Sluggish demand growth, continued capacity expansion, and mounting geopolitical and environmental pressures have created a perfect storm for petrochemical producers worldwide, resulting in the lowest margin levels in over a decade. While some companies have begun to rationalize capacity, a substantial portion of the sector still depends on old, uncompetitive, and subscale assets.

In this volatile landscape, leading companies are using consolidation to reduce costs, strengthen resilience, and reposition for long-term relevance. As this trend continues, the petrochemical market will likely take one of three different forms: (1) feedstock-rich regions and growth markets lead global trade; (2) national oil companies (NOCs) dominate through scale and integration; or (3) protectionism drives the emergence of regional champions.

Petrochemical companies should weigh these different scenarios to plan their strategic positioning and determine how best to use consolidation to create value. Players that act now will be best positioned to not only survive the current disruption but to lead through it.

Challenges on the Rise

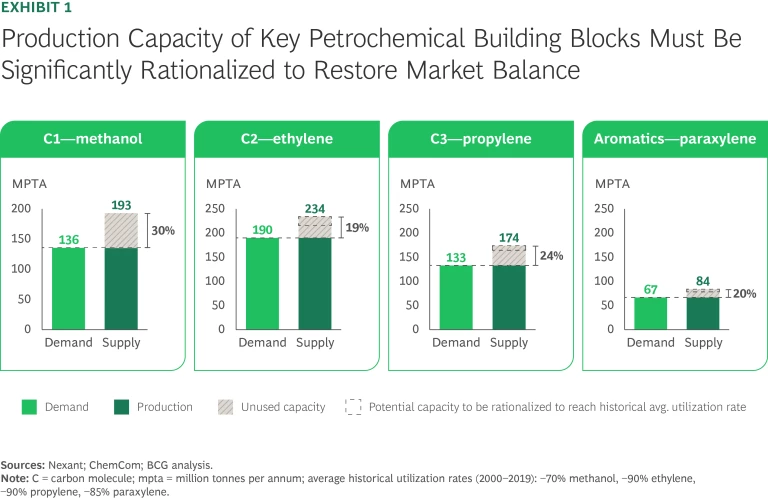

The recovery after the height of the COVID pandemic boosted many industries but has failed to stabilize the global petrochemical sector. Today, the industry faces extreme volatility as supply-demand imbalances escalate. Demand growth has slowed and is expected to continue slowing over the next decade, which will likely ensure that oversupply persists. Global utilization rates for key commodities such as ethylene and propylene have plummeted and are forecasted to remain well below their historical averages, exerting pressure on margins and increasing competition. Meanwhile, the competitive landscape has heated up as players in China, the Middle East, and North America continue to build their production capacity.

Declining Financial Performance—and Shareholder Returns. These developments have hit global petrochemical companies hard. The average return on capital employed (ROCE) for global petrochemical companies fell from 8% in 2019 to approximately 4% in 2024. During this period, EBITDA for global petrochemical companies plummeted from 17% to about 12%, which greatly limited players’ ability to reinvest in decarbonization or downstream integration.

Shareholder returns reflect this decline in performance. Between 2019 and 2024, the annualized TSR of petrochemicals was –1%, far lower than the S&P 500 return of 15.3%.

Many petrochemical companies are feeling the pain, particularly those in regions where feedstock advantage or market access is limited. Unless these players take steps to remedy the situation, they are likely to fall behind.

Rationalization Measures. Recognizing this reality, some petrochemical companies have already begun rationalizing their manufacturing capacity, especially in Europe. Since 2023, players have reduced capacity there by nearly 14 million tonnes per annum (mtpa). This includes Sabic’s closure of its Olefins 3 cracker in the Netherlands, ExxonMobil’s closure of its Gravenchon steam cracker in France, and Dow’s decision to temporarily idle its LHC3 cracker in the Netherlands.

