Advanced analytics, powered by a variety of data sources, are transforming industry after industry, from technology to financial services to industrial goods. With a few notable exceptions, however, restaurants have been slower to move—which is ironic considering the amount of data that restaurant brands have available and the range of ways that they can put it to use.

BCG’s 2018 digital maturity survey of top restaurant brands found that four in five brands can access a wealth of data from multiple sources, but only one in five has in place a comprehensive big data strategy, an integrated customer master data set that the entire organization can access, or the ability to use predictive analytics algorithms to drive business decisions automatically. Not a single brand self-identified as fluent in advanced analytics techniques such as artificial intelligence, machine learning, chatbots, or voice-enabled ordering.

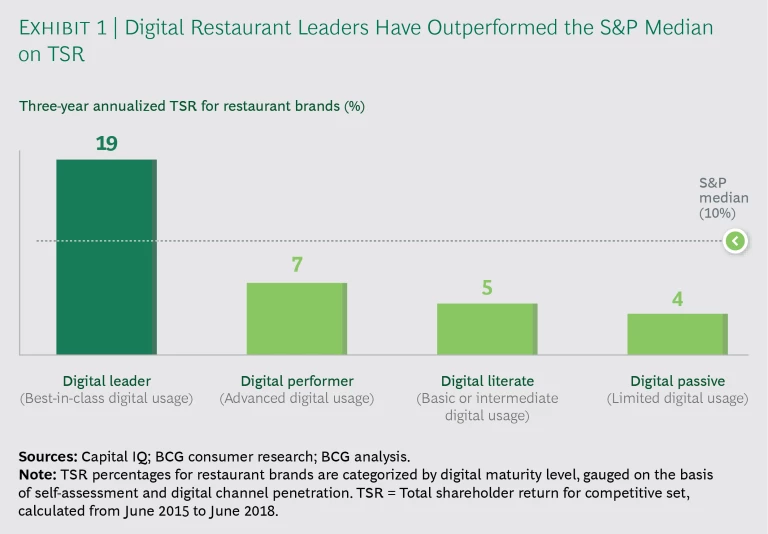

This is a big opportunity for the brands that move fast. We’ve seen data and analytics programs yield 5% to 10% increases in revenue, 10% to 15% reductions in store-level operating costs, and 10% to 20% improvements in EBITDA. An even more significant development: digital leaders’ total shareholder return over the past three years has outpaced that of other restaurants by 12 percentage points and has almost doubled that of the S&P 500. (See Exhibit 1.)

As notable as these results are, the threat to restaurant companies that move slowly may be more important. Because many advanced analytics tools require training, and because the data used in training can be proprietary or usurped by aggregators (as can technical talent), brands that build early leads in advanced analytics capabilities will be difficult for others to catch. Brands that delay could find themselves on the losing side of the data divide.

Most restaurant companies are attacking pieces of the data puzzle. Here is how leaders are moving fast to put the full puzzle together.

Digital Disruption Intensifies

In our 2017 restaurant industry report, we detailed how digital technologies are disrupting every segment of the restaurant value chain. The disruptive forces include in-store technologies, new consumer interfaces, and third-party insurgents, such as digitally enabled delivery services and aggregators. The emergence of advanced technologies such as AI will further redefine the way brands interact with consumers, as well as the sources of competitive advantage. (See The New Digital Reality for Restaurants, BCG Focus, November 2017.) As we predicted, the disruptive forces have only accelerated in the past 12 months.

