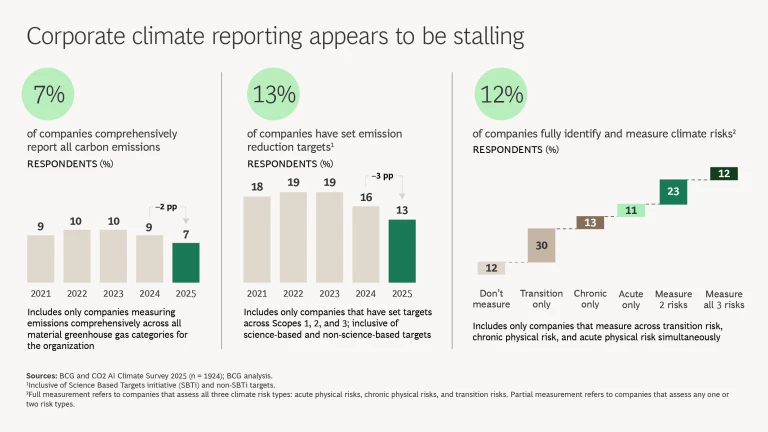

At first glance, corporate momentum on climate action seems to be stalling. Only 7% of large companies comprehensively report their greenhouse gas emissions. Just 13% have set targets that cover all emissions sources (Scopes 1, 2, and 3). And only 12% fully measure their climate risks. What’s more, our CEO Radar found that discussions in earnings calls of environmental and sustainability-related topics declined sharply for both CEOs and analysts, and a broader wave of companies have been publicly walking back climate commitments.

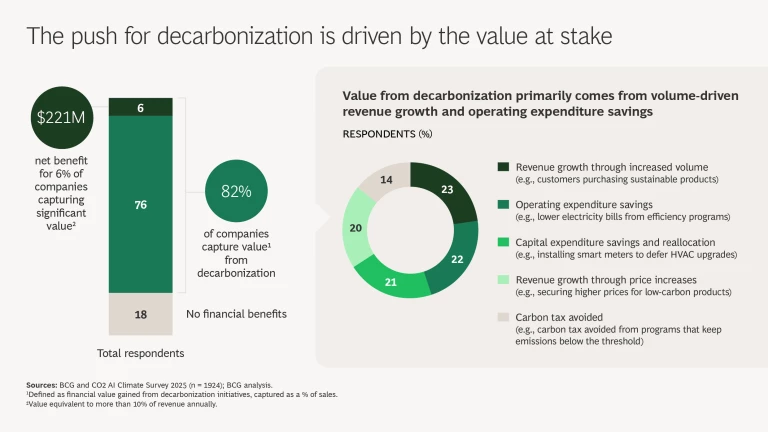

Yet our survey shows that companies are investing in climate action where there is a business case around strategic risk management and compelling financial incentives. More than four out of five companies we surveyed reported financial gains from their decarbonization efforts, and nearly half of respondents said their average return on investment for climate risk investments was more than 10%.

Signs of Momentum

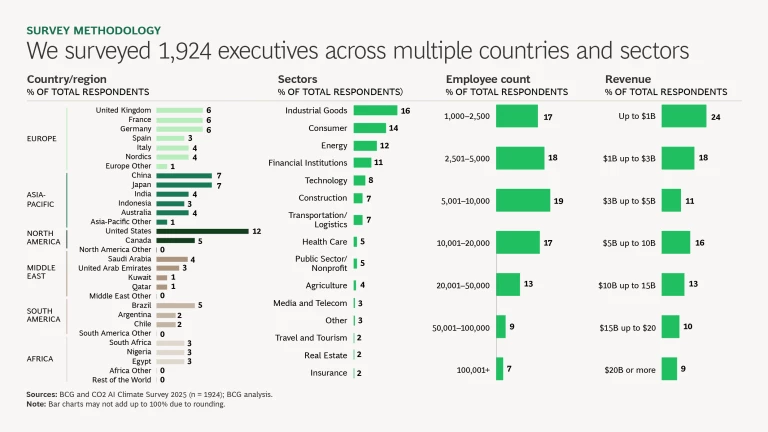

Now in its fifth year, the BCG + CO2 AI Climate Survey captures responses from companies responsible for 40% of global GHG emissions. This work builds upon the work BCG + CO2 AI began in 2021 and expanded in 2022, 2023, and 2024. This year’s findings reinforce a key insight: while the external narrative suggests retreat, internal progress is accelerating. (See “Survey Methodology.”)