These are certainly steps in the right direction. But to restore market balance and achieve operating rates that can support long-term investments, more rationalization is needed globally—we expect 10 mtpa of capacity is needed in cracker capacity alone. (See Exhibit 1.)

Stay ahead with BCG insights on energy

The Consolidation Solution

In the current business environment, M&As offer petrochemical companies access to some crucial sources of advantage:

- Feedstock. Consolidation provides companies with a way to expand their access to traditional feedstocks like crude oil and natural gas, thereby lowering production costs. Ineos, for example, acquired various oil and gas assets in the North Sea.

- New Markets. For some companies, consolidation offers a way to enter high-growth markets, such as Asia-Pacific. For instance, Saudi Aramco acquired a stake in Rongsheng Petrochemical, a Chinese company known for its production of paraxylene and purified terephthalic acid. The acquisition continues the growth of Saudi Aramco’s downstream presence in China while supplying Saudi Arabian crude to China’s largest integrated refining and chemicals complex.

- Technology. Companies can also use consolidation to gain access to proprietary technologies that can lower R&D costs or improve manufacturing capabilities. For example, by acquiring DuPont’s Mobility & Materials division, Celanese greatly expanded its portfolio and became a leader in engineered polymers and advanced materials.

- Portfolio Diversification. Some companies pursue M&As to build out their core offerings and create a platform for future ventures. Indorama Ventures was able to solidify its position in the diversified chemicals industry by acquiring Huntsman’s intermediates and surfactants businesses.

- Greater Control over Value Chain. Companies use vertical integration to capture more value upstream, downstream, or both. The purchase of Covestro, a German plastics manufacturer, helped the Abu Dhabi National Oil Company enter downstream in high-value polymers and high-performance material markets.

Consolidation Opportunities. The consolidation trend is quickly gaining steam. More than 300 deals were announced in 2024, among them Ineos’s acquisition of TotalEnergies’ 50% stake in Naphtachimie, Appryl, and Gexaro, which were previously joint ventures of the two companies. More transactions are anticipated in 2025, including an announced signature deal whereby Borealis and Borouge will merge; the new entity, Borouge Group International, will acquire Nova Chemicals for US$13.4 billion. And Orlen is set to acquire Azoty’s polyolefins business.

The consolidation trend is quickly gaining steam. More than 300 deals were announced in 2024.

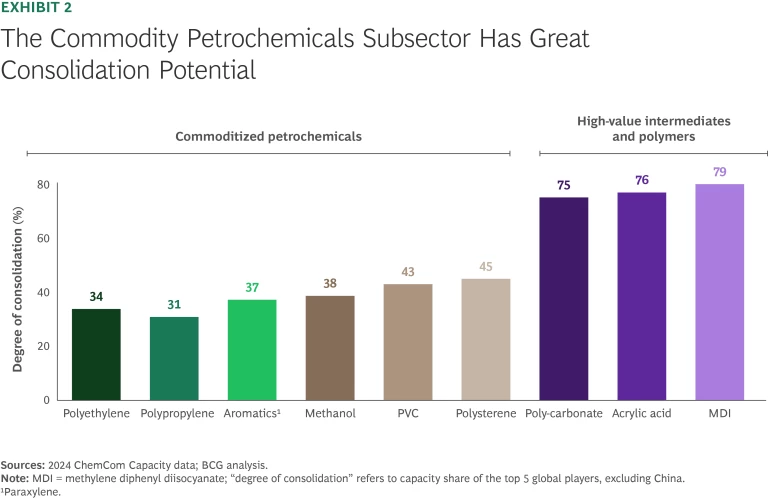

But not all markets are experiencing a high level of consolidation. We observe a low level in commodity petrochemicals, where margin pressures are greatest. (See Exhibit 2.) These value chains offer more opportunities for consolidation than intermediates or high-value polymers, which are already heavily consolidated. The key lies in identifying the commodity petrochemicals that can be consolidated for higher-margin applications.