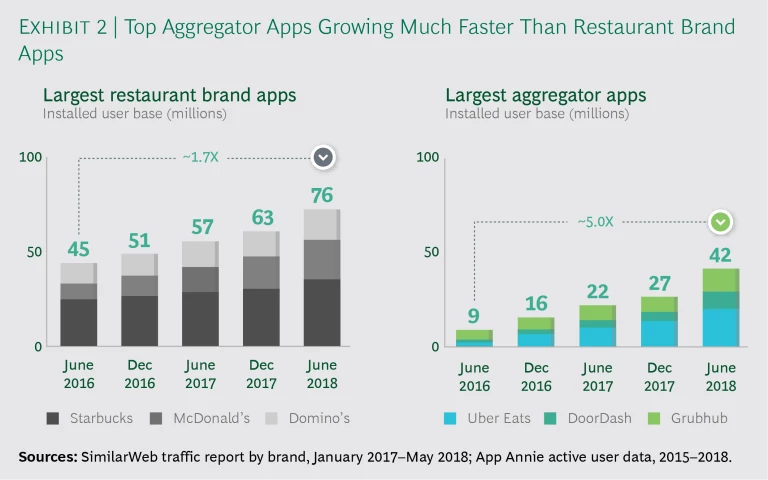

Aggregators continue to make inroads. From June 2016 to June 2018, restaurant delivery mobile app sessions increased by almost 400%, with the biggest increases accruing to aggregators. (See Exhibit 2.)

Uber Eats is gaining traction especially quickly. Its business grew 20-fold over that period, and the dollar value of the meals that it delivers already exceeds $6 billion on an annual basis—more than the sales of the US’s largest pizza brand. (See “How Data Powers Delivery for Uber Eats”)

How Data Powers Delivery for Uber Eats

How Data Powers Delivery for Uber Eats

Uber has applied a digital native’s perspective to the problem of fast, reliable, predictable restaurant meal delivery. The company is changing the game for brands—as well as for aggregators and other delivery services—by using data and advanced technology to address the challenge of simultaneously satisfying the distinct and competing priorities of customers, restaurants, and drivers. The cross-party optimization problem is complex, dynamic, and subject to the influence of external factors such as weather, traffic, and concerts and sporting events.

Uber Eats is expanding in markets where Uber already operates, building on existing elements of Uber’s logistics platform, infrastructure, customer awareness, and (in some places) delivery partner network. Uber Eats is also launching in new markets for Uber, including cities and towns in Canada, France, Mexico, and Japan, demonstrating that Uber Eats can extend Uber’s technology with new services in new places.

One big challenge involves quoting order delivery time to customers and directing driver dispatch. Precise estimates of delivery time (which update in near real time) are essential to solving the needs of customers, who want accuracy and make choices based on estimated delivery time; drivers, whose income suffers if they waste time waiting for food that is not ready for pickup; and restaurants, which need drivers to pick up on time so that meals are still hot when they reach customers.

Uber Eats broke the delivery process down into its components—ordering, preparing, picking up, transporting to the customer, and actually delivering. It uses motion sensor data from drivers’ phones to provide a picture of when the driver is on the road, walking, or stuck and not moving, to create the Uber Eats Trip State Model, which tracks each stage of a trip. Using gradient-boosted decision-tree models, Michelangelo, Uber’s internal machine-learning-as-a-platform service, predicts end-to-end delivery time and updates throughout the process. The system tracks such factors as the order, historical data for similar restaurants, and near-real-time data on current conditions (traffic, for example). The system feeds data from each delivery back into the self-learning model to improve delivery estimates for the next trip.

Uber has built a similar optimization algorithm to determine which restaurants (and specific dishes) it highlights to customers who are placing orders, again balancing the needs of customers, restaurants, and drivers. It uses a multiobjective optimization model to display a relevant and diverse set of personalized restaurant recommendations that match customers’ taste preferences while also weighing up-to-date data related to delivery times (such as traffic and order volume for each restaurant) and ensuring fairness across the set of restaurant partners. In view of ever-rising expectations about the seamlessness of the order process, this algorithm is critical to satisfying and retaining customers.

Meanwhile, loyalty programs, another contributor to digital disruption, continue to build membership. US restaurant loyalty programs now have a combined 130 million members, more than double their 2015 level, making dining the fastest-growing industry for loyalty programs. More than two-thirds of restaurant users are members of at least one such program, and 25% cite membership in three or more programs.

