Whether they generate it themselves or acquire it from external sources, the amount of data available to companies today is increasing exponentially. And companies that choose not to use that data to create value risk hastening their own obsolescence or, at the very least, losing competitive advantage.

These imperatives hold true not just for large companies but for PE-owned companies as well. Despite their smaller size, they can also harness data and analytics to enhance top-line performance, achieve operational excellence, and develop competitive edge—achieving a high return on a low initial investment. In fact, PE funds are uniquely positioned to provide digital expertise and scale to subscale portfolio companies in what are often fragmented industries.

The Key to Creating Value

Data and analytics are key to the success of the many technology-enabled companies—startups as well as others—that are now disrupting their industries with new, digitally driven business models. Examples include nonbank lenders such Rocket Loans and Quicken Loans, which have created simple electronic initiation and automated approval processes for personal loans and mortgages.

Similarly, Carvana, an online-only dealership, lets consumers handle the entire car-purchasing process online. Shopping for the car, applying for financing, transferring the paperwork for title and registration, securing and sharing proof of insurance—the buyer can do all of this virtually, including arranging for the car to be delivered to his or her home.

Such companies take advantage of low-cost, digitally enabled operating models to offer competitive alternatives to more traditional players. But even companies with operations more dependent on brick-and-mortar footprints or in-person interaction can respond to technology-enabled disruptors by using data and analytics for value creation.

Still, many PE owners and managers assume that using “big data” and advanced analytics such as predictive algorithms or elements of machine learning cannot be done at the smaller scale of most PE-owned companies—or with sufficient ROI.

Some may think that advanced data and analytics are for either large, deep-pocketed companies that can afford the cost of revamping or replacing their technology infrastructure, or for startups that are unencumbered by legacy systems and processes. And even those PE professionals who may want to try to use advanced data and analytics might not know exactly how to go about it.

Fortunately, the truth is that data and advanced analytics are not just for large firms or startups. Big data and advanced analytics can also work for small to mid-sized companies and are very relevant for companies with legacy systems. This means that PE-owned companies, which tend to be small to mid-sized, can also harness data and analytics to enhance top-line performance, achieve operational excellence, and develop competitive edge—achieving a high return on a low initial investment.

Unlocking the Power of Data in Private Equity

In fact, PE funds are uniquely positioned to provide digital expertise and scale to subscale portfolio companies in what are often fragmented industries. Just as they did with core IT and ERP expertise in the late 1990s and 2000s, such firms can marshal specialized analytics teams to create strategic weapons that unlock the power of data for their portfolio companies.

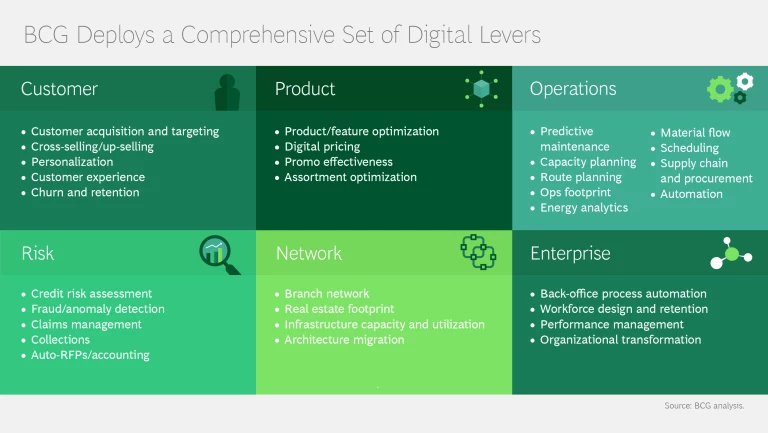

For smaller firms, the starting point for realizing the potential of data and analytics is selecting the use cases that offer the greatest potential for value creation—and using those use cases to generate quick wins that create momentum for broader business transformation. Identifying the right use cases or digital levers requires thinking strategically about the most relevant gaps to fill or vulnerabilities to address—and thinking operationally to identify where usable data is available.

Through our work with clients, BCG has developed a library of typical digital levers, spanning functional areas, that can be quickly assessed for their applicability, then implemented, based on the specific context of the company and its industry.

Examples in Action

For some sample use cases, consider the following three examples—based on actual BCG client experiences—that present solutions utilizing advanced data and analytics. Each of these examples highlights a PE-owned firm or company and demonstrates that advanced data and analytics can generate significant and lasting value for these companies.

