As companies explore the world for new sources of growth, many search for commonalities that can simplify a complex and diverse world. Typically, companies organize their efforts by regions or by market segments, such as developed and emerging. Or they look for nations that share cultural roots. They then assume that strategies that succeed in one country will succeed in seemingly similar consumer markets.

But are these the right ways to find like-minded consumers? We asked ourselves: What if we were to gain an understanding of consumer mindsets around the world? Would we discover clusters of markets that bunch together due to geographic proximity, for example, or income levels or cultural roots? Are there stereotypes that can be confirmed or dismissed?

How Similar Are Consumer Mindsets and Needs Around the World?

For answers, we conducted research on 40,000 consumers in 18 of the world’s biggest markets about their mindsets as well as the needs they seek to fulfill when making a purchase. The answers were surprising and intriguing. After running regressions on 130 variables that determine consumer choice, we found few of the country clusters or regional themes that we expected to see.

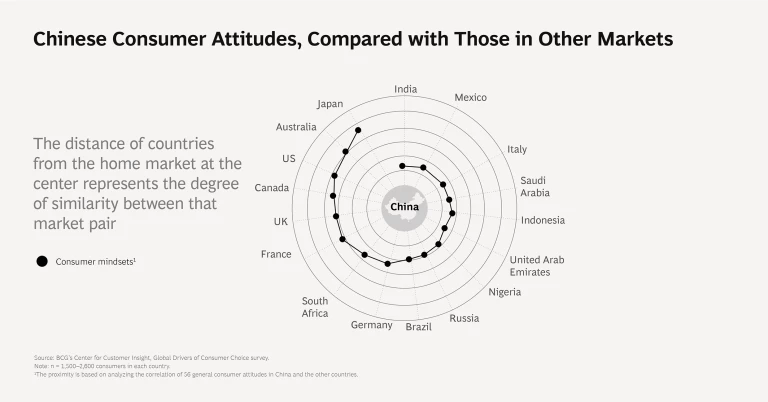

Instead, we found a world of remarkable diversity. While we detected strong similarities among consumers in the US, Canada, Australia, and the UK, for example, our analysis found that mindsets in every Asian market we studied are quite unique. European mindsets also aren’t as similar as we thought. In terms of specific attitudes, we found that Chinese consumers care deeply about how they are perceived by peers, but Russian and French consumers generally do not. And while Nigerians, Mexicans, and Indians are very keen to start businesses, Japanese consumers express little interest in entrepreneurship.

