Digital technologies that transform the way upstream oil and gas companies solve key business problems can unlock an enormous amount of value. Pockets of digital excellence already exist in the industry within disciplines such as reservoir and flow assurance modeling. But there are still significant opportunities to use digital technologies to create value by enabling better integration across disciplines, asset organizations, and players in the value chain.

We’ve found that disruptive value creation from digital is being driven by two key factors. First, companies are creating innovative business models to become more competitive. Examples include operators establishing remote or integrated operations centers and suppliers providing a greater share of production optimization or maintenance as an outsourced service. Second, companies are benefiting from digital twin technology. By replicating physical equipment or real-world processes in a virtual environment using digital twins, companies are able to make faster and better decisions. As a company’s portfolio of digital twin use cases grows, each digital twin of an asset or plant becomes more impactful.

Although oil and gas companies are increasingly creating digital twins, many organizations are failing to capture the potential value, typically for three reasons:

- They prioritize use cases for digital twins on the basis of what the technology can do, rather than what generates the most value.

- They do not secure proper buy-in and commitment from the end users in the business.

- They underestimate the extent of the changes to the ways people work that are necessary to realize value.

No one approach to implementing digital twin technology is right for all companies, but our experience shows that successful companies avoid these pitfalls by following several essential steps and maintaining a strong focus on value.

How Digital Twins Create Value

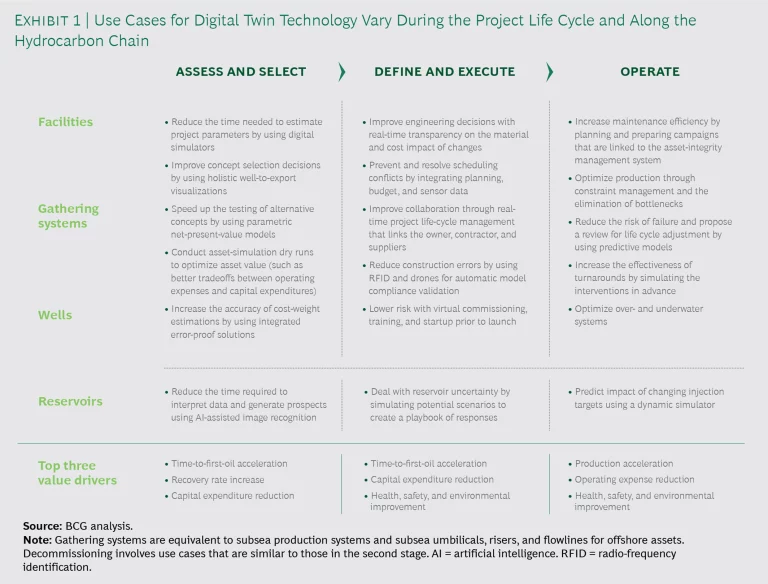

Digital twin use cases can help companies optimize the following value drivers: capital expenditure reduction, time-to-first-oil acceleration, recovery rate increase, production acceleration, operating expense reduction, and health, safety, and environmental improvement. (See Exhibit 1.) In general, digital twin technology enables companies to optimize operating processes and improve capital investments in a virtual world before applying them in the real one.

Some digital twin use cases require precision and the capability to leverage very-high-frequency data. For example, optimizing valve controls often involves sampling data at frequencies below one second. Other use cases are broader in scope and need less precision; these are typically used for optimization at a system or plant level. Rather than using a one-size-fits-all approach, the most successful companies adapt the data requirements and accuracy of their digital twins in order to chart a unique course to value creation. These operators also use digital twins to seamlessly navigate from broader to more detailed use cases to easily derive information and insights.

Digital twin use cases typically rely on a combination of engineering data, sensors, life cycle information, and digital models to replicate the real world and serve different needs. For example, a company can use a digital twin to see how a process or machine is working, create an analytical what-if model, or build a predictive what-will model. In addition, digital twins can enable automatic improvements and decision making—for example, by using an algorithm to alter valve settings.

