For leadership teams at airlines, the challenge isn’t merely to respond to the industry’s current operating environment—it’s to anticipate what’s coming and position the company to win in the future. We have identified seven trends that we believe will reshape the industry over the next five years: the customer-centricity imperative, rapid growth in the adoption of data science and advanced analytics across the value chain, the rise of sustainability concerns, an increasingly complex distribution landscape, shifts in airline fleets and networks, growth in strategic alliances and partnerships, and dramatic shifts in organizational skills, capabilities, and ways of working.

Each of these trends would be tough to manage on its own. Collectively, they demand that management teams put a proactive agenda in place that enables them to not only adapt but also to use these developments to create competitive advantage. In this way, airlines will be able to anticipate looming disruptions that could threaten their business model—and potentially even become disruptors themselves in travel and adjacent industries.

Years of Steady Growth, but the “Fasten Seatbelt” Light Is On

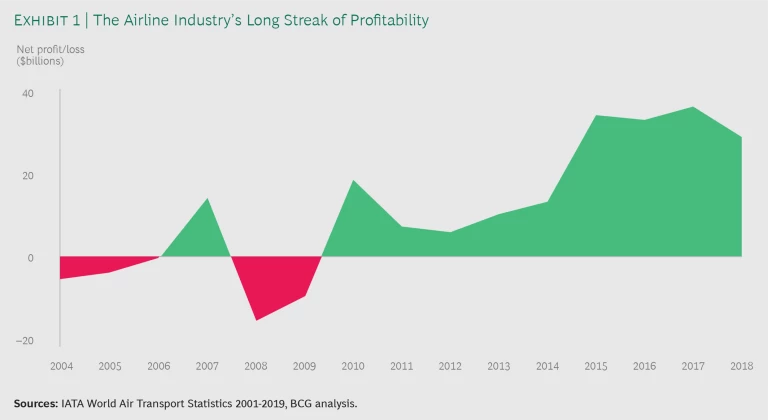

The airline industry has seen sustained profitability since 2010, with global profits reaching a peak of $38 billion in 2017, according to the International Air Transport Association. (See Exhibit 1.) A significant portion of the profit pool during that period has been captured by leading North American carriers, thanks to increased economies of scale, the strong dollar, and a buoyant US economy, among other factors. Globally, operating profit margins for leading players have typically been in the midteens—even exceeding 20% for some carriers. Large full-service carriers as well as ultralow-cost players such as Wizz Air, Ryanair, and Spirit have achieved high levels of profitability during this period.

Demand for commercial air travel is set to increase significantly over the next ten years across all regions. The growing economies in Asia will represent the largest share of demand growth (passenger traffic in Asia is projected to grow by 85% and its share of global traffic will increase by 4.7 percentage points). We expect North America to remain relatively stable and continue to pull in the largest share of industry profits. Europe’s market landscape is likely to change the most over the next five years, with concentration and consolidation strengthening the position of the three leading airline groups (Lufthansa, IAG, and Air France-KLM) and low-cost carriers (Ryanair, easyJet, and Wizz Air).

Macroeconomic and geopolitical trends—particularly slowing economic growth worldwide—have produced a mood of uncertainty. The industry’s performance has traditionally been closely linked to the overall economic cycle, and as the current expansion surpasses all others in terms of length, we expect airlines to be affected by the looming economic slowdown, rising nationalism, and trade wars. These factors will likely lead to reduced demand, lower yields, and a potential increase in the cost base as foreign-exchange rates and oil prices fluctuate—and they will elevate the importance of scenario planning as a core strategic capability for the industry.

As the current expansion surpasses all others in terms of length, we expect airlines to be affected by the looming economic slowdown, rising nationalism, and trade wars.

The seven global trends that will shape the airline industry over the coming five years are critical for leadership teams to understand and put at the top their strategic agenda.

The Customer-Centricity Imperative

The customer experience at most airlines lags that of top digital-native companies in industries such as retail and media, where it tends to be far more streamlined and personalized. Airlines’ interactions with customers are traditionally focused on booking reference numbers that contain essential data about an individual flight but little information about the person flying.