Customers’ expectations for the digital experience keep rising as well. Four in five restaurant app users cite ease of ordering as the app’s most important attribute. The amount of time customers expect to devote to placing an order has fallen from about 5.5 minutes in 2017 to about 3.5 minutes in 2018, primarily because of the proliferation of easy-to-use interfaces from aggregators and leading brands. One result is that customer retention has become a struggle: for most restaurant brands, the average percentage of people who remain active 30 days after downloading an app is only about 10%. That said, for brands that get it right, the rewards continue to be substantial: 40% of app users say that they increased their visit frequency after downloading the app, and we typically see an increase of from 10% to 30% in ticket size for digital orders, depending on the brand.

As we documented last year, scale is becoming a prerequisite for many companies if they are to make the substantial investments they need in digital technologies and data and analytics. The industry has seen a flurry of acquisitions—more than $30 billion in M&A activity since the start of 2017. For example, JAB Holdings and Roark Capital have made a number of deals that added scale to their portfolios and digital and data know-how to their capabilities. JAB continues to snap up coffee and breakfast brands, including Peet’s Coffee & Tea, Krispy Kreme, Panera, Au Bon Pain, and Pret A Manger. Early in 2018, Roark Capital created Inspire Brands to combine Arby’s, Buffalo Wild Wings, and Rusty Taco. It announced acquisition of the Sonic quick-serve chain in September 2018.

Restaurant tech players are also seeking scale through M&A, with more than 20 deals announced over the past 18 months, including multiple technology acquisitions by Grubhub—among them, LevelUp and Tapingo. “I think a lot of the consolidation is driven by access to technology,” Wendy’s CEO Todd Penegor said recently. “In the technology world, information is everything—how do you better connect with consumers and change their behavior?”

Data, Data, Everywhere

One of the major consequences of this digital revolution is a fundamental change in how companies source, analyze, and ultimately use data. The underlying management challenges that face restaurant brands today haven’t changed: marketing the brand, optimizing labor productivity in the store, and managing the supply chain remain the same priorities they have always been. But digital technologies, particularly as they relate to data, have enabled new solutions to old problems; and for brands that embrace these capabilities, the technologies have empowered managers to generate much greater value with their decisions and investments. Here are some of the major shifts that have occurred recently in the way that leading restaurant brands think about data.

Explosion of Sources. Restaurants have access to much more data and many more data sources than ever before: internal and external, commercial and operational, and structured and unstructured. In addition to their own customer data, brands can now access outside sources such as social media posts, telecom providers (for locational data), and weather, traffic, and event services. More and more brands are accessing their own operational data—for example, speed of service data coming from kitchen management systems.

From a commercial perspective, brands are shifting from a transaction-centric view to a customer-centric one that supports a more complete perspective on customer lifetime value. Brands are also expanding from traditional structured data (in a consistent, familiar format) to new sources of unstructured data (such as the text of online reviews). The resulting explosion of types and sources of data requires new ways of storing and manipulating it, shifting from the traditional data warehouse to a more flexible and scalable data lake.

Sophistication of Analytical Tools. Historically, restaurant brands have used Excel-based modeling to gain insight from data. But advances in artificial intelligence, including self-learning algorithms (such as random forest and neural networks), deliver vastly increased analytical power. As a result, the potential depth and detail of analysis increases exponentially, from analyzing weekly sales to delving into hourly sales by restaurant and product.

Integration into Business Processes. The true power of data emerges when it ceases to be backward looking and explanatory and instead becomes predictive, prescriptive, and fully integrated into business processes. Take customer segmentation. In the past, brands might analyze transaction data to identify specific customer personas (customer segments augmented with common, or shared, behavioral data) and then use those insights to inform strategy. Now, brands can track behavior at an individual level, run it through an optimization algorithm to find the perfect offer for a specific customer, and deliver that offer directly to the customer’s mobile app—all without human intervention.

The best brands will achieve a data flywheel effect in which data accumulation and data analysis fuel improvements in products and business processes, which stimulates growth, which leads to more data accumulation, which drives more growth.

