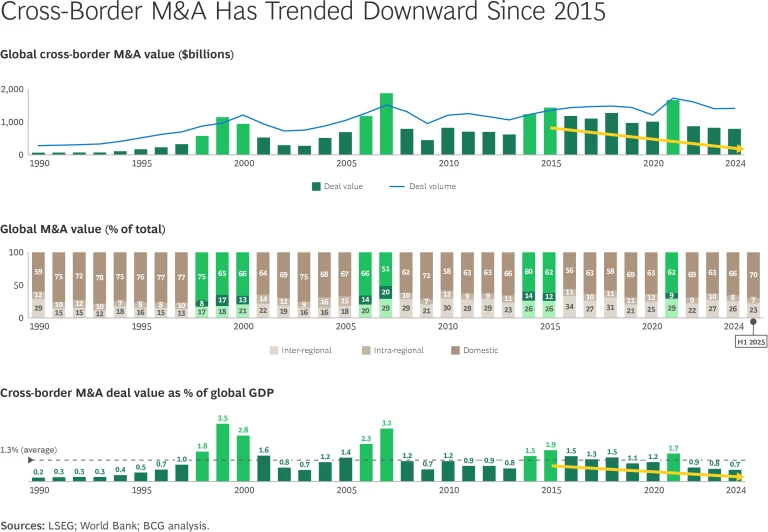

Once a hallmark of globalization, cross-border M&A activity has diminished considerably—declining from 50% of global deal value at its peak in 2007 to approximately 30% today. (See “A Downward Trajectory in Cross-Border M&A.”) Despite this decline, BCG research reveals that cross-border deals, when