The financial crisis put risk, liquidity, and cash management at the forefront of attention. As the dust settles, those same elements continue to drive the finance agenda. But having weathered the past eight years of tumult, treasurers—especially those in large multinationals—are now looking to manage their expanded responsibilities with greater efficiency and sophistication. A global survey of treasurers at multinational corporations around the world, conducted on behalf of BNP Paribas and The Boston Consulting Group, reveals that corporate treasurers are bringing an increasingly strategic lens to their remit.

ABOUT THIS REPORT

This report was developed based on a proprietary cross-industry survey of 500 corporate treasurers and CFOs from organizations around the world with consolidated annual revenues of more than $500 million. The survey was conducted by Expand Research (a wholly owned subsidiary of BCG) for BNP Paribas and BCG. The study included interviews with approximately 50 corporate treasurers and CFOs from multinational organizations with total revenues of approximately $1 trillion and more than $75 billion in cash and cash equivalents.

This summary document highlights the survey’s key findings. Survey participants receive a separate exclusive appendix with benchmark data and detailed analysis (by region, company size, and industry).

An Expanded Role for Corporate Treasury

Corporate treasurers continue to occupy a prominent strategic position within large corporations and multinationals: what used to be a supporting role before the financial crisis has evolved definitively into a position of significant stature. The treasury mandate now encompasses a full set of balance sheet responsibilities: in addition to cash management and investments, treasury responsibilities now often include debt and financing, as well as financial risk management and hedging strategies. Further, about 50 percent of treasurers manage adjacent activities, such as trade finance and credit risk, and about 25 percent oversee some insurance and compliance activities.

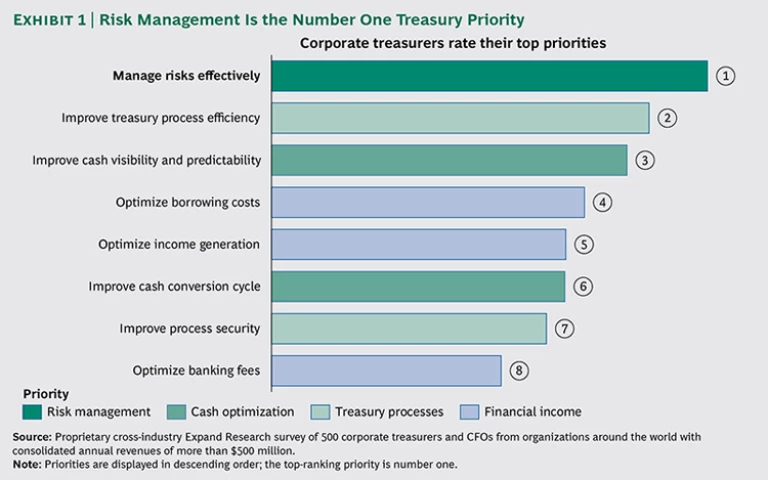

The heightened risk climate of the post-financial-crisis period means that senior management is paying much closer attention to treasury activities and liquidity management. Treasurers who participated in our survey reflected that heightened interest by ranking effective risk management as their number-one priority, followed by increasing process efficiency and improving cash visibility and predictability. As one treasurer stated, “My priority is to manage our day-to-day risks and advise senior management on the strategic decisions required to tackle them.” Survey results found treasurers negotiating a careful balancing act: how to put treasury risk management at the forefront—especially in light of growing fraud and security concerns—without disrupting cash optimization and cost reduction efforts. (See Exhibit 1.)

To improve efficiency, visibility, and operating control, more treasurers are moving to centralized decision-making models within their global headquarters. More than 80 percent of treasury teams have already chosen to centralize strategic decision making around global treasury policies, cash management, key investment-management operations, funding, and hedging. Strategic decision making at the local level is increasingly limited to those countries that have complex regulatory requirements or that drive a significant portion of the organization’s revenue growth (for example, China). Most other local treasury teams are charged with tactical execution, managing transactions within set limits, and rolling out global-process and operational-improvement initiatives.

