The numbers are really big. We estimate that by 2050, a total of $150 trillion in investment capital will be needed to achieve the ambitious goal of limiting warming to 1.5°C above preindustrial levels and reaching net zero . That’s more than $5 trillion every year until 2050—far greater than the current annual volume of around $1 trillion, as reported by the Center for Climate-Aligned Finance (CCAF).

The outlook for investments in companies focused on climate and sustainability is turning favorable.

Recent results indicate an encouraging uptick in investments going to companies operating in the climate and sustainability (C&S) space. Deal activity increased by 40%, with more than 60 new private equity and venture capital investors in climate tech since the start of 2021 and around 1,000 climate deals closed last year. And according to the CCAF, around $37 billion in dry powder specifically earmarked for climate is currently available for deployment. Meanwhile, Europe has an ambitious target to become the first climate neutral continent by 2050. The European Union has recently mobilized efforts to close the gap US and other climate tech subsidies have left. These efforts have culminated in the EU Green Deal Industrial Plan (GDIP) that builds upon established EU climate policy frameworks such as the EU Emissions Trading System (EU ETS) and REPowerEU to create a more hospitable regulatory environment, boost investment, and expedite approvals for key green technologies.

In short, the outlook for investments in companies focused on climate and sustainability is turning favorable. A growing number of private equity (PE) and venture capital (VC) firms, as well as corporate venture arms, are finally recognizing this value creation opportunity. In response, they are developing dedicated climate change and decarbonization funds. The result: an influx of capital into a range of sectors with real upside potential. Meanwhile, more and more private equity and other institutional investors are participating in earlier stage deals, blurring the line between private equity and venture capital. And with generalist investors entering the climate tech space, competition for both investments from limited partners and deals is increasing.

Yet investors can still struggle to find investible opportunities in the climate space. To make the most of their investments—both financially and to meet their climate and sustainability impact targets—investors need a clear view of the value chains in the key sectors across the C&S space and a systematic, results-oriented approach. In what follows, we provide guidance into the sustainable investment landscape and offer a deeper dive into four especially promising climate-friendly sectors.

The Climate and Sustainability Investment Landscape

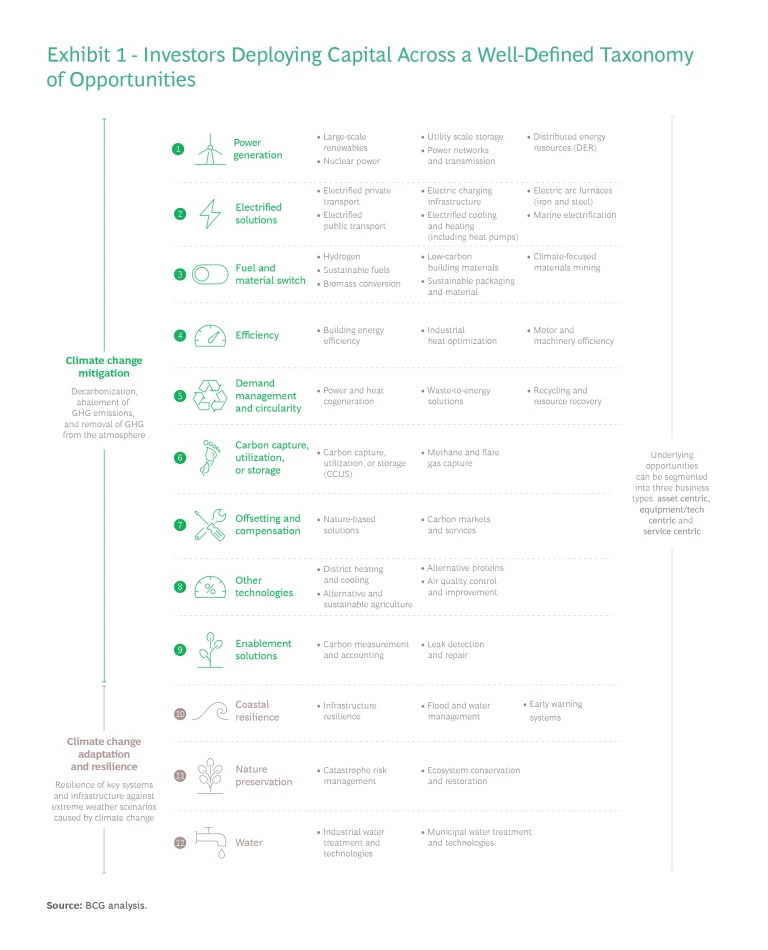

The climate and sustainability space offers attractive investment opportunities in a wide array of segments and technologies. Our taxonomy of the space includes 12 categories. Nine categories are devoted to climate change mitigation technologies intended to decarbonize industries and reduce greenhouse gas emissions. The remaining three categories include technologies aimed at boosting infrastructure and other systems’ resilience in the face of extreme weather caused by climate change. (See Exhibit 1.)

