Roughly a year after its launch, generative AI (GenAI) is already helping some companies create value in startling new ways. GenAI is different from earlier tech advances—more accessible to frontline employees, with a wider range of applications. A select tier of companies is capitalizing on these differences and leading the way in scaling the technology across their entire organization. As a result, they are not just experimenting with GenAI but using it to unlock efficiency gains, improve the customer experience, and boost revenue. For an organization with $20 billion in revenue, we estimate that GenAI can lead to gains of $500 million to $1 billion in profit, with nearly a third of those gains coming in the first 18 months.

Yet most companies—roughly 90% in our analysis—are further behind in their use of GenAI. These organizations often don’t know how to get started, they don’t know which applications are most impactful for their sector, and they don’t know the specific steps to take to catch up. To that end, we recently surveyed more than 150 senior executives globally across 10 sectors to understand where organizations are succeeding with GenAI. We supplemented that with in-depth interviews and our experience with nearly 200 GenAI client projects across industries and geographies.

This comprehensive research enabled us to develop a set of prescriptive, data-driven steps for how lagging companies can accelerate their adoption of GenAI and start scaling projects across the enterprise. These are the early lessons from the leaders in GenAI—and a playbook for others to take action on immediately.

Segmenting the Landscape of GenAI Adoption

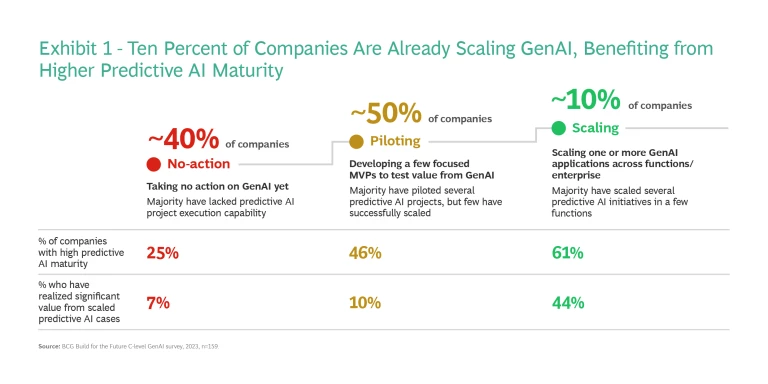

Our analysis shows that companies can be grouped into three categories, based on their level of GenAI adoption so far. (See Exhibit 1.)

The top 10% of companies are scaling at least one GenAI application across the enterprise.

These companies are currently winning in their use of GenAI by moving out of the pilot stage and beginning to capture real value from the technology. Moreover, they’re on the path to reimagine entire functions—or the overall enterprise—through GenAI. Overall, this group is also far more likely to have a solid foundation in predictive AI, which focuses on analytical tasks. Yet they are not satisfied with their current status. As a group, they are four times more likely than the other companies to have increased their investment in digital and AI due to the emergence of GenAI.

Although some of these organizations are digital natives like Amazon and Google, a full two-thirds are incumbent companies in industries like energy, insurance, and biopharma. For example, a US energy company launched a GenAI-driven conversational platform to assist frontline technicians, increasing productivity by 7%. A biopharma company is reimagining its R&D function with GenAI and reducing drug discovery timelines by 25%.

Roughly 50% of companies are in the pilot stage.

Companies in this group have begun their GenAI journey and are developing a few focused pilots to test the technology’s value. Most of these companies have had some success with earlier digital and AI initiatives; however, they are not yet scaling them across the organization.

About 40% of companies have taken no action.

The third group of companies have yet to take significant action on GenAI. The majority are still grappling with earlier digital and AI initiatives and lack many of the foundational capabilities to succeed, such as modern tech infrastructure or reliable, accessible data. Leaders in these companies may not have a robust understanding of GenAI and thus don’t see the need to take more ambitious steps to implement it.

Why GenAI Is Already Reshaping Businesses

Technology has been advancing for decades, and many companies have worked to digitize their processes and functions. Yet GenAI is different. In our research, roughly two-thirds (65%) of senior executives say it has the greatest disruptive potential of any technology over the next five years. And one-third have already increased investments, despite the tight cost environment. Why are executives so bullish on GenAI?