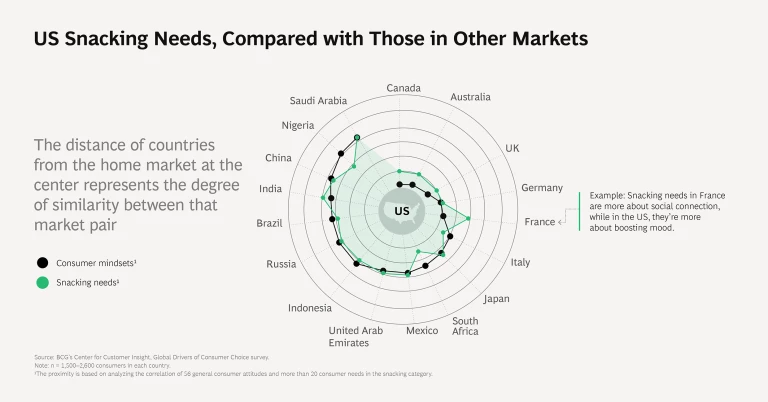

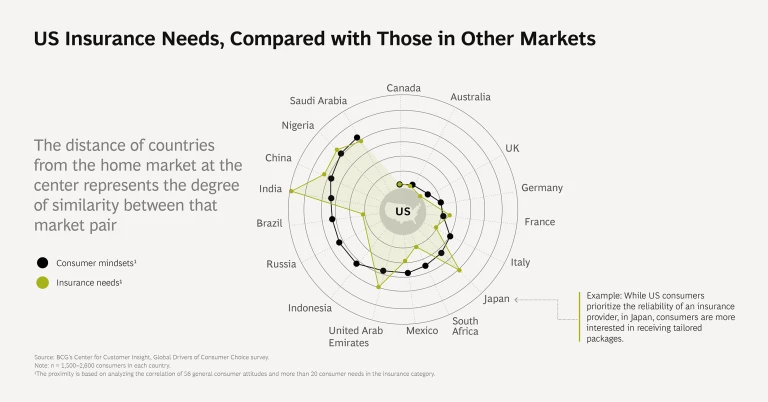

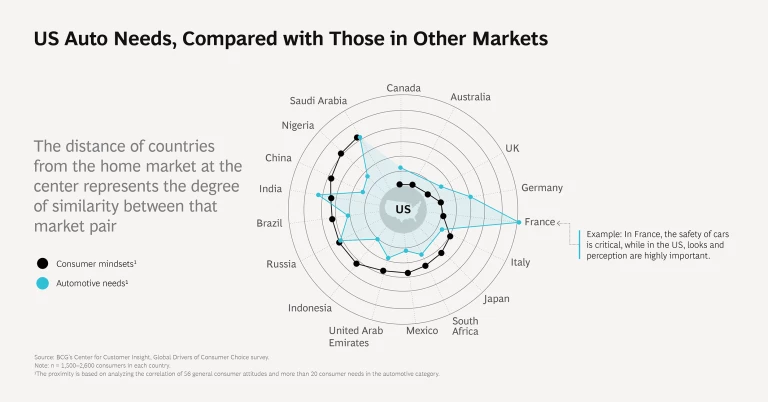

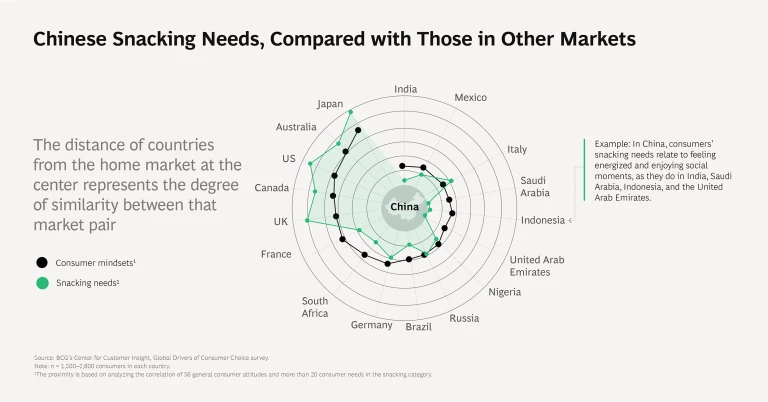

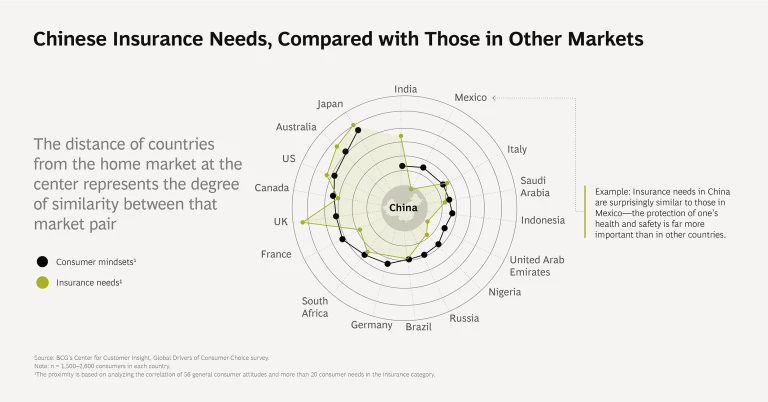

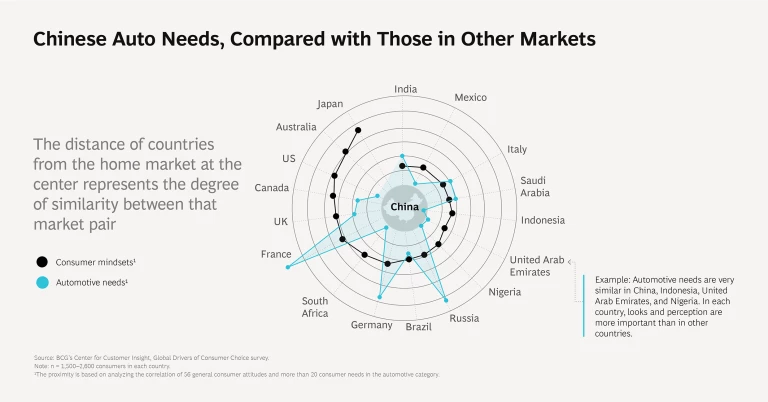

What’s more, we found that similarities in consumer mindsets in two countries don’t necessarily mean that consumer needs for a product category are similar as well. Even among markets with apparently like-minded consumers, the motivations that drive them to consume a certain snack, buy a car, or choose an insurance policy, for example, can be dramatically different. Just as surprising, we learned that two markets with dramatically different cultures can share similar needs for specific products. Chinese and Mexican consumers, for example, have very little in common by way of mindsets—and yet their needs when purchasing insurance are remarkably aligned.

For companies pursuing the global consumer market, these findings have important implications. They suggest that it’s risky to build brand strategies around broad segments, such as emerging-market and mature-market consumers. Similarly, it’s risky to rely too much on regional clusters, such as those comprising East Asian, Latin American, or European consumers. Instead, companies need a nuanced country-by-country, category-by-category understanding of the factors that influence consumer decisions and needs.

Few Meaningful Clusters Based on Consumer Mindsets

As part of our research into the drivers of global consumer choice, BCG’s Center for Customer Insight analyzed consumers in 18 nations that account for 60% of the world’s population: Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Nigeria, Russia, Saudi Arabia, South Africa, the United Arab Emirates, the UK, and the US. We applied BCG’s proprietary Demand Centric Growth methodology, which creates a differentiated understanding of consumer demand and enables identifying organic growth opportunities.