A leading supplier decided to use digital twin technology to transform its offering. The company wanted to move from selling equipment and time to a more service-oriented business model based on equipment uptime and performance. Customer value would be created through quicker response times, deeper insights into how to optimize production and maintenance, and a more integrated service. To enable the transition, the supplier created a comprehensive asset-level digital twin by using engineering data, sensor data, 3D models, and simulation tools. The digital twin facilitated end-to-end operational processes, from diagnostics and problem solving to planning and execution, and reduced the supplier’s operating expenses and maintenance costs.

The Essential Steps to Success

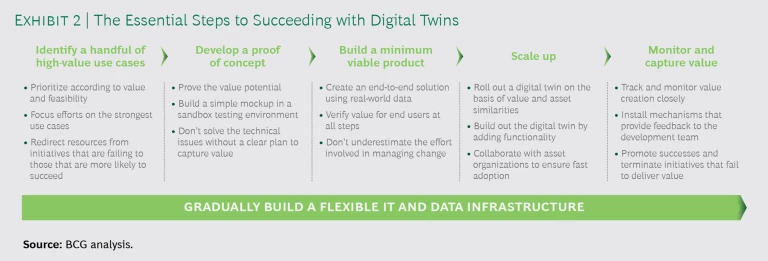

Companies that successfully develop high-value digital twins follow several essential steps. (See Exhibit 2.)

Identify a handful of high-value use cases. It may be tempting to immediately build very faithful digital representations of an entire asset base, but companies should concentrate their efforts on first developing a small number of high-value use cases. When prioritizing, take a top-down approach to identify areas where the most value can be generated, and then figure out how digital can help capture it most efficiently.

Consider flow assurance. A company may want to develop a digital twin use case to improve the regularity of the flow of hydrocarbons in upstream operations. This use case could optimize value drivers such as higher throughput, lower operating expenses, and reduced safety risks. The implementation requiring the least effort would be a digital twin that visually represents pressure and temperature measurements so that an operator could monitor them more easily. The next level of sophistication could involve adding data about the dimensions and layouts of pipelines as well as the properties of hydrocarbon fluids. Such data would enable the company to create smart alerts that issue warnings if there is a danger of unstable flows.

At its most advanced, a fully integrated digital twin would simulate hydrocarbon flows from the reservoir to the receiving facility using real-time data. This would provide the operator with a bird’s-eye view of flows throughout the pipeline at any time and enable the company to analyze the possible impact of changing conditions. A company should choose the option that creates the most value given the implementation effort, which is likely to vary from one asset to another.

A digital twin could provide an operator with a bird’s-eye view of flows throughout a pipeline.

At this early stage, companies should create a list of flagship use cases that will help achieve the business’s priorities and have the support of senior management. Each will need to be sufficiently advanced, in terms of value creation potential, scope, and necessary resources, so that the company has enough information to decide whether to proceed to a proof of concept (PoC) phase.

Although some longer-term planning is necessary, take a flexible approach since technology and operating limits are rapidly evolving and new opportunities will emerge as you mature these initial use cases. By ensuring that the focus is on demonstrating value as quickly as possible, you can avoid getting bogged down in protracted IT projects, build support within the organization around a few early success stories, resolve problems quickly, and leverage lessons for future use case developments.

Digital twins are relevant to both legacy and new upstream developments. For legacy assets, companies typically use digital twins to enhance their understanding of value drivers and obstacles and improve visualization of real-time operations information. For new developments, companies can use digital twins to make better use of capital and accelerate the time to first oil.

We often find that companies decide to mature most of their flagship applications on a single asset, rather than spread them over several assets. Equinor has taken this approach in the Johan Sverdrup oil field. The benefits include being able to use the same data, IT infrastructure, and development teams, as well as having fewer stakeholders.

An international oil company wanted to screen its asset portfolio to find use cases for digital twin technology that would generate significant value. The operator used a three-pronged approach. First, it identified its main value drivers by assessing the reserves, production, uptime, and health and safety performance of each asset. The company then established each asset’s digital maturity by examining the availability of data, the IT infrastructure, and the current use of digital twins. Finally, the operator combined the findings with information about production volumes, capital expenditures, and operating expenses to identify value creation opportunities and create a priority list of use cases. This approach enabled the company to deploy resources more effectively and speed up value creation from its digital twin use cases.