- It has a faster time to value compared with other software. Based on the three broad value plays—deploy, reshape, and reinvent—leading organizations can rapidly put GenAI solutions in place and start realizing benefits in as little as three months, especially by leveraging plug-and-play applications. In basic tasks, employee productivity can increase by 10% to 20%.

- More ambitious applications can generate correspondingly larger benefits. Using GenAI to reshape functions or invent new business models can take longer—one to three years—but trigger a much bigger impact. For example, a consumer goods company is building a GenAI-powered conversational assistant to provide customers with personalized diagnostics, trend discovery, product recommendations, and virtual try-on services.

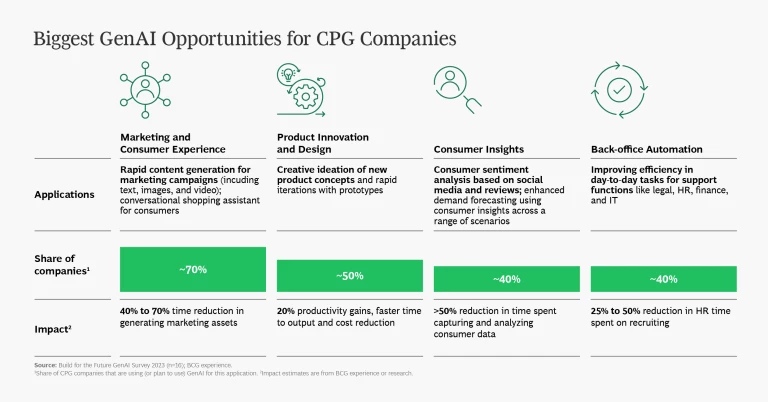

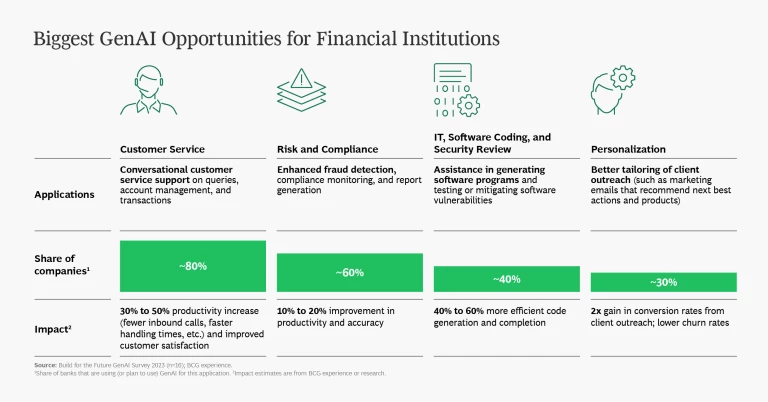

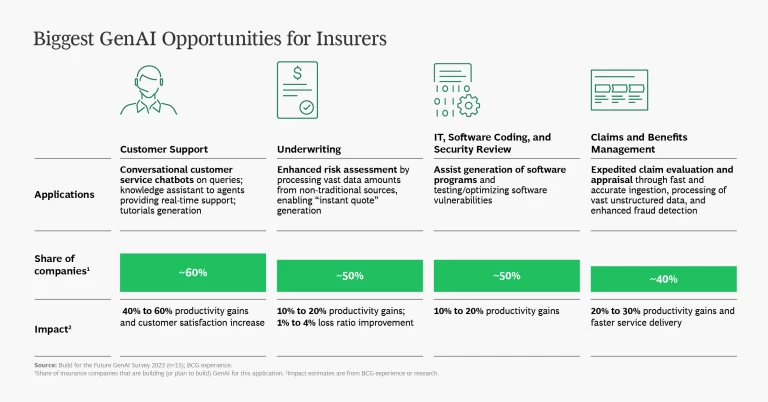

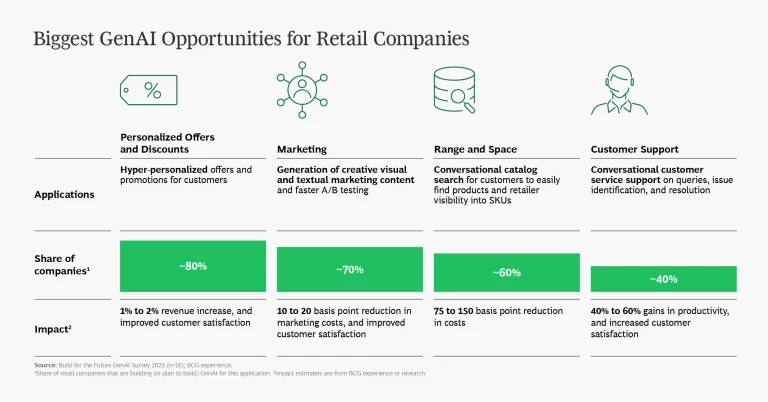

