Indonesia is at an inflection point in its economic development, with large swaths of the population moving into the middle class and enjoying higher incomes and more discretion over how to spend—or save and invest—their money. Like most Asian emerging markets, the country has experienced significant turbulence during much of 2015 owing to the slowing Chinese economy and currency concerns. But its long-term outlook remains positive. For financial services companies, winning new customers and converting them into brand loyalists remain critical. In addition, banks have the opportunity to help higher-income Indonesians diversify their income sources and risk through more advanced financial services.

Methodology

We conducted a deep-dive analysis of consumers’ shopping attitudes, spending levels, channel preferences, and experiences with several brands in order to better understand how they assess products and make purchasing decisions, giving us an in-depth understanding of the path to purchase (that is, the process by which customers make buying decisions). We analyzed the path to purchase for 63 product categories across three consumer categories: consumer durables (18 categories), fast-moving consumer goods (23 categories), and financial services (22 categories). Additionally, we captured a wide range of profiling variables, including demographics, household expenditure, and overall consumer sentiment in Indonesia.

INDONESIAN CONSUMER SERIES

- Consumer Durables

- Fast-Moving Consumer Goods

- Financial Services

To gauge the scope of this opportunity, The Boston Consulting Group recently surveyed more than 3,000 Indonesian consumers regarding their savings habits, spending levels, overall sentiment, and interaction and relationship with financial brands. (For details on the research, see “Methodology.”) We performed similar analyses of Indonesia’s consumer durables and fast-moving consumer goods sectors, which are discussed in separate publications.

Continued Optimism Is Fueling Economic Growth

Indonesia’s population is one of the happiest and most optimistic in the world, particularly middle-class and affluent consumers (MACs), a demographic group that is growing rapidly.

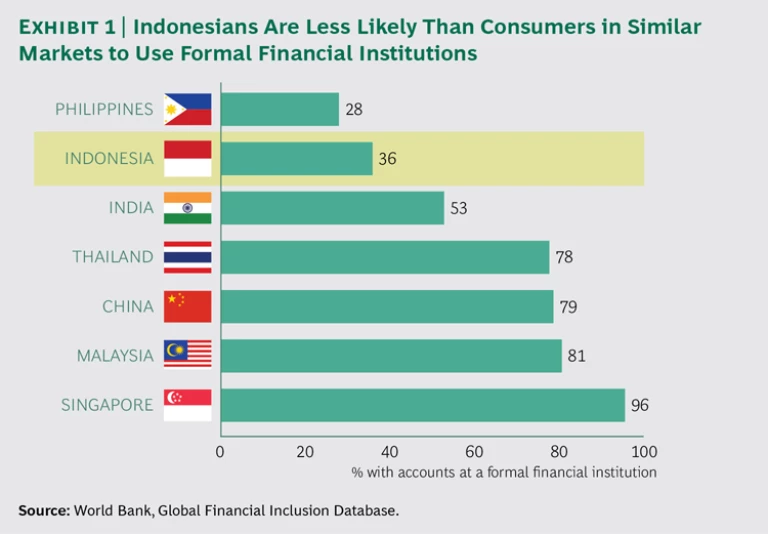

At the same time, many Indonesians still do not use formal financial services. According to the World Bank’s Global Financial Inclusion Database, only 36% of the country’s population held an account with a financial institution as of 2014, and only 13% used a formal channel to borrow money. (See Exhibit 1.) Our study indicates that a lack of knowledge about the financial system, along with the perception that it provides no benefits, are the main reasons for the low penetration of financial services among Indonesians.

This low rate—combined with the population’s optimism about the future—presents a huge growth opportunity for new and incumbent players in Indonesia’s financial sector. To capture it, they will need to thoroughly understand the financial priorities and preferences of Indonesia’s various consumer segments.