In the future, airlines will build a single, coordinated view of the customer across all systems and touch points, and we expect a step-change in the degree of personalization and customer centricity offered by airlines in the next five years. Carriers will be able to leverage their customer data to construct specific offers that match customer preferences and the travel occasion. Customers will receive more tailored service before, during, and after each flight. The in-flight experience, for example, will feature entertainment options and other attributes based on detailed customer profiles, which the flight crew will be able to access.

As airlines strive to be more customer centric, we expect travel ecosystems to grow, supported by an increased exchange of data among providers. Leading airlines will create or join ecosystems with the goal of better understanding the customer’s overall journey, rather than just the flight component, and thus providing a better experience overall. For example, if a customer’s flight is delayed, her hotel reservation will be adjusted automatically. By providing a better experience, the ecosystem will gain customers’ loyalty and garner a higher share of their spending over time. These ecosystems could transcend travel and encompass a broader set of lifestyle companies, products, and services—allowing airlines to tap into a wider customer base and maintain relationships with infrequent travelers.

Loyalty programs are a key means of becoming more customer centric, in that they capture more data and insights about customers. For this reason, we may see loyalty programs that have been previously spun out as separate businesses brought back within airline organizations. Loyalty programs will continue to evolve from simple “earn and burn” schemes into propositions akin to lifestyle membership clubs that offer more personalized service, recognition, and aspirational reward options that go well beyond travel. Finally, we may see airlines use their loyalty programs to open up new business lines and expand into entirely new products and services, as Qantas has done in Australia, for example.

To succeed, and even gain a competitive edge, carriers should take the following steps to create a streamlined and more personalized customer experience:

- Objectively assess your current level of personalization and customer centricity—for example, gauge the extent that customer data can be shared across siloes to develop a holistic customer view, and determine how effectively these insights are used to create tailored offers and services.

- Consider how a network of partnerships could enable you to deliver high-quality, personalized customer service.

- Consider the role of loyalty programs when developing a compelling customer-centric proposition.

Increased use of data science and advanced analytics will help airlines reinforce traditional sources of advantage to deliver substantial performance improvements.

Rapid Adoption of Data Science and Advanced Analytics

Over the next five years, many airlines will continue to develop their ability to deploy advanced analytics at scale. Although the industry’s use of data and analytics has been increasing for some time, we expect this to accelerate, with use cases spanning the entire value chain from a customer’s initial travel inspiration and research through the ticket purchase and flight all the way to postflight services. (See Exhibit 2.) These use cases are enabled by the vast quantities of data available to airlines, including from third parties. While traditional sources of competitive advantage for airlines such as cost base, scale, network, and product will continue to be important, we believe that increased use of data science and advanced analytics will help airlines reinforce these sources of advantage to deliver substantial performance improvements.

For example, in commercial departments, we expect airlines to use AI and machine learning to construct smart offers that combine seat and ancillary services to match each customer’s unique requirements for a specific trip. We will see changes in how offers are priced, moving away from traditional fare ladders toward continuous and dynamic pricing. Another area that will see huge changes will be marketing—algorithms will help airlines tailor messages to individual customers based on a combination of factors such as travel history, contextual variables, and customer preferences.

Use cases for advanced analytics will extend beyond commercial activities. For example, in operations, we’ll see leading airlines using big data and AI to significantly improve their on-time performance and minimize the costs of disruption. For example, KLM has already made significant strides toward digitizing its operations to improve real-time decision making, and we expect other airlines to make similar strides in this area.

As airlines digitize their core functions, they will face the challenge of dealing with legacy technology. This is not unique to airlines. In fact, carriers can look to the leading players in industries such as retail and financial services that have successfully developed digital capabilities despite their legacy technology stack. Often this involves decoupled development, whereby new digital capabilities are built outside of the legacy system, which is gradually phased out over time. Airlines will have to make choices on how best to develop these new digital capabilities. Our expectation is that most will reduce their reliance on traditional technology providers and instead will seek a hybrid approach, enhancing their in-house capabilities while working with niche tech companies in specific areas.

To capitalize on the growing applications for data science and advanced analytics, airlines should take the following steps:

- Ensure that data and advanced-analytics capabilities are high on the agenda and prioritize investments in this area; build a program of high-value use cases and develop a data strategy to support those initiatives.

- Define your approach to building capabilities—for example, building them in-house, developing partnerships with niche providers, or relying on established travel technology players.