Moderate Progress…

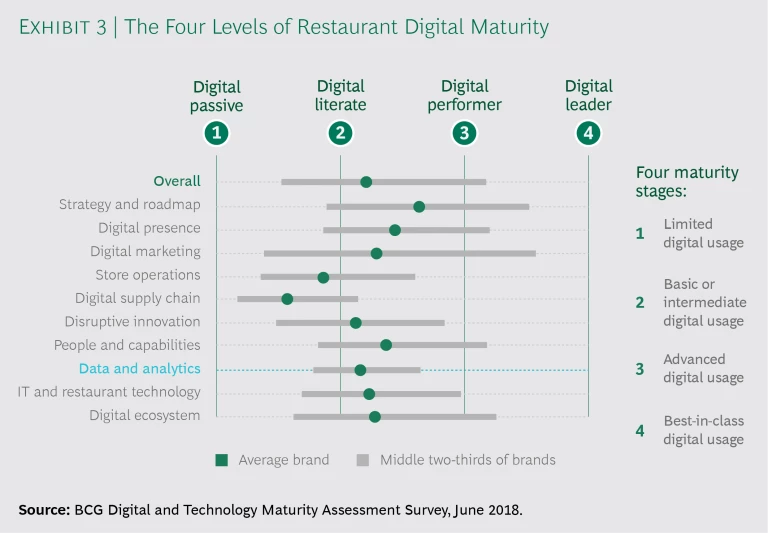

A fairly steep maturity curve is already emerging in how restaurant brands use data. Most major brands have made investments: our most recent digital maturity assessment among major players in the industry indicates that 100% have teams dedicated to business intelligence and reporting, 90% have resources focused on CRM analytics, and 70% have groups dedicated to pursuing data science and advanced analytics. Compared with other digital capabilities, however, the overall maturity level for data and analytics remains low, with all but a few brands giving themselves moderate grades in this area. (See Exhibit 3.) A number of brands are becoming discouraged as investments return less than expected or presage lengthy payback periods of three or more years.

This is not unusual. Across multiple industries, BCG has noted the emergence of an “AI paradox”: although it is deceptively easy to launch AI pilots and achieve powerful initial results, it is fiendishly difficult to move toward AI applied at scale.

In our client work and our research in the restaurant industry, we see four stages of digital capability taking shape—passive, literate, performer, and leader—with most brands today clustered at the digital literate level. The picture can vary by use case, but one important data application—how brands use data to improve their demand forecasting—illustrates the current state of play.

Passive brands (which include many smaller companies and individual franchisees at larger brands) rely on gut feel at the store level to forecast sales for the upcoming week, scheduling labor and placing product orders on that basis. Literate brands base daily sales forecasts at the individual restaurant level on historical data and recent trends; these forecasts inform labor scheduling and inventory ordering. Performers (only a few of which exist so far, especially with respect to data) use sales forecasts at the menu product and hour-of-day levels of detail, based on various internal and external data points, such as scheduled sporting events and weather forecasts. True digital and data leaders (which are rarer still) go a step further, updating forecasting information in real time and automatically linking this data to tools that update labor and replenishment schedules without human intervention.

For digital leaders, the next step is within reach: linking forecasts to the commercial engine. For example, brands could identify slow sales at a particular store on a given afternoon in real time (via always-on, AI-enabled analytics) and automatically send personalized promotional offers to customers in the area. Analytics tools could then feed the response rate back into the demand forecast, and the algorithm could automatically update the store’s labor and product needs.

…And Plenty of Pitfalls

As they build out their data capabilities, many companies run afoul of false starts and common pitfalls that have a wide range of underlying causes.

Misalignment on What Data Means. We often see brands confuse business intelligence with advanced analytics. Although KPIs and metrics are certainly important, unlocking the real value of data involves automatically feeding the output of analytics into decision making. Until the mindset shifts away from using data to explain what has happened and toward employing integrated analytics to predict customer behavior and inform forward-looking decisions, opportunities will remain limited.