Historically, most of the investment in the C&S space has been concentrated in a small number of mature, well-understood technologies. Between 2017 and 2022, 35% of global investment went into power generation and storage, and another 30% into electrified solutions including electric vehicles. Indeed, while the investment opportunity and dry powder available is large and growing, most private investment thus far has been mismatched with the potential impact on emissions reduction or improving adaptation and resilience.

At the same time, half of the technologies needed to achieve net zero by 2050 is still in the demonstration and prototyping phase, according to the B Capital Group. Emerging technologies that are starting to demonstrate significant traction and whose impact lacks widespread awareness have high potential for breakthroughs and offer tremendous commercial opportunities. PE and VC investors play a vital role in identifying these pockets of high potential and driving their scale and broader adoption.

Where to Play

Given the current state of the C&S sector, investors need a game plan for deploying their capital if they are to reach their investment return goals while making the greatest contribution to the fight against climate change.

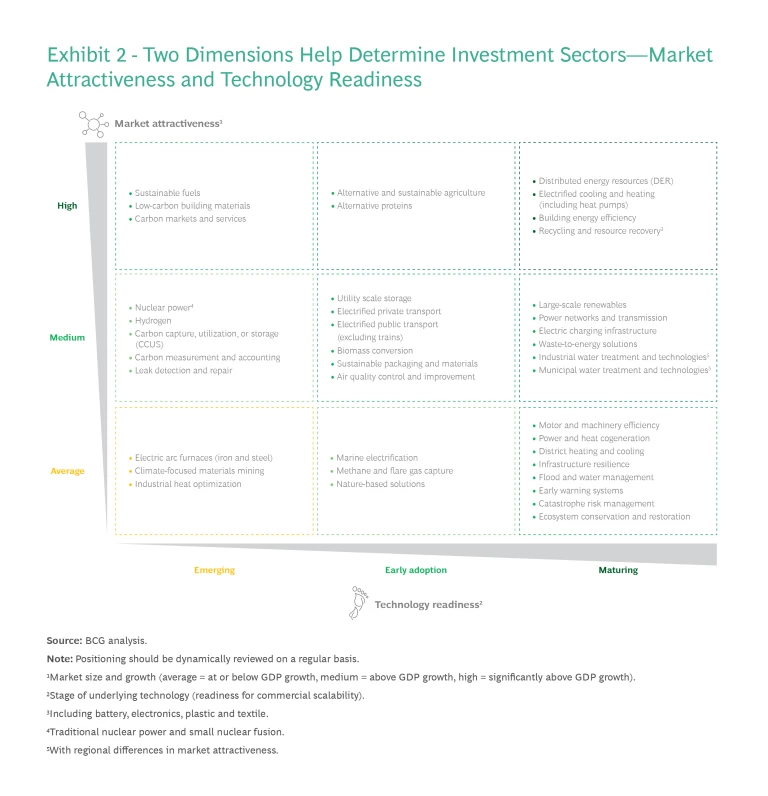

First, investors will need to identify the most attractive subsectors that align with their investment approach. Exhibit 2 lays out the landscape of C&S investment opportunities along two criteria: market attractiveness and technological readiness.

Market attractiveness, determined by both the current size of the overall market and its likely growth trajectory, can serve as a general indicator of the amount and size of opportunities in each category. Regulatory measures and government incentives such as carbon pricing will likely have the greatest impact on companies in industries that produce significant amounts of GHG emissions, providing them with a strong inducement to reduce their emissions. Therefore, we expect that the subsectors with the most significant GHG emission reduction potential are likely to offer the greatest potential for growth.

The technological readiness of each product or solution—emerging, early adoption or maturing—indicates its current status and the likelihood that it can be scaled up in the near term.

Thus, the market potential for sustainable fuels, for example, is high, but much of the underlying technology is not yet ready to be scaled up for broader market adoption. In contrast, while the technologies needed to improve the energy efficiency of equipment for a variety of industries are quite mature, the market’s growth potential is less strong.

Note, too, that the matrix does not account for factors such as target company size and business model, level of risk, and climate impact potential—all of which investors should take into account in light of their investment horizon, strategy, and goals.