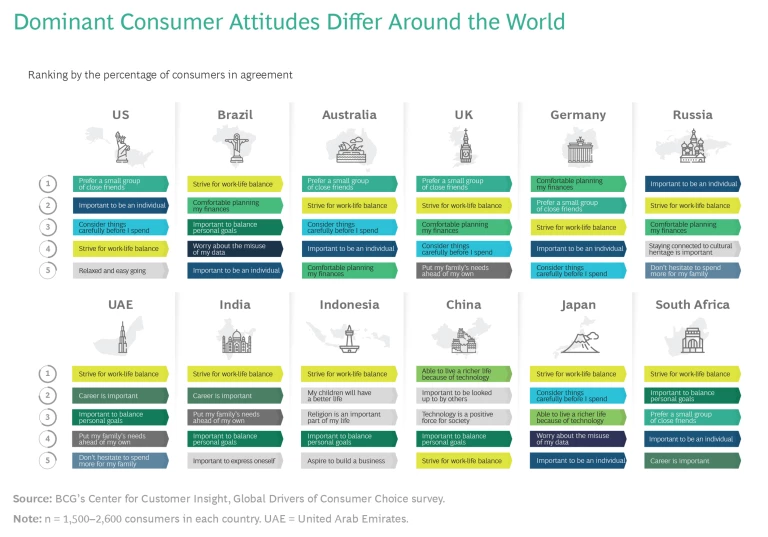

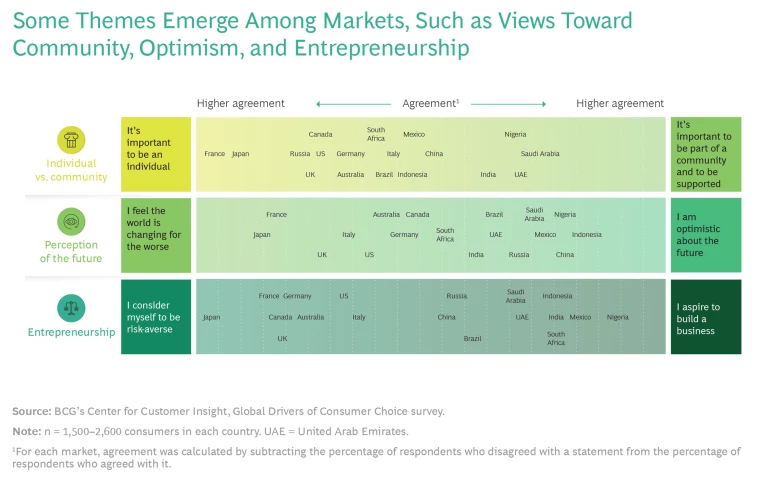

We first looked at mindsets—attitudes that are part of a consumer’s personality. The first thing that struck us when assessing some of the most important attitudes were the dramatic differences in consumer cultures. In China, for example, it is very important to be looked up to by others. In Indonesia, religion is paramount. In India and the United Arab Emirates, one’s career is of utmost importance. In Russia, consumers greatly value individuality.

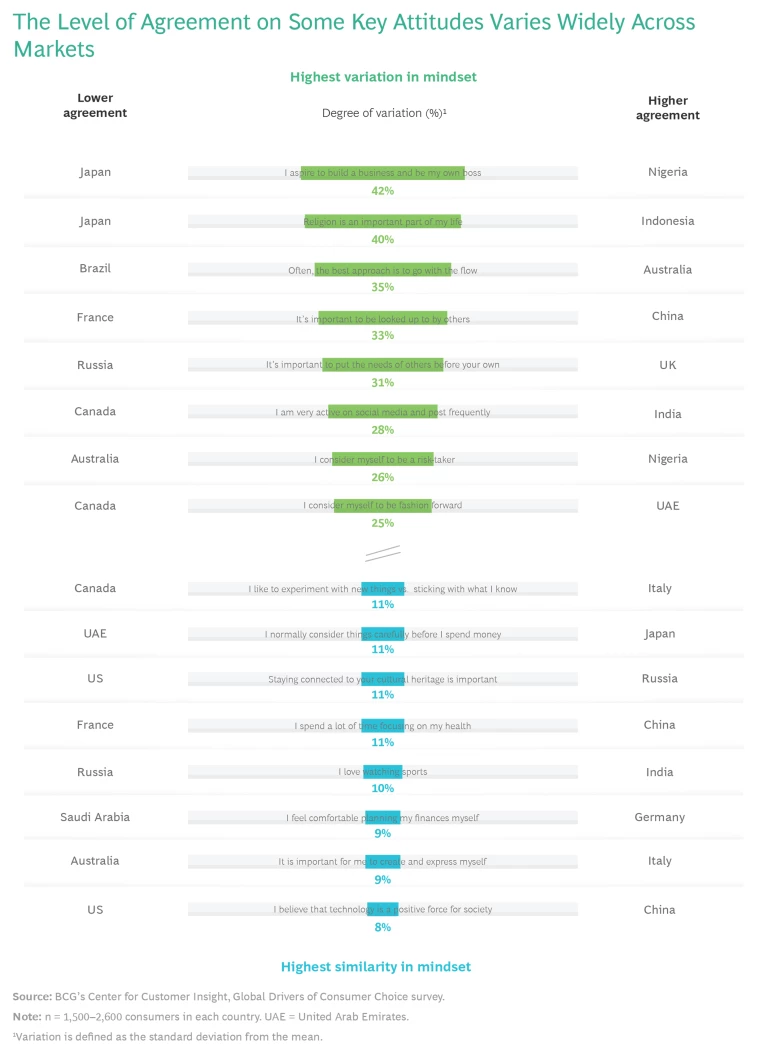

We also saw wide variations in a number of attitudes. While 80% of Nigerians surveyed said that they want to build their own business, for example, only 16% of Japanese shared that aspiration. Sixty-three percent of Australians said that it’s important to “go with the flow,” but only 14% of Brazilians agreed.

