This is the third report in a collaborative series between BCG and Vestiaire Collective, a leading global platform of desirable preloved fashion that is active in the US, Europe, and Asia. You can find our report from 2019 here and our report from 2020 here.

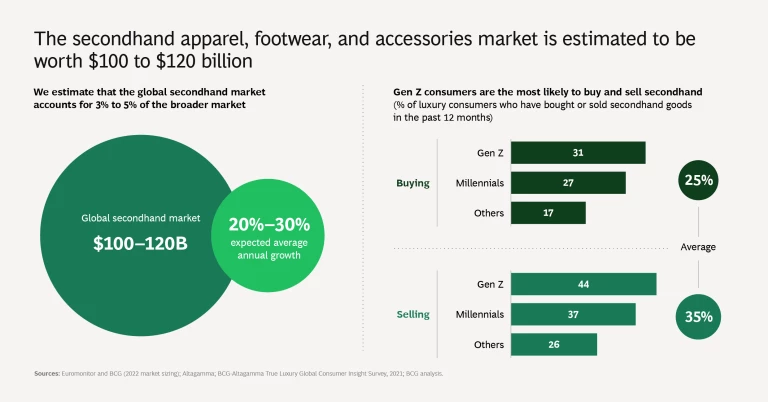

The secondhand fashion and luxury market is big, and it’s quickly getting bigger.

With a value estimated between $100 to $120 billion worldwide, the apparel, footwear, and accessories resale market has nearly tripled in size since 2020 and shows no signs of slowing down. Though buyers generally enter the secondhand market through bags, many turn to apparel and, ultimately, to jewelry.

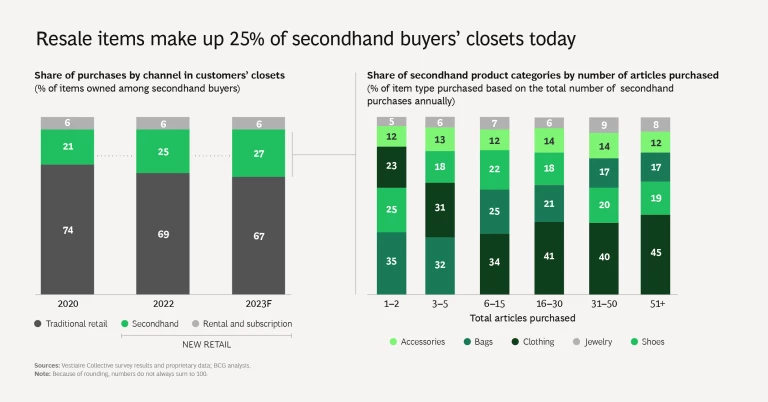

The demand for the secondhand market is clear, with preowned clothing making up 25% of the average secondhand consumer’s wardrobe. But the reasons behind it are evolving and might even surprise some observers. To provide context on the most important trends in fashion resale and what this means for brands and retailers today, BCG has once again partnered with Vestiaire Collective.

Our research, based largely on consumer surveys we’ve conducted over the past few years, sheds light on consumers’ shopping habits and the critical steps fashion companies can take to capitalize on the rapidly expanding secondhand market.