Rising Sustainability Concerns

Airlines will face growing pressure to address environmental sustainability over the next five years. We have seen this topic gain significant momentum in just the past few months, and a number of airlines have recently announced ambitious targets to tackle emissions. Pressure will continue to build: the question is when it will reach a tipping point—not if. Airlines will feel pressure from multiple stakeholders:

- Regulators. Expect Europe to move first and take the boldest steps; France has already proposed a tax of €1.50 on economy-class tickets for departing flights to other EU countries. Governments in Asia could follow. For example, four airports in India are carbon-neutral, out of a total of five in Asia. Similarly, China has begun enacting environmental regulations in other industries, such as banning the import of plastic recyclables in 2017. On the other hand, we expect the US to remain reluctant to take any major regulatory action.

- Customers. Expect “flight shaming” to gain some momentum, particularly among younger, environmentally conscious travelers. It’s likely that some people in this group will begin switching to alternate travel models like high-speed rail for regional travel where possible, and perhaps eliminating air travel altogether. In the short term, however, we expect that sustainability concerns will lead to only limited pockets of impact, particularly in Europe.

- Travel Intermediaries. Third-party entities that track airline sustainability will influence consumers’ choices and push them toward flight options with lower emissions. For example, Skyscanner influenced the purchases of millions of customers in this way in 2019. More intermediaries will start informing customers about different methods of carbon offsets to help them make better choices, and airlines will share that information as well.

- Corporate Customers. Expect companies to respond to environmental pressure from employees and investors by radically reducing nonessential business travel and investing in technology to replace many in-person meetings. A drop in business travel, a key component of airlines’ business, would have an impact on their top line.

- Investors. Expect investors to increasingly favor companies with sustainable operations and those making significant progress in reducing carbon emissions.

Sustainability is an industrywide issue, and we hope to see airlines starting to collaborate more to generate meaningful change. Some attempts are already underway. One such collaboration is the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), developed by the United Nations’ International Civil Aviation Organization. CORSIA aims to reduce greenhouse gas emissions from airline operations by 590 million to 800 million tons of CO2 by 2040. Already, 78 countries have pledged to participate in a voluntary pilot program, although there are several notable omissions, including Russia and India. There is considerable uncertainty around exactly how airlines will achieve CORSIA’s agenda. Another cross-industry initiative is the EU’s Emissions Trading System, which aims for a 43% reduction in emissions by 2030 in the sectors it covers. The ETS is a cap and trade system that sets a limit on the total amount of greenhouse gases that can be emitted (by an individual power plant, for example, or by an individual carrier), while allowing participants to receive and buy emissions allowances.

Although airlines are gradually renewing their fleets with more efficient aircraft, the industry is unlikely to make meaningful progress until it addresses the area where environmental impact is greatest: fuel. While work on developing sustainable aviation fuel (SAF) continues, we don’t think that these fuels will provide a viable alternative to jet fuel in the short-to-medium term. Still in the earliest stages of development, SAF lacks scale and will require much more investment in R&D. We expect airlines, oil and gas companies, and other interested parties to come together to jointly invest in the development of SAF, as the task will be too big for any individual player to tackle on its own.

The airline industry is unlikely to make meaningful progress on sustainability until it addresses the area where environmental impact is greatest: fuel.