Technology-Led vs. Business-Led Organization. Technical and data science skills are important in the organization, but ownership of the data and analytics capability must rest with the business. Success requires a relentless focus on value, which means prioritizing and executing use cases that can show early and sustained results.

Ignoring Technology Implications. Some brands pilot analytics use cases without forethought about their implications for technology infrastructure. This approach is particularly problematic in AI, which learns inductively from data and needs access to systems throughout the organization. Without a clear plan in place to embed the AI capability throughout the business, data and analytics become difficult to scale, even when initial pilots demonstrate success.

Perfection as the Enemy of the Good. Too many brands are unwilling to act on data until it is complete, cleansed, and sorted. But perfection is never achievable. Companies are better advised to look for early ways to drive value from the available data and to use the activation of specific use cases to determine what data they need to pull into their ecosystem and when they are likely to need it.

Random Walk. On the other side of the coin, we see brands leaping from use case to use case and from technology to technology, without a clear underlying strategy. Speed and flexibility are important, but they should not become excuses for flitting among the flavors of the day. Our industry maturity survey indicates that only one in five brands has an overarching big data strategy. In contrast, a recent study of AI users found that 90% of AI pioneers across all industries have a clear strategy for AI usage. (See Artificial Intelligence in Business Gets Real, a report by MIT Sloan Management Review and BCG, September 2018.)

Vendor Dependence. Many restaurant brands use multiple third-party providers (marketing agencies, digital marketing specialists, loyalty program and CRM providers, app developers, and business intelligence vendors) across the data value chain. The resulting piecemeal environment makes it hard to get a true 360-degree view of the brand’s customers and requires a more thoughtful approach to data and analytics implementation. Increasingly, leading brands are wresting control of the data from third-party providers and building their own in-house analytics capabilities.

Inadequate Senior Leadership Support. Unless the C-suite champions them, data initiatives that need support from a diverse, cross-functional set of stakeholders (technology, analytics, marketers, and operators, for example) often cannot move beyond the pilot stage. Among AI passives included in the MIT Sloan Management Review study cited above, 60% identified lack of leadership support as a major barrier to AI adoption; the corresponding figure for AI pioneers was less than 20%.

How Leaders Climb the Maturity Curve

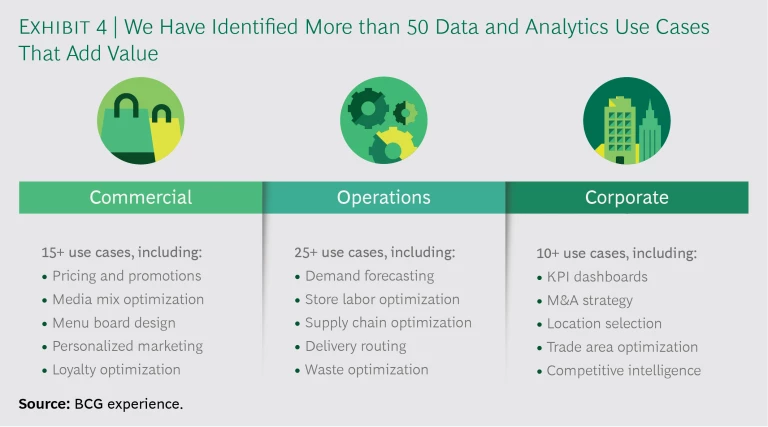

Leaders that use data to fundamentally change the ways in which they work generally begin with a use-case-centric approach. In our work with leading brands, we have identified more than 50 data and analytics use cases that can add value. (See Exhibit 4.)

The following use cases are representative:

- The more than 15 commercial use cases we have identified relate to menu, product, and store design, as well as to the full set of customer interactions. For example, McDonald’s digital menu boards update in real time in response to the weather, highlighting comfort food when it is cold outside and lighter fare on hot days. The company reported a sales increase of more than 3% during the initial pilot. Dickey’s Barbeque Pit sends geotargeted personalized push notifications to customers when a store is experiencing low traffic. Its system automatically updates with refreshed data every 20 minutes, enhancing both inventory management and the brand’s ability to test new concepts.