A Consumer’s Perspective

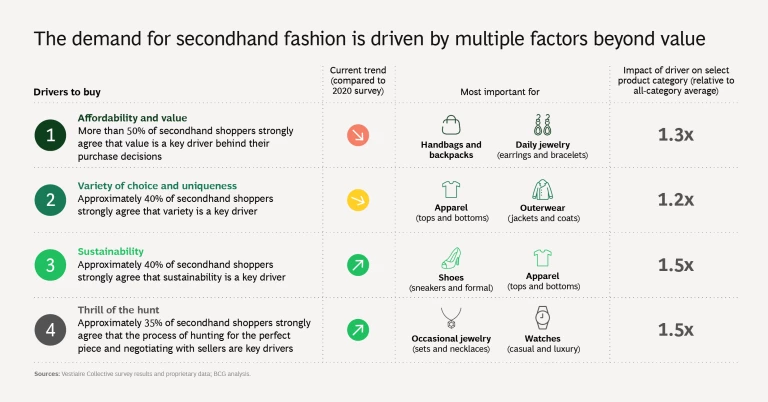

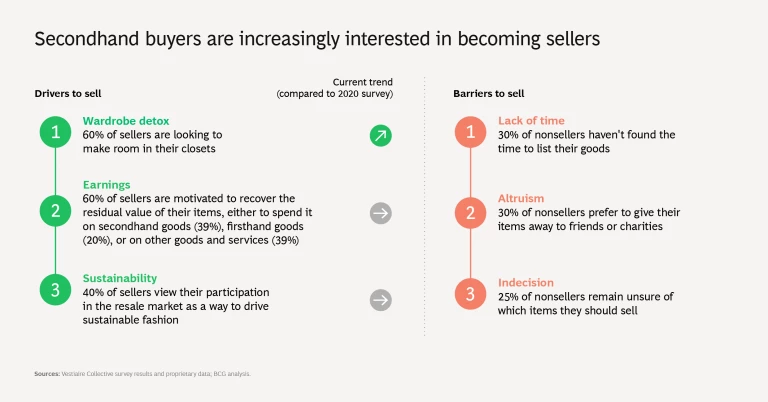

While half of the respondents to our 2022 survey cited affordability and value as the number one reason for buying secondhand, this number has fallen markedly from 2019 and 2020. Sustainability is an increasingly popular driving force for purchasing secondhand clothing, as is the thrill of the hunt and the opportunity to barter with sellers. Product variety remains important and is still the second biggest driver behind secondhand consumption, no doubt powered by the increasing popularity of resale apps.

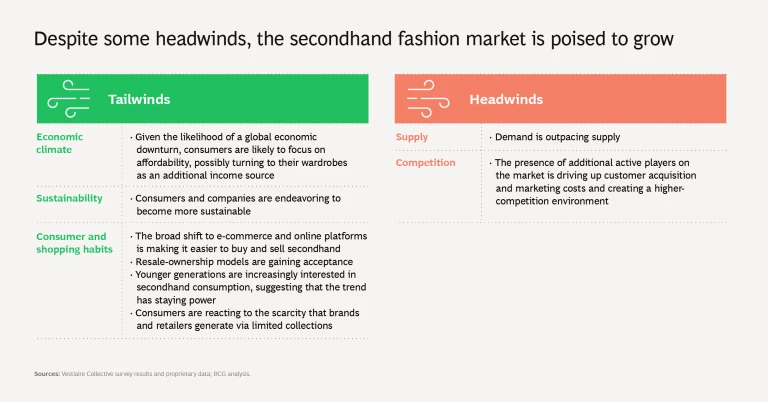

The threat of recession could result in a reversal of the affordability trend, just as the cost-of-living crisis might motivate people to turn their wardrobe as an additional source of income. The sector has also seen considerable advancements in privacy and product-authentication protocols, which make it easier and safer for individuals to resell their goods online.

Secondhand fashion also appeals to shoppers’ desire for exclusivity. It has attracted many celebrity supporters, such as Zendaya, who has regularly appeared with vintage clothes on the red carpet. Singers Lorde and Rihanna are also fans of the secondhand trend. These factors will all continue to shape the market in 2022 and beyond.

While consumers are generally comfortable when buying online, our research reveals that fears of counterfeit or poor-quality goods could deter them from buying secondhand. As much as 10% of branded goods sold are counterfeit, and an estimated 80% of consumers have handled fake or falsified goods, with or without their

How Brands and Retailers Can Respond

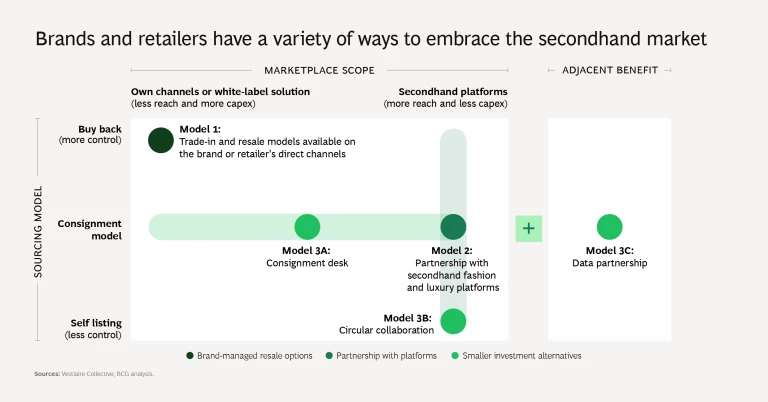

Businesses entering the resale space could help mitigate consumers’ fear of counterfeiting. But, to succeed in this brave new retail world, brands and retailers will need to devise and implement innovative business models that reflect the changing landscape and evolving consumer behaviors. As competition in resale platforms increases, they must remain relevant to their existing audiences and develop tactics that will increase their reach to new audiences. They’ll also have to take steps to mitigate risk and protect their reputation.

As with any business strategy, the right approach depends on a brand or retailer’s goals and objectives as well as the needs and expectations of its customers.