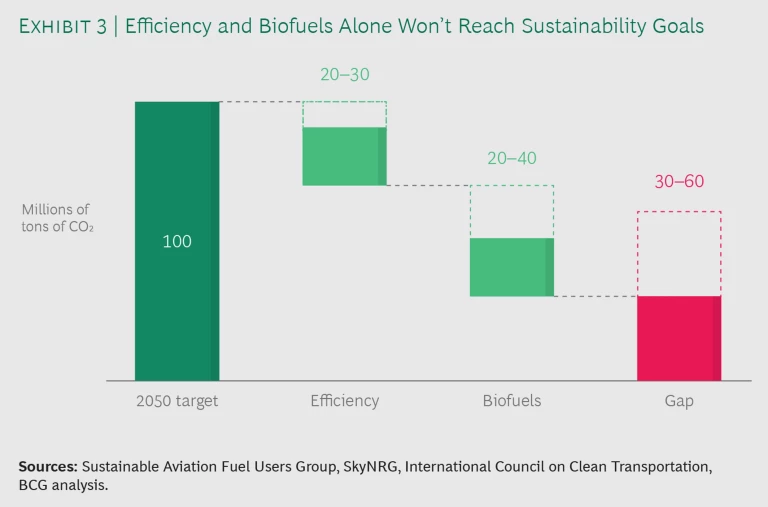

Increased efficiency and biofuels can only account for a portion of the desired reduction in airline CO2 emissions. (See Exhibit 3.) Subsequent improvements are likely to come from a mix of sustainability efforts including SAF, technological breakthroughs such as electrification, and carbon offsets. As airlines wait for SAF to gain commercial scale and other technologies to arrive, they will rely mostly on offsets to help reduce their carbon footprints. The current maturity of offset schemes is low, resulting in some overpriced and largely ineffective projects. Over the next five years, we expect that the demand for high-quality offset projects will prompt significant development in the emissions offset value chain. Airlines will have a choice on how to participate: buying offsets on B2B exchanges, partnering with a specialized company, or creating their own offsets.

To address rising sustainability concerns, airlines should take the following steps:

- Develop a sustainability strategy, including a program of initiatives to reduce carbon emissions, plan for a range of scenarios (such as a material reduction in demand or government action), assess potential SAF supply chain partnerships, determine how to participate in offset schemes, and demand OEM involvement in long-term aircraft innovations.

- Start implementing no-regret moves right away, such as recycling and waste management initiatives.

An Increasingly Complex Distribution Landscape

As discussed above, the customer experience at most leading airlines trails far behind that offered by digital companies. A key underlying reason for the disparity is distribution—an area where change is coming to the airline industry, albeit slowly. Over the next five years, distribution will be increasingly digital, and airlines will continue to increase their direct share sales—particularly via mobile and the web—at the expense of channels where the economics are less attractive for them, such as retail travel agencies.

Adoption of the International Air Transport Association’s New Distribution Capability (NDC) standard will grow, allowing richer communication between airlines, travel agencies, and travel management companies. We expect that a significantly higher proportion of bookings will be made using the NDC standard in the next five years. But this does not mean that traditional global distribution systems will become redundant. They will also participate in NDC adoption and will remain fundamental in the future distribution landscape as content aggregators.

New direct channels are likely to grow rapidly—for example, conversational commerce through devices such Amazon’s Echo and through messaging apps such as Facebook’s WhatsApp and Tencent’s WeChat. Some airlines already interact with customers postbooking via social media, and certain segments (chiefly millennials and Gen Zers) will increasingly seek flight bookings and ancillary bundles through these services.

We expect the tech giants to reshape airline distribution as well. For example, Google, along with other big players, is already well placed in the inspiration and planning elements of the customer journey, where it can take advantage of the vast quantities of data it has collected to develop personalized travel offerings. One step further, Amazon and Alibaba are already operating in the booking space—Amazon through a partnership with Cleartrip in India and Alibaba through its Fliggy travel platform. We expect both companies to continue experimenting across global markets. By partnering with airlines, Amazon and Alibaba can use ticket sales to access rich customer data and attract customers into their wider ecosystem. There are benefits for airlines as well: teaming up with tech giants can help carriers gain a foothold in new markets. For example, Singapore Airlines’ partnership with Alibaba has given it greater access to the fast-growing Chinese travel market.

We also expect that online travel agencies will continue to broaden their existing offerings to bridge gaps that airlines have not yet filled. For example, they are increasingly creating product bundles (combining seats and different ancillary products from the airline) and providing virtual interlining capabilities, such as between airlines that are not interline partners themselves.

To succeed in an increasingly complex distribution landscape, airlines should take the following steps:

- Ensure that that your distribution strategy is current and goes beyond the traditional booking channels, including social media and other digital channels, and create broader partnerships outside of traditional travel distributors.

- As part of this, set a target for NDC adoption and build a plan to get there.

Shifts in Airline Fleets and Networks

Capacity today is lower than it should be, for several reasons. First, some airlines have chosen to constrain their capacity growth in light of economic uncertainty. Second, multiple airline failures, particularly in Europe (primarily the result of fierce competition, a strong US dollar, labor unrest, and a range of issues within individual carriers), have removed capacity from the market. Third, production delays at Airbus, the grounding of Boeing’s 737 MAX following two fatal accidents, and ongoing 787 engine issues have all combined to reduce capacity. In general, we expect capacity growth to be somewhat subdued over the next few years, before likely increasing as these issues abate.