Different Consumer Segments Require Different Approaches

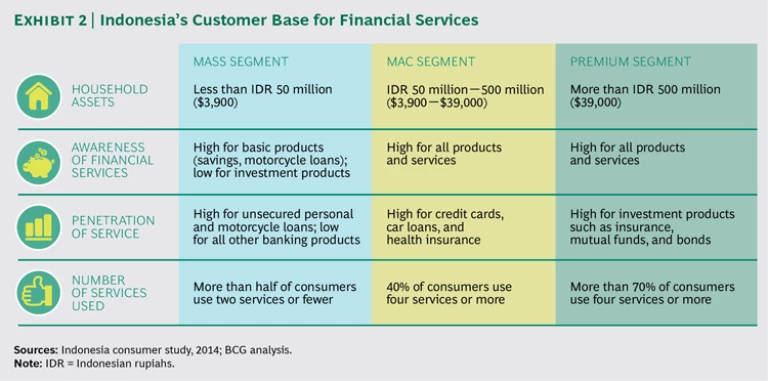

While the overall opportunity in financial services is sizable, our study suggests that a single, one-size-fits-all approach to Indonesian consumers will not work. Rather, financial services organizations should disaggregate the market and target the needs, habits, and aspirations of individual demographic groups, as companies in industries such as consumer durables and fast-moving consumer goods have already successfully done in Indonesia. We identified three major segments in the country’s financial services market, each at a different stage of development. (See Exhibit 2.)

- The Mass Segment. With assets of less than 50 million Indonesian rupiahs (approximately $3,900), mass-market households form a sizable part of the Indonesian population: approximately 165 million people. Higher-income mass consumers (this article does not address the segment’s lowest-income members) are relatively well aware of basic banking products but are unaware of investment products such as insurance, mutual funds, and bonds. The majority purchase no more than two basic banking products, such as unsecured personal or motorcycle loans.

- The MAC Segment. With assets between 50 million and 500 million Indonesian rupiahs (approximately $3,900 to $39,000), MAC households comprise 88 million people, a number that is projected to exceed 140 million in the next five years. These consumers have a greater awareness of all financial products and services than those in the mass segment. We found that 40% of MAC consumers use four or more financial services, and penetration of credit cards, car loans, and health insurance is significantly higher than among mass-market consumers.

- The Premium Segment. With assets in excess of 500 million Indonesian rupiahs (approximately $39,000), premium households constitute a small market in terms of absolute size but make a significant contribution to the country’s financial services industry. Awareness and penetration of all financial products is greatest among these consumers—more than 70% use four services or more—as is the penetration of investment products specifically.

Because the premium segment is already well served by financial services companies in Indonesia, we believe that the most significant opportunity lies with the mass and MAC segments. Moreover, we determined that 80% of mass and MAC consumers are located in just 12 provinces. Of those, 8 provinces include significant populations of people in both segments, while the remaining 4 are dominated by one group or the other. This finding highlights the need for a differentiated strategy to reach both the mass and MAC segments effectively.

The Mass Segment

Our experience in this sector, as well as the results of our Indonesian consumer survey, point to a several insights about the mass segment that can help companies draw these potential customers into the formal financial system.

1. Mass consumers need to be convinced that the formal financial system is worth their attention. The majority of people in this segment believe that their financial needs are already being met through informal channels, such as individuals who make loans to neighborhood residents. They do not see a clear advantage in switching to formal institutions. (People with lower income levels within the mass segment are most likely to feel this way.) Respondents to our survey cited long distances to the nearest bank branch (especially in rural areas), significant paperwork, a perceived lack of benefits, and feeling intimidated as reasons for not trying formal financial channels. These people are simply more familiar and comfortable with informal banking processes.

To overcome this resistance, financial services companies need to educate potential customers about the relevance and benefits of the services that they offer. Banks need to simplify processes and minimize paperwork so that all services and transactions—particularly the opening of new accounts—are simple and straightforward. They also need to strategically expand their networks so that branches are more conveniently located for consumers in the mass segment. Finally, banks can differentiate themselves through various channels and formats—such as flagship locations, standard branches, and more basic branches—as well as through partnerships with retailers.

2. Mass consumers have little awareness of most financial services beyond savings accounts. The majority of mass-segment consumers who do use formal channels limit themselves to basic savings accounts. They have little awareness of most other financial products, particularly investment instruments like mutual funds and bonds, debt instruments like personal loans and credit cards, and banking services like debit cards. Awareness of life insurance is greater, but penetration levels are still extremely low. The implication for financial services companies is clear: they need to focus on nonsavings products and convince consumers of the value of such offerings.