Despite these differences, there are a few things that consumers often agree on. They generally concur that technology is a force for good. They value individual expression and feel passionate about sports. They also are highly conscious about their health, possibly because of the COVID-19 pandemic.

Several general themes also emerged from our analysis. One is that consumers in Middle Eastern and South Asian markets deeply value community. Another is that consumers in high-growth emerging markets were very optimistic about the future and interested in entrepreneurship.

Searching for Pairs—Rather than Clusters—of Similarity

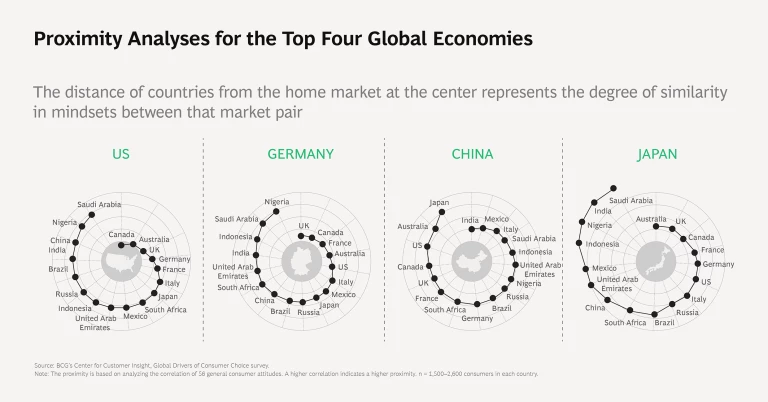

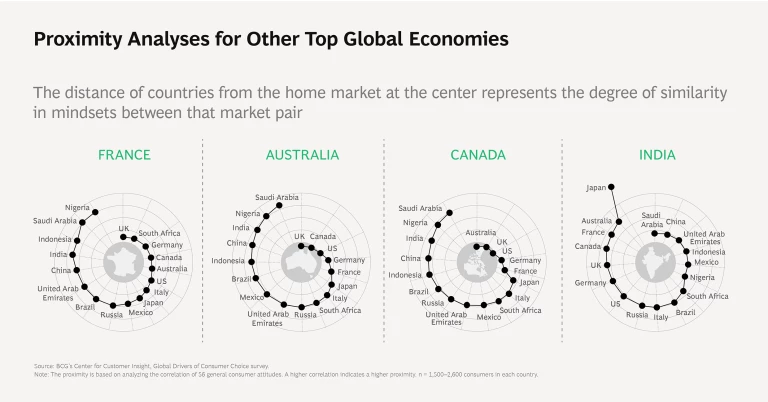

If it’s hard to identify significant clusters of markets with consumers who have similar attitudes, how can brands bring some method to the madness as they foray into uncharted territory? We recommend that marketers look at nations in terms of pairs, rather than groups. We ran a correlation analysis on 56 attitudes for each pair of countries.

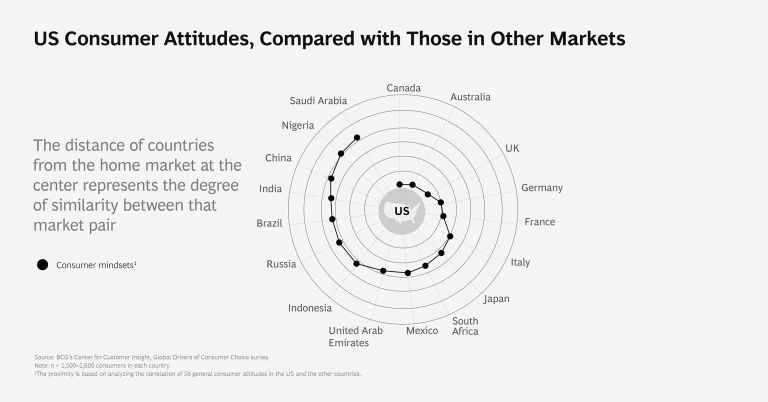

This enabled us to perform proximity analyses that show which pairs of countries are the most similar and which are the most different. Companies can use these insights to study foreign markets and identify which are most aligned with their home market or with other markets where they have a presence. (See “Methodology for Proximity Analyses of Consumer Markets.”)

