Understanding the challenges can help other players in the circular economy.

Driving greater circularity is a key lever for public and private sector players to improve their sustainability. As a result, leading global companies are setting tough goals to increase the use of recycled materials in their manufacturing. But there’s a hitch: flat recycling rates and poor processes in the US and elsewhere are threatening to derail these green ambitions.

Aluminum, which is found in everyday items from cans to cars, provides clear insights into the workings of recycling ecosystems in general because, unlike other materials, it can be infinitely recycled without losing its original properties. Understanding the frictions and squeeze points in the aluminum ecosystem—and applying these lessons to other parts of the circular economy—can help players navigate recycling bottlenecks.

This ability will become increasingly important as corporate sustainability commitments continue to soar and sustainable resources become more scarce. To ensure access to these critical resources, players will need to act early, forge innovative partnerships, and invest in new technologies and manufacturing techniques.

A Widening Gap

Across industries, household names in the US and Europe are making bold sustainability commitments. General Motors, for example, plans to increase the share of sustainable materials in its vehicles to 50% or more during this decade. And by 2030, Coca-Cola wants to use recycled material for at least 50% of its packaging.

Aluminum value chain players are taking notice. Hydro plans to recycle more postconsumer aluminum scrap (from discarded products) as part of a commitment to reach net-zero emissions by 2050. Meanwhile, Novelis has pledged to increase its use of recycled aluminum, which currently accounts for 61% of the company’s inputs.

There is a growing disconnect between many companies’ recycling commitments and the reality, however. In the US, recycling volumes for household waste have barely changed since 2005. Only about 19% of the durable goods discarded by US households by volume was recycled in 2018, with the remainder sent to landfills or combusted to generate energy. The same year, just 14% of plastic containers and packaging were recycled.

About half of all used aluminum beverage cans in the US were recycled in 2020. This puts the country far behind Germany, for example, where the recycling rate—determined by the materials collected for recycling as a percentage of the total materials generated for recycling—for cans was 99%. And while about 80% of the weight of a car or light truck is typically recycled in the US, the recycling process faces other problems.

Two Key Challenges

To examine what’s preventing aluminum from realizing its full potential in the circular economy, we took a deep dive into the aluminum recycling ecosystem in the US. Two overarching challenges emerged: improving recycling volumes, which is the main issue for used beverage cans; and maximizing the value of recycled materials, which is pivotal for end-of-life vehicle recycling.

There are two key challenges: improving recycling volumes and maximizing the value of recycled materials.

Used Beverage Cans

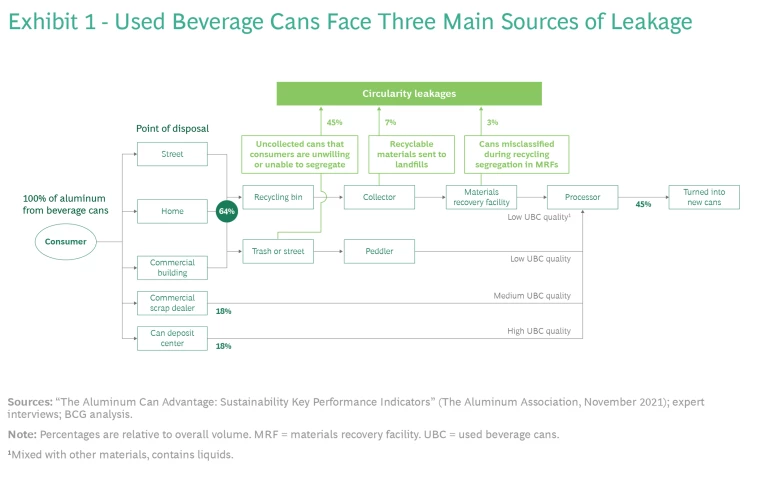

We found that raising the recycling rate for cans depends on solving three critical problems. (See Exhibit 1.) According to our analysis, tackling the following issues would deliver an extra 290,000 tons of recycled aluminum each year in the US—potentially increasing the recycling rate from 45% to 62%:

- Most important, a large proportion of used beverage cans are thrown away because consumers are either unwilling to separate them from regular trash or unable to recycle them because of lacking collection infrastructure. This accounts for 80% of lost recyclable aluminum.

- Some US cities still send aluminum cans that have been successfully separated at the point of collection to landfills because of the low costs of this option and the relatively high processing costs of running a materials recovery facility (MRF).

- Finally, older sorting technology at MRFs sometimes mistakenly identifies cans as plastic, due to their labels, and sends them to landfills.

Cars and Light Trucks

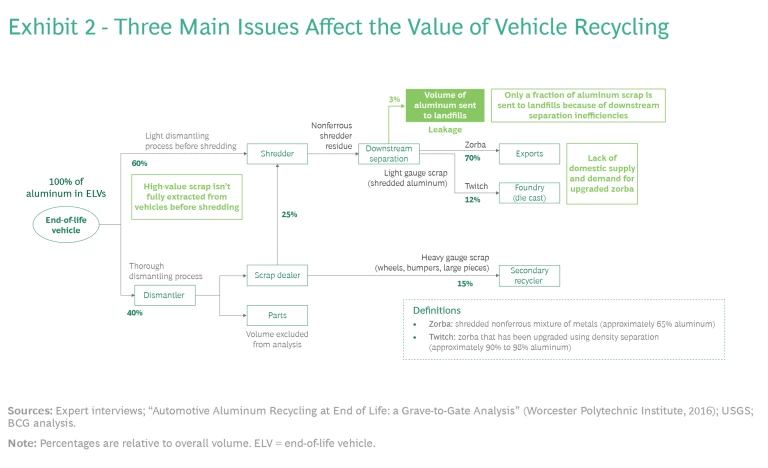

Recycling rates for end-of-life automobiles and light trucks, including vans and sports utility vehicles, are far higher than cans because they contain valuable items like batteries and precious metals in catalytic converters. On average, about 97% of the aluminum content in an end-of-life vehicle is recycled. Despite this, most US recycling players are not generating the levels of high-quality aluminum scrap that they could.