As responsibilities centralize, global corporate treasurers are becoming the primary owners of the transaction banking relationship, a shift that will require banks to adapt their relationship-management efforts accordingly.

Financing and Cash Optimization

Corporate treasurers have been closely watching developments in the banking regulatory environment because new capital and liquidity rules following the financial crisis could make it tougher for them to obtain financing. With financing needs again on the upswing as markets recover, corporations need to compensate for this expected drop-off in financing. Survey data found treasurers exploring the following three areas.

Working Capital Financing Solutions. Treasurers signaled strong interest in working capital financing (WCF) in general and in supplier financing in particular (in which funding is made available to a company’s suppliers through a payables discounting program). The latter has emerged as an attractive tool for maximizing working capital efficiency and enhancing vendor relationships. Survey results revealed that 25 percent of treasurers with WCF responsibilities said they plan to increase their use of supplier financing in the near term. Those already using supplier financing were among the most eager to do so, with treasurers in the Asia-Pacific region and at companies with revenues of less than $1 billion also showing strong interest.

To grow their supplier-financing business, banks must tackle cost concerns (a key barrier for 30 percent of nonusers) and address the perception that supplier-financing schemes are difficult to unwind once put in place or involve complex IT implementation. Treasurers indicated they would react favorably to banks that differentiated their supplier-financing offering in the following three ways.

- Competitive pricing—including synergies with cash management and overdraft offerings—in order to address treasurers’ cost concerns

- Greater connectivity across the company-supplier network as well as automation of routine steps (such as adding or removing suppliers)

- Greater consistency in the user experience across regions, while ensuring that solutions are in compliance with local regulatory requirements

The appetite for other WCF solutions also remains solid, even among cash-rich companies. As an illustration, approximately 20 percent of large corporations indicated that they plan to increase their use of receivables financing. That finding was especially true for respondents in high-growth economies (in which companies face more critical cash-shortage issues), those with long cash-conversion cycles, and those that operate in mature industries in which payment terms are already optimized.

Cash Optimization as a Financing Lever. Cash pooling has been in the treasurer’s tool kit for a long time, but minimizing cash traps and idle cash through pooling became an especially important means of generating internal funding during and after the liquidity crisis. Still, while around 80 percent of large corporations have—or soon will have—some form of cash pooling in place, only 50 percent currently pool cash at the global level. As treasury functions centralize, more organizations will look to make that global transition: approximately half of those surveyed said that upgrading cash-pooling solutions through physical cash pooling is their top cash-management priority. Our survey found that banks can help treasurers manage that shift and navigate the relevant regulatory allowances.

Newer cash-optimization tools are also gaining more attention. About 35 percent of treasurers said that instituting a payment factory, in which an organization’s payment processes are all centralized, is a key priority—second only to physical cash pooling and electronic bank-account management (e-BAM)—with large multinationals likely to be the earliest adopters given their high transaction volumes. In-house banks also hold strong appeal, since they facilitate intercompany netting and lending and minimize idle and local cash balances. Over time, advanced treasury teams could even adopt a shared service model with which to manage payment factories and in-house banks in addition to accounts receivable, accounts payable, expenses, and payroll.

Other Innovative Financing Sources. Advice-intensive financial products—such as off-balance-sheet structuring, currency conversion tools for regulated currencies, tax-exemption benefit structures, and enhanced-yield products—could also find an interested audience. Survey data showed that 25 percent of treasurers within most structured treasury teams would be willing to pay for additional advisory services from banks on cash optimization and yield enhancement.

Treasurers’ Enablement Expectations

One finding rang out especially clearly: corporate treasurers are not satisfied with the service they are receiving. And although public rankings often conflate market leadership with service leadership, our survey showed that treasurers do not see any bank leading the market on service quality. Mindful of that, adaptive banks must ensure that their banking models become more client centric and better integrated. They should not assume that the complexities of switching transaction banking providers give them any long-term lock on a client’s business. Banks need to provide greater global coordination, more frequent and relevant communication, and greater process efficiency.

