Tech isn’t just for tech companies anymore—and it hasn’t been for some time. Nearly every industry has been affected by digital and mobile technologies, and many have been upended. Other advances, such as robotics and additive manufacturing, are also taking hold. No company can afford to ignore the impact of technology on everything from supply chains to customer engagement, and the advent of even more advanced technologies, such as artificial intelligence (AI) and the Internet of Things, portends more far-reaching change. The question is, How do companies rapidly access the technologies that can advance their businesses and integrate them successfully with their current operations?

The 2017 M&A Report

- The Technology Takeover

- The Resurgent High-Tech M&A Marketplace

- Doing Tech Deals Right

For an increasing number of organizations, the answer is to buy rather than to build. Acquisitions of high-tech targets have become an instrument of choice for buyers in all sectors looking to boost innovation, streamline operations and processes, shape customer journeys, and personalize products, services, and experiences. High-tech deals represented almost 30% of the total $2.5 trillion of completed M&A transactions in 2016. Approximately 70% of all tech deals in 2016—9 percentage points more than in 2012—involved buyers from outside the tech sector. The 2017 M&A report examines three questions here and in two related articles:

- What moves global M&A? Our analysis of M&A activity in 2016 and during the first half of 2017 highlights three global trends: China’s increasing appetite for international M&A, private equity’s insatiable need to invest, and, yes, the growing volume of deals involving tech targets.

- What does the tech M&A marketplace look like? Big tech deals, such as the acquisition of LinkedIn by Microsoft and the purchase of Germany’s KUKA by China’s Midea, are hard to ignore. But behind the headlines, little is actually known about the underlying drivers in this booming market when it comes to the key players, their motivations, and the current trends and valuation levels. An analysis based on BCG’s proprietary Technology Deals Database—which includes more than 43,000 high-tech M&A transactions over the past 20 years and which BCG built expressly to examine acquisitions involving high technology targets—sheds light. (See “The 2017 M&A Report: The Resurgent High-Tech M&A Marketplace”)

- Do tech acquisitions pay off for acquirers? Given a median enterprise value (EV)/sales multiple of 2.9 in 2016, and a total deal value almost reaching the levels of 2000, one has to ask whether tech M&A is adding value for shareholders. We look at the announcement returns of more than 37,000 high-tech deals performed by both tech companies and traditional industrial acquirers and review acquisition strategies for technology targets. (See “The 2017 M&A Report: Doing Tech Deals Right.”)

What Moves Global M&A?

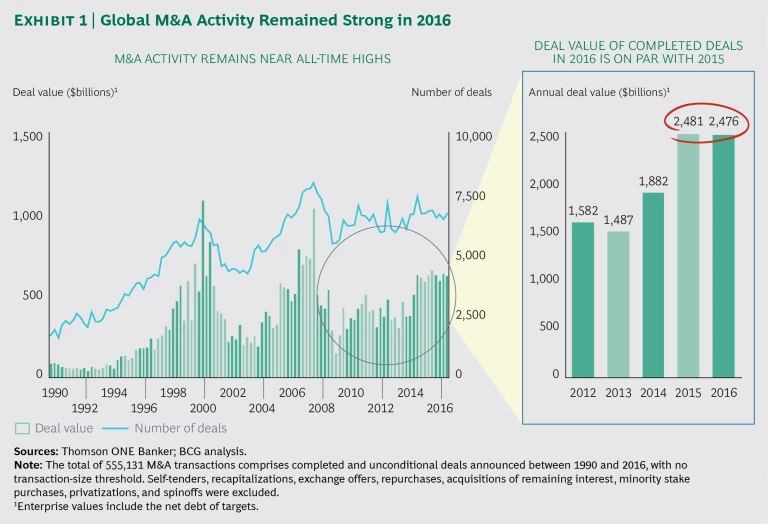

M&A activity remains robust. On the basis of completed deal volume, some 26,000 deals took place worldwide in 2016—a level similar to that of the previous year and approaching the boom years of 1999 and 2007. Aggregate deal value totaled about $2.5 trillion, on par with 2015. (See Exhibit 1.)