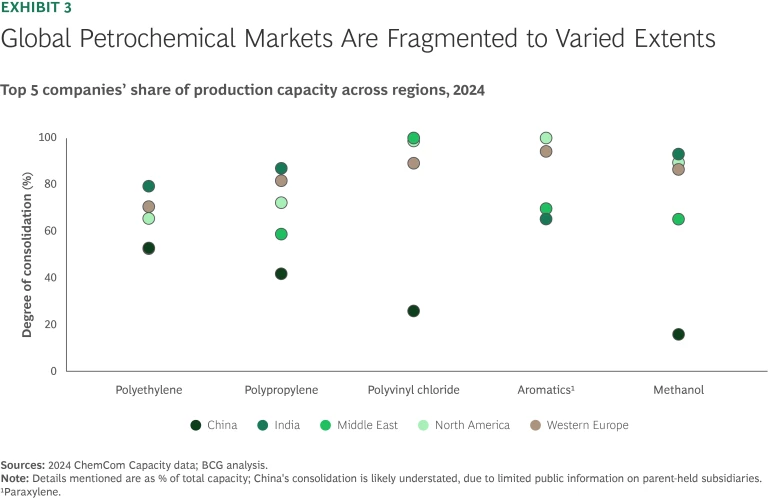

Consolidation Across Regions. Since economic pressures, regulatory frameworks, and political landscapes influence M&A and divestment activity, consolidation activity is uneven across different regions. China’s key petrochemical value chains appear to be the most fragmented, reflecting the scale and diversity of its market. (See Exhibit 3.) Given the country’s vast production capacities, any move toward consolidation in its domestic market could play a pivotal role in shaping global industry trends.

On the other end of the spectrum, markets such as Europe and North America (excluding polyethylene), and India (excluding aromatics) demonstrate relatively higher levels of consolidation.

Predicting the Petrochemical Future

Over the next decade, the petrochemical industry will undergo significant shifts in where and how value is created. Our analysis outlines three possible scenarios for how these changes may play out. (See Exhibit 4.)

Feedstock- and market-advantaged players will be the winners. In the first scenario, leading US players would capitalize on feedstock advantages to dominate exports across the Americas, while Middle Eastern producers would primarily supply Europe and Asia. Meanwhile, local champions could emerge in China and India, taking advantage of local demand and reducing dependence on imports. Companies lacking access to feedstock, market access, or technology advantage would lose out.

NOCs dominate through M&As and scale. In the second scenario, we would see select oil and gas NOCs vertically reintegrating petrochemical businesses to offset the declining demand for transport fuel. M&As and investments in technology, including crude-to-chemical capabilities, would enhance competitiveness and secure access to global markets. As a result, several traditional large petrochemical companies would exit the market. NOCs in China and India would continue expanding and integrating downstream, leveraging domestic demand to their advantage.

Regional champions emerge amid protectionism. In the third scenario, trade barriers and environmental regulations would lead to a decline in global trade and an increase in domestic production. Each region would be forced to develop its own value chain. Consolidation would become the new norm, with two to three players dominant in each region. The global supply curve would flatten, benefiting producers in Europe and Asia and hitting US exporters hard. Players in the Middle East would not be affected by these developments because of their easy access to both eastern and western markets.

How Acquirers and Acquirees Can Best Create Sustainable Value

As these scenarios make clear, no petrochemical company can afford to be complacent. A clear and compelling strategy will be vital regardless of whether the goal is to thrive or simply to survive.

Players’ first step should be to map out their strategic chessboard by product and region to determine what their moves could be in the three different scenarios. Whether acquirer, acquiree, or bystander, this role will largely determine the actions they should take, from building M&A pipelines to shoring up defensible niches. We could also see private investors getting involved in a big way, as AEQUITA’s recent decision to acquire four of LyonellBasell Industries’ production sites illustrates.