- The most valuable GenAI applications are already apparent. More than 50% of executives point to marketing and sales, customer operations, R&D, and IT/software engineering as the biggest value pools for GenAI. At the same time, the technology offers many sector-specific applications as well. The slideshow below shows the most impactful GenAI applications across several industries.

- The initial GenAI applications that companies deploy are usually geared toward increasing productivity or improving customer service, but GenAI also creates new revenue streams. Of a typical GenAI portfolio, about 60% of initiatives reduce costs and 40% increase revenue (including through applications that boost engagement and increase customer satisfaction). This also increases the strategic nature of GenAI: opening up a lead on competitors offers opportunities for sustainable advantages in cost, customer service, and value propositions.

The Key Capabilities Companies Need to Scale GenAI

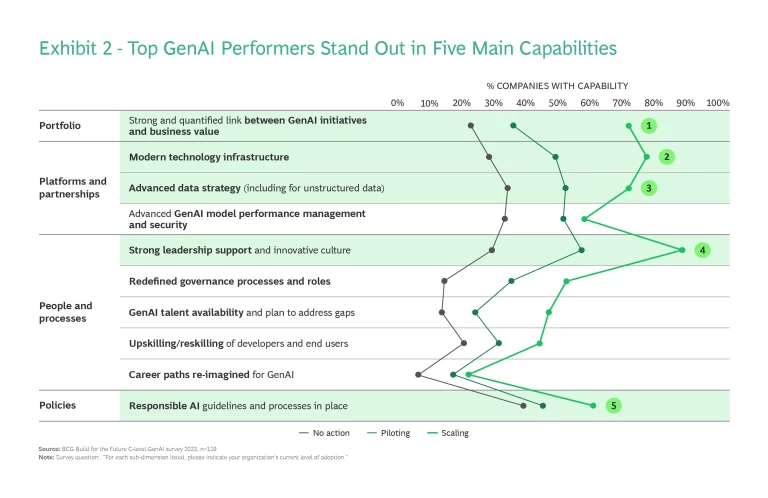

Our analysis points to five specific capabilities that separate the top 10% of companies from the rest. These are the areas where leaders show the strongest performance and have the biggest gap over the competition. (See Exhibit 2.)

A clear link to business performance.

