A select group of leading companies have cracked the code for winning in a world defined by digital engagement, embedded artificial intelligence (AI), and low-emissions products, processes, and supply chains. They have mastered the ability to realize business value from their digital and data investments, avoiding the trap of lengthy IT projects with large cost overruns. Their financial and nonfinancial performance is dramatically superior to that of companies still playing by the old rules, which, as a result, face an existential threat. The leaders, for their part, have created $9.3 trillion in shareholder value in the past five years.

BCG’s latest research provides a compelling and pragmatic blueprint for how CEOs can propel their companies to the front of the pack by accelerating and de-risking their change agendas to rank among the winners.

The Changing Basis of Advantage

Every CEO faces the challenge of meeting investors’ expectations for current performance while dealing with myriad other issues such as rising interest rates, supply chain shortages, geopolitical tensions, cybersecurity risks, and activist investors. Current cost pressures add to the challenge. And while 60% of companies worldwide are planning to increase their 2023 digital investments, compared with their allocations in 2022, BCG research shows that many if not most CEOs are frustrated by poor business cases, increasing demands for significant capital expenditures, and unclear realized value for the business. Almost 85% cite cumbersome coordination with vendors, and 74% believe their company is implementing cookie-cutter solutions. Almost 70% say their company does not prioritize its investments well in executing digital transformation programs.

Critically, the fundamental drivers of both superior current performance and sustainable competitive advantage are changing because growth opportunities and the capabilities required to win in new markets are shifting.

Growth, which accounts for 60% to 70% of shareholder returns in the medium term, has plateaued in traditional markets. The action has shifted to new markets, including those created by technology disruption, such as e-commerce, streaming media, cloud-based interactions, mobility solutions, and smart energy solutions. Growth opportunities are expanding in areas related to the energy transition and low-emission technology as well as in gene therapy, the metaverse, and quantum computing.

Many incumbents struggle to justify investments in these disruptive new opportunities and, instead, only make incremental investments in their current businesses (or they invest in the wrong areas). Since they lack the capabilities—the talent and processes—that are required to access the new markets and gain advantage with AI and other technologies, their futures are bleak. Growth will slow and insurgents will target their profit pools.

Meanwhile, a small number of companies have built winning capabilities and have broken away from the pack. They have found a way to invest not only in smart technology but also in their people, processes, and culture to realize value from their investments. For example, when investing in AI, these companies have adhered to the 10-20-70 rule: 10% of the effort lies in building an adequate AI model; 20% involves making high-quality data available; and 70% focuses on people, developing new business processes, and transforming the way business functions operate. Equally, these companies are addressing the rapidly changing skills mix required to win in new growth markets. For example, consider the skills that will be needed for generative AI. A new study from Goldman Sachs suggests that this technology could expose 300 million jobs to automation worldwide. At the same time, new technologies will create many other jobs. These companies understand such shifts and are planning for the future.

These future winners share a common set of attributes (six, to be exact) that, regardless of their sector, underpin their success. These attributes enable them to outperform, to be more resilient to shocks and disruptions, and to exploit innovation faster for value-creating growth. They are widening the gap with their competitors and generating shareholder returns almost three times greater than those of the S&P 1200, with two-thirds of the value created coming from revenue growth. These leading companies are built for the future.

A clear blueprint, or playbook, has emerged for how to become a company that is built for the future. The blueprint reconciles the challenge of what these companies need to do (identifying which initiatives drive the most value by sector) with how to do it (determining which capabilities drive success and how to build them fast). CEOs can tailor this new playbook to their company-specific change agendas. Here are the details.

Performance, Advantage, and the Six Attributes of Success

Against this backdrop, CEOs need to strengthen their companies’ competitive advantages, the basis of performance for the future. In the past, advantage derived from structural differences, such as scale, that often can be replicated and neutralized. The new bases of advantage are rooted in superior capabilities, especially those related to digital, AI, and innovation.

These capabilities are more difficult to establish but much more enduring for two reasons. First, technologies themselves are evolving rapidly. So, for example, companies that have built capabilities around data and analytics can ride the wave as AI algorithms become more sophisticated and better trained and the companies deploy further innovations around new developments (such as generative AI). Second, companies that have these capabilities benefit from a flywheel effect—they can invent, deploy, adapt, and reinvent more quickly and with greater impact than their competitors can. They also get better at cocreating with customers and ecosystem partners and at democratizing the use of data throughout their organization.