Continue to focus on value while developing a PoC and building a minimum viable product. After prioritizing the digital twin use cases that have the most value, the next step is to develop a PoC that demonstrates the value and viability of each one. The PoC should be developed quickly over a few weeks or months, typically in a sandbox testing environment that is not linked to real-life production systems and data. Developing a PoC typically involves many different disciplines and actors, and it requires iterating frequently with end users to confirm that the PoC solves the intended business challenge and creates value. Companies will therefore need multidisciplinary development teams that use agile ways of working. These teams should be autonomous, properly resourced, and have strong governance mechanisms to remove obstacles.

If the PoC is successful, the next step is to develop a minimum viable product (MVP)—a working solution that taps data and creates value for end users in a real-world environment. A leading international oil company wanted to reduce instances of gas compressor failures. It formed a multidisciplinary team to develop an MVP that collected data from 1,500 sensors. Then, using advanced analytics, the team established the health of 12 key systems affecting compressor performance. The solution was deployed in the company’s onshore and offshore operations, with extensive personnel training. The digital twin is now on track to reduce compressor failures by more than 40%.

Operating processes and decision-making procedures—internal ones as well as those that guide relationships with suppliers and partners—will need to be adjusted at this stage. We find that changing the way people work is typically more than 50% of the overall effort of developing a high-value digital twin. Also in this phase, companies should actively involve end users, including decision makers, to ensure that the digital twin solution is effective and to create buy-in.

Changing the way people work is typically more than 50% of the effort of developing a digital twin.

Scale up the digital twin, and monitor and capture value. Scaling up a digital twin brings its own challenges. Companies must consider not only how to best roll out a proven technology solution across an asset portfolio but also how to free up resources to develop the next wave of projects. These projects may involve adding functionality to existing use cases or starting new ones.

When scaling across an asset portfolio, prepare early and determine the implementation sequence by considering how to deliver the most value and which assets have similar work processes, stakeholders, and technology requirements. Ensure continuity between development and scaling teams by identifying the human resources needed for each asset and onboarding them early so that they can learn from MVP development and hit the ground running in the scaling phase.

As the organization moves from scaling to daily operations, ensure that the operating model and capabilities are in place to maintain the digital twin as real-world conditions change.

To monitor value creation, companies should establish and track simple KPIs. Furthermore, proper governance mechanisms should be put in place to ensure further development of successful digital twins and termination of poorly performing ones. Communicating success stories broadly throughout the organization will build momentum and justify funding future digital twins.

An upstream operator wanted to develop several digital twin use cases to increase throughput and cut maintenance costs. Scaling up involved using the MVP with three assets and then rolling it out across some 30 assets over one to two years. Extensive work was done to optimize the rollout sequence and engage with the respective asset organizations to ensure that they were ready to adopt the changes to their operating models that were necessary to capture value from the digital twin. The operator’s goal was to increase throughput by 2% to 4%. KPIs were implemented to monitor value creation. Current progress indicates that the organization is ahead of its target.

Gradually build a flexible IT and data infrastructure. As companies go through the steps outlined above, they will also need to think about their evolving IT requirements. Combining engineering and production data in new ways is critical to creating high-value digital twins. However, ingesting, contextualizing, and making data available for use is often difficult, because different asset organizations or suppliers in a company’s ecosystem have different legacy systems and ways of categorizing data. Several platforms are available to help companies deal with these challenges. (To learn how Cognite’s platform fit the needs of Aker BP, see the sidebar “How Platforms Can Help Oil and Gas Companies Solve Digital Twin Data Challenges.”)

How Platforms Can Help Oil and Gas Companies Solve Digital Twin Data Challenges

How Platforms Can Help Oil and Gas Companies Solve Digital Twin Data Challenges

When exploration and production company Aker BP needed an open technology platform for digital twin data orchestration, it turned to Cognite. The company’s solution offers not only a decoupled architecture that separates data management from applications but also secure data sharing as a service.