It should be noted that the companies in these examples are somewhat atypical in having had access to large amounts of data before they figured out how to use it for strategic and operational improvements. It is notable, however, that in each case, the BCG team was able, with limited investment by the company, to identify and design algorithms for use with existing data that generated quick returns on investment—typically in less than 6 months.

Example 1: Geoanalytics

A mid-sized vending machine operator that sells through a partner network of brick-and-mortar retail locations wanted to expand its footprint efficiently. By analyzing geography-based demographic data along with rich channel-performance data to which the company had access, BCG was able to identify and prioritize top-quality locations including new sites, geographies, and channels for installing the company’s vending machines.

More than 1,000 new locations were identified, and the company is realizing significant savings by investing only in infrastructure that is likely to generate profitable sales.

Example 2: Predictive Maintenance

A small company that generates revenue through an installed base of machines wanted to reduce unplanned failures so that it could improve utilization levels and reduce opex costs on the maintenance of the installed base. A BCG team used the large quantities of performance data, including log files from failures, generated by the machines to develop a predictive-failure model that was used to schedule maintenance activities.

The analysis prioritized machines with higher risk of failure and downtime. The new schedule directly reduced the number of required maintenance FTEs, the need for replacement components, and overall downtime. In combination, these changes reduced overall maintenance costs by 40%.

Example 3: Workforce Optimization

A specialized retail software systems provider wanted to reduce the cost associated with servicing installed systems and improve customer satisfaction levels. BCG’s team analyzed scheduling data and identified utilization levels for service technicians significantly below industry benchmarks. Client satisfaction scores also revealed poor alignment between tasks and technicians’ proficiencies, as well as chronic service delays.

A redesigned algorithm more accurately matched the skill sets of field technicians with customer requirements and analyzed the role of external factors such as traffic and parts availability in causing delays. The new, optimized routing algorithm increased field technician utilization by 50%.

Partnering with BCG GAMMA for Advanced Data and Analytics

Of the more than 500 specialty analytics vendors in the marketplace, each touts its own “silver bullet” solutions for different use cases. This complexity makes it quite challenging for PE-owned companies to find the right partner for experimentation in advanced data and analytics. Large software vendors typically offer systems that require clients to possess significant technology capabilities and need expensive customizations to run the needed algorithms.

On the other hand, boutique providers can develop specific algorithms but lack the scale to work with the existing software stack. They also often push their own licensed solutions. Neither of these types of firms uses a strategic approach for determining what the client needs, which can result in prohibitively high levels of initial investment.

BCG can help any company—including those owned by PE firms—looking to tap the power of advanced data and analytics to increase the top line, achieve operational excellence, and earn the high potential ROI from such investments.

BCG GAMMA is a dedicated team of data scientists and technologists who work closely with our industry-expert consulting teams. We offer a comprehensive set of solutions that can help companies to:

- Identify potential use cases that are suitable for their circumstances

- Quickly implement proofs-of-concept to pressure-test use cases with limited investments

- Launch a full-scale implementation that includes support for capability building and change management—both of which are critical to the success of such efforts

We are vendor-agnostic and work with legacy IT stacks rather than pushing for a software solution built for a different purpose or for other players.

The BCG GAMMA Solution

BCG GAMMA has a simple prescription: Think big, start small, and grow fast. Once we have identified a major business opportunity for using advanced data and analytics, we help the client undertake a process of building, testing, and iterating initial solutions, then rapidly scaling them to achieve maximum impact.

The final stage involves transforming the organization so that working with advanced data and analytics is part of “business as usual”—however foreign or daunting it may have seemed at the outset.

In many cases, we require only a short sprint to begin creating real value. For example, we have conducted proofs-of-concept and developed use cases for clients in as little as 10 to 12 weeks.

In these challenging times for PE, when value creation is more important than ever in many deals, PE firms have a significant opportunity to use digital to their advantage. Low-investment, high-ROI approaches can be applied to meet a PE firm’s objectives of limited holding periods with limited budgets for investment. Digital levers based on big data and advanced analytics can not only generate significant value during the holding period but also be a crucial part of the investment thesis for the subsequent buyer.

Most importantly of all, by building capabilities in their portfolio companies that can unlock the next wave of productivity, PE firms can be more aggressive in valuations when buying companies and increase their exit valuation potential.