Methodology for Proximity Analyses of Consumer Markets

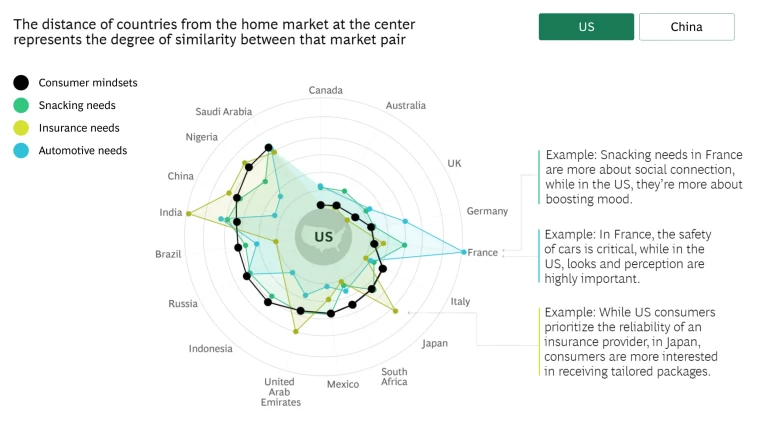

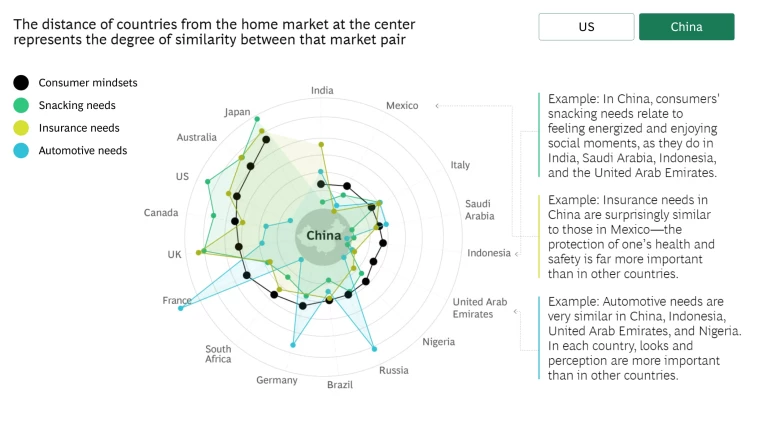

To understand the similarity between markets in terms of both mindsets and needs, we ran proximity analyses. These analyses are based on the correlation of the attitudinal variables and needs for each category. The higher the correlation, the closer the markets. For a variety of home markets, we plotted the proximity of each of the other 17 markets in a spiral. The distance of each country from the center indicates the degree of similarity to the home market.

For a variety of home markets, we plotted the proximity of each of the other 17 markets in a spiral. The distance of each country from the center indicates the degree of similarity to the home market at the center. In simple terms, if you are a US company, the proximity spiral for the US will indicate how similar the other 17 countries are when viewed through the lens of consumer attitudes.

We did find strong similarities among consumers in the US, Canada, Australia, and the UK, all of which share a common cultural heritage. We observed a correlation of 93% to 96% across all 56 attitudes. The countries that are most different from the US when it comes to consumer attitudes are China, Nigeria, and Saudi Arabia.

China and Japan, however, are practically islands unto themselves when it comes to consumer attitudes. This is reflected in the fact that even the most similar countries in terms of attitudes are quite far away from China and Japan in our proximity analyses, and, therefore, significantly different. For instance, the proximity spirals for China and Japan show that no other nations are in the inner circles.

Some other findings were eye-opening. Consumer attitudes in Europe weren’t as similar as we expected. And those in India correlated most closely with the attitudes in Saudi Arabia—a country that has a higher per capita GDP by a factor of ten and that has a radically different cultural heritage—followed by China, the United Arab Emirates, Indonesia, and Mexico.