BCG’s latest research, capping three years of empirical study of digital transformations and the changing nature of competitive advantage, offers the blueprint CEOs are looking for. (See “About Our Research.”) The new research reveals the attributes, or groups of capabilities, that best correlate with superior current performance and future advantage. Six specific attributes are endemic to companies that are built for the future and enable them to move into new high-growth markets that are beyond the reach of less-capable players:

- Leadership that is aligned around a corporate purpose that integrates sustainability and social impact goals, building trust and transparency among stakeholders

- A clear people advantage to attract, retain, and develop world-class talent

- An operating model that enables agility and resilience to combat exogenous risks

- An innovation-driven culture

- A decoupled data platform and flexible, scalable technology platforms and applications to facilitate data access and to support business needs easily and flexibly

- Fully embedded AI that can create value for the organization

About Our Research

- “Flipping the Odds of Digital Transformation Success,” October 2020

- “Performance and Innovation Are the Rewards of Digital Transformation,” December 2021

- “The Rise of the Digital Incumbent,” February 2022

- “Are Digital Natives Losing Sight of the Digital Basics?,” November 2022

Our latest survey asked all participants about five areas that are fundamental to success, the emphasis of transformation efforts, how successful they have been, and the degree to which each of more than 50 potential influencing capabilities were in place. (See the exhibit.) We then used the resulting data set to analyze which combination of capabilities, if built sufficiently well, had the biggest impact on future readiness and which combination differentiated future-built organizations from those facing greater risk of disruption. Six attributes emerged from this analysis and, in our judgment, serve as the best descriptors for leading companies.

To determine the most effective combination of critical capabilities, we conducted a multivariate analysis of the full list of potential influencing factors. We employed a multivariate linear regression approach, run using the R programming language. All input capabilities were included in the initial regression analysis, with the combined success score being the target or output variable. R2 and adjusted R2 values for this initial regression analysis were measured, as well as the coefficients and standard errors for each input factor. This analysis determined that this particular combination and concentration of attributes explained more of the variance of the data points than any other combination. For example, adding the sixth attribute increased the likelihood of delivering on organizational outcomes significantly (by about 20%), while adding a seventh attribute had a negligible additional impact. Thus, we can say confidently that our combination of six attributes best reflects future-built organizations.

The Journey Reveals a Widening Chasm

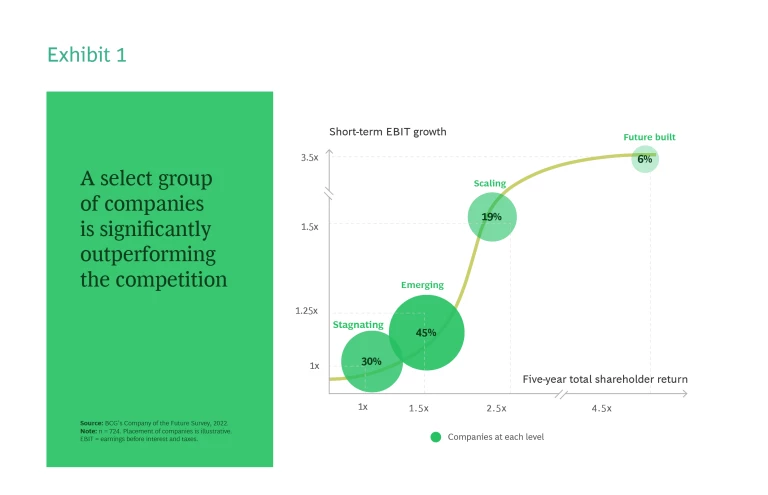

The journey to acquire these six attributes is similar for all companies, but since sectors, company context, and starting points differ, it requires tailoring. BCG surveyed 725 C-suite members to understand how their companies are building (or have built) more than 50 different capabilities in five areas that previous research has shown are fundamental to success: senior management commitment, strategy and approach, governance, people, and technology. We then analyzed which of these capabilities contribute most to an organization’s future readiness, which we can link to financial and nonfinancial metrics that investors value, such as shareholder returns, growth in earnings before interest and taxes, customer satisfaction, and talent attraction. We scored each surveyed company on its position along the journey toward becoming future built and identified four groups of companies on the basis of their progress: stagnating, emerging, scaling, and future built. (See Exhibit 1.)