Survey Methodology

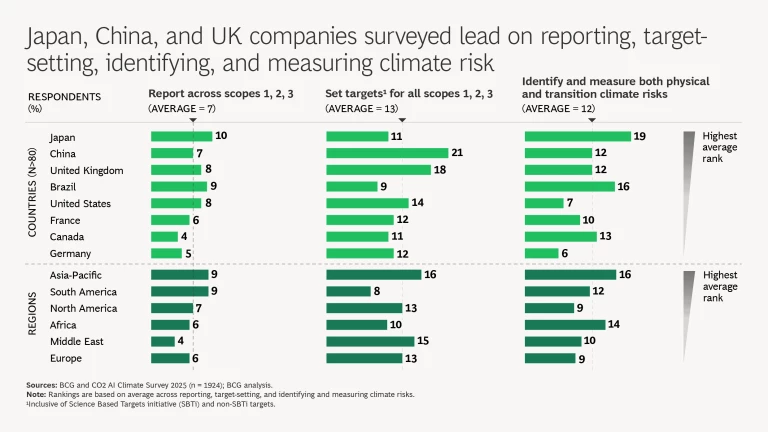

Without question, external reporting and target setting has slowed. In 2025, only 7% of companies reported emissions comprehensively across Scopes 1, 2, and 3—down from 9% in 2024 and 10% in 2023. Similarly, the number of companies setting targets to reduce emissions across all scopes decreased three percentage points year-over-year since the high of 19% in 2023. Only 12% of respondents comprehensively measure climate-related physical and transition risks. According to our survey, global corporations in Japan, China, and the UK are leading in reporting emissions, target setting, and measuring climate risk. This is the second year in a row China is in the top three.

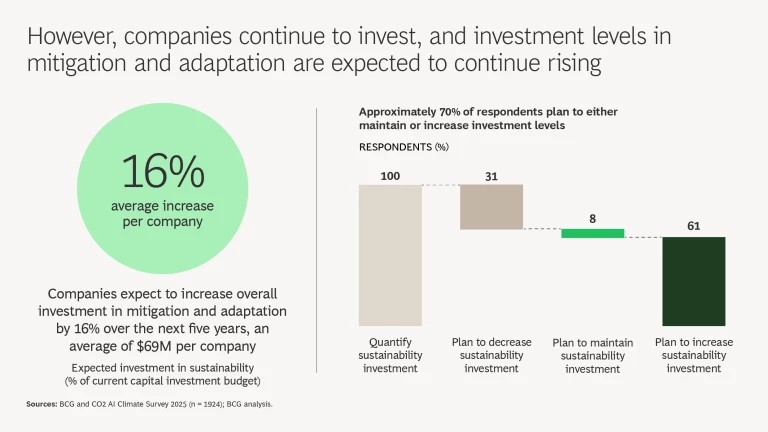

Internally, however, companies are still gaining momentum. Over the next five years, companies plan to increase their investments in mitigation, adaptation, and resilience by dedicating an additional 16% of their capital expenditure budget to sustainability, which amounts to an increase of $69 million per company. Additionally, approximately 70% of companies have maintained or increased their overall investment in sustainability, with the largest investment increases expected from the energy, construction, technology, health care, and industrial goods sectors.

Stay ahead with BCG insights on climate change and sustainability

For example, Takeda, Japan’s largest biopharmaceutical company, continues to make measurable progress in decarbonization across its operations and value chain. The company is transitioning its offices and manufacturing sites to renewable energy, while partnering with health care providers to reduce medical waste. “Internal accountability is our strongest lever in climate action,” said Johanna C. Jobin, the global head of environment and sustainability. “Each year, we challenge ourselves to raise the bar on decarbonization, whether it be in our internal operations (Scope 1/2) or in our supply chain (Scope 3).” Since 2016, Takeda has reduced Scope 1 and 2 emissions by 55%. Since 2022, Scope 3 emissions have decreased by 7%.

Financial Outcomes Are Driving Action

Companies are discovering that climate action can deliver real value—not just in risk reduction, reputational benefits, and future readiness, but in financial returns.

