Despite the increasing sums that companies are spending on technology initiatives to drive transformation and digitization, many are not getting where they need to go fast enough—if at all. The annual growth rate for technology spending is consistently in the high single digits, but digital maturity is still lagging. Companies aren’t just wasting resources, they are falling further behind those that successfully leverage technology at a time when digital capabilities have emerged as an essential competitive differentiator and main pathway to future success.

The problem is that IT is still often seen as a support function that a company can evolve piece by piece without needing to tightly coordinate with the business. But bold transformation is only possible if companies end these IT practices. Technology and business must create a joint vision for the company’s technology transformation and then collaborate on strategy, investments, implementation, and governance to ensure all efforts keep steering in that direction. Without that alignment, complexity proliferates, scale becomes impossible, value remains elusive, and competitive agility suffers. Based on our work with clients, we have identified the scope necessary to define this vision and act on it.

A Litany of Challenges

While many CIOs and CTOs report generating some value through digital, overall transformation efforts have tended to be disappointing. Companies generally face at least some of the following challenges:

- Failure to Align Business and Tech. Many companies want to simplify their complex tech landscapes to gain speed and digital maturity. But because business and tech often remain unaligned when it comes to simplification and harmonization, these initiatives can easily stall or fail.

- Agile in Name Only. Most companies consider themselves agile when in reality they have achieved only partial agility or have simply rebranded old ways of working. As a result, agile often exists in pockets but not across tech and the business, impeding collaboration and slowing delivery speed.

- Data Issues That Impede Scale. It’s often difficult or even impossible to scale initiatives because the data itself, the data infrastructure, and the analytics capabilities reside in vertical siloes.

- Architecture Complexity. Many companies suffer from a debilitatingly complex and inflexible technology architecture, making change prohibitively expensive and slow and accumulating technical debt.

- Shortage of Tech Talent. Attracting and retaining tech talent is getting increasingly difficult, and the shortage of workers is slowing down digital and tech transformations.

- Difficulty Tapping into Small, Innovative Tech Vendors. Companies struggle to systematically tap into a growing array of specialized digital vendors to access the best know-how and technologies.

- Growing Threat to Cybersecurity. Threats and breaches are multiplying and causing disruptions that legacy defenses struggle to prevent.

Tech + Us: Harness the power of technology and AI

Defining the Business and Tech Vision

To establish a world class technology function, companies need to create excitement and value quickly by launching digital use cases together with the business, attracting new talent, and accelerating delivery. They must define the business and tech vision in parallel, agreeing on the target level of process simplification and harmonization for the whole organization so that every initiative will help improve overall performance.

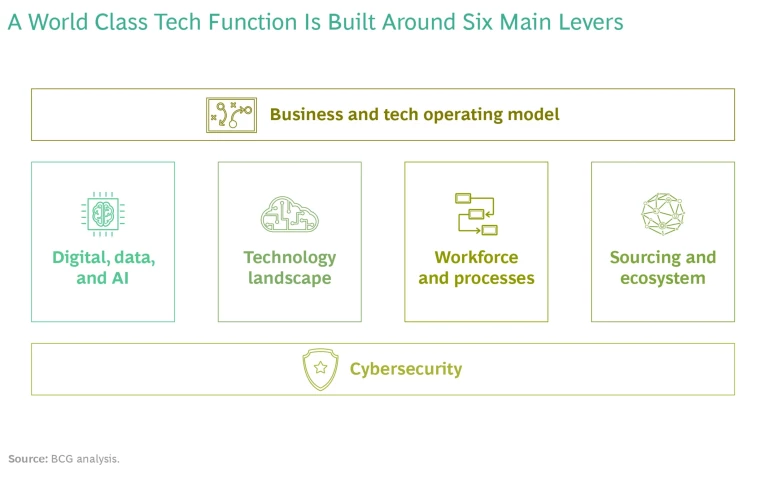

All too often we have seen companies embark on just one or two dimensions of a technology transformation, effectively dooming the effort. For instance, the company might double down on digital, data, and AI but neglect to transform its workforce, revamp its sourcing strategy, or simplify and enhance its tech landscape. Or the company might make a big insourcing play, only to learn belatedly that its new talent is frustrated by lingering legacy systems. In other words, a piecemeal approach to technology transformation is a no-go. Companies must move in parallel across six critical dimensions to establish a world-class technology function. (See the exhibit.)

Business and Tech Operating Model. Companies should drive explicit alignment between business and technology. Over time, many organizations have permitted their global functions—R&D, marketing and sales, operations, supply chain, finance, HR, procurement, and so on—to implement many processes tailored to run in specific divisions, countries, or regions. This profusion of processes creates complexity that makes it difficult to scale innovation and digital use cases, roll out new products or upgrades across the enterprise, and realize the value of data. Business and technology need to explicitly align on which processes to keep independent because they create market differentiation, and which to simplify and harmonize.