Acquirers: Capitalize on Dislocation to Secure High-Value Assets

Acquisitions are a powerful lever for creating long-term value, though the pathway will differ with each company’s positioning, capabilities, and strategic ambition. Given that many companies’ valuations have declined over the past few years, now is a good time to buy. Still, there are multiple factors to consider.

Pre-Transaction Synergy Assessment. In an environment of fluctuating raw material prices, demand uncertainty, and increasingly complex regulation, value creation in petrochemical M&A hinges on a comprehensive understanding of potential synergies across various dimensions.

Given fluctuating raw material prices, demand uncertainty, and increasingly complex regulation, value creation in M&A hinges on a comprehensive understanding of potential synergies across various dimensions.

From a revenue perspective, value can be created through new cross-selling opportunities, pricing uplifts, and enhanced commercial capabilities. Cost synergies can be realized by rationalizing manufacturing footprints, streamlining logistics, and consolidating procurement operations. Companies should also consider optimizing networks; for example, by reallocating volumes to more efficient plants and specializing production lines to lower unit costs while maintaining quality and reliability. Sharing certifications and using AI for demand planning can also be beneficial.

Due Diligence. Potential acquirers should view their due diligence efforts through three lenses—strategic fit, financial discipline, and integration feasibility. This means, first of all, determining whether the potential acquiree enhances feedstock advantage, offers access to new markets, or strengthens the company’s position in the value chain. Acquirers should also evaluate key financial metrics to determine if the merger will be financially viable, assessing the acquiree’s cost structure as well as their own strategies for funding the purchase. And to avoid any post-deal surprises, acquirers need to thoroughly appraise the acquiree’s contract transferability, offtake obligations, environmental liabilities, and permitting risks.

Post-Merger Integration. To ensure seamless execution on day one, the acquirer needs to define clear integration goals—particularly for feedstock, operations, and go-to-market (GTM) strategies, tailoring them the unique needs of each region. Realizing these goals will require a dedicated and well-managed program supported by strong leadership and cross-functional teams. To accelerate synergies and maximize value across cost, operations, and GTM, companies will need to start planning changes to their IT systems, operating models, and organizational structures early. It is equally important to engage employees and customers from the outset to retain key talent and client relationships. And proactive communication will help ensure alignment and minimize uncertainty throughout the organization.

Acquirees: Position for Premium Valuation

Sellers have just as much at stake as buyers. To maximize their attractiveness to potential acquirers, companies aiming to divest or carve out assets need to develop a narrative that clearly articulates the business strategy, the financial profile, and the investor value proposition.

First, sellers should frame the discussion by outlining the company's position within the broader context of global overcapacity and regional demand trends. They should then outline their portfolio vision across key product chains while highlighting how they differentiate between commodity and specialty offerings. Emphasizing strengths such as advantaged feedstock access, proximity to demand, differentiated technology, and the potential for downstream integration can enhance the asset’s strategic appeal. At the same time, it is critical to demonstrate how feedstock flexibility, offtake agreements, and joint ventures can help in managing risks such as pricing volatility, demand shifts, and regulatory uncertainty.

Building on this narrative, the seller should articulate how free cash flow will be used—such as for capacity expansions—and set clear expectations for capital allocation and leverage through chemical cycles. It is also advisable to highlight if it has a buffer for downturns and a disciplined reinvestment approach, because these factors signal strong financial stewardship. Demonstrating cost discipline through metrics such as reduced payback periods will reinforce credibility and investor confidence.

Lastly, the acquiree should speak to the factors that investors care about, whether feedstock advantages, proximity to demand, or potential for vertical integration. This means clearly defining and quantifying the benefits and proactively addressing any gaps. Transparency around performance metrics is essential for building trust and minimizing the risk of post-deal surprises.

Consolidation is likely to play a major role in shaping the next era of the petrochemical industry. As the wave continues to build, few companies can afford to stand on the sidelines. Those that act now to prepare for this new landscape will emerge stronger and more resilient in the years to come.