Stagnating companies (a sobering 30% of our sample) remain at the starting gate—they are still deciding how to move forward. Some haven’t yet aligned executives around the need for fundamental, as opposed to incremental, change. Many are wary about writing big checks (though some have) to systems integrators and platform providers for multiyear technology upgrades that are well known to have high rates of failure. Still others have digital initiatives that have gone nowhere—they have little to show for the time and money they have invested.

Emerging companies (45% of the sample) have created value from a digital transformation, but they continue to face challenges in effectively scaling solutions, and they haven’t evolved much beyond fixing the basics in their core value chain. They risk becoming stuck with pockets of digital capabilities but fail to create systemic, organization-wide changes to their culture and operating model.

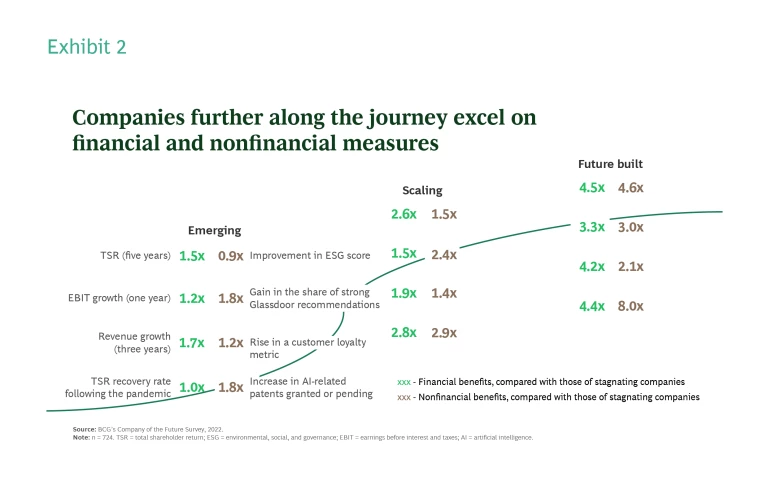

Scalers (19%) have delivered a successful wave or waves of digital and AI transformations and created sustainable change in the organization. They are focusing on embedding these solutions across the enterprise and pivoting toward growth from innovation. These companies are delivering (in some cases, eye-popping) results. (See Exhibit 2.)

Future-built companies (6%) exhibit all six attributes at scale. They are on the leading edge of disruption in their sectors, demonstrate resilience in the face of uncertainty, and are best placed to benefit from technology disruption.

The more advanced companies (scalers and future-built firms) are opening big chasms with the stagnating and emerging companies in critical capabilities that cement advantage. For example:

- Five times as many advanced companies are scaling AI solutions as opposed to running pilots at a subscale level (72% versus 14%).

- Advanced companies invest twice as much in AI solutions and realize 3.5 times greater ROI.

- Three times as many advanced companies have stronger capabilities in the operational value chain, for example, intelligent asset management, smart factories, automated maintenance, and Industry 4.0.

- More than twice as many have stronger capabilities in sales and marketing, and twice as many have stronger capabilities in customer experience and journeys, for example, personalization, consumer-centric services, and customer support and services.

- Twice as many have stronger capabilities in digital ecosystems, such as leveraging platforms and partnerships to drive sustainable revenue growth beyond their core.

- Advanced companies show a greater proclivity for earlier-stage innovation, launching 1.6 times more ventures or new companies compared to less-advanced firms.

The value implications are staggering. Measured against the S&P 1200 index, scalers and future-built companies (the top 25%) are responsible for $9.3 trillion, or nearly half, of the index’s value creation in the past five years. Relative to the leaders, stagnating companies (the bottom 30%) have missed an opportunity to create an additional $5 trillion.