Companies must define the business and tech vision in parallel, agreeing on the right level of simplification and harmonization for the whole organization so that every initiative will help improve overall performance.

As part of the operating model design, companies need to create a prioritized initiative roadmap, so that all investments and implementations adhere to the business-tech vision. And to ensure value delivery, companies need to apply consistent governance across four dimensions: processes, applications, data, and sourcing. Initiatives will involve cross-functional teams that need to collaborate in a disciplined, agile way in order to scale and realize benefits. With this in mind, many companies also have decided to adopt a platform-based tech organization. This new setup promotes the agile collaboration of business and tech experts so they can align on and implement business solutions with increased speed and productivity.

The operating model design needs to include how to measure performance—cost control, value delivery, operational delivery, cybersecurity, sourcing effectiveness, and project delivery—by defining KPIs and using dashboards. It’s also important to consider how deeply to embed green initiatives into the operating model design. Companies must define where and how to use tech to reduce CO2 emissions across the organization.

Another consideration is that the legal and regulatory requirements in some countries are pushing companies to build local systems or work with local vendors. In these countries, companies need to choose a “local for local” approach when designing the operating model or the tech landscape.

Digital, Data, and AI. Companies should plan to bet heavily on a small set of high-value digital and AI use cases. Many organizations have compelling use cases—digital pricing or predictive maintenance, for example—but have difficulty scaling them globally across different manufacturing sites, divisions, or regions. To support the scaling effort and build high-value digital and AI use cases, leaders need to develop capabilities in certain critical areas: high-quality data, a skilled workforce, and cloud adoption. The efforts are worthwhile. BCG’s latest research on digital proficiency and maturity, which covered approximately 2,000 global companies, found that scaling individual digital solutions can generate revenue increases of 9% to 25% and cost savings of 8% to 28%.

Logically, companies must establish an enterprise data model and data strategy that defines how customer, product, supplier, or transactional data is stored. The quality and consistency of data is also an issue. If a company wants end-to-end, real-time information about global production, delivery, and sales, then it must simplify data and create consistency across countries. Whatever decisions are made, governance is critical to maintaining data quality and consistency on a daily basis. For example, companies must determine who has access to data and who has decision rights around data definitions and data management.

Technology Landscape. Companies should apply API-centric design with a data layer as they build a modern technology landscape. This slim and modular design usually includes a data layer that decouples legacy systems from the smart business layer. Such an architecture allows companies to insert new functionalities or make changes very quickly and efficiently. Companies also need to decide how aggressively to migrate to a public or private cloud, weighing the feasibility of shifting from legacy data centers. Another issue is how best to replace infrastructure with a more modular infrastructure as a service, or platform as a service.

To ensure that the decisions shaping the application landscape and platforms continue to support the goals for business capability and process simplification across regions and business units, companies should make these decisions at the corporate level and not at the regional level. As with digital and data, it’s important to define governance for the entire target architecture—application, infrastructure and cloud, and data—so that, for example, companies can handle exceptions in a consistent way to keep the enterprise aligned with the vision.

Workforce and Processes. Organizations must build tech capabilities strategically. As tech becomes more core to the business, the need to hire and retain tech talent will grow critical. Having an army of generalist project managers overseeing vendors will no longer be sufficient. Companies need their own talent to drive customer-centric innovation and follow a test-and-learn approach. This talent will include digital architects, software engineers, user interface and user experience designers, and cybersecurity specialists.

Companies also need to rethink their employee value proposition. How can large companies attract and retain top talent that previously would either join tech companies or tech professional services firms? These workforce efforts should be strategically focused on areas of the business where a company wants to innovate and differentiate. Many activities once viewed as prime candidates for outsourcing—such as software development—have become more differentiating and strategic. For example, car companies want to have autonomous driving and connected car expertise in-house.

Sourcing and Ecosystem. It’s important to efficiently manage external expertise. Many companies have significant potential to optimize their vendor landscape and align their sourcing model better to an evolving business and tech vision. Digital platforms and ecosystems offer innovative and compelling ways to collaborate externally, and we’ve observed that companies that leverage an ecosystem with a single large system integrator and several specialized vendors often show the best outcomes. For instance, a company might share data with a specialist payment provider to create value-added services, thus changing the role of the company’s own tech function within the ecosystem.

The process of optimizing the sourcing model inevitably leads companies to reevaluate their external and internal sourcing balance and to selectively choose to build differentiating and strategic capabilities in-house. Other optimization possibilities include consolidating vendors and services across business units or regions, cutting back on the “long tail” of nonstrategic vendors, aligning vendors better with end-to-end business processes, and working to reduce unused licenses in favor of selecting the most suitable license types for the business. All these moves can free up significant funds to invest in tech and digital.