Most automotive scrap yards are small, independent operations focused on creating high volumes and keeping costs low. While the most valuable components in an end-of-life vehicle are removed and processed by a specialist dismantler, 60% of the vehicle by volume is only lightly dismantled before being shredded and turned into scrap, resulting in a low-quality mixture of aluminum, other metals, and nonmetallic matter. (See Exhibit 2).

These small yards lack the capabilities to remove impurities from shredded scrap and transform it into better-quality scrap that can be used in aluminum components, such as extrusions. As a result, most of this lower-grade scrap is exported to markets in Asia and Mexico, where its value is realized through the manual separation of metals. In addition, some US scrap yards, due to inadequate sorting equipment, send a small proportion of the scrap mixture they generate to landfills without recycling it. Other adjacent components, such as tires, are also sent to landfills because these yards do not have the infrastructure to manage them.

While addressing such shortcomings won’t generate greater volumes, it would deliver hundreds of millions of dollars in higher value aluminum scrap and other recyclable materials, such as plastic and rubber.

Solving Recycling Problems

There are multiple ways to significantly improve the recycling of aluminum. Most have important implications for other parts of the circular economy, such as glass and packaging. But these methods will require players to adopt a fresh approach and challenge their current thinking.

Consumers and Collectors. Deposit schemes that create a financial incentive for consumers and small businesses, such as restaurants and food outlets, to recycle used cans and bottles can boost rates sharply. Currently, only ten US states operate deposit schemes. They work by adding a small deposit to the price of a beverage, contained in an aluminum can or a plastic or glass bottle, that’s refunded when the container is returned for recycling. The payoff from operating a scheme is significant: the average recycling rate in these ten states is approximately 90%, compared with approximately 35% elsewhere in the US.

There are multiple ways to significantly improve the recycling of aluminum. Most have important implications for other parts of the circular economy.

Legislation is one way to ensure that all players participate in a deposit scheme. This approach is a key reason why beverage-can-recycling rates in Germany are so high. In the US, where many states and cities are reluctant to introduce deposit laws, voluntary industry partnerships are often a viable alternative for encouraging greater recycling. By signing on to a partnership, retailers, brand owners, and other players can reap significant reputational benefits. Beyond aluminum, the Northeast Resource Recovery Association is partnering with municipalities in New Hampshire, Massachusetts, and Vermont to boost glass-recycling rates. The nonprofit organization connects sellers of recyclable commodities to purchasers. It runs two programs that repurpose glass bottles and jars by turning them into fiberglass insulation or processed glass aggregate for use in road and infrastructure projects.

Making it easier for consumers and households to recycle through better and more segregated collection infrastructure—unlike the single-stream recycling that is commonplace in the US—can also boost rates. This includes adding more visible or prevalent roadside collection points, dedicated domestic recycling bins, and municipal waste services that are configured to collect multiple household waste streams. By increasing public awareness, local leafleting campaigns can also improve consumers’ willingness to recycle.

Scrap Yards. Recycling players also need better incentives to carry out greater upfront manual dismantling of end-of-life vehicles, preventing aluminum from being sent to landfills or turned into low-quality scrap streams. At present, yards are incentivized to focus on higher-value items and to ignore content that’s mixed in with other materials, which is harder and takes more time to extract. Manufacturers and other users of recycled metal can improve the economics of scrap yards and make the recycling process more efficient by paying yards an adequate return for full dismantling, committing to purchase large scrap volumes (provided they are high quality), or committing to reuse specific components such as tires. Local governments can also participate by providing grants that contribute to the cost of these activities.

Designing for Circularity

Building automobiles or designing packaging so that these items can be easily dismantled and processed by recycling players would reduce separation costs and result in more aluminum being reprocessed rather than exported or sent to landfills. For example, car manufacturers can make disassembling their products easier by using a modular approach to design and creating vehicles with distinct sections that can be repaired and upgraded independently. Greater transparency by car makers and other manufacturers about which materials have been used where—in vehicles or washing machines, for example—could also facilitate recycling.

Greater technological investment can improve recycling in two ways.

On the one hand, automotive companies and other big users of recycled aluminum can develop new manufacturing techniques that require alloys containing a greater proportion of lower-grade aluminum scrap and less primary aluminum. This would enable more lower-quality scrap to be used domestically in the US rather than exported abroad.

As inflation pushes up labor costs and material inputs become scarcer and more valuable, these solutions will increasingly make economic sense.

On the other hand, recycling players can invest in technologies—including optical sorting machines that rely on sensors, x-rays, and lasers—to separate materials more effectively. Without financial support from government or other players in the recycling ecosystem, workforce costs would have to rise, technology costs would need to fall, or the value of high-quality scrap would have to increase for scrap yards to invest in greater automation. However, as inflation pushes up labor costs and material inputs become scarcer and more valuable, these solutions will increasingly make economic sense.

Success in creating more effective recycling won’t be achieved by a single player alone. Many of the solutions to tackling bottlenecks in aluminum and other parts of the circular economy require long-term investment and greater collaboration across a range of different players, from retailers and brand owners to manufacturers and scrap yards. Adopting a new approach to recycling will be challenging. But by securing early access to sustainable resources, companies can gain competitive advantage and avoid future systemic problems.