International Operating Model. As treasury functions become more global and centralized, transaction banks have struggled to integrate their service across borders. Treasurers still see banks as ill positioned to support them at a global level and reported that global coordination capabilities have now become more important than even the depth of the product portfolio or the size or creditworthiness of a bank. Banks must therefore find a way to scale their service, or risk having their role limited to servicing only domestic or regional businesses.

Quality of Service. While treasurers indicated that they are comfortable with the two-level servicing model traditionally used by banks—in which a global relationship manager is supported by local teams and product specialists—they believe that banks are still underperforming in several areas. In particular, they want more visibility and traceability into incidents and greater consistency in the quality and skills of supporting teams across locations. They may also expect a consistent set of key performance indicators governed by a single, global service-level agreement.

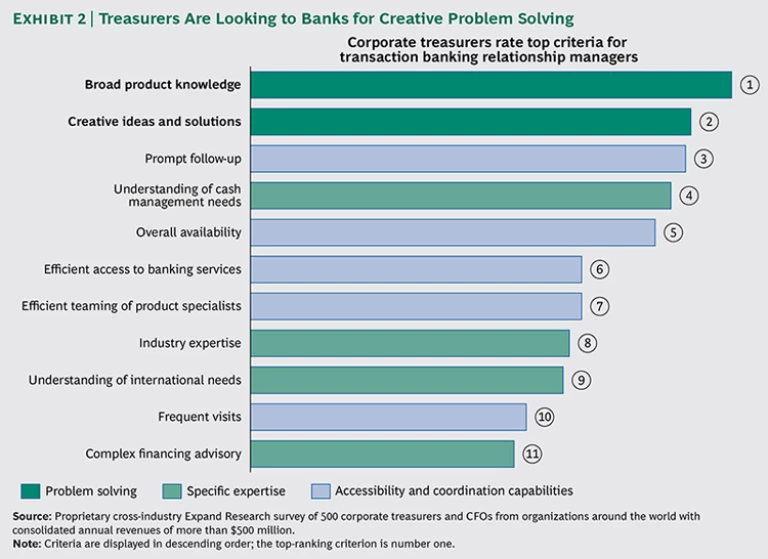

In response, banks need to adopt a day-to-day problem-solving posture across their servicing organization. The relationship manager role must evolve into that of a trusted advisor and problem solver—someone with broad product knowledge and innovative ideas for dealing with challenges. Treasurers ranked “creative ideas and solutions” as the second most important criterion for selecting a relationship manager—ahead of such attributes as complex financing-advisory skills, industry expertise, or overall availability. (See Exhibit 2.)

While all respondents ranked problem solving as a top priority, there were some regional differences when it came to defining what makes a good relationship manager. For instance, treasurers in the Asia-Pacific region put more emphasis on responsiveness and frequent visits, while treasurers in Europe want relationship managers to demonstrate a solid understanding of their organization’s cash-management needs. The findings also showed that the more leveraged a company is, the more important the relationship manager’s responsiveness becomes.

Efficiency Enablement. Reducing process complexity and administrative intensity are high on treasurers’ agendas—not least because corporate treasurers are increasingly expected to contribute to cost reduction efforts. The majority of those surveyed stated that the transaction-banking experience needs to become more streamlined and efficient. As an illustration, automating administrative tasks ranked among the top three most attractive transaction-banking services across regions and segments.

Treasurers expect transaction banks to address these needs in the following three important ways.

- Straight-Through Processing. Treasurers want transaction banks to design more streamlined, electronic, and automated back-end processes in order to reduce the administrative load on treasury teams. More than one-third of treasurers flagged e-BAM as one of the most important cash-management solutions of the future. Beyond e-BAM, digitized management of signature delegations, e-invoicing, and automated account opening also offer significant potential for differentiation.

- Treasury Infrastructure. Treasurers would also welcome dedicated implementation support for payment factories and in-house bank structures. Banks should also make it easier for clients to integrate mobile and other payment methods into existing systems and consider introducing convenient new features, such as intraday account-balance updates.