Four Subsectors with High Investment Potential

To clarify the relationship between market attractiveness and technology readiness and the factors that investors should consider in determining investment potential, we provide deeper dives into exemplary subsectors. Among the range of attractive subsectors, here we highlight four that showcase the variation in investment themes and the value of deep knowledge about the value chain: distributed energy resources and electrified cooling and heating; recycling and resource recovery of batteries and electronics; alternative and sustainable agriculture; and carbon markets and services. While each subsector offers attractive market fundamentals, they vary in technology maturity level and thus in their risk-return profiles.

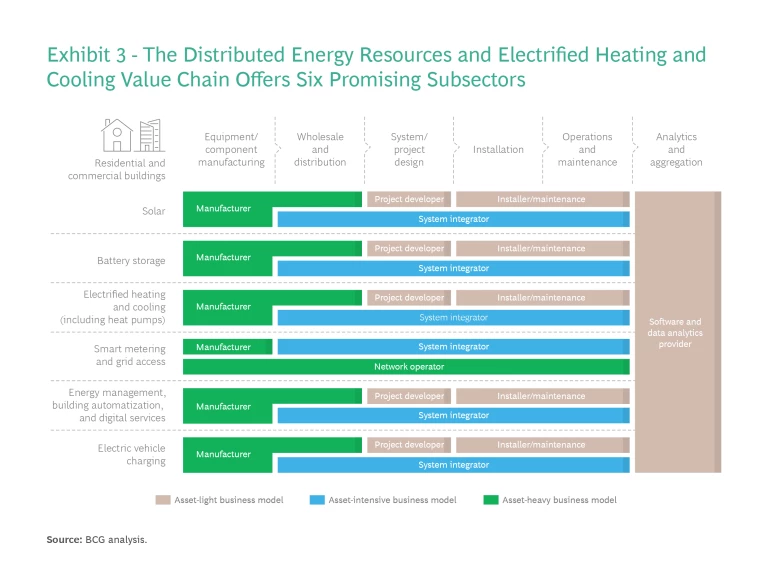

Distributed Energy Resources (DER) and Electrified Cooling and Heating. The building sector accounts for over 30% of total carbon emissions, and clean energy generation and efficient energy usage are prime levers for improving its environmental impact. These two categories can be usefully grouped together, as they provide a valuable combination of services for residential, commercial, and industrial buildings alike and a very attractive market for investors. These include the autonomous production of electricity through solar photovoltaic, local energy storage, and local energy consumption through electrified heating and cooling (heat pumps) and charging of electric vehicles (EVs), as well as efficient energy management through smart meters and energy management systems.

While some investors will likely be willing to support companies involved in manufacturing and network operations, the sector also offers a variety of asset-light business models along the value chain. (See Exhibit 3.) For example, companies could develop a software-as-a-service (SaaS) product that offers demand-side customers the ability to comprehensively monitor and manage their energy consumption.

The European market for these services is projected to grow around 9% annually through 2026, mainly driven by increased demand for heat pumps, which is expected to grow 19% annually to 2030. Other factors include high energy prices, in part as a result of the war in Ukraine and of EU regulations that incentivize the decarbonization of buildings.

Recycling and Resource Recovery of Batteries and Electronics. The recycling and resource recovery segment includes the collection and processing of recycled waste for reuse. Here, we focus on battery and electronic waste recycling, since global demand for batteries is strong and recycling technologies are rapidly maturing. The global lithium-ion battery recycling market is expected to grow around 18% annually between 2026 and 2040, to $35 billion a year. Major growth drivers include the rapid adoption of EVs, the need for storage of renewable energy, and limits on the supply of lithium. The EU battery directive, which mandates strict recycling efficiency targets, will also support the market’s growth. Further support will likely be provided through the EU’s Critical Raw Materials Act (part of GDIP), which aims to strengthen access to supplies through combination of international engagement and enhanced extraction and recycling.