The Playbook for Moving Up the Curve

So how do CEOs focus their management teams on embedding the six attributes across their organization? BCG has created a pragmatic playbook that companies can tailor to their sector, current attribute maturity, and stakeholder requirements to drive both performance in the short term and sustainable advantage. It shows how to achieve value from new initiatives, especially from AI use cases, growth from innovation, and ESG initiatives. (See “How Digital and AI Capabilities Deliver ESG.”)

How Digital and AI Capabilities Deliver ESG

At advanced companies, the ESG agenda is tightly linked to digital and AI maturity and the attributes for future success generally. The data shows that 60% of ESG innovators (companies scoring highest on ESG capabilities and outcomes) are scaling or future-built companies (which make up 30% of companies overall), and the remaining 40% of ESG innovators are spread across the 70% of stagnating and emerging companies. This makes intuitive sense: for example, it is hard to baseline emissions without a robust data architecture and AI capabilities.

Stagnating and emerging companies tend to focus on social and governance issues versus environmental ones. They prioritize foundational capabilities, such as digital audit trails for compliance, digital health and safety reporting, and data collection to fulfill regulatory requirements.

Scaling and future-built companies do two additional things. They extend these social and governance capabilities to more advanced use cases, such as creating digital reskilling and upskilling programs; improving diversity, equity, and inclusion outcomes; and adopting predictive risk analytics. And they focus more on the environmental agenda with initiatives such as AI-driven emissions monitoring and predictive asset maintenance and integrating sustainability into all functions and operations (such as product development, sourcing, and manufacturing).

The language used to describe ESG aspirations differs between less advanced and more advanced companies. The former group tends to talk about compliance and risk management, while the latter discusses integration into the overall operating model with expectations for growth, value contribution, and improved competitive differentiation. Furthermore, advanced companies are moving faster and using ESG to prioritize digital initiatives and vice versa. In 2021, 45% of stagnating and emerging companies, versus 60% of scaling and future-built companies, reported that ESG is a primary focus or key criterion in prioritizing digital initiatives. One year later, these numbers rose to 71% of stagnating and emerging companies and to a whopping 87% of scaling and future-built companies.

Stagnating and Emerging. In 2020, we described the six success factors that are critical to the success of a digital transformation. Embedding the success factors enables a programmatic step change in digital capabilities that typically fixes the basics by digitizing the core value chain, improving the customer experience, and supporting end-to-end customer journeys. In the two years since, the companies in all sectors that have deployed this approach have delivered individual solutions in such diverse areas as implementing agile operating models, replacing aging technology stacks, and achieving digital excellence in targeted corporate functions. These companies have been focused on business value through prioritized use cases and have avoided spending years and large amounts of capital on generic foundational capabilities. For example, they have not built all the large-scale infrastructure for data and analytics upfront; instead, they have worked back from the use cases and built what is necessary for impact, recognizing that scaling the infrastructure will go hand in hand with scaling the benefits.

The 2022 data shows only a modest improvement in scores for stagnating and emerging companies, far from what is required for these firms to remain competitive. Too many firms are approaching digital transformation with a cautious, evolutionary mindset, which is holding them back and widening the gap with the companies that are progressing at a faster pace.

For example, one tenet of the CEO playbook is that companies need a certain level of digital maturity in order to create value from AI initiatives. AI maturity tends to lag digital maturity, since successful at-scale AI deployment requires some foundational capabilities, including clean, accessible data and an openness in the business to experiment with and commit to using AI. Our latest research shows that 46% of companies have not built strong digital foundations, and none of these has a strong AI capability. Another 42% are relatively advanced digitally but don’t feel that they are AI mature. Only 12% of the companies have achieved strong digital and AI maturity—and, thus, are positioned to capitalize on the next wave of advances.