- Outsourcing. Approximately 75 percent of treasurers indicated they are open to outsourcing administrative tasks (such as invoicing, payment reconciliation, and account payables management) as well as some higher-value activities (such as foreign exchange exposure management and excess cash investment).

Rather than developing these ideas in-house, banks could partner with IT vendors and consider building an open-architecture banking platform that would allow them to take advantage of their partners’ system-efficiency capabilities.

The Challenges of Digitization

As business grows more digital, automated back-end processes have become a baseline requirement for treasurers. In addition, treasurers have high expectations for data enrichment, an emerging interest in analytics, but a limited interest in mobile services. Respondents also noted that treasury management systems (TMS) are raising the competitive bar, putting banks under mounting pressure.

Data Enrichment: An Immediate Strategic Priority. Treasurers view data enrichment as an important tool to simplify reconciliation and payment tracking and to improve fraud detection. Transaction banks have an opportunity here to make data available in standard and customizable formats: banks able to capture company-specific transaction information, such as company billing numbers, can carve out meaningful competitive differentiation among clients with massive billing-reconciliation volumes.

Introducing standard formats that address the data inconsistencies many organizations struggle with could, therefore, prove very attractive. But since formats differ among countries for legacy reasons, leading banks should take the lead in developing industry-wide solutions and creating global and regional banking alliances based on the enriched standard payment formats they develop.

While no killer app has emerged on the analytics side, treasurers signaled strong interest in emerging bank offerings. Analytics tools took four of the top five slots when treasurers were asked which new transaction-banking services they would most like to see. Analytics that can improve working capital efficiency are notably high on the wish list. Treasurers are especially interested in peer group metrics and customized recommendations on cash velocity, gearing ratios, bad debt, cost of finance, and days outstanding. Payment analytics tools, advanced market data and pricing tools, advanced payment-planning support, and investment management benchmarks also have strong appeal. By contrast, while cash flow forecasting is a priority for some, interviews with treasurers found others see relatively limited value in this offering—first because the returns depend heavily on the quality and interpretation of internal data (which can be variable) and second because participation would require disclosure of internal, nonpublic information.

With big data capabilities growing in importance, banks looking for growth should be prepared to capitalize on treasurers’ concrete ideas in order to demonstrate the value of new analytics.

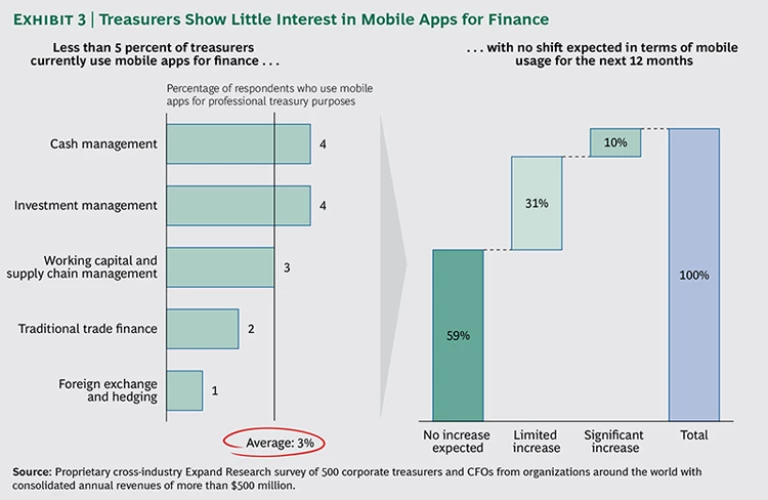

Limited Interest in Mobile Execution. Treasurers expressed little interest in mobile use for professional finance purposes: less than 5 percent of treasurers currently use mobile applications in that capacity. When asked why, many treasurers said they have little need for out-of-desk execution. They also worry about security, and they view current mobile offerings as relatively weak. We believe corporate treasurers are likely to remain on the sidelines in the coming months when it comes to mobile applications for professional finance: 60 percent stated that they do not plan to increase their usage and only 10 percent plan to increase their use significantly. That said, treasurers do see value in some baseline functionalities, such as the ability to receive alerts and to authorize transactions over mobile devices. (See Exhibit 3.)