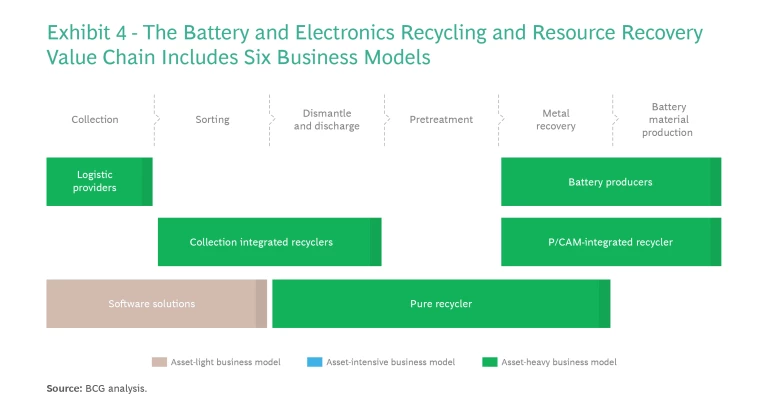

Three business models in particular offer high value-creation potential—battery collectors and aggregators; pure players focusing on recycling of the lithium, nickel, cobalt, and manganese in Li-ion batteries; and precursor cathode active material (P/CAM)-integrated recyclers. All of these are seeking growth by moving up and down the value chain. (See Exhibit 4.)

Due to this category’s need for large-scale recycling facilities and its geographical challenges and environmental challenges, the business models of many of these companies are asset-heavy and may not appeal to investors looking to focus on asset-light software solutions such as battery health checks or traceability of waste. However, this should not limit their value creation potential, given the high resale value of the recycled resources.

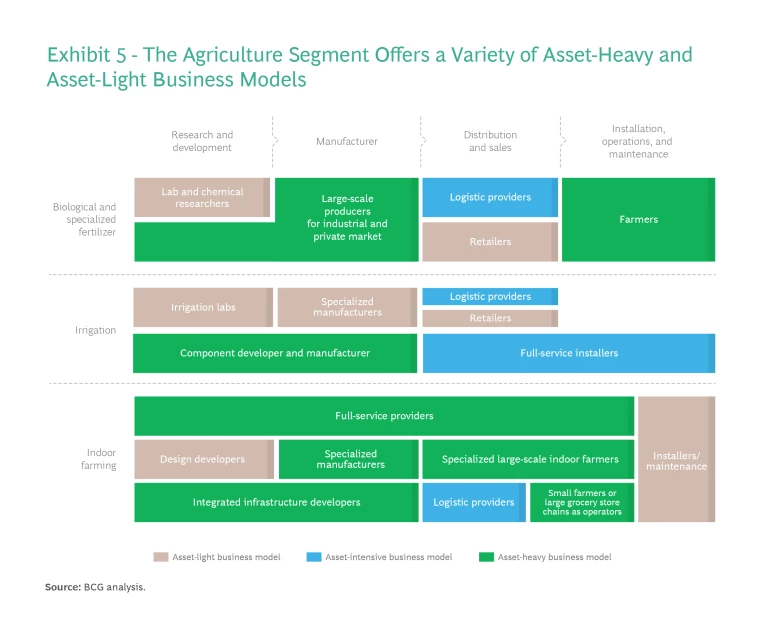

Alternative and Sustainable Agriculture. This category includes companies specializing in biological crop protection, biostimulants such as alternative fertilizers, farming infrastructure such as irrigation and lighting, indoor farming, and livestock methane emissions reduction. Its market attractiveness is driven by several megatrends, including a focus on healthy and climate-conscious lifestyles, new digital farming tools, smart agriculture, biological innovation, and the continuing consolidation of farms. EU regulations are increasingly supporting ecological farming and reductions in the use of synthetic fertilizers and chemical pesticides. And the global food crisis, exacerbated by the Ukraine war, will be one of the biggest challenges of the next decade. As a result, the category is expected to grow by around 9% annually between 2020 and 2025, reaching around $51 billion a year toward the middle of the decade.

Due to the size of physical assets and capital required, many of the business models along this sector’s value chain are asset heavy, although companies focusing on distribution and sales as well as systems installment and maintenance offer business models with lower asset intensity. (See Exhibit 5.) Especially attractive opportunities include biological crop stimulants and protection, irrigation and farming infrastructure, and indoor and vertical farming. These areas offer the potential for product- and sales-mix innovation and commercial expansion into new geographies and new sales channels such as e-commerce platforms, as well as greater efficiency and economies of scale.