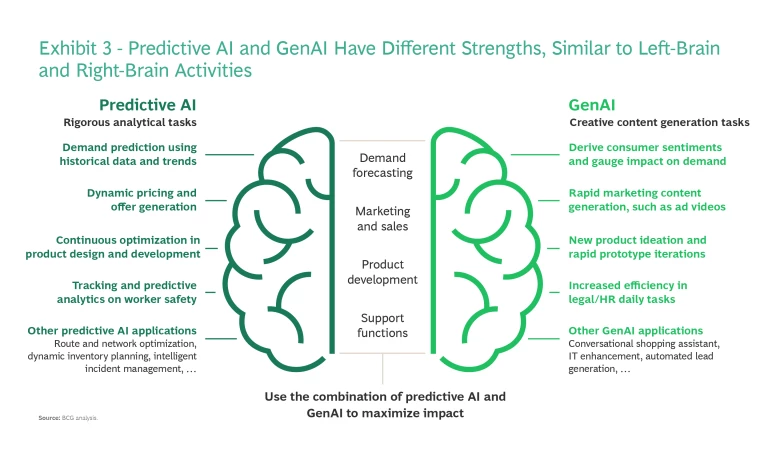

More than 70% of scaling companies explicitly tailor their GenAI projects to create value. That can be both financial value (increased revenue and reduced costs) or non-financial value (such as an enhanced customer experience). Scaling companies are over 20% more likely to perceive GenAI’s potential to drive top-line growth versus cost savings potential only. In contrast, fewer than one-quarter of bottom performers link GenAI projects to value. Further, scaling companies tend to focus on a small number of targeted applications that can create significant value when scaled, rather than a more fragmented, scattershot approach. These often combine the foundational capabilities of predictive AI, which is strong in traditional left-brain activities like analysis, with GenAI’s strengths in right-brain activities like content creation. (See Exhibit 3.)

Modern technology infrastructure.

Leading companies are three times more likely to have a modern, modular IT infrastructure. This enables companies to develop new, GenAI-powered services on top of foundational AI models and to seamlessly work with outside developers. Compared to lagging companies, these top performers are also 1.5 times more likely to focus on building the GenAI stack internally over the coming three years, underscoring their desire to make the technology a core capability for the organization.

Strong data capabilities.

Top performers are twice as likely to have data pipelines and data management practices in place, helping them to source and store high-quality data (even from unstructured data sources). This is a critical element of GenAI, given that models are only as strong as the data on which they’re trained. As the head of data and analytics at a global media company said, “If training data is biased or lacks the diversity of our global audience, the outputs from GenAI tools will replicate those issues, which would impact our ability to serve our markets around the world.”

Critically, tech infrastructure and data capabilities are not formal, ironclad prerequisites to create value from GenAI. These attributes help, but some organizations find success even with less mature skills in these areas— though it may take them longer as they need to address the specific infrastructure and data capabilities in parallel.

Leadership support.

As with any change initiative, support from leadership is crucial. Scaling companies are three times more likely than no-action companies to have leaders who prioritize innovation and actively support GenAI across the company. These leaders usually have a deep understanding of the technology’s potential impact on their industry, and they are publicly committed to ensuring that the organization harnesses it in ways that generate value. As the head of data and analytics at a global media company said, “Visible support and commitment from our leadership team has been crucial, as it provided the freedom to experiment and deal with failures along the way.”

Guidelines and processes for responsible AI.

GenAI is a new and rapidly evolving technology, with implementation risks for organizations that do not understand it. But there are well-known ways to mitigate the risks, such as putting “humans in the loop,” using only factual data, and—critically—implementing responsible AI. Our research shows that leading companies are far more likely to have developed guardrails, guidelines, and policies to ensure that they follow the principles of responsible AI. In the findings, the share of scaling companies that are cautious about the potential misuse of GenAI and taking proactive measures to address these risks is 20 percentage points higher than the share of companies taking no action in this area.

As the head of data and analytics at a global media company said, “Sometimes we deal with highly sensitive personal identifiable information or content that is pre-release, so policies have to be very clear on what people can and cannot do with GenAI.”

Priorities for Lagging Companies to Close the Gap

It is imperative for companies that have been slow to embrace GenAI to take decisive action and ramp up their aspirations for the technology. Our research points to specific recommendations for both groups.

Priorities for “No Action” Companies

The 40% of companies that have yet to take action with GenAI should focus on leadership support, identify a small number of priority applications, work with outside partners, and tailor their approach to governance.

Turn leaders into informed advocates. More than half of the companies yet to take action on GenAI cite a lack of sufficient knowledge among leaders as a key barrier. Accordingly, leaders should educate themselves about the potential value from GenAI and push the organization to embrace the technology. As the GenAI product lead at a scaling company said, “Changing people’s working habits is tough. We use a top-down approach to drive adoption by setting targets for usage and measuring progress.”

Start with a small number of priority applications. Companies do not need to start from scratch—the highest value applications by sector are already well-known. Organizations can choose several that are most applicable to their needs and apply a minimum-viable-product approach to developing them. An agile team can determine the data required, the means to access that data, and the people needed to develop, implement, and run the solution—all within months. “Once we defined a set of projects that were technically feasible, we assessed them against each other in terms of their value and impact on the business,” said the head of technology strategy and transformation at a global financial services company. “And we used that assessment to make the hard choices needed to prioritize.”