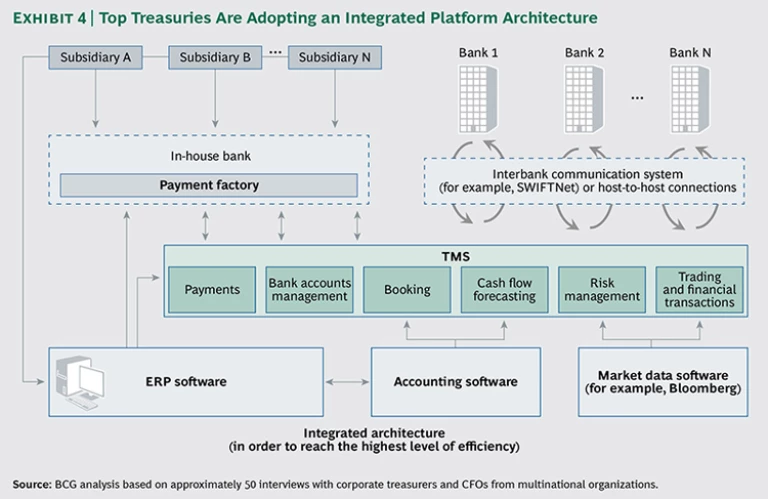

The Banking-Platform Challenge. Corporate treasurers want systems that can deliver a single consolidated view of their liquidity. But the current solutions landscape remains fragmented among single banks and multibank platforms, bank-agnostic connection providers (such as SWIFT), enterprise resource-planning (ERP) systems, and TMS. While banks are currently well positioned, survey findings indicated that treasurers are increasingly turning to nonbank players for this consolidated view—especially for cash management.

TMS is proving particularly popular, because treasurers like the automation and efficiency those systems provide and because treasurers increasingly want the ability to execute operations directly, rather than being wedded to banking platforms. They see platform independence as a way to limit counterparty risks—in terms of both business continuity and platform evolution flexibility. Looking ahead, many would also like to streamline connections through host-to-host technology or SWIFT in order to gain the added security and cost benefits. (See Exhibit 4.)

ERP solutions with treasury add-ons are also already being deployed in corporate-to-bank integration: approximately 30 percent of large corporations currently have a direct link between their ERP and banking portals, and such integration is becoming increasingly important.

These factors make the environment a risky one for banks. Should TMS, ERP providers, and new nonbanking players gain ground, banks could lose the direct interface they currently enjoy with their corporate customers.

Because banking platforms play a strategic role in deepening the client relationship and facilitate the cross-selling of value-added products, banks should rise to the competitive challenge and beef up their offering, in order to secure their direct connection with treasurers, in the following three ways.

- Improve automation, connectivity, and ease of use. After security, respondents said that ERP integration is the next most critical criterion for platforms. This was true across regions (except for the Asia-Pacific region, where it ranked third) and segments. Ease of use and customization are also important—especially as companies grow.

- Make platforms easy to implement. Implementation simplicity is a key selection criterion—and treasurers partner closely with their IT departments in the proposal process. Minimizing IT complexity is so important that some treasurers stated they would rather lose some automation benefits if securing them meant going through a difficult implementation. Transaction banks that offer implementation support—such as access to an experienced project manager—will have a distinct advantage, especially in the context of often scarce corporate IT budgets.

- Create treasurer-centric banking platforms. Treasurers want platforms that improve scalability, have multilanguage capabilities, and are built on an open architecture that makes it easier to configure systems to specific needs (for instance, operation tagging to generate automatic reporting). Banks have an opportunity here to develop tools and insights that drive more traffic to their platforms—for example, by leveraging innovations from other digital players.