Stay ahead with BCG insights on the retail industry

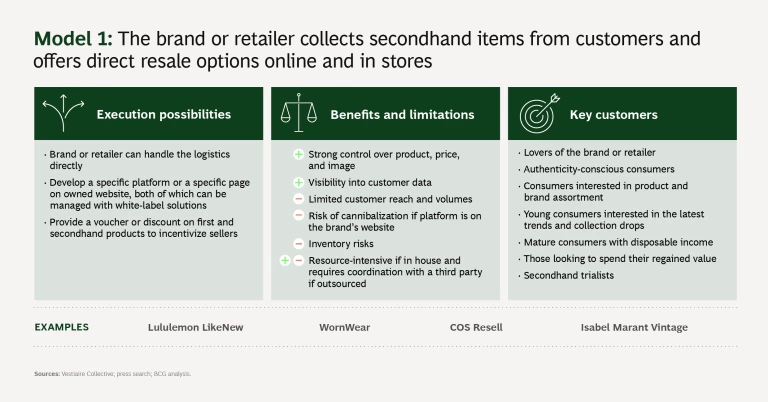

Companies like Lululemon, Cos, and Isabel Marant have seen success selling collections on their websites and in their stores, supported by in-house capabilities or white-label solutions. Indeed, just one year after launching its vintage resale arm, Isabel Marant reported that two-thirds of its secondhand buyers are new direct clients. The strength of this approach is that it allows companies to retain control of their brand and pricing structure and still make the margin twice on the same garment. Furthermore, they can use the additional insights gained online to stay ahead of a fast-changing game. Brands can, for instance, enrich the data they hold for first-time purchases and use it to inform retargeting campaigns and their CRM data. But this approach is not without drawbacks. It can be resource intensive, cause inventory issues (should sales be underwhelming), and risk product cannibalization, with consumers lured away from the brand or retailer’s new products.

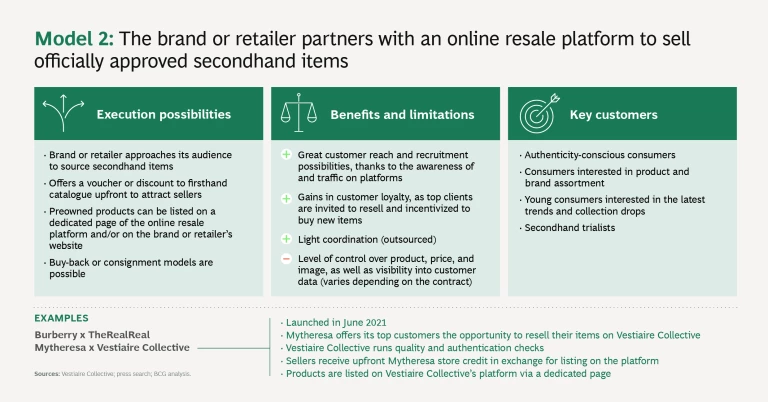

Naturally, not every fashion player will have the resources to implement and manage its own resale operation. Partnering with a resale platform can be a good alternative. This model offers a mutually beneficial solution: the platform handles the logistics, payment processing, and product validation (performing quality and authentication checks), all while gaining increased traffic, promotion, and credibility from its new partner. Brands and retailers, for their part, can resell products, boost recognition, and cheaply acquire new customers without having to actually run the resale operation. They can source products from individual sellers in exchange for store credit, which in turn builds customer loyalty. In this vein, luxury retailer Mytheresa has partnered with Vestiaire Collective, while luxury brand Burberry has partnered with The RealReal.

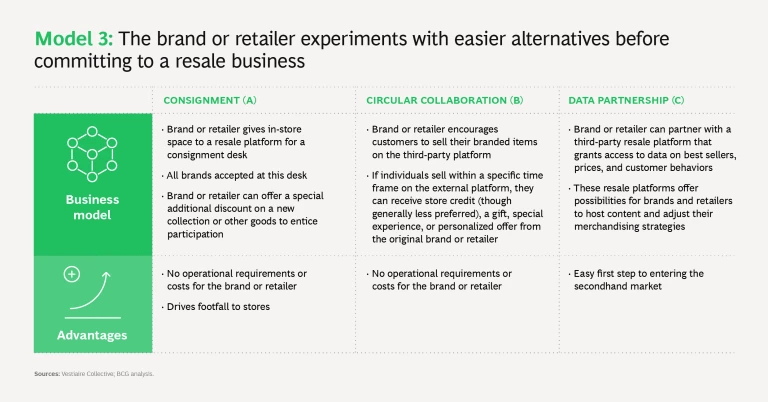

A third approach would be for fashion companies to explore the opportunities that come with growing their business through resale without making a significant investment or long-term commitment. Options for brands and retailers include giving third-party resale platforms a modestly sized space in stores and developing discount-and-incentive schemes for customers who sell their secondhand clothing back. These lighter solutions help increase footfall and audience reach. They allow players to participate in the circular economy while mitigating the risk that comes with counterfeit goods.

Looking Ahead

The secondhand market is already worth 3% to 5% of the overall apparel, footwear, and accessories sector and could grow to as much as 40%, depending on macroeconomic conditions. Regardless of global economic challenges—and the effects this has on the way individuals buy and sell their clothes—the fashion industry will continue to play a major role in consumers’ lives. But this doesn’t guarantee success, and it belies a hypercompetitive industry. Marketplace innovators are already creating and delivering solutions that will allow them to win in the future. Playing catch-up is not a strategy for success.