Conversations about climate and retailing in Canada quickly turn to the “say-do” gap, where consumers say they value the climate but do little to change their purchasing behaviour – especially during times of economic duress. However, fresh data from Boston Consulting Group’s annual Canadian Consumer Survey suggests that in spite of declining consumer confidence, a quarter of Canadians are still willing to purchase goods that align with their climate convictions in at least some product categories.

This trend represents an opportunity and a risk for retailers: the opportunity to grow share with a consumer segment that is younger and wealthier than average, and a risk of losing business to other brands if they don’t prioritize this space.

Our survey confirmed the “say” part of the equation. Two-thirds of the 3,000 Canadian consumers we polled describe themselves as either a “climate advocate” or a “silent supporter.”

On the “do” side, an attention-grabbing 31% of respondents reported they had reduced or stopped consuming some products or services due to their perceived climate impact. The top categories affected included: eating out; luxury items; household cleaning products; packaged, frozen or canned foods and beverages; and travel.

More than half (54%) of consumers surveyed said climate impact was at least somewhat important to them when making a purchasing decision. Among high-income Gen Z respondents, this figure rose to 83%. And 17% of consumers said that the climate impact of a product or service was “very important.

Climate consciousness is strongest among the young. A quarter of those aged 34 and under rated climate impact as “very important.” This compares to 15% of those aged 65 or older who said the same.

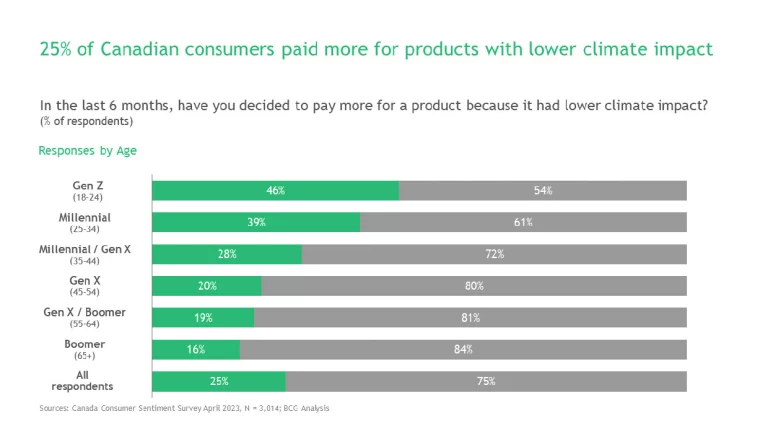

A quarter of all respondents also claimed they spent more in the last six months for a product or service due to its lower perceived climate impact. (See Exhibit below.) Again, this figure was highest for the young: 39% for Millennials and 46% for Gen Z.

Food was the top category for premium climate spending, with consumers focusing on both fresh and organic foods. Products for the home are also top of mind for buyers, including more environmentally friendly household cleaning products and home items such as bedding. These consumers were also willing to pay more for hair, face, body care and cosmetics that were eco-friendly.

Our survey showed that it is not just the desire to help the climate that motivates Canadian consumers. Peer pressure plays a role too, with 37% of those aged 34 and under saying they felt increasing pressure from friends and family to purchase climate-conscious products.

The Canadians in our sample also identified barriers to climate-conscious purchasing. Perhaps in light of inflationary pressures, the top answer was “too expensive.” A lack of alternatives and inadequate information were other top concerns.

To make climate spending decisions, consumers had to navigate a confusing array of climate labels, both Canadian and international. Claims linked with climate included terms such as “biodegradable,” “eco-friendly” or “sustainable.”

Consumers also identified opportunities that would help reduce these barriers. When asked what traits made a retailer stand out to a climate-conscious consumer, the top answers revolved around offering greater choice and actively promoting these products in the store.

Interestingly, consumers ranked public commitments to net zero or donations to climate organizations farther down the list than offering climate-conscious products or active in-store promotion.

While it is too early in the net-zero transition to identify climate-conscious consumption as the biggest trend in the Canadian market, the beginning of S-curve growth often looks no bigger than a niche opportunity. Leading European retailers have learned how to adjust product offerings and promotion to address this opportunity. It’s only a matter of time before some Canadian retailers seize the S-curve opportunity. The question is which will be the ones to move first and which will let competitors take the lead?