Leverage outside partners early on. Over 40% of no-action companies cite the absence of modern tech infrastructure as a key barrier. But revamping IT infrastructure takes time. Instead of waiting, companies can work with outside partners and rely on turnkey GenAI platforms, enabling them to get solutions into place quickly. As the head of data and analytics at a scaling global media company said, “You don’t need advanced tech infrastructure to carry out a pilot. We have an ecosystem of partners that we’ve screened carefully, and we work with them to quickly run pilots.”

Tailor governance to the needs of GenAI projects. At many organizations, the governance for major technology projects is weak, and without sufficient attention, initial GenAI pilots can quickly go off-track. Rather than trying to solve this, companies should create bespoke governance specifically for GenAI projects. Some companies are creating GenAI centers of excellence to spur rapid action and lead to greater impact—with appropriate governance built in. The right approach should enable fast decisions and interventions to maintain progress, while ensuring that the necessary functions (including risk and compliance, procurement, IT, and business owners) are involved as required. Over time, as companies gain momentum with GenAI, they can continue to refine their governance model to address a broader set of applications.

Companies that have been slow to embrace GenAI must take decisive action and ramp up their aspirations for the technology

Priorities for “Piloting” Companies

Compared to “no action” companies, the 50% of companies in the pilot stage reprioritize their portfolio of projects already underway, re-evaluate tech infrastructure and data requirements, and adjust their people strategy.

Reprioritize applications. As awareness of GenAI grows, companies at this stage are often inundated with requests to deploy GenAI solutions across the organization, leading to fragmented, isolated efforts. To improve, companies need to assess their portfolio of projects and reprioritize them based on potential value. “It’s easy for people to fall in love with an initiative and not pay attention to the actual value being delivered,” said the digital and innovation lead at an energy company. “We were ruthless in looking at business cases to determine which initiatives to scale. If a pilot fell short, we deprioritized it or killed it outright.”

Re-evaluate technology and data requirements. Modernizing technology and data infrastructure is a long and challenging quest. But companies can be smarter about the process based on the lessons from early pilots. After several initiatives are done, it’s essential to re-evaluate the core technology and data aspects needed to support broader adoption of GenAI. For example, about 50% of piloting companies say that siloed data represents a key barrier at this stage. This process can ensure that GenAI requirements dovetail with the broader technology needs of the organization, and it helps leaders make decisions about which capabilities to build internally versus which to outsource to partners.

For example, a multinational financial services company considered cloud solutions for some GenAI applications but ultimately brought that capability in-house. “The significant costs associated with GenAI factored into our decision,” said the head of technology strategy and transformation. “We use our on-premise processors to train GenAI models so we don’t feel the pinch of training costs on the cloud.”

Improve the people strategy to accelerate adoption. As GenAI gets embedded and data becomes democratized across the organization, companies need to adjust their people strategy to ensure that workers have the skills they need to thrive with the technology. Yet piloting companies are 20% less likely than scalers to have upskilled their workforce on GenAI. And executives believe that 44% of their workforce will need to be reskilled in the next three years due to the impact of GenAI on their current roles. In some cases, the right approach is to work with employees in developing new tools, which can generate buy-in and support.

As the digital and innovation head at a European oil and gas company told us, “We needed to appropriately engage employees at the front line in helping to develop one of our GenAI tools, because they could strongly resist adoption if they misunderstand the purpose of the technology and assume it would replace them.”

GenAI is becoming an integral part of business ecosystems and is already a strong source of value and competitive advantage. But only 10% companies have mastered how to scale GenAI to create value. GenAI is still a new, evolving technology, but each new release offers more value to corporations. The GenAI leaders have forged a path to early success. The risk for their competitors is to be left behind as the best players increase their advantage further by shortening their times to at-scale deployment and focusing more on reshaping and invention. The time is now for other companies to put these learnings into practice and begin reaping the benefits of this transformative new technology.