Strikingly, 82% of surveyed companies say they have captured economic benefits from decarbonization, with 6% reporting value that exceeds 10% of annual revenue; that is, a net value (after accounting for costs) of $221 million per company. These benefits stem from:

- Revenue growth from sustainable products. BCG studies in automotive, home appliance, and fashion found that more than half of customers view sustainability as important, with a substantial portion willing to pay more for sustainable products across categories. Increasingly, companies are investing in green businesses to take advantage of the sustainability value proposition.

- Operational savings from efficiency gains and resource optimization. Companies are discovering that many climate initiatives—like smart metering or making buildings more efficient—not only reduce emissions but also lower costs, making them profitable rather than an expense.

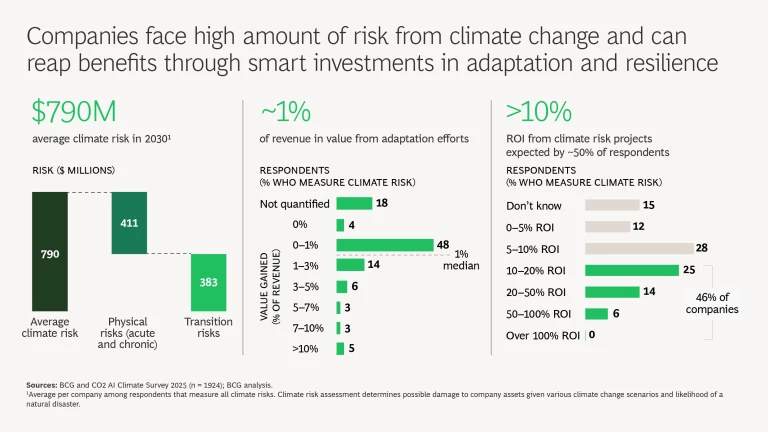

Companies also see the value at stake for climate adaptation and resilience. Physical risks, such as storms and rising seas, can damage assets, while transition risks, including policy and market shifts, can disrupt operations and profitability. Companies that have assessed both types of risk estimate an average climate-related financial exposure of $790 million by 2030.

Anticipating that exposure, companies are already seeing the upside of investing in climate adaptation and resilience. Those actively investing in adaptation are achieving near-term financial gains equal to 1% of revenue. Nearly half of the companies report that their climate risk adaptation efforts generate a return on investment of more than 10%—demonstrating that proactive preparation delivers real and measurable value

Advanced Tools for Turning Climate Goals into Action

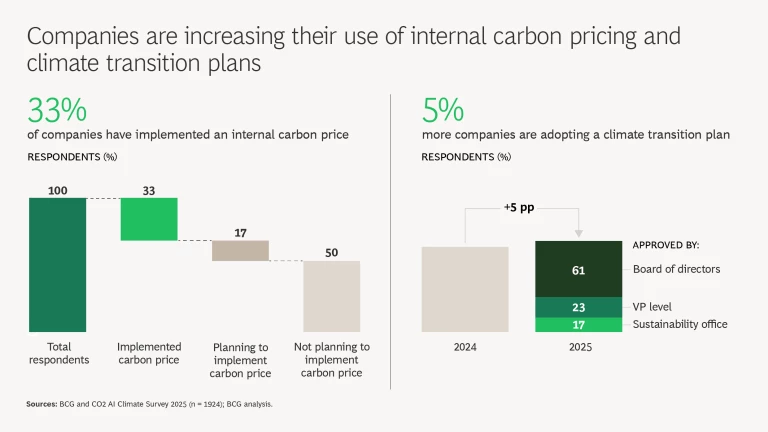

As companies scale up their climate investments and goals, they are also strengthening how they finance and operationalize climate action. Two practices—internal carbon pricing and climate transition plans—are becoming key features of climate strategies.

Carbon pricing. One-third of the companies we surveyed have implemented a carbon price; that is, they have assigned a monetary value to their carbon emissions to incentivize decarbonization. By putting a cost on emissions, carbon pricing helps companies embed carbon considerations into budgeting and identify the most practical path to decarbonization.

Climate transition plans. The adoption of climate transition plans has increased 5% year-over-year, and 61% of current transition plans have board-level approval. This uptick may be due in part to new rules and regulations—such as the EU’s Corporate Sustainability Reporting Directive, the PRC Sustainability Reporting Guidelines, or the Australian Sustainability Reporting Standards—that require companies to disclose information on their environmental and social impact. Climate transition plans offer clear roadmaps for how organizations intend to meet their goals, complete with interim targets and accountability structures.