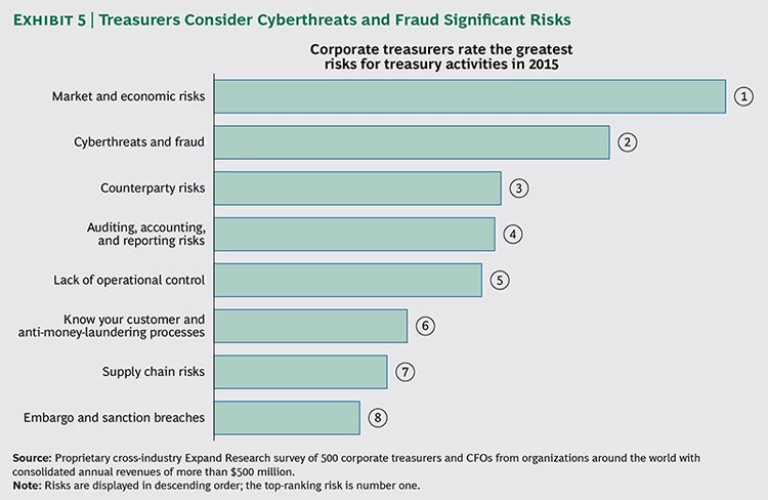

Risk Management and Compliance: High Expectations. After market and economic risks, treasurers are most concerned about cybersecurity threats and fraud. Banks are well positioned to help treasurers address these key risks by providing advanced risk-management tools, such as credit risk assessments, proprietary perspectives, and advisory offerings that help treasurers with long-term financial investments. Of those surveyed, 70 percent said banks that offer strong fraud-detection capabilities would have a competitive edge. (See Exhibit 5.)

The survey also made clear that treasurers find the risk and compliance environment increasingly difficult to navigate. Most treasurers indicated that banks currently do not go far enough to factor in the quality of the client experience when it comes to compliance. They cited the substantial additional paperwork—notably for account opening and know your customer (KYC) processes—duplicative information requests, inconsistent processes, and slower response times.

One in three treasurers said that more efficient KYC and anti-money-laundering (AML) processes would give banks a distinct competitive advantage. In addition, to improve client satisfaction, banks should look for ways to simplify and digitize

processes based on client considerations and implement a “we ask once” policy, backed by rigorous internal information-sharing processes.

The compliance and regulatory management arena also opens significant opportunities for product and service innovation for banks: 40 percent of those surveyed said that regulatory expertise in overseas markets would give banks a competitive advantage (and would help banks monetize the significant investments they have made in this domain over the past few years).

Treasurers are also interested in payments and transactions monitoring as well as alert management systems to help with AML and sanction breaches. Training and advisory services to help clients apply and integrate local regulations would also attract strong interest. In addition, banks should consider new services, such as making KYC capabilities available on demand and developing software to track and manage compliance requirements and documentation.

Playing and Winning in the Selection Process

To be invited to play in the selection process, transaction banks must meet two prerequisites. Banks must be willing to commit capital and take risks on their balance sheets. And they must, of course, be competitive on price—which, not surprisingly, was the top selection criterion across regions, company size, and segments.

Once transaction banks are in the race, winning the selection process continues to depend heavily on high-quality service and domestic capabilities. Treasurers flagged the following four areas as especially decisive.

- Process Execution. Banks that offer automated and streamlined processes backed by strong IT capabilities and common standards will have the edge in delivering consistent, high-quality service.

- Responsiveness. Speedy delivery and rapid problem resolution are essential elements of high-performing treasury relationships.

- Domestic Know-How. Banks need to show they have the right advisory capabilities and account teams with the requisite local experience.

- Transparency. Treasurers expect relevant key performance indicators, meaningful communication, early visibility on issues and incidents, and a standard billing format.

Once a transaction bank has been selected, its cash-pooling capabilities will remain critical to its staying in the field: not only does cash pooling establish a strong bond with the client, it also provides a strong starting position for attracting foreign exchange and trade finance flows to the bank and for generating more deposits. As such, banks should strive to deliver superior service quality and process efficiency and maintain competitive pricing—since these are the top factors that push treasurers to seek different cash-management providers.

