To tackle their biggest challenges and capture the most promising new opportunities, insurance players have launched transformation programs—aimed not only at improving their performance but also at rethinking the way they serve their customers and manage their operations—to become insurers that build for the future.

Our unique formula for insurance transformation is built on the foundation of BCG's core business transformation offering. We partner with our clients to improve their business processes, digitize their operations, strengthen their balance sheets, and grow new businesses—while promoting cultural change, a bias-to-action mindset, and organizational and technical capability upgrades.

Unlocking Long-Term Success in Holistic Insurance Transformations

Successful holistic insurance transformations focus on more than securing financial, commercial, and operational gains. They pay close attention to how those gains are achieved, particularly with respect to long-term organizational health.

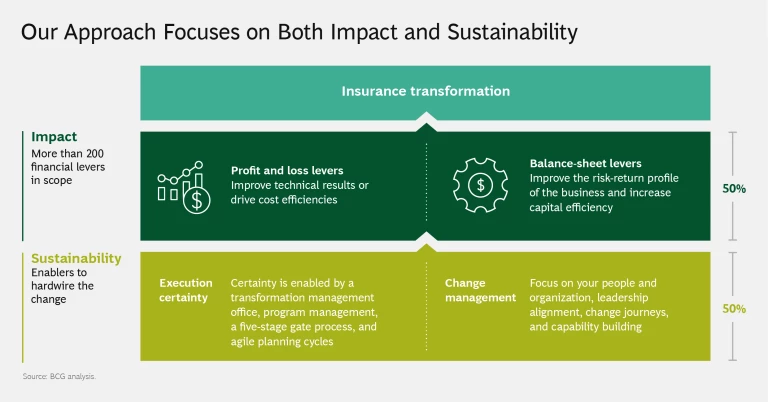

Our research shows that two elements related to organizational health—execution certainty and change management—constitute about 50% of the success factors in a winning transformation. This is why, in our approach, we focus on measures to both boost impact and ensure its sustainability. This dual focus is what successful holistic insurance transformation is all about.

How We Support Holistic Insurance Transformations

Our experts in insurance transformation help clients improve their performance by developing and implementing well-scoped, pragmatic initiatives using two classes of levers:

- Profit and loss levers to improve technical results or drive cost efficiencies throughout distribution, pricing, operations, claims, IT, and support functions

- Balance-sheet levers in areas such as asset liability management, investments, risk modeling, reinsurance, and financial engineering to improve the risk-return profile of the business, increase capital efficiency, or create room for further growth

At the same time, we ensure that impact is delivered in a durable way by improving the overall health of the organization through execution certainty and change management.

Our approach to achieving execution certainty involves four program management best practices:

- An activist transformation management office to challenge and support the business functions’ use of best practices; the TMO should be led by an experienced chief transformation officer to expedite decisions and impact

- Deployment of KEY Impact Management by BCG X, a cloud-based program management tool that acts as a single source of truth on initiatives’ progress and performance

- A disciplined five-stage gate process, from idea generation to benefit realization, tracking and expediting impact until it hits the bottom line

- Agile planning cycles to regularly assess the health of the initiative portfolios and trigger new initiatives as needed to fill gaps

Our approach to change management consists of four enablers that activate new ways of working:

- Measuring the vitality of your people, processes, and structure with our OrgVantage Survey, and defining the key behaviors needed to enable change

- Ensuring alignment among the leadership team, whose members will need to communicate, live, and breathe the case for change and the transformation story

- Designing and launching three change journeys: the people journey, through communication and engagement; the program journey, through progress cadence; and the leadership journey, through strategic alignment, incentives, and consequence management

- Upgrading your team’s capabilities by acknowledging organizational and technical gaps to be covered and new capabilities to be built

When partnering with our clients on insurance business transformations, we leverage our global industry, functional, digital, and analytics capabilities to deliver fast results while changing mindsets and ways of working for lasting impact.

The 2021 Insurance Value Creators Report

Featured Client Successes in Insurance Transformation

Our insurance clients that have implemented this approach found greater vitality as they focused on making the right big bets, inspiring and empowering their people, and executing and innovating with agility. These are traits of companies that make long-term, transformational change.

Our Latest Thinking on Insurance Transformation