Together, these tools represent an important shift from loose aspirations to operationalized climate strategies.

What Sets Leaders Apart

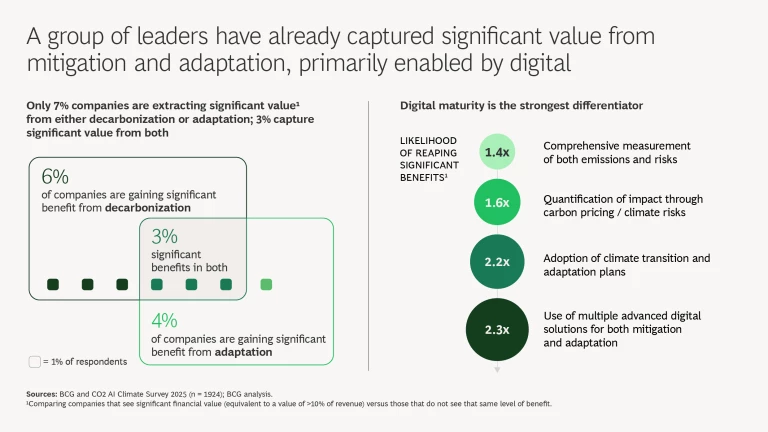

A small group of companies have cracked the code on sustainability. By making it central to strategy, they’re realizing financial benefits worth roughly 10% of their revenue. They’re not treating climate as compliance. They’re using it as a growth and resilience engine.

Four enablers set leaders apart:

- Comprehensive emissions and risk measurement (1.4x more likely to achieve significant revenue)

- Quantification of impact through internal carbon pricing and risk modeling (1.6x)

- Adoption of transition and adaptation plans (2.2x)

- Use of multiple advanced digital solutions (2.3x)

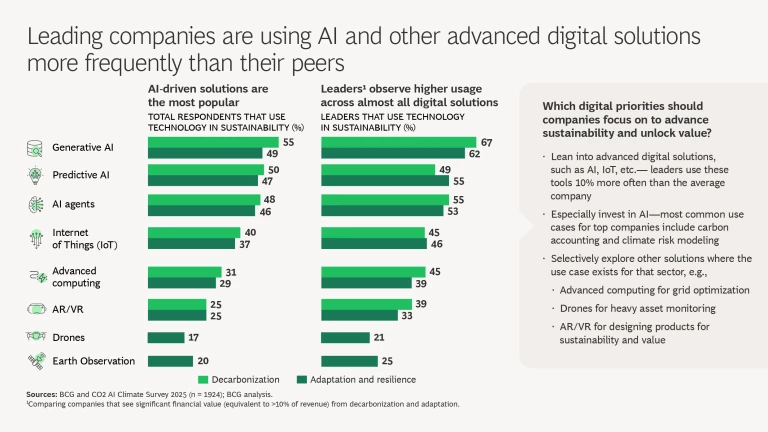

All four features are significant, but advanced digital tools stand out as the most important marker. Companies using advanced digital technologies were two times more likely to capture significant climate value.

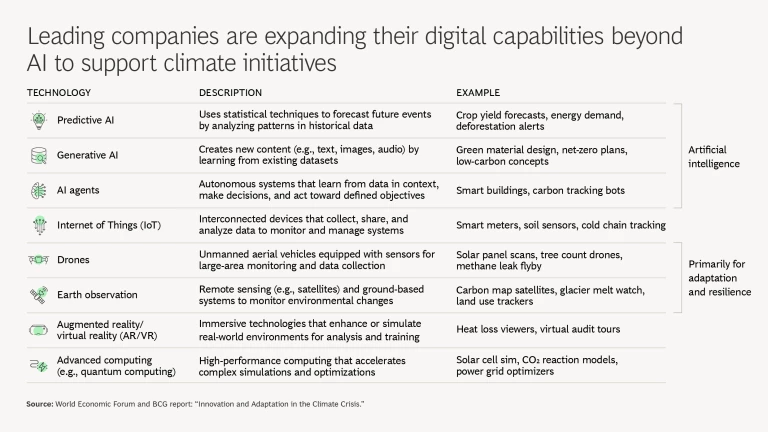

Eight digital technologies are driving measurable sustainability outcomes:

- Predictive AI to forecast emissions, demand, and climate risks; for example, predicting energy demands or forecasting crop yields

- Generative AI to design low-carbon solutions and pathways, such as sustainable product concepts and net zero roadmaps

- AI agents to automate critical tasks, such as tracking carbon emissions and managing smart buildings

- Internet of Things (IoT) sensors to collect real-time climate data, such as smart meters for energy use, soil sensors for moisture levels, and cold chain trackers for temperature control

- Advanced cloud and quantum computing to enable high-speed modeling of complex scenarios like solar cell performance and power grid optimization

- Immersive technologies, like AR/VR, to simulate climate impacts or train teams; for instance, visualizing heat loss or conducting virtual site audits

- Earth observation using satellite imagery and analytics to track climate conditions, such as methane emissions, glacier melt, and carbon mapping

- Drones to capture localized climate data with precision; for example, to detect methane leaks or monitor forest health

Among climate leaders, digital tools are the single strongest predictor of value creation. Leading companies are deploying advanced technologies more broadly than their peers, particularly in adaptation and resilience. They are leaning heavily on technologies like AI, IoT, and other solutions not only to support their climate ambitions but also to enable business growth. While these technologies unlock new value, their climate impact depends on the infrastructure behind them. Ensuring that the data centers powering these solutions are green is critical to achieving a truly net-positive impact.

Advanced Digital Case Studies in Action

General Mills, a global consumer goods company, is using digital innovation to accelerate its progress towards net-zero by 2050. General Mills is working with CO2 AI to integrate carbon data into its core data systems and workflows. This enables the organization to automate emissions reporting, improve data accuracy, and support Scope 3 performance tracking. The digital platform not only improves accuracy in emissions reporting, but also lets the company track supply chain emissions and measure how suppliers affect General Mills’ overall footprint. Jessica Jubara, who leads the company’s climate strategy and roadmap development, said, “General Mills is continuing to invest in several Scope 3 initiatives, like supplier-specific emissions data collection, that will allow us to scale our decarbonization and support our suppliers on their own sustainability journeys.”

As a global leader in plant nutrition, OCP Group is implementing a comprehensive climate strategy that integrates mitigation, adaptation, innovation, and inclusive growth, while addressing the urgent challenge of feeding a growing world population. Through its $13 billion Green Investment Plan, OCP is accelerating its transition to carbon neutrality by 2040 (Scopes 1, 2, and 3) by scaling up green hydrogen and ammonia production; leveraging new technologies such as carbon capture, utilization, and storage (CCUS) to capture hard-to-abate emissions from phosphoric acid production; and shifting to 100% clean electricity by 2027. In addition, it has relied on 100% unconventional desalinated water since early 2025. Beyond industrial decarbonization, OCP embraces a farmer-centric, innovation-led approach to support the transition to climate-smart agriculture. Through its subsidiary OCP Africa, the Al Moutmir program, Tourba, its carbon project developer, and other flagship initiatives, OCP provides soil testing, tailored fertilizer recommendations, support for sustainable agricultural practices, and carbon credit generation. These efforts are enabled by advanced technologies, helping to scale resilience and productivity across the agricultural value chain. These are a few examples of how OCP approaches the climate challenge—as both a duty and an opportunity, one that demands bold action on both mitigation and adaptation.

What Companies Can Do Now

Leading companies are advancing the sustainability agenda while building value by adopting tools and solutions that enable their journey. Here are some fundamental actions companies can take now:

- Measure and track climate impact, whether it be emissions, climate risk, or wider environmental and social impacts. You cannot improve what you do not measure.

- Quantify sustainability impact through in-depth climate risk modeling and/or carbon pricing. The business case for climate action will become clear.

- Build a transition plan that enables the company to meet its climate obligations effectively and cost-efficiently. Ensure alignment with the enterprise’s overall strategy.

- Lean-in to advanced digital solutions to unlock value from sustainability, such as automating measurement or predicting impact. These technologies aren’t hypothetical, they’re already in use.

Despite headwinds, companies are staying the course and continuing their climate agenda where it helps them stay competitive. They’re investing in what matters, operationalizing climate plans, and deploying digital capabilities at scale.

What’s happening is profound: a steady, determined shift toward value-driven, digitally enabled climate leadership. The companies investing today are building the resilience, reputation, and advantage that will define tomorrow.