While world attention focuses on dramatic tariff hikes that are reconfiguring trade flows of physical goods, geopolitics are quietly transforming another major dimension of cross-border commerce: trade in services. Services include everything from tourism and entertainment to finance and retail. They count for up to 60% of global GDP, and even more in advanced economies. And while the estimated $8.7 trillion in services trade in 2024 is around one-third the trade in goods, it’s projected to grow twice as fast. (See “Services Taxonomy.”)

Services Taxonomy

Services transactions fall in four categories defined by the World Trade Organization. The US uses this framework when reporting balance of payments data.

- Mode 1 measures cross-border supply of services.

- Mode 2 measures consumption of a nation’s services abroad.

- Mode 3 measures services provided by a company’s overseas commercial presence through its local affiliates.

- Mode 4 measures services consumed by nationals living or traveling abroad.

Services trade has now come under greater scrutiny. Digitally delivered services—such as cloud storage, software as a service (SaaS), enterprise software, and streamed media—have become prime targets. Governments no longer treat them merely as neutral platforms. Because they power artificial intelligence (AI), enable cross-border flows of personal and business data, and help shape public discourse, policymakers see them as sitting at the crossroads of national and economic security, technological leadership, and competitiveness.

As a result, digital services are moving to the frontlines of global power struggles. Policymakers are asserting greater regulatory control over the storage and use of data, advertising, content, and payment systems. In some cases, they’re banning certain foreign-owned platforms and cloud providers altogether. And they’re increasingly targeting these services as retaliatory leverage in trade disputes.

Stay ahead with BCG insights on international business

This changing global landscape is forcing the international delivery of digital services to fragment. Instead of using single platforms and IT systems to serve customers across the world, firms are shifting to regional models that reflect geopolitical considerations. They’re storing data locally and tailoring their systems and offerings to comply with different rules in different jurisdictions.

The consequences affect a broad scope of companies, which must now reach customers in different ways and store data in more locations. They may also need to overhaul contracts, supply chains, and cybersecurity plans. This digital fragmentation also increases costs by forcing global companies to deploy customized technology solutions to meet specific market requirements.

At the same time, digital service providers are feeling the indirect impact of trade disputes. Higher tariffs on materials, components, and critical minerals—as well as production shifts to higher-cost countries—are raising the cost of the communications hardware that is key to providing services. As a result, many digital service buyers are taking a wait-and-see approach. They’re delaying projects, scaling back discretionary services spending, and diversifying providers to reduce risk.

Providers and their customers can get ahead of these risks—without having to forfeit the advantages of scale. What’s required is a comprehensive approach to anticipating disruptions, protecting margins, and adapting operating models.