The value of closed deals in 2016 was about $100 billion lower than expected because of several rejected takeover advances (such as that of Medivation by Sanofi and Hershey by Mondelez International), megadeals that did not go through (Deutsche Börse and the London Stock Exchange Group, for example), and transactions that were still in regulatory review at year end, including Bayer’s acquisition of Monsanto, China National Chemical’s takeover of Syngenta, AT&T’s purchase of Time Warner, and British American Tobacco’s acquisition of Reynolds American.

In last year’s M&A report, we observed that the direction of the market was not clear, and we questioned how long the heights could be maintained. (See The 2016 M&A Report, BCG report, August 2016.) One year later, the path remains unclear, with many of the same fundamental factors in place.

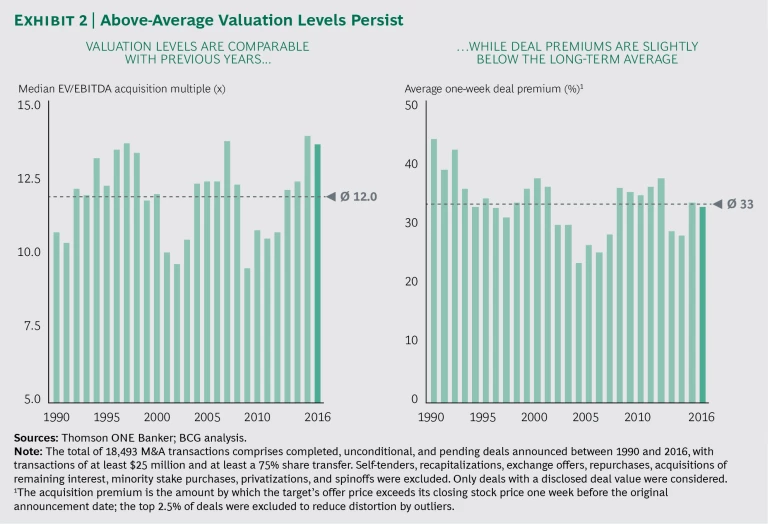

High Valuations

Valuations remain high. The median EV/EBITDA multiple of about 13.6 has stayed well above the historical average of 12.0 and close to the ten-year high of 13.7 in 2007. (See Exhibit 2.) This reflects continuing inexpensive financing and increased competition for targets. The average one-week deal premium (the amount by which the offer price exceeds the target’s closing stock price one week before the announcement date) of 32% is close to the long-term average of 33%. Market trading multiples are already high, and buyers struggle to find additional synergies to justify significant takeover premiums.

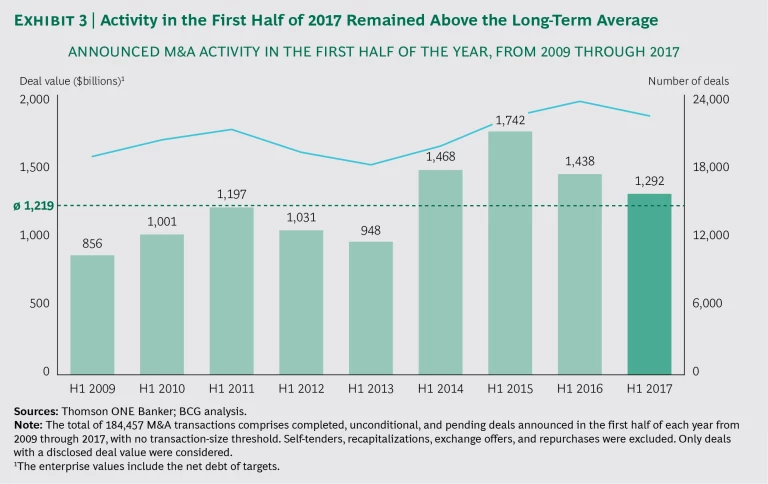

Despite political uncertainty in the US and Europe, global M&A activity has maintained its momentum, with almost $1.3 trillion in announced deal value in the first half of 2017, well above the historical average of $1.2 trillion. (See Exhibit 3.) Deal volume has also been running above average, with more than 22,000 deals announced in the first half of the past three years.