To ensure that the improvements materialize, companies also need the skills to negotiate with vendors on both a commercial and a technical level. Negotiations over incentive schemes are particularly difficult in an agile work environment, since, by definition, detailed specifications are not available up front. Instead of tying incentives to deliverables with detailed specifications, or using time- and materials-based contracts, companies should aim for hybrid models in which a portion of the payments are tied to the timely and successful delivery of key milestones.

Cybersecurity. Companies should focus on defense and resilience from the outset. Security is not a discrete layer to be piled onto the existing business. CISOs and other executives must collaborate closely to embed security into their organization’s culture and processes. Without question, high security standards will increase technology costs. Secure software development methods require more developers, for example, and using strong encryption for web traffic requires more servers. Security can also drive HR costs by mandating more-thorough background checks and training.

To get the most value from cyber investments, companies need to understand the risks the company faces, its appetite for taking on more risk, and its defensive capabilities. But companies can’t afford to focus their investments and security efforts solely on their ability to ward off attacks. They must also ramp up the organization’s resilience: its ability to remain functional after the company suffers a breach.

Time for Bold Moves

We have worked with several companies that have made bold moves to tackle what seemed like intractable problems. Take, for example, a leading European bank that was suffering increasingly poor financial performance. It had underinvested in the technology landscape for years, and the growing cost of maintenance and regulatory requirements left little room in the budget to acquire the digital capabilities the business needed. But after gathering business and tech to define a joint vision for a technology transformation, the company was better equipped to transform the operating model, technology landscape, and digital, data, and AI.

The bank decided to shift as much as possible from its old mainframe to modern platforms. It switched to SaaS for commodity functions such as fee management, adopted cloud, and used API-only integration to go from thousands of point-to-point integrations to several hundred reusable APIs. These efforts reduced costs and complexity, which freed capacity to invest even more into tech modernization and new skills.

The bank also pivoted to an agile operating model, reorganizing several thousand FTEs from business and IT across retail banking, commercial banking, and group functions such as risk and finance. Instead of working on large, often ill-defined projects, these agile squads were assigned clear business and tech objectives that were aligned with the joint vision. The bank also reset its data and analytics approach to better scale use cases and generate measurable returns. This reset included creating clear governance, reengineering the data platform towards a public cloud, and implementing an industrialized, cross-functional setup to scale use cases.

In another case, a Fortune 30 company was struggling to achieve its digital ambitions fast enough for several reasons: a fragmented tech landscape in which business units made local decisions that impaired enterprise scale, a lack of digital skills, and old ways of working. Since its incremental efforts at change had failed, the company decided to take bolder steps. It started by assembling a cross-functional team of top performers to set the business-tech vision. It defined the target state, key decisions, anticipated value, and the roadmap.

After aligning on the vision, the company reorganized the operating model into agile teams with cross-functional skills. To improve in-house digital talent, the company identified specific capabilities to build differentiation in the marketplace, including software engineering, data engineering, cybersecurity, and agile. And to create a modern, scalable tech architecture, the company consolidated the application landscape significantly, moving homegrown applications to the cloud and modernizing those applications with the help of external partners and vendors.

Strong change management was critical given the scope of the transformation. Agile teams shared the details of planned changes with stakeholders, tested changes in specific areas, gathered direct feedback from business customers, and then carefully phased in the rollout. The results have been impressive. The company is 25% more cost efficient and is on track to double the value that digital contributes to the business.

A Boardroom Imperative

To create a world class technology function that enables business value and digital transformation, a company’s executive management team needs to take several steps to get off the blocks as fast as possible.

Ensure C-suite alignment. When it comes to tech and digital capabilities, executives must identify key priorities going forward, determine needed investments, and estimate expected value. One frequent cause of misunderstanding is that tech and digital often are not well represented at the C-level.

Assess the company’s starting point. At a high level, what is the company’s digital business strategy? What digital opportunities does it want to pursue, and what digital threats does it want to thwart? It also needs to understand the tech function’s current state and pain points. What elements are good, and what must be changed?

Pick and prioritize levers. From the six levers that build a world class technology function, carefully choose those that best support the joint business and tech vision. This prioritization process should include levers and initiatives for both efficiency improvements and enhancing digital capabilities.

Develop a realistic roadmap. Many companies try to do too much at the same time and lack the rigor to sequence initiatives and make the right trade-off based on existing resources and capabilities. The goal should be quick early wins that can fund the journey and build enthusiasm for longer-term initiatives.

Because digital transformation is a huge task that touches every aspect of the organization, it’s easy to drift off course, undermining business performance and value generation. To keep that from happening, senior leaders in business and tech need to collaborate on the target level of process simplification and harmonization for the whole company so that every initiative will help to improve overall performance. At the same time, it’s important to create excitement and value quickly, such as by launching digital use cases together with the business, attracting new talent, and proving accelerated delivery. Now that the piecemeal approach to technology transformation has proven to be largely ineffective, it’s time to take a more bold, comprehensive approach.