The Global Services Trade Landscape

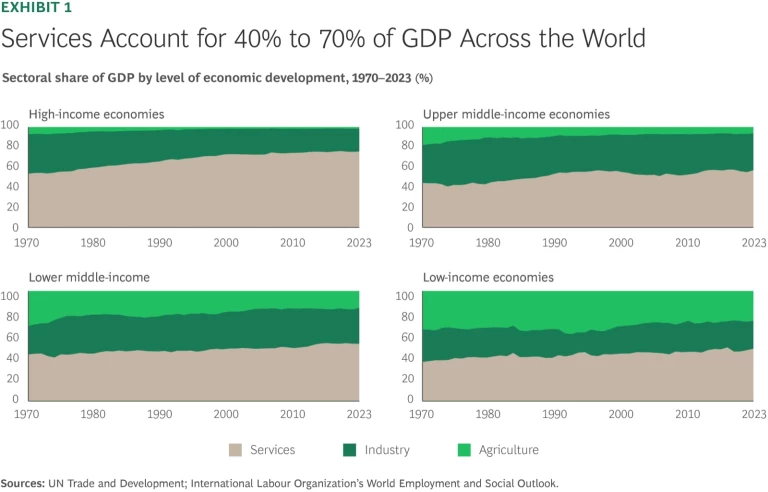

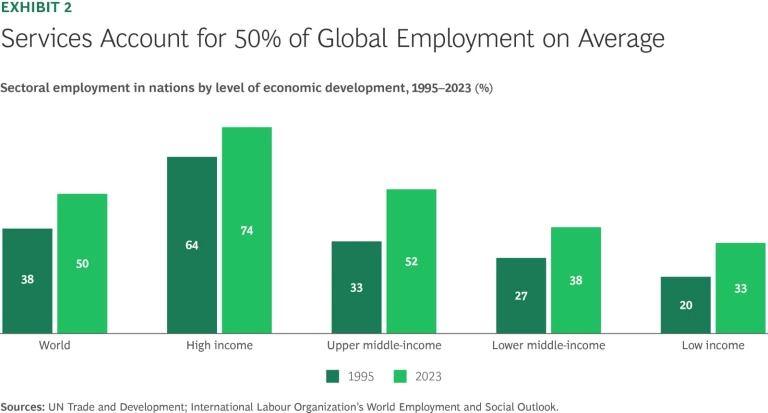

Even in these times of economic and political volatility, services have been a beacon of growth. Services account for anywhere from 40% to 70% of GDP in most nations. (See Exhibit 1.) They have also accounted for a greater share of employment in low- and high-income nations alike. (See Exhibit 2.)

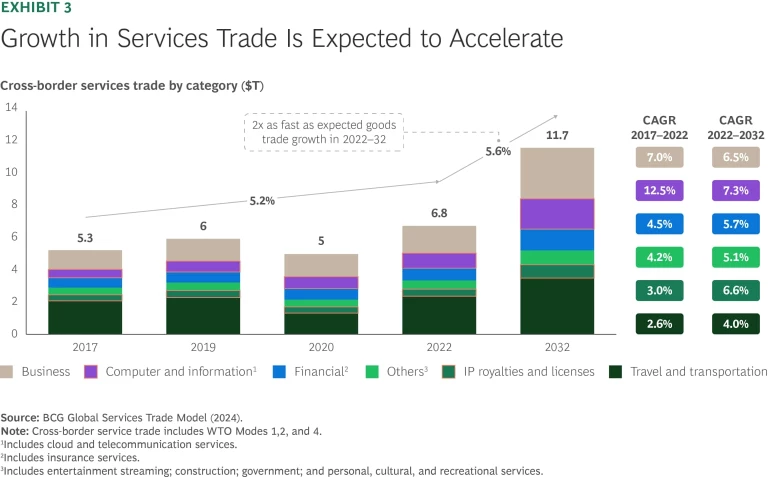

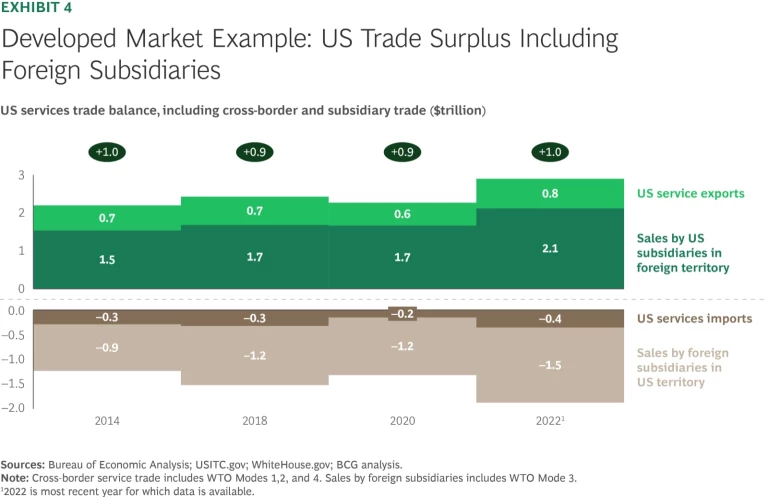

The value of services crossing borders is projected to grow by around 5.6% annually through 2032—twice as fast as trade in goods—to around $11.7 trillion. (See Exhibit 3.) The US leads this trade, with $1.1 trillion in services exports in 2024 accounting for 14% of the world total. In sharp contrast to its large trade deficit in goods, the US runs an annual trade surplus of around $300 billion in services—and an effective surplus of nearly $1 trillion if sales of offshore affiliates are included. (See Exhibit 4.) The US is followed by the UK, with $649 billion in services exports and a $223 billion surplus in 2024; Ireland ($519 billion in exports and a $12 billion surplus), and India ($375 billion in exports and a $91 billion surplus). Although China remains a net importer of services, it is rising fast as an exporter, with $446 billion in 2024.