Needs Can Change the Picture Even Further

Even if attitudes are similar in two or more markets, it’s important that companies understand the nuances of consumer needs in each product category.

When we ran proximity analyses for needs, category by category, we found surprising divergence from where the countries should have landed given consumer mindsets. Consider snacking. The differences in snacking needs between the US and France are far greater than differences in consumer mindsets. In the US, the most important snacking need expressed by consumers is to boost one’s mood. However, snacking is more about social connection in France. Companies’ marketing approach for a snack, therefore, must be substantially different across these two markets.

Insurance also illustrates the divergence between mindsets and needs. US consumers reported that their top need when shopping for insurance is quality and reliability of the insurance provider. But for Japanese consumers, getting exactly what one wants is most critical. When it comes to automobiles, we found an even greater variance in needs: In France, safety is the paramount need when buying a car. In the US, it’s looks and perception.

The converse is also true. Countries that appear to be very different given consumer mindsets may demonstrate surprisingly similar needs for a product category. Even though Chinese mindsets diverge widely from those in most other markets, similarities emerge when you look at needs by category. We found that snacking needs in China closely align with those in Saudi Arabia, Indonesia, and the United Arab Emirates, even though the cultures of these countries are starkly different. In each market, the top snacking needs are to feel energized and enjoy social moments.

This insight could be highly valuable for companies searching for new growth markets. For instance, a Chinese snacking company that is successful at home might be able to identify opportunities to expand into Saudi Arabia and Indonesia given the similarities in needs.

We found other surprising similarities between markets when it comes to insurance and cars. Even though the consumer mindsets in Nigeria are very different from those in China, for example, in both markets, looks and perception are the most important needs when deciding which car to buy. This implies that there may be an opportunity for Chinese automakers to succeed in Nigeria because they can apply part of the strategies used in their home market to address Nigerian consumers’ needs.

The Implications for Brands

To establish a significant global presence for their companies and brands, corporations need to find synergies among markets in order to scale efficiently and profitably. In fact, we often see companies organizing themselves into regional and subregional structures in an attempt to benefit from perceived commonalities among markets. Our research, however, proves that marketing themes that try to target regions or country clusters because of some prevailing wisdom are likely to fail. So how can businesses make sense of this wide diversity?

We suggest the following approach:

- Embrace consumer diversity around the world. A global category approach cannot be an effective model for companies that truly seek global advantage. Consumer mindsets around the world are simply too diverse.

- Understand needs granularly, often at a local level. Common mindsets do not necessarily mean that needs and consumer demand are also similar. Consumers’ needs for a product category are determined not only by their mindsets but also their demographics and the context in which they make their purchasing and usage decisions. At the intersection of these drivers of choice, companies can find specific demand spaces to target and to differentiate themselves. BCG’s demand-centric growth methodology helps build a deep understanding of that intersection for a specific market and category to unlock breakout growth.

- Use a bottom-up approach to understanding needs and identifying true commonalities. A granular understanding of needs will help companies find commonalities globally among consumers. But similarities won’t be driven by common mindsets or rules of thumb regarding perceived market clusters. Consumers in two markets that have similar consumer cultures may have very divergent needs for a product because consumption or usage occasions may differ. Conversely, companies may find unexpected commonalities between highly dissimilar markets that happen to share similar needs for a specific category. This granular approach can enable businesses to correctly activate marketing strategies at scale where there are true commonalities of consumer needs—and strategize locally where there are none.

Now is a perfect time to gain a fresh understanding of what drives choice in global markets. We are living in unusual times—a unique tipping point in the trajectory of consumer behavior. The world has just been through the shared experience of the COVID-19 pandemic, which is still affecting consumers in each market in different ways. Like never before, businesses must develop an appreciation for what drives consumer choice. We believe that companies that embrace consumer diversity and deepen their understanding of granular demand spaces to drive strategy will gain a once-in-a-lifetime competitive advantage in their global forays.