It may be the biggest bet a company can make: the transformation to a different portfolio of businesses. More big companies undertake portfolio transformation than many people realize—almost 20%, according to our research. Consider Nokia, which recently transformed itself from a world leader in mobile phones to a world leader in network technology and services. Or Bayer’s ongoing transformation from a chemical and pharmaceutical conglomerate to a life science company focused on health care and crop science. Bayer accomplished this through multiple spinoffs, divestitures, and acquisitions, which may soon include Monsanto, pending regulatory approval of Bayer’s takeover offer.

While organizational, financial, and business model transformations have been well researched and examined (See for example: Building Capabilities for Transformation That Lasts, BCG Focus, June 2016; A Leader’s Guide to “Always-On” Transformation, BCG Focus, November 2015; Transformation: The Imperative to Change, BCG report, November 2014,) the factors that determine the success of large-scale, strategic transformations of the corporate portfolio have not. BCG and the University of Göttingen researched the portfolio transformations of more than 1,000 large US and European companies over 12 years. We examined the following questions:

- How prevalent are portfolio transformations among large companies, and what is the success rate?

- What is the typical direction of change—that is, do companies tend to use portfolio transformation more often to refocus or to diversify their portfolios?

- How are portfolio transformations designed in terms of magnitude of change, duration, and the sequencing of portfolio moves (for example, do companies first divest and then acquire, or the other way around)?

- Most important, how do these design characteristics affect the success of the transformation under different environmental and company-specific circumstances?

We found that a significant number of large companies use portfolio transformation as a strategic response to sustained weak performance or expected disruptions in their industries. Perhaps surprisingly, given the ambition and complexity of these transformations, the success rate is reasonably high—more than 50%, better than the success rate for individual M&A transactions. (See “Why Deals Fail” BCG article, October 2015.) We also found that there is no single best way to design a portfolio transformation: the right combination of direction, magnitude, and speed depends on the company’s circumstances at the start of the process as well as its industry environment. We were, however, able to identify successful portfolio transformation designs for just about any starting point.

A Popular Option

To gain an understanding of the prevalence, nature, and success of portfolio transformations, BCG and the University of Göttingen built a proprietary database of portfolio development data for large US and European companies, including all companies in the S&P 500, FTSE 350, and MSCI Europe indices, covering the period from 2001 through 2011. After inspecting and correcting segment financial data and eliminating companies with incomplete data sets, our sample comprised 1,088 firms from 16 countries operating in more than 70 two-digit standard industrial classification industries.

From our sample, we identified major portfolio transformations (a restructuring of 20% or more of the business portfolio) in 200 companies, almost one-fifth of our sample. On average, the 200 companies transformed 43% of their portfolios over a period of 2.3 years, and 10% of companies transformed their portfolios by more than two-thirds. A small share of companies (8%) took five years or more to complete their transformations.

A Viable Path to Improved Performance

We also examined which design characteristics led to successful portfolio transformations, taking into account individual company circumstances and the industry environment. We determined success on the basis of the change in industry-adjusted return on assets (ROA) reported two years before and two years after the transformation.

We found that the majority of companies undertake portfolio transformations to tighten their focus: two-thirds of those in our sample chose to refocus their portfolios, while only one-third opted for diversification. And though success is hardly guaranteed, it is a reasonable bet: more than half (55%) of portfolio transformations were successful on the basis of improved industry-adjusted ROA. Interestingly, while almost half the transforming companies (48%) started from a strong base (defined as an ROA above the industry average), those starting from a base of weak performance had a considerably higher success rate. More than two-thirds (68%) of poor performers increased ROA during the transformation, compared with only 40% of strong performers. It is hard to ascribe causality, but it seems reasonable to assume that poor starting performance leads to a greater willingness to change among key decision makers, which helps in the successful execution of a major portfolio transformation.

Success Patterns

What are the factors—beyond healthy pressure from weak performance—that determine the success of portfolio transformation? We investigated the impact of company- and industry-specific factors, as well as the design of the transformation, on success. Company-specific factors included prior performance and level of diversification. Volatility and industry direction (whether the industry was booming or declining) were among the industry factors. Design choices included the direction of the transformation (diversifying or refocusing), magnitude (size of the change), and speed of execution.

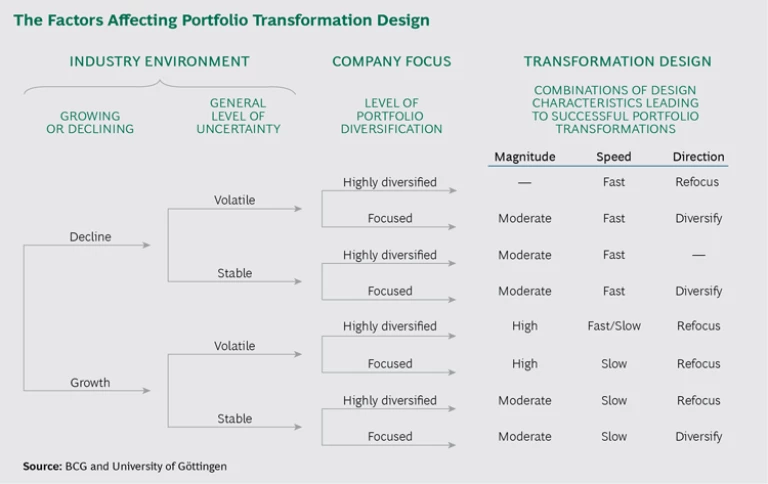

Portfolio transformations starting from almost any competitive situation can be successful if managers choose the right design for the company’s circumstances. (See the exhibit.) Our study identifies the respective combinations of design characteristics that consistently lead to successful portfolio transformations, depending on industry environment (growing or declining), level of uncertainty, and company characteristics (level of portfolio diversification). For example, a company planning the transformation of a highly diversified portfolio in a declining and volatile industry should choose a fast refocusing strategy (the first configuration in the exhibit). However, a company that wants to transform a focused portfolio in a booming and overall stable industry will do better with a slow and moderate diversifying transformation (the last configuration in the exhibit).

Most companies will never need to consider portfolio transformation. But for those that do, the evidence shows that smart planning based on sound analysis of a company’s condition and an industry’s circumstances is the first step toward success.