By strategically planning the evolution of their networks and fleets, forward-looking airlines will be able to capture a number of opportunities.

Over the next five years, by strategically planning the evolution of their networks and fleets, forward-looking airlines will be able to capture a number of opportunities. For example, we will see growth in smaller-gauge aircraft, including longer-range single-aisle jets and smaller twin-aisle aircraft (such as the 787 and Airbus’s A350). We expect that, in turn, this will lead to an increase in point-to-point routes, in many cases serving smaller, secondary airports. The new jets will allow airlines to serve these lower-volume routes profitably, avoiding heightened competition on connecting routes. While hubs will remain important, we foresee some degree of “dehubbing” for both full-service and low-cost carriers.

To capitalize on the shifts in airline fleets and networks, carriers should take the following steps:

- Assess the opportunities for increased network breadth, supported by newer fleet types.

- Given fleet and market dynamics, conduct scenario planning to determine the potential implications for your business and what actions you can take now to capitalize on opportunities or mitigate risks

Growth in Strategic Alliances and Partnerships

Although the future of global alliances has been questioned in recent years, we believe they will remain in place for the foreseeable future. It is likely that we will see changes to membership, as airlines leave and/or join new alliances as a result of mergers, joint ventures, or other factors. The global alliances will be focused on providing improved service to their customers, such as ensuring a seamless experience for travelers with itineraries involving more than one carrier in the alliance.

Meanwhile, we expect to see more bilateral or multilateral agreements beyond the current global alliances, potentially including equity stakes. These agreements can help airlines strengthen their position in strategically important markets or regions, allowing them to shape the competitive landscape rather than responding to changes forced upon them.

To take advantage of the growth in strategic alliance and partnerships, airlines should take the following steps:

- Proactively identify partnership opportunities as a way to establish or strengthen your position in new markets.

- Accelerate work within alliances to provide customer service innovations.

- Anticipate potential competitor moves and their implications for your business—and develop plans now to respond.

Dramatic Shifts in Organizational Skills, Capabilities, and Ways of Working

The rise of advanced analytics and the increasing digitization of core airline functions will have a significant effect on how airlines manage talent in the future. We expect to see fewer people in some job families and functions—such as call centers, airport operations, and traditional inventory and pricing roles in revenue management—and an increased need for other skills, particularly data scientists, designers, and software engineers.

As airlines look for ways to attract new digital talent, we expect them to rethink their recruiting strategies, employee value propositions, and even office locations in order to become more attractive places to work. We will see more airlines forming partnerships with travel and tech startups to supplement in-house talent and capabilities. More airlines will run incubator programs (like IAG’s Hangar 51) to source both ideas and talent.

In addition, we expect competition for frontline talent to continue. For example, pilot shortages will likely remain an issue. The need to attract pilots will be most acute in Asia, where demand and capacity will grow rapidly. That shortage will lead to aggressive competition among airlines, higher salaries for existing pilots, the poaching of pilots from competitors, and subsidized pilot training to help fill the talent pipeline.

In terms of internal ways of working, our clients often highlight a lack of collaboration among siloed functions as an issue. We expect more airlines to experiment with agile ways of working and cross-functional teams in an attempt to increase their speed to market and boost customer and employee satisfaction. New-product development and commercial activities (requiring close collaboration between, say, marketing, sales and revenue management) are prime use cases to test agile ways of working in airlines.

To build new skills, capabilities, and ways of working, airlines should take the following steps:

- Develop your talent strategy: Which capabilities do you have today, which capabilities will you need in the future, and how can you effectively bridge that gap?

- Update the brand and employee value proposition to attract digital talent.

- Run agile ways of working pilots in pockets of the organization and apply lessons broadly.

The last decade brought a sustained run of profitability to the global airline industry, but carriers must expect that the next five years will be tougher. The seven trends described above will dramatically change how airlines operate. Management teams have a choice: they can try to stick with a business-as-usual approach, reacting only in hindsight to those developments, or they can take proactive steps—starting today—to adapt to and shape the future of the industry.