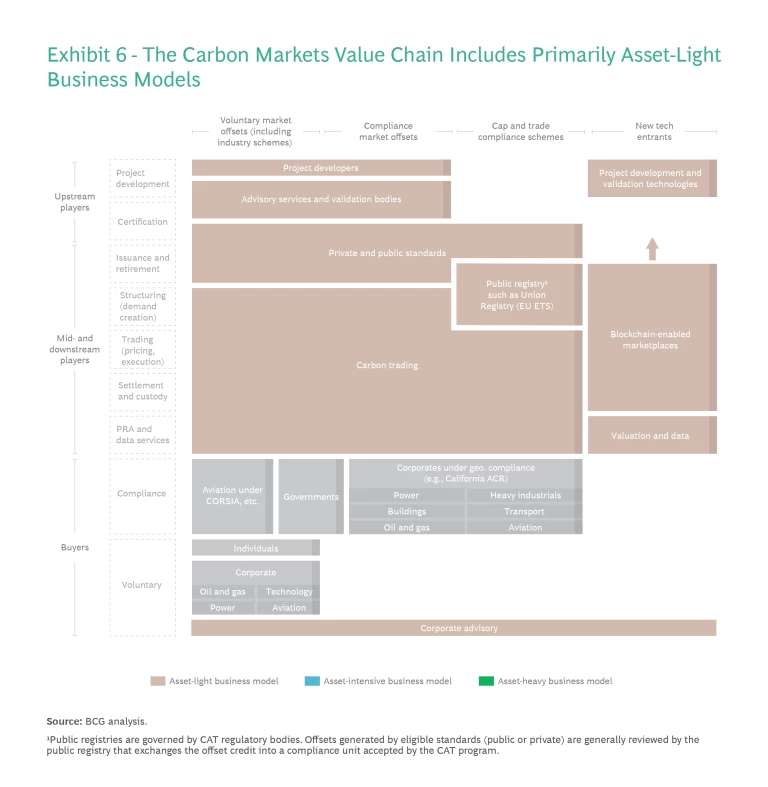

Carbon Markets and Services. The carbon markets segment includes companies that enable the development, buying, selling, and retiring of carbon credits to offset residual carbon emissions. They serve two types of customers: companies required by regulatory bodies to purchase carbon credits, and both companies and individuals that voluntarily engage in reducing their carbon footprints by offsetting their emissions through voluntary carbon markets.

This category is relatively small, just $1 billion in 2021, but it is growing fast—around 50% annually—and should reach a market size of $7 billion in 2026. Increasingly strict regulations are boosting demand for carbon credits, as is increasing pressure from consumers, business partners and investors alike. Europe accounts for about 90% of the total currently turnover in global carbon credits, making it the clear leader in the carbon market and a pioneer in policy innovation.

This category’s value chain offers an especially wide variety of asset-light business models with high scalability, given their considerable reliance on digitization. (See Exhibit 6.) And many offerings in the category should be scalable across geographies and a variety of carbon credit-producing environmental processes. Core value creation opportunities include carbon financing consultancies and portfolio managers, exchanges, ratings agencies, project development and carbon credit producers, and monitoring, reporting, and verification (MRV) entities.

Due Diligence

As the examples above make clear, the C&S space offers a wide range of markets and technologies, and company of all types, sizes, business models, and growth goals. Yet its sheer variety—and the urgent need to reach net-zero goals quickly—makes it that much more critical for PE and VC investors to swiftly learn as much as possible about the space, and how it can help meet their goals. Each potential investment must closely align with those goals, in terms of risk/return profile, initial investment size, investment phase, holding period, and return expectations.

To ensure success, PE and VC investors need to keep in mind three key steps in approaching the C&S space:

- Develop a clear taxonomy of the space and a strong view of where the most attractive opportunities lie, the risk profile is appropriate, and the investor can add strategic value.

- Build a meaningful ecosystem of coinvestment partners with track records, as well as experts, corporate partners and others, who can help attract and underwrite deals and add value.

- Commit to and invest the necessary capital and resources to help target companies scale their business and fulfill their growth strategies.

At the same time, investors in the C&S space should be prepared for some challenges. The regulatory environment is still in flux, and remains unclear, and true international standards are lacking. Expect frequent changes in regulations aimed at improving transparency and consistency in companies’ reporting on environmental compliance. Investors must also consider the likelihood that many C&S technologies will take years before they can be scaled up and reach their full market potential. And many of these markets are facing talent shortages and infrastructure and supply chain constraints. So caution, good advice, and lots of due diligence are in order.

Subscribe to our Climate Change and Sustainability E-Alert.

To slow the process of global warming, investors of all kinds must make massive investments in companies and technologies that can reduce carbon footprints, abate GHG emissions, and help adapt to its effects. PE and VC funds are instrumental in supporting the growth of companies developing and scaling these technologies. In Europe, successful private investments in green tech can spur a virtuous cycle of compounded innovation, expediting regulatory change, driving mass adoption, and encouraging sustainable infrastructure development—as evidenced by the European EV market’s success. Standing out from the climate tech investor pool requires a strong understanding of the space—its technological potential and its risks. But the rewards can be significant, both financially and environmentally.