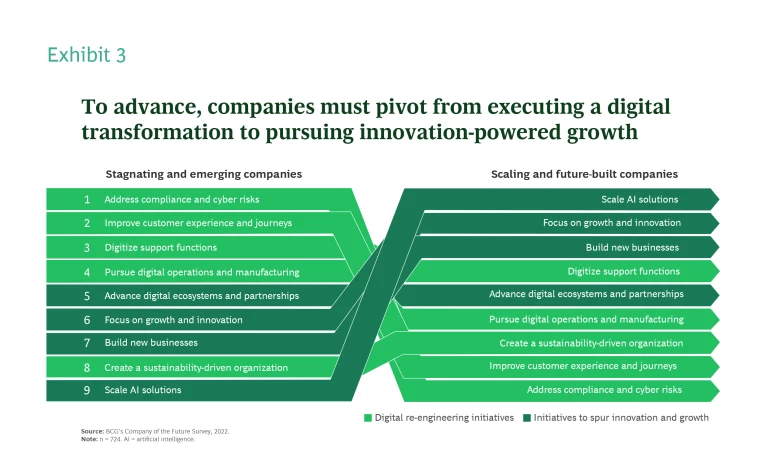

Scaling and Future Built. Our latest research yields critical insights into how more-advanced companies, irrespective of sector, pivot their priorities. Once a step change has been achieved through a successful digital transformation, the next question is how best to keep building the attributes that will underpin future success. Typically, companies tire of large-scale change programs, so management looks for solutions that are implemented by business units under the mantra of continuous improvement. This approach has risks: it can lead to line managers prioritizing short-term results over more systemic change, and it risks a loss of momentum in the transition and a failure to capitalize on early gains.

Successful change requires a purposeful approach to both the what (the specific initiatives to prioritize for highest impact) and the how (the mechanisms and governance processes to deploy to make continuous change an integral part of the new operating model). Advanced companies reduce the emphasis on process-digitization fixes (since their core processes, channels, and customer engagement are much improved) and shift the focus to growth from innovation. (See Exhibit 3.) They typically prioritize scaling AI solutions (for example, in order to drive revenue growth from personalization) and orchestrate and contribute to business ecosystems.

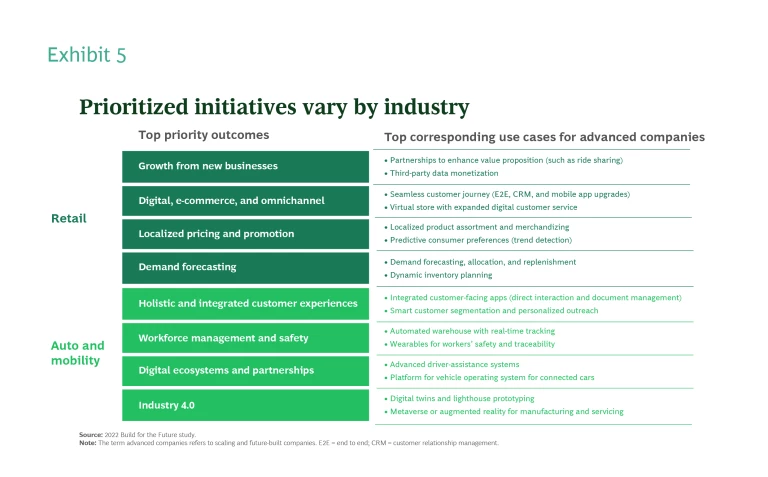

There is a remarkable similarity among advanced players in all sectors in their focus on the six attributes. (See Exhibit 4.) At a more granular level, however, the details of the capabilities that companies prioritize vary by sector and company context. The value-driven portfolio of initiatives for scaling and future-built companies also varies significantly by sector. (See Exhibit 5.) As an example, retailers tend to get the highest value from new-business opportunities, such as ride-sharing partnerships, and e-commerce initiatives, such as personalization. Advanced automotive and mobility players tend to see the most value from integrated customer experiences (using customer-facing apps, for example) and workforce management solutions (such as an automated warehouse). Companies need to decide on the business outcomes they seek and the specific use cases they need to build. They also need to determine the minimum viable foundations of technology and data that will enable them to scale solutions. Advanced companies are doing this and incorporating a continuous improvement agenda with new initiatives that leverage the progress already made.

Companies such as Anheuser-Busch InBev, Apple, BMW Group, Microsoft, and Woolworths provide useful insights into how to execute this playbook. Here are some examples:

- Leadership and Purpose. Top leadership teams in advanced companies communicate a clear vision and purpose; create an environment of inclusion, access, and equality; and empower people throughout the organization to make decisions. They go beyond just alignment to ensure that middle management is driving delivery of the ambition and the adoption of individual initiatives. As Microsoft’s CEO Satya Nadella wrote in his book, Hit Refresh, “The CEO is the curator of an organization’s culture. Anything is possible for a company when its culture is about listening, learning, and harnessing individual passions and talents to the company’s mission. Creating that kind of culture is my chief job as CEO.”