The services trade landscape could be on the cusp of profound change, however, driven by technological advances and new global players. Services of the future could include AI systems operations, robotics management, and remote monitoring of factories and infrastructure, for example. AI translation and synthetic content generation tools could also open opportunities in areas like customer support and back-office operations, particularly in countries where foreign language proficiency has been a barrier to entry.

Such advances could also alter national competitiveness in services. The export market is currently polarized. High-cost nations specialize in IP-rich services. The US, for example, leads in digital-intensive sectors requiring scale, IP generation, and innovation, such as media and information, financial, and business services. The UK is a leader in financial, legal, professional, and creative services.

Low-cost hubs dominate labor-intensive digital services. India’s services exports, for example, are driven by cost-efficient IT services, consulting, business processes, and software development.

No country is yet strong in connecting both high-skill and cost-efficient delivery at scale. But China, for example, has the potential to get there. It is rapidly increasing investments in AI, digital infrastructure, and end-to-end service integration.

How Trade Actions Are Creating New Vulnerabilities

A downside for nations that have large service export surpluses is that they expose them to potential retaliation in trade disputes. Unlike goods, it’s inherently difficult to assess tariffs on services. They’re harder to define, measure, and track as they move across borders. They’re also intangible and often delivered digitally, bypassing ports and customs stations.

Services are, however, easier to restrict. They’re increasingly subject to a range of non-tariff measures traditionally taken out of concern for privacy, data security, and competition—but are now more frequently used to advance strategic interests or as leverage in negotiations. In December 2023, for example, the EU adopted the Anti-Coercion Instrument, a legal framework allowing it to impose restrictions on trade and investment—including in services—in retaliation for allegedly abusive trade actions taken by other nations. Although it hasn’t been used, that option remains open in the future.

Other non-tariff tools include:

Regulatory actions. China placed several US digital firms on its Unreliable Entity List, a tool used to ban companies that allegedly endanger national interests. It also banned Google Cloud and Amazon Web Services in retaliation for US export controls on semiconductors and AI chips. In 2023, India enacted legislation requiring local storage of AI models and personal data, targeting SaaS, AI, and fintech firms in the name of strengthening digital sovereignty and cybersecurity.

In Europe, the Digital Markets Act and General Data Protection Regulation are reshaping the rules for platforms. The European Commission recently fined Apple €500 million for restricting payment options and Meta €200 million for its “pay-or-consent” advertising model. Separately, Google was fined €2.95 billion under EU antitrust law for its competitive practices in advertising technology. Company appeals of the fines are underway. These moves are forcing the platforms to change the way they operate in the region.

- Export controls on services. For example, the US now requires licenses for deploying certain advanced AI models beyond its borders. And China has introduced broad regulations that restrict how AI models and algorithms may be shared or used in foreign markets.

- Digital services taxes. More than a dozen nations have introduced taxes, generally ranging from 1.5% to 12%, on revenues from services such as online ads, digital marketplaces, and user data—sectors largely dominated by US firms. Digital services taxes are increasingly used as bargaining chips in trade negotiations. Canada had proposed a digital services tax but paused implementation out of concern for potential US retaliation. The Organisation for Economic Co-operation and Development included multinational service providers in a package of corporate tax reforms. Although G7 nations agreed to exempt US firms from certain provisions, the issue could resurface.

- Investment screening. Governments are more aggressively scrutinizing foreign investment in digital services on national security grounds. Examples are US efforts to force China’s ByteDance to divest from TikTok and Germany’s request for digital platforms to ban the Chinese generative AI app DeepSeek.

Service providers are also absorbing the indirect ripple effects of high tariffs and other trade measures on physical goods. These developments include:

- Indirect tariff exposure. Core hardware like computers, servers, and networking gear, as well as semiconductors, have been temporarily exempted from new US tariffs at the time of this writing as they undergo an investigation under Section 232 of the Trade Expansion Act. But while finished hardware products are exempt, the cost of tariffs and associated supply-chain risks for key materials used to produce them are rising. They include recent US tariffs of 50% on imported steel, aluminum, copper ore, and certain copper products under Section 232.