We observed last year that several factors were encouraging corporate caution and promoting market unpredictability. These included political uncertainty, volatility in equity markets, expected increases in interest rates, and tightening of regulations, particularly with respect to tax-driven deals. It’s hard to argue that the political seas have calmed in the past 12 months. Indeed, in some areas—such as the prospects for global trade and continued global economic integration—they are more roiled than ever. Nonetheless, markets seem to have regained confidence, and activity continues at full speed, despite broader uncertainties and increasing concerns about whether or not a peak has been reached or a potential bubble has begun to form.

Two macro factors still weigh heavily on the minds of CEOs: low growth in mature economies and cheap money. With a few exceptions, organic growth is hard to come by, and while shareholders used to look skeptically at attempts to grow inorganically, they now realize that M&A offers one of the few proven avenues to higher revenues and earnings. At current borrowing rates, at least in developed markets, acquisitions are easily and inexpensively financed. The first factor, low growth, is likely to be with us for some time. The second, cheap money, is more likely to reach an expiration date. However, we might observe differences in geographic momentum given that the European Central Bank is staying put while the US Federal Reserve is increasing rates slowly.

Three Big Trends

Embedded in this worldwide investment climate are three major M&A trends.

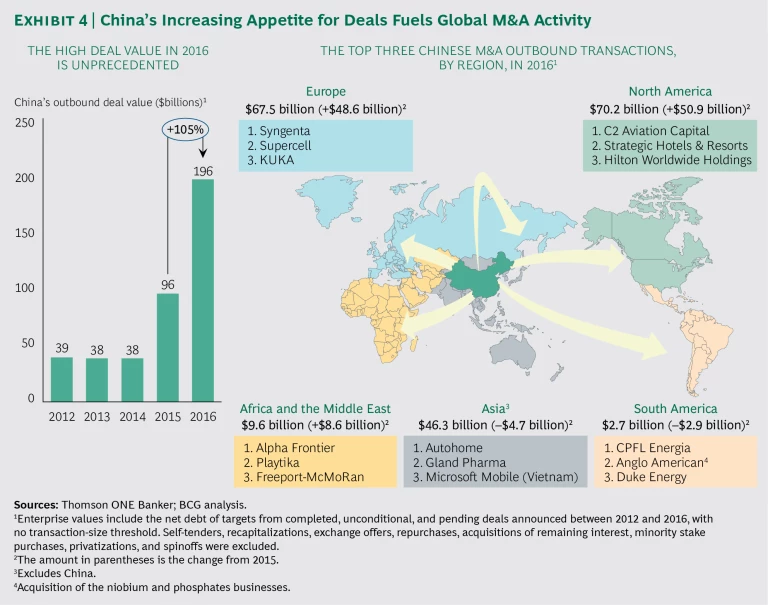

China goes shopping. China embarked on a global shopping spree in 2016, more than doubling, to almost $200 billion, its 2015 announced deal value. About two-thirds of China’s M&A activity today is outbound, with Europe and North America emerging as the most attractive target regions. (See Exhibit 4.)

Several factors are fueling deal activity, including rising consumption by the growing middle class and the execution of the latest five-year plan, which recognizes that M&A is an important means of gaining access to strategic technologies and expanding the country’s commercial capabilities. Midea’s acquisition of Germany’s KUKA, for example, brought robotics expertise to China’s (and the world’s) largest appliance manufacturer while also providing KUKA with greater access to the world’s most important automotive production market. Chinese outbound deal volume slowed somewhat in the first half of 2017, but we attribute this to the record heights achieved during the prior year and see the general trend continuing.

Health care and private equity buyers have been particularly active. The acquisition of Gland Pharma of India strengthens Shanghai Fosun Pharmaceutical Development’s international business and its position in generics. The acquisition of Playtika by a consortium of several private equity players led by Chongqing New Century Cruise, now known as Shanghai Giant Network Technology, allowed the Chinese firm to enter the online gambling market overseas. (Playtika is headquartered in Israel and has studios in several countries, including Argentina, Australia, Canada, Japan, and the United States.) China is also a player in the rising number of tech deals: approximately 20% of 2016 outbound acquisitions by Chinese companies involved tech companies.