- People Advantage. There are many aspects to delivering superior people performance, including better recruitment, retention, development, and engagement of the right talent. The best companies innovate around their employee value propositions. For example, Anheuser-Busch InBev has differentiated its employee value proposition for digital talent in many markets by creating separate pay structures, equity arrangements, and work patterns for people focused on driving innovation. Michel Doukeris, CEO of Anheuser-Busch InBev said, “Aligned with our strategy as a tech-first fast-moving consumer goods company, we have developed a differentiated employee value proposition to attract and grow leading digital talent. Our team has a unique opportunity to drive growth for our ecosystem by working on innovative tech products, such as Bees, TaDa Delivery, and Zé Delivery, which reach millions of monthly active users, and solve consumer and customer problems at scale.”

- Agile Operating Model. This brings advantages such as faster decision making, better adoption of innovations, and more resilience. For example, a large Asian insurance company transformed from a hierarchical organization model to a platform, data, and technology model that covers the full insurance value chain and makes data and analytics available throughout the organization (the much-sought after democratization of data). The platform model puts decision making at the frontline with a continuous feedback loop to the center.

- Innovation-Driven Culture. Apple is famous for innovation. Its organization is rooted in functional expertise, one factor that drives scalable innovation. Other advanced companies implement continuous customer feedback loops that power rapid iteration and constantly explore new technologies to push the boundaries of innovation. They emphasize building relationship ecosystems to develop value propositions that they cannot construct on their own and an entrepreneurial culture that promotes a fail-fast-learn mindset.

- Data Platform and Modernized Technology. A robust approach to making data available and defining a value-optimizing pathway to modular, scalable technology is critical. Brad Banducci, CEO of Woolworths, says, “We purposefully built data and technology architectures and capabilities to ensure we could rapidly scale business solutions to drive incremental revenue and bottom-line benefits across the group. For example, our group shopper media business, Cartology, creates an incremental revenue stream, and wiq, our advanced analytics business, delivers performance improvements from multiple use cases across the group.”

- Embedding AI. Most leading companies focus aggressively on leveraging advanced analytics and AI. For example, Stefan Meinzer, general manager of corporate performance management and advanced analytics at BMW Group, said at the launch of BMW X, “Because of changing environmental conditions, changing customer demands, changing circumstances in the supply chain, we have to react extremely fast…and the best way is to leverage AI and utilize massive amounts of data…. We have launched a worldwide cloud platform to make data available from different parts of the supply chain to make the customer experience significantly better…and to make the best cars in the best configuration possible.”

Featured Insights: Explore the ideas shaping the future of business

Our empirically derived insights offer a practical playbook that guides companies to both improve near-term performance and build the necessary capabilities for sustained advantage. For stagnating and emerging companies, this playbook flips the odds of digital transformation success from 30% to 80%. For scaling companies, it shows how to make the transition to continuous improvement and capability building. The playbook also brings together the sector-specific initiatives that drive the most value at each stage of the journey and shows how to build the specific capabilities that will strengthen the six attributes.

We all know the adage that past success is no guarantee of future success. This has never been truer. The rules for current performance and future advantage are changing, and CEOs urgently need a pragmatic change playbook. Success depends on a de-risked and accelerated change agenda that drives current performance and builds the capabilities required for sustainable advantage. The corporate world is bifurcating between high value-creating, resilient, adaptive, and future-proofed winners—companies that are built for the future—and companies that risk underperformance and even extinction by failing to respond fast enough to the tectonic changes taking place.

The authors are grateful to Priyanka Birla, Sébastien Cagnon, Alec Kennison, Michael Mckissack, George Punnen, Shreyansh Sharma, Divakar Singh, Anshu Singhal, Karen Wang, Travis Washington, Katie Wells, Matthew Williams, and Yingying Zhu for their assistance with the research and their contributions to this article. Special thanks to BCG’s Center for Growth and Innovation Analytics team.