- We noted more than 25 operations use cases, spanning such tasks as demand planning, labor scheduling, and day-of operations management. Domino’s built an algorithm to predict how long it will take to make and deliver a pizza, given the number and tenure of staff in the restaurant, among other factors. This yields an accurate “promise time” to the customer and optimizes in-store labor. Panera aggregates information about orders on all digital channels (app, site, third-party) to help plan for in-store labor and product needs. It now receives 250,000 digital orders a day and has changed its store operating model to handle the volume.

- The more than 10 corporate use cases we found include business intelligence, financial forecasting, and site selection for new locations. For example, Starbucks uses geoanalytics and analysis of past store openings to optimize its process of location selection for new stores.

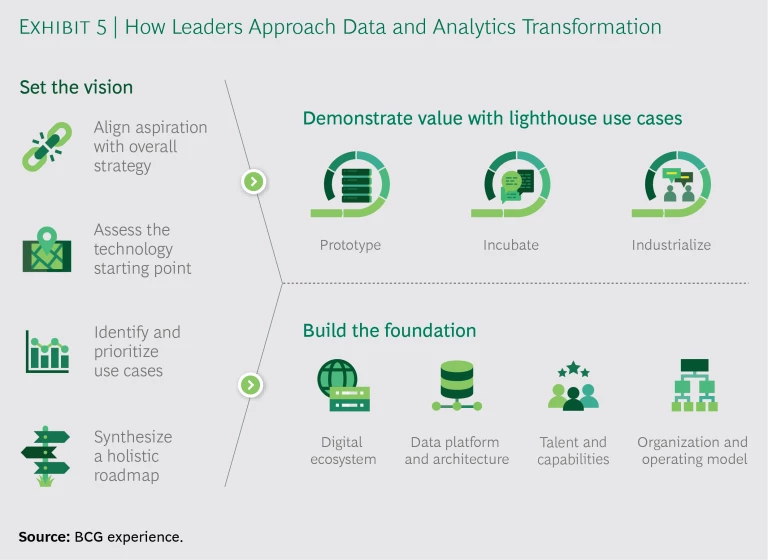

The sheer volume and variety of potential use cases can be as much a problem as an opportunity. Absent a vision of what they want to achieve, companies may find themselves blinded by the possibilities that the “transformational” new tools offer. Leaders, on the other hand, take a strategic and comprehensive approach, setting the vision for where they want to go and then designing the journey to include steps to generate early successes, provide funding, and show the way to the rest of the organization. (See Exhibit 5.)

Set the Vision

Leaders begin by defining data and analytics aspirations that are firmly linked to the brand’s overall strategy. They then systematically identify the universe of data and analytics use cases for the brand that will support this aspiration.

At the same time, these companies honestly assess their starting points, with a particular focus on technology infrastructure, including what data they have available, how full a picture it provides, and how well integrated their analytics tools are with the data sources. Fragmented legacy systems, such as multiple point-of-sale (POS) systems, can hinder quick movement and reduce the ultimate benefits. Reality can far underperform expectations for brands that don’t acknowledge such constraints.

On the basis of these inputs, leading brands then select a handful of “lighthouse use cases” that are linked to the overall brand strategy and can show value in the near term while illuminating the way for the brand to build foundational data and technology capabilities.

Demonstrate Value with Lighthouse Use Cases

Leading brands begin by pursuing lighthouse use cases, employing an agile model based on cross-functional teams and quick iterations. Agile ways of working are designed to put a minimum viable product in the market quickly and to test, learn, and scale up from there. For most companies (not just restaurants), this represents a radically different way of working, and it is important not to underestimate the difficulty of the transition. (For examinations of agile in two related industries, see “Agile to the Rescue in Retail,” BCG article, October 2018, and “Agile to the Rescue in Consumer Goods,” BCG article, May 2018.) But a cross-functional organizational approach is all but a prerequisite for companies looking to solve today’s challenges. Agile methodologies have extended beyond software precisely because they comprehend a set of organizational principles that successfully address many inefficiencies of the modern organization.