Private equity keeps buying. Private equity firms racked up another record year of deal making while increasing their reserves of dry powder at the same time, continuing a trend of the past several years. (See Exhibit 5.) These firms face ever-growing pressure to put their resources to work.

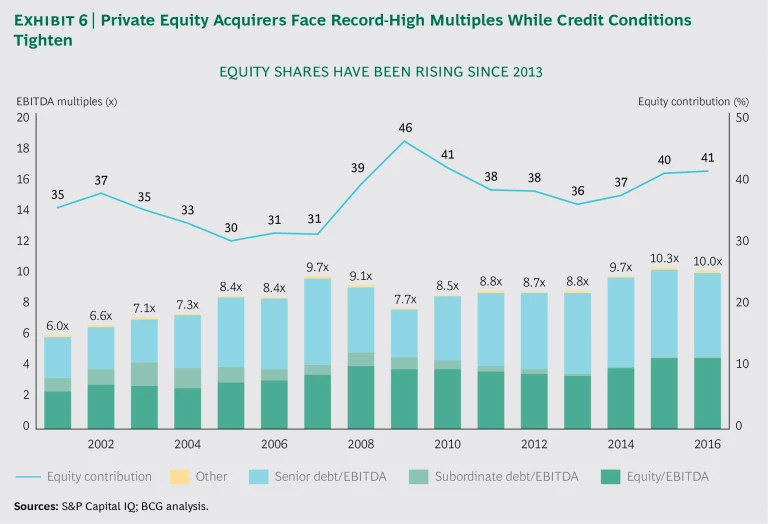

That said, we see an increasingly challenging environment for private equity buyers as they face both record-high target multiples and more competition from cash-rich corporate acquirers. The number of high-quality assets is shrinking, and wary lenders are demanding that firms put up larger equity shares to get transactions done. (See Exhibit 6.) Despite low interest rates, this market environment challenges private equity buyers to execute operationally in order to achieve their target returns.

Tech M&A resurges. “Digital disruption” has evolved from a tech term to a boardroom reality in industry after industry. As the pace of technology-driven change accelerates, a key question for senior executives has become: how do we position ourselves in a highly disruptive ecosystem? More often than not, acquisitions of tech-driven, and especially digital, business models have become the instrument of choice to acquire needed technologies, capabilities, and products and to close innovation gaps.

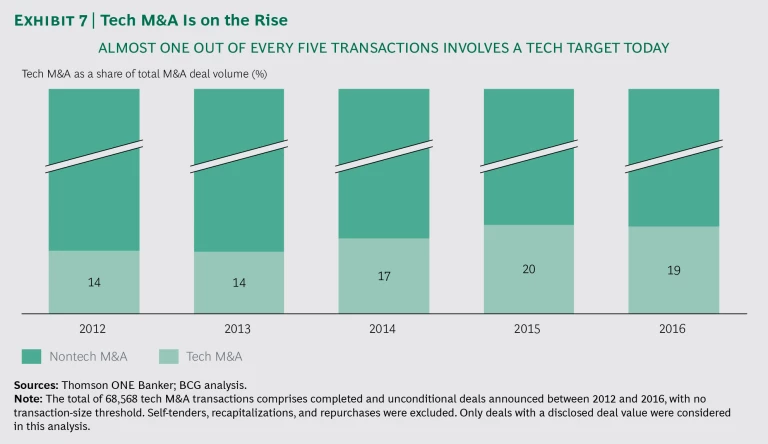

Though the overall M&A market has grown significantly over the past five years, the share of deals involving a tech target has been rising even faster. Today, one out of every five transactions has a clear link to some form of technology, and the value of these deals as a percentage of the overall market is even greater. (See Exhibit 7.)

Deals involving technology targets differ in many respects from traditional M&A. Corporate leaders contemplating tech transactions need to reconsider how they pursue M&A. Their review should take in all aspects of deal making, including strategy, execution, valuation, synergies, and postmerger integration.