TMS providers present the stiffest competition for banks. They have solid penetration with corporations, high levels of market trust, and bank-agnostic appeal. In addition to TMS providers, new digital players have also begun to encroach on the payments, trade finance, and WCF markets. Survey results found that approximately 15 percent of treasurers, notably global treasurers, currently use or have considered using nonbanking digital providers for these services. In general, however, these players pose less of a competitive risk to banks, since digital entrants don’t have the same long-standing institutional credibility, and their services are more limited and potentially more complicated to introduce into the treasurers’ mix. Rather than competing head-on with new, nonbanking players, transaction banks should keep an eye on the market and make sure they integrate the most innovative practices and applications into their own service offering.

A bank’s balance sheet will remain one of its strongest competitive levers—one that will probably make it more difficult for new, digital nonbanking entrants to gain traction in the near term. Interviews with treasurers showed that most are willing to privilege banking relationships in order to secure financing commitment.

How to Exceed Treasurer Expectations

To be perceived as a transaction-banking champion by treasurers, banks will need to adapt their strategy in the following three ways.

Strengthen capabilities. Treasurers expect banks to strengthen their service and support capabilities and help them reduce process and administrative complexity. Shifting from a sales to an advisory mind-set is also critical. To do so, treasurers expect banks to attract talent with the relevant sector expertise and the right service orientation.

Develop new areas of differentiation. Client centricity is key. Improving banking platform connectivity and ease of use through seamless connection with client systems is essential, as are multilanguage capabilities and scalability at the global level. Treasurers expect banks to leverage digital technologies—in order to improve efficiency and value—and to develop new, treasury-centric analytics.

Treasurers are also open to seeing banks as trusted security partners. Compliance-related processes should be streamlined in order to reduce the administrative burden, and some treasurers showed interest in a commercial offering around KYC capabilities, transaction monitoring, and alert management systems. New regional regulations, notably in Europe, could open additional opportunities to help companies consolidate invoicing and collections onto a single platform and use mobile payments to collect and analyze data.

Refine segmentation and go-to-market approach. To maximize their hit rate and identify which products and solutions are most appropriate to specific clients, banks should tailor their go-to-market outreach using the three following segmentation axes: company characteristics (revenue size, industry, financial leverage, and geographic footprint); treasury team characteristics (team size, organization model, missions and activities, and IT system architecture); and treasurer profile (mandate and personal mind-set toward, for instance, innovation or mobile).

As the dust settles from the financial crisis, treasurers have embraced their expanded role. Transaction banks need to respond in kind by elevating the quality and reach of their service offerings. To remain competitive and sustain growth in this environment, transaction banking models must display smart pricing schemes and become more client centric and better integrated in order to create a richer and more convenient experience. Banks must also capture emerging opportunities in areas such as global cash pooling, compliance, and risk management. Although treasurers will continue to rely on banks for their strong balance sheets, banks nonetheless face growing competition from TMS and related systems and should make sure they incorporate the digital innovation offered by nonbanking entrants.

This new landscape creates high expectations from treasurers and a sense of urgency for banks to close service gaps and differentiate their offering, providing a combination of service excellence, cybersecurity leadership, and innovative use of digital technologies.

Acknowledgments

The authors would like to thank Thierry Bujon de l’Estang, Mylène Delahaye, and Alec McLaurin from BNP Paribas for their most valuable contributions to this report and their helpful thought partnership. They also extend their thanks to Franck Vialaron, Angela Paulk, and Liz Monahan from Expand Research for their support and advice in designing and executing the proprietary global survey and their know-how in conducting large-scale global quantitative analysis. In addition, they would like to thank Torben Deuker, Alexandre Martin, and Maarten Peeters from BCG for their most valuable help.

The authors would especially like to thank the 500 corporate treasurers and CFOs across the globe who took the time to answer our questions and the 50 corporate treasurers who welcomed us for dedicated interviews.