Done properly, agile increases employee and customer engagement while reducing time spent on planning and administration (in meetings, for example). And it puts more resources into customer-oriented activities. Organizations that embrace agile have more doers, fewer managers, and, as a result, a lower cost base. Agile requires operating-model changes in such areas as governance, processes, culture and behavior, and leadership and talent. But our experience suggests that companies that get it right can reduce costs by 25% to 35%, improve quality by 20%, and accelerate delivery of new products, services, and internal capabilities by 100% to 200%.

One leading pizza brand uses agile methodologies to build its own in-house digital platforms. Its IT and marketing departments work together closely to manage the customer digital experience, breaking projects into small steps and distinct processes so that customer experience improvements and the IT that enables them move forward in lockstep. Innovations include allowing customers to track orders through preparation and delivery, and reducing the number of steps involved in ordering from more than 25 to just 5.

Build the Foundation for the Future

In parallel with activating lighthouse use cases, leading organizations carefully plot how to scale the data-driven, agile mindset across the organization. These companies typically pursue this effort at four levels: digital ecosystem, technology architecture, talent and capabilities, and organization and operating models.

Digital Ecosystem. Access to data is essential, of course, as is the ability to manipulate and use both structured and unstructured data from multiple sources. Customer data is often the first priority, and that is where the digital ecosystem comes into play. Leading brands focus on mobile apps, loyalty programs, and other digital interfaces as their primary customer data collection points. For example, McDonald’s is offering free fries every Friday through the end of the year to customers who download its app. Drawing customers into the owned digital ecosystem not only reduces friction in the customer journey, but also allows McDonald’s to learn more about specific customers and to offer an increasingly personalized experience. In the absence of explicit customer linkages via digital platforms or a loyalty program, brands may use traceable tender (such as credit card data) to link transactions from the point-of-sale system to specific customers.

BCG has written about the power of digital ecosystems to create enormous value, partly as a result of the data flywheel effect. (See “Getting Physical: The Rise of Hybrid Ecosystems,” BCG article, September 2017, and “How IoT Data Ecosystems Will Transform B2B Competition,” BCG article, July 2018.) Restaurants that interact regularly with customers in both physical and digital channels are well placed to orchestrate ecosystems. Access to proprietary operations data (such as store traffic, store labor, preparation times, and delivery times) puts restaurants in an enviable position to marry their own data with data from external sources (weather, events, and traffic, for example) for marketing and other purposes. So far, however, the leading ecosystem players are tech companies and new entrants such as Amazon, Uber, Facebook, and OpenTable. A number of brands are partnering with aggregators to leverage the scope and scale of their delivery capabilities, but they are doing so more as participants than as orchestrators. To minimize the risk of being disintermediated, they must avoid losing ownership of customer data.

Technology Architecture. The current state of many restaurant IT systems—in particular, those that are fragmented across multiple POS systems or vendor point solutions—presents challenges. The problem of fragmented systems is especially common in heavily franchised networks. Our digital maturity survey found that half of respondents had two to five POS systems, and 10% had more than five. In addition, many brands have not historically captured data from their back-of-house systems (the kitchen management system, for example), which can be a powerful force in activating operational analytics.

A modern technology platform is critical for scaling use cases beyond the pilot phase, and connections between systems become increasingly important as the data and analytics grow more interdependent. It is one thing to stitch together data to power a pilot; it is quite another to industrialize a use case across the system, integrating analytics outputs with a multichannel set of customer- and operator-facing interfaces. To support this level of industrialization, leaders adapt legacy systems or, more often, scrap them in favor of an up-to-date digital technology stack that is customer-centric, modular, capable of handling multiple sources of data and multiple “tenants” (for multibrand companies), and flexibly linkable to multiple output channels (such as the mobile app, the website, the POS system, and the back-of-house system). A number of companies move to cloud-based systems that sidestep large up-front capital investments and are easy to customize and update as new use cases emerge and as technology advances.