The platform enabled Aker BP to securely share asset- and process-specific information with a global provider of pumping equipment. Using Cognite’s application programming interface, the supplier integrated its systems with a digital twin platform operated by Aker BP. The supplier was then able to use real-time contextualized data derived from Aker BP’s operations and IT systems to improve its service delivery. Specifically, the supplier’s access to Aker BP’s streaming information, and its integration with the operator’s enterprise resource management system, allows it to predict pump performance and guarantee equipment uptime, enabling the company to shift to a novel performance-based contract. A feedback loop covering Aker BP’s design, engineering, and maintenance functions also helps the supplier strengthen its products and offering.

Cognite helped transform the traditional transactional supplier relationship into one that is more open, effective, and service oriented. The supplier’s use of Aker BP’s digital twin platform has already led to a significant reduction in manhours and maintenance. Longer-term projections show a 30% reduction in maintenance work, a 70% reduction in shutdowns, and a 40% increase in pump availability.

To succeed, companies should build a flexible IT and data infrastructure, looking at the process as a journey, rather than as a one-off event. Players should adopt a modular approach, establish the overarching architectural principles, and build the infrastructure step-by-step while tackling the challenges created by concrete digital twin use cases.

Data ingestion and governance can pose particular issues. With legacy assets, engineering and 3D data often need to be recreated from scratch. To minimize the effort involved, it’s important to prioritize must-have data over that which is nice to have. By using new technologies such as laser scanning, drones, and point cloud solutions in georeferencing, companies can save time and cut data ingestion costs. In the case of greenfield assets, the main challenge is to embed digital requirements in the engineering, procurement, and construction processes and move toward the exchange of information using structured data and metadata, rather than unstructured data. With both types of assets, it is essential to have well-defined governance and ownership regimes to ensure that data is properly maintained and updated.

For digital twin solutions to be effective, upstream oil and gas companies will need to develop or acquire new capabilities. Faced with building digital twins, traditional IT departments typically find that they have gaps in software development, cybersecurity, data science, user interface design, and test management. A key consideration is whether to develop these capabilities in-house or to rely on external suppliers or off-the-shelf solutions. The decision should be guided by the strategic importance of controlling such capabilities.

Suppliers Must Redefine Their Roles

Suppliers are a vital part of the upstream ecosystem, and they can use digital twins to both broaden and deepen their offerings. To be successful, though, suppliers need to focus on how use cases add value for operators and remain flexible so that they can tailor their offerings to operators. For example, larger operators are more likely than smaller ones to build more digital twin capabilities in-house and outsource less work to suppliers; smaller operators are more likely than larger ones to outsource a bigger share of production optimization and asset management activities. In any case, it’s likely that having digital twin technology will soon be table stakes to bid on the majority of contracts.

Savvy suppliers can gain a competitive advantage from how they handle data orchestration—the process of pulling data from different channels and devices, mixing it, and adding previously collected data. Suppliers can create value for operators by developing digital twins for specific tasks and doing so in a way that anticipates future integration. For example, suppliers might create a digital twin of a piece of equipment so that it can easily be integrated in the future with an operator’s systems-level digital twin. Robust data controls and the ability to share the right level of information with the right individuals at the right time will be important for this kind of application.

Suppliers also need to think ahead. Long industry lead times mean that they must define value propositions now to support exploration, development, and production activities that will be deployed years into the future. In addition, suppliers will have to introduce new commercial models that support investment in digital products and services, moving from remuneration models that are based on time and the cost of materials to performance-based ones. At the same time, suppliers will need to negotiate contracts smartly to avoid giving away their intellectual property, differentiate their offerings to avoid commoditization, and innovate to stay ahead of new players, such as pure analytics providers.

Savvy suppliers can gain a competitive advantage from how they handle data orchestration.

Digital twin technology has the potential to create significant value for oil and gas companies. But they need to be ready to use the technology to disrupt and fundamentally change the way their companies operate. We believe that digital twins will increasingly play a pivotal role in reshaping the industry’s operating and business models. Companies need to act boldly and embrace the disruptive potential of digital twins, or they risk losing out to competitors and new players.