply deals into complex, dynamic exchanges that challenge both network and billing systems. Software and services made up just 3% to 5% of grid investment from 2016 to 2022, but based on industry data and BCG experience, this will reach 8% to 12% from 2041 to 2050.

For gas distributors and retailers, the decarbonization picture is different, but the short- and medium-term pressures are no less intense. Regulators require capital efficiency, customer expectations are high, and investors demand strong returns.

This is why both sets of energy companies are pushing forward with a slew of new platforms. In other industries, each platform would be considered a major program; these companies are in many cases managing seven programs at once and pouring billions into tech.

Until energy companies deliver on this ambitious portfolio of change, they will be stuck with outdated, fragile technology infrastructures that fall short.

But until they deliver on this ambitious portfolio of change, they will be stuck with outdated, fragile technology infrastructures that fall short. Problems include (see the exhibit):

- A weak coupling between business and technology teams

- Siloed designs

- Budgetary overruns

- Benefits that are hard to track back to projects

- Immature data strategies

These problems come amid heightened regulatory scrutiny, increasing the risk that the costs of these pricey programs will not be recoverable.

Now What

Breaking this impasse requires a strategy with three areas of focus, each of which reinforces the others.

Strategic focus 1: Drive business outcomes, not technology, that will unlock the most value

With investment funding and talent limited, organizations that want across-the-board transformation will instead need to make tough calls on priorities. But this inevitable prioritization is complex because the programs are connected and have dependencies. Rather than simple ranked prioritization, a more sophisticated approach is needed with programs mapped, relationships analyzed, and priorities decided on a dynamic basis.

The conceptual breakthrough here is to drive business outcomes, not technology. Companies must start by building a digital and AI outcome map that lists all the business capabilities that matter and then ranking them in three dimensions: the impact on the customer resonance, financial impact, and regulatory importance. This ranking poses difficult questions, but the process brings clarity.

Each of these outcomes then needs tracing back. For instance, to drive a 20% improvement in System Average Interruption Frequency Index (SAIFI) at an electricity network, the capabilities would include automated outage detection, predictive vegetation management, and dynamic switching. This list should be focused: 8 to 12 capabilities per outcome is typical. Then they must identify the data that powers those capabilities and formalize the data owner, a service level agreement (SLA), and access policies.

Strategic focus 2: Build a modular technology and data platform to future-proof the business

To deliver on these outcomes across a complex web of programs, organizations supplying electricity and gas need a “next-gen utilities” framework, a scalable, modular architecture. Starting from the top:

- Customer-Centered Interfaces. Web portals and mobile apps, proactive agents, and AI chatbots that provide an “energy at your fingertips” customer experience.

- Smart Business Capabilities. Personalized energy insights, seamless digital experiences, and optimized tariffs, driving stronger customer engagement and satisfaction—enabled by GenAI.

- Liberated Data, Used as an Asset. Smart-meter, grid, and market data transformed into actionable intelligence that enables proactive operations and a faster response to market shifts.

- Efficient and Automated Processing. Automated billing, compliance, and asset workflows that reduce costs, minimize errors, and ensure transparency for regulators and customers alike.

- Resilient and Future-Ready Foundation. A scalable technology backbone built on cloud, a DevOps toolchain, and agile workflows.

The modular approach means components can be upgraded without reworking the entire stack, crucial to accommodate rapid shifts in regulation, AI capability, or business model, such as increased consumer use of renewables for electricity companies.

It also drives investment efficiency: reusable data products cut marginal costs, and cloud-native applications avoid stranded on-premises capex. In-house APIs and libraries can boost developer productivity by 30% to 50%.

In addition, the modular approach facilitates security and compliance-by-design with capabilities including zero-trust access, automated policy enforcement, and data lineage tracking. Building these into the architecture ensures that audit requirements do not slow innovation.

Another activity runs through all these layers: digital talent development. Many of these companies are operating with an older workforce: some have an average employee age in the fifties. There is an urgent need to upgrade technical skills and drive a digital-first mindset.

Strategic focus 3: Connect the dots across transformation programs

The way is now clear to clarify the investment portfolio and manage interdependence. Key milestones can be set. This in turn helps de-risk the investment portfolio and drive value.

At a practical level, delivery can be oriented around business outcomes and value streams that link to the bigger picture. This clarity also facilitates ongoing value delivery and reporting. Each team within the portfolio can report on delivery in terms of business outcomes instead of technology installed, tracking at the portfolio level and ensuring consistency for reporting across teams.

It’s important to note that this process of connecting the dots is not a one-time exercise. It needs to be set up as a continuous process.

If programs start under-delivering:

- Check priorities. Ensure that programs are integrated.

- Find any faulty connection points and resolve them.

- Identify the programs that are delivering value fastest and prioritize them. Consider delaying those where the payback is slower.

The Idea in Action

Transformative results are possible. A leading North American electric utility collapsed 12 legacy billing systems into one cloud customer platform. The customer impact was stark: application for a new connection was cut from 10 days to 20 seconds, with 40% of calls diverted to AI chatbots and self-service.

Equally impressive were the results when a European electricity distribution network operator implemented a data-driven approach to manage and maintain its assets. The transformation included leveraging machine learning to predict equipment failures and optimize maintenance strategies, and using AI to dynamically reprioritize work orders for more effective field execution. The impact: a 15% reduction in total expenditure (opex plus capex, as measured by regulators), a 25% improvement in margin loss reduction, and a 10% increase in the efficiency of field work planning—driven by automation and better prioritization of tasks.

These are valuable results. But, crucially, the three-focus program means organizations can deliver multiple outcomes like these simultaneously, driving value across the organization. Broader benefits include:

- 20% to 50% uplift in customer satisfaction scores

- 20% to 50% improvement in workforce utilization

- 10% to 20% reduction in operations and maintenance spending

Following this three-focus strategy means companies in both electricity and gas finally have a clear path that delivers enterprise-wide value from their extensive digital investment.

Better yet, this strategy enables power utilities to meet their complex challenges. They can now deliver the value demanded by regulators, employees, and customers, play their part in the energy transition, and break free from tradition to become truly customer-driven service providers.