Our digital maturity survey showed that digital leaders invest 50% more resources in platform development (e-commerce, loyalty, and restaurant technology) than digital literate brands do, relative to overall brand size. The investment can be substantial: digital performers and digital leaders are investing more than $10 million annually in technology, and several are investing more than $50 million a year. Building a modern technology architecture is a multiyear effort—which is one reason why it’s important to show value from the lighthouse use cases along the way.

Talent and Capabilities. To operate at advanced levels of data and analytics, restaurant companies need new types of capabilities, including technical expertise and businesspeople who can help integrate technical know-how. The former are already in short supply as companies across many industries look to build or augment their technical skills.

It’s also challenging for brands to know what kind of talent they need. There are many types of technical skills (data science versus machine learning versus deep learning, for example, or Python versus R versus SQL) and functional capabilities (digital marketing versus operations optimization). Outsourcing some data activities may be necessary, but it brings its own issues, including ensuring data ownership and managing the vendor ecosystem.

Restaurants tackling this challenge may want to study companies in other industries, some of which are hiring or developing “integrators.” These people understand the drivers of business value and have a working knowledge of analytics—and so are able to lead efforts to turn data insights into operational results. Integrators can work with business leaders and technical personnel (internal or outsourced) to identify and prioritize the highest-value use cases, develop the necessary data assets, and incorporate analytics into business processes. Integrators must have a good understanding of statistics and analytics. They may have previous experience in the restaurant industry, but the more important requirement is strong problem-solving skills.

Organization and Operating Model. We see a variety of organizational models for data and analytics, but most leaders start by centralizing the critical data and technology functions under a chief data officer as they build their broader capabilities. In this way, they ensure the right level of focus and the ability to attract and develop talent. We have seen companies initially house their data operation in a separate incubator until it reaches sufficient scale to be integrated into the broader organization. Companies using the incubator model often rotate business executives through the incubator so they can gain valuable experience in agile delivery and working in cross-functional teams. Then, when they return to the business unit or staff function, they can help promote agile ways of working.

Data or Bust

We expect these trends to continue building momentum across multiple sectors. In a recent survey of 3,000 executives in 29 industries, BCG found that 95% believe that advanced analytics techniques will create substantial business value in the next five years, compared with 45% who are seeing value realized today.

In the restaurant industry specifically, the trends behind the increased importance of data are only accelerating, and digital sales will continue to gain steam. Although most brands generate less than 5% of their sales from digital channels today, most expect that figure to rise above 10% within the next five years. Moreover, the explosive growth (and threat) from aggregators continues—witness the investment of nearly $800 million in DoorDash in two rounds of funding during 2018 alone.

For brands looking to start or reset their data journey, we recommend four initial steps. First, reach alignment across the leadership team on a common definition and vision for data—explicitly recognizing the value pools created when analytics are used for purposes beyond business intelligence. Second, complete a rapid assessment of the brand’s data and technology maturity. This assessment should include a statement of the overall vision; the documentation and prioritization of advanced analytics use cases; a clear-eyed perspective on the state of technology infrastructure, including digital interfaces, in-restaurant systems, and the underlying enterprise architecture; and an evaluation of the organization and its capabilities to support a data strategy. Third, synthesize the results of the assessment, along with the brand’s vision for data, into a streamlined roadmap that folds in (or terminates) related efforts.

Finally, and critically, maintain data vigilance, even if the brand is not yet ready to go down the path of full data transformation. It is becoming increasingly clear that owning customer data will be a source of competitive advantage going forward. For many brands, this may require unwinding existing relationships and contracts. At the very least, in any new contract negotiations with third parties—whether they are traditional partners (such as marketing agencies) or potential competitors (such as delivery aggregators)—brands should prioritize ownership of customer data or risk being disintermediated.

In the restaurant industry of the near future, data will be as important as—if not more important than—cash. It will provide the currency that holds ecosystems together and the means by which companies connect with their customers. Brands that have not built the capabilities to corral and manage data will find themselves marginalized, watching from outside as more data-literate competitors grab the growth and profits that the sector has to offer.