- Export controls. The US is considering a ban on exports of advanced semiconductors used for AI systems, while China has curbed exports of critical minerals used in manufacturing chips, batteries, and other electronic components.

- Production relocations. In response to trade policies and technology controls, manufacturers of key equipment and components are shifting or considering shifting more manufacturing, including wafer fabrication plants, to locations that are less impacted by policy changes, even if they have higher costs. This has already prompted suppliers of advanced graphic processing units to raise prices.

The Impact on Tech Companies and Their Customers

Digital fragmentation is reshaping the operations of all global businesses—not just services providers. As more governments assert control over data and digital systems, companies are shifting from global models to ones tailored to specific regions or countries.

To understand the implications to tech companies and their customers, BCG recently surveyed information technology buyers from midsize and large US and European companies across a range of sectors. Among the key findings:

Buyers of IT services are more cautious about the near term.

Since new US tariffs were announced, the share of respondents saying they expect IT budgets to grow has dropped from 77% to 56%. Companies that are increasing their IT spending plan to do so by an average of half as much as before the tariffs were unveiled. Spending growth remains resilient for some organizations, however, particularly among those that are advanced in their AI journeys.

Cost control has surged to the top of the IT agenda.

Sixty-three percent of respondents rank cost control among their three biggest priorities—the highest level since mid-2023. The share of respondents preparing for macroeconomic and trade-related uncertainty has jumped to 31% from just 9% in December 2024. Immediate responses to the tariffs include hardware pull-forwards and project deferrals, while mid-term plans focus on supply chain shifts and automation. Budget trimming is widespread, but investments in several sectors regarded as essential are often protected.

Spending in AI persists.

Even in this more volatile economic environment, 80% of companies are either maintaining or accelerating investments in AI technology. AI-mature organizations are leading the way: 40% are using the technology to improve productivity, extract cost savings, and create long-term competitive advantage. Organizations with less AI experience are adopting a wait-and-see approach, with 58% of respondents reporting no change in planned AI investment.

What Leaders Can Do Now

Business leaders need to get ahead of digital disruption—not just react to it. To stay resilient in a fragmenting global economy, we offer a framework called Anticipate, Cushion, and Transform (ACT):

Anticipate impact.

Gain a clear view of where your service businesses are exposed to policy changes in key markets and how you can respond. Build geopolitical muscle and set up a trade command center with a cross-functional team to consolidate intelligence and present it to the C-suite. The command center team should track in real time key risks that could impact operations, margins, market access, and delivery methods—such as digital service taxes, data-localization rules, investment restrictions, and export controls. Use scenario planning to assess how potential retaliation or regulatory shifts could affect your business. Develop Plan B options that are modular, reversible, and region-specific.

Cushion your P&L.

Mobilize teams and use AI tools to quickly identify strategies for offsetting hardware and compliance cost shocks. Reduce unit costs. Consider adapting pricing models, such as by shifting from fixed fees to modular, ROI-based, or outcome-driven pricing that aligns better with client value. Build flexibility into contracts by using cost-escalation clauses, shorter terms, and add-ons for local compliance to manage risk in volatile markets.

Transform your global model.

As digital markets fragment, agility drives competitiveness. Local tech stacks can keep you in a market when regulations of data and AI tighten. This doesn’t mean fully rebuilding the entire stack. But it may involve separating components like storage, computation, and data flows to meet local requirements. For example, a separate tech stack may be needed for China and the EU, which often requires dedicated infrastructure to ensure data is processed and stored within the region.

Many providers need to become more agile so that they’re ready to move fast when opportunity strikes. Build the ability to test and scale new technologies, delivery models, or market entries ahead of competitors by staying on top of market trends, price shifts, and AI breakthroughs. Finally, consider engaging with policymakers to provide perspective on how evolving digital trade, tax, and access rules may impact your business. Building a clear, fact-based understanding of these issues can support informed dialogue and help leaders anticipate potential implications.

Global trade in services, as with goods, is entering a time of sweeping change. The era when global service companies could serve most customers around the world with common infrastructure, tech stacks, content, and business models is giving way to digital fragmentation that increases costs, complexity, and risk for providers and their customers alike. Companies that build the capacity to flexibly adapt can gain strategic advantage by staying ahead of changing trade policies and regulations—without sacrificing the advantages of scale.