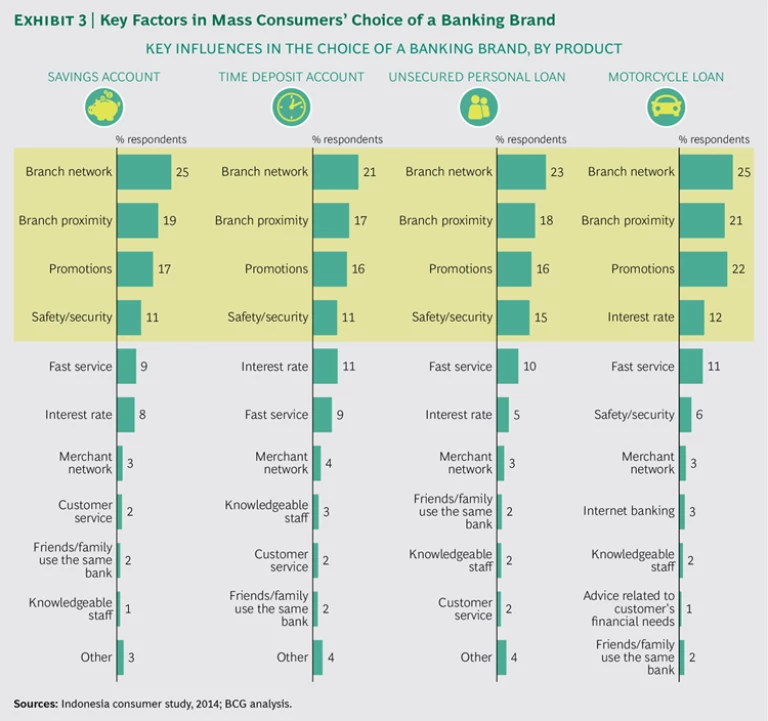

3. A bank’s overall brand image is the most important factor in attracting new customers. When mass-segment consumers need a banking product or service, they tend to choose on the basis of the bank’s overall brand image rather than its strength in any particular offering. According to our study, the key factors driving a bank’s brand image are the size of the branch network, branch proximity, product and service promotions, security of customers’ assets, and interest rates. (See Exhibit 3.) Banks need to focus on these factors in order to build their overall brand image, instead of trying to differentiate on the basis of individual products.

4. Brand awareness and word of mouth are critical. The typical path to purchase for mass consumers in Indonesia is simple. They consider one or two options from among the banks they know about and compare them based on recommendations from friends and family. (Promotions, too, can increase brand awareness but are less important.) They make their final decision before setting foot in the bank, and when they do, they are ready to sign the paperwork and open an account. In practice, this means that the biggest and best-known banks are de facto the most likely choices for mass consumers. For new players, the message is clear: they need to market themselves creatively and increase awareness of their brand in order to gain entrance to the small subset of banks that mass consumers consider. In addition to marketing, banks can ensure that they have the right branch presence in priority locations and offer services such as group lending, which generates word-of-mouth referrals and reduces lending risks at the same time.

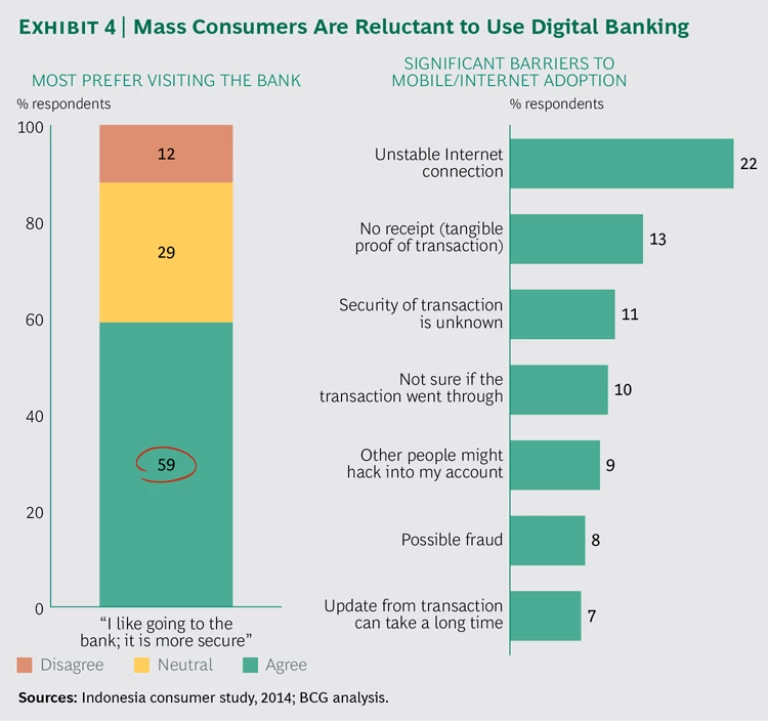

5. Digital banking is still in the nascent stage. Despite the increasing use of digital and mobile technology—including smartphones and tablets—by Indonesian consumers in the mass segment, digital platforms are not yet widely used for banking. Indonesia has few digital platforms designed to sell financial services online, and consumers generally still prefer to visit a branch or use an ATM for most activities. Other factors that limit penetration of financial services online are unreliable Internet connections, lack of a receipt confirming transactions, and concerns regarding overall security. (See Exhibit 4.)

Banks can address some of these concerns by educating consumers about the benefits and safety of digital banking. In addition, the slow rate of adoption thus far has created an opportunity: over time, as the technology becomes more pervasive and reliable, customers will switch to digital, and digital banking will become a competitive advantage in serving the mass segment. Banks that deliver outstanding digital experiences while emphasizing privacy and security will be able to capitalize.

The MAC Segment

A number of insights can help companies spur the adoption of more advanced financial services such as insurance and investments by Indonesia’s MAC segment.

1. There is a huge opportunity for banks that offer a wider range of financial services. As Indonesians enter the MAC segment, they begin using a broader set of financial services. Credit cards, car loans, and health insurance all show far greater rates of use by MACs than by mass consumers. Yet penetration of these products among MACs is still low in absolute terms. The MAC segment therefore provides a significant opportunity for financial services companies as it continues to grow in terms of both size and income level.

2. Life transitions and increased income can create a need for new financial services. The adoption of more advanced financial services usually corresponds to key transitions in the professional or personal lives of MACs, such as a new job, a pay raise, the birth of a child, or the decision to pay down debt. This makes sense, since such transitions usually have financial implications. Financial services companies must get better at identifying MACs at these points in their lives, which are prime opportunities to cross-sell new offerings. Consumers also buy more durable goods as they move into the MAC segment, and they are often amenable to financing those purchases.

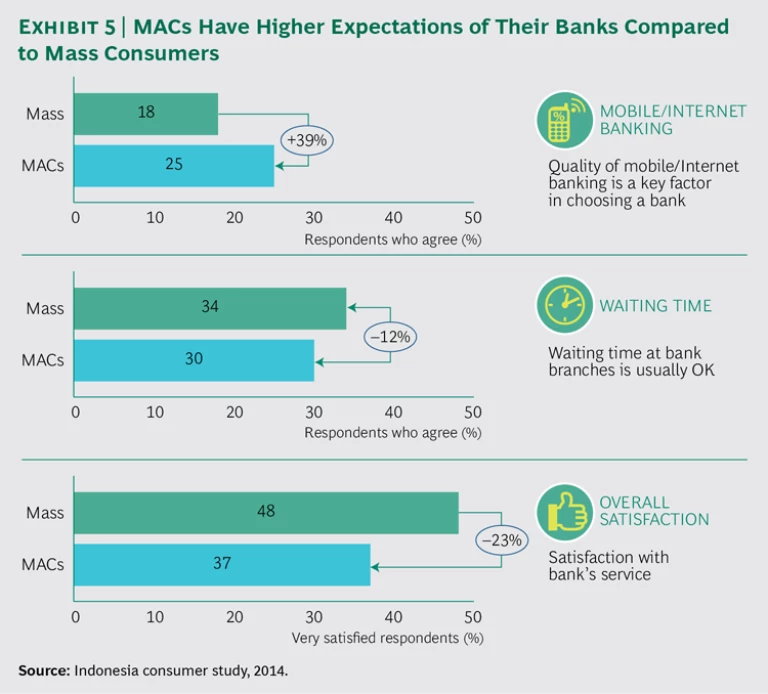

3. MACs have higher expectations of their banks than mass consumers. As people enter the MAC segment, their needs and expectations change, sometimes creating pain points in their existing banking relationships. For example, while online and mobile banking are low priorities for the mass segment, they are of greater importance to MACs, who tend to be more comfortable shopping online and are more likely to use smartphones and tablets. Similarly, MACs are more likely to be dissatisfied with wait times and overall customer service at their current bank. (See Exhibit 5.)

Banks that target the MAC segment should understand that its members are not simply mass consumers with larger assets. In particular, they seek banks that are convenient, safe, and—critically—flexible, meaning they are able to waive fees, negotiate interest rates and terms, and process loans quickly.

4. MAC consumers tend to research financial service brands before making a purchase. The path to purchase for basic products is very similar for consumers in the MAC and mass-market segments. For advanced products like insurance and investment instruments, however, the process for MACs is more complex, involving more touch points and necessitating a strategic approach to winning them over (rather than just the provision of basic information). For example, MACs will consi-

der a larger set of providers and read online reviews by experts and customers. They will call companies with questions about service features and processes, and they will seek information and recommendations from an inner circle of relatives and friends. The entire process can take as long as a month, compared to a much shorter period for basic products. Similarly, MACs are usually extremely loyal to banks where they already have an account, but for new products they typically seek out product or service expertise (in addition to considering overall brand image).

5. Digital banking will become more important to MACs over time. While digital usage continues to be low in absolute terms, the MAC segment is more familiar with the Internet than other demographic groups in Indonesia (29% penetration, compared with 15% for the rest of the population). Like our mass respondents, MACs identified unreliable Internet connections, the lack of a receipt confirming transactions, lack of perceived benefits compared to traditional banking, and concerns about security as the primary barriers to online banking. However, these barriers are likely to dissipate quickly as digital technology becomes more prevalent in the country. In the last six months alone, investors have made large investments in digital companies in Indonesia. The technology is growing in other sectors and will grow in banking as well.

Banks that target the MAC segment should understand that its members are not simply mass consumers with larger assets. In particular, they seek banks that are convenient, safe, and—critically—flexible, meaning they are able to waive fees, negotiate interest rates and terms, and process loans quickly.

4. MAC consumers tend to research financial service brands before making a purchase. The path to purchase for basic products is very similar for consumers in the MAC and mass-market segments. For advanced products like insurance and investment instruments, however, the process for MACs is more complex, involving more touch points and necessitating a strategic approach to winning them over (rather than just the provision of basic information). For example, MACs will consi der a larger set of providers and read online reviews by experts and customers. They will call companies with questions about service features and processes, and they will seek information and recommendations from an inner circle of relatives and friends. The entire process can take as long as a month, compared to a much shorter period for basic products. Similarly, MACs are usually extremely loyal to banks where they already have an account, but for new products they typically seek out product or service expertise (in addition to considering overall brand image).

5. Digital banking will become more important to MACs over time. While digital usage continues to be low in absolute terms, the MAC segment is more familiar with the Internet than other demographic groups in Indonesia (29% penetration, compared with 15% for the rest of the population). Like our mass respondents, MACs identified unreliable Internet connections, the lack of a receipt confirming transactions, lack of perceived benefits compared to traditional banking, and concerns about security as the primary barriers to online banking. However, these barriers are likely to dissipate quickly as digital technology becomes more prevalent in the country. In the last six months alone, investors have made large investments in digital companies in Indonesia. The technology is growing in other sectors and will grow in banking as well.

Key Questions for Financial Services Companies

In sum, companies that wish to capitalize on Indonesians’ rising incomes and corresponding need for financial services should ask themselves two critical questions regarding their current readiness:

- Do we have clearly differentiated strategies and risk models, products, value propositions, and go-to-market approaches for both mass-market and MAC consumers?

- Do we have a digital strategy? What is the main objective of our digital efforts (for example, reducing our costs or attracting new clients through innovative offerings)?

To win the over mass consumers specifically, companies should answer these questions:

- Do we have a laser-sharp focus on the key products that are most relevant to this segment, and do we have a clear sense of these consumers’ needs and pain points?

- Do we have a business model that meets our financial goals despite the smaller account sizes and fewer transactions typical of mass consumers?

- Do we have a means to persuade mass consumers of the value of formal financial services? Is it sufficient to overcome their resistance?

To win over MACs specifically, companies must ask themselves these questions:

- Do we have a strategy and the capability needed to identify and leverage transition points in the personal and professional lives of consumers in this segment?

- Do we have an attractive value proposition and enough product offerings to increase our wallet share among these consumers?

- Do we have a clear plan to balance overall brand communications and product-specific communications ? How should we educate MACs on our more complex products? What is our strategy to win over key opinion leaders and other sources of influence?

Acknowledgments

The authors thank Federico Burgoni and Peter Cho for their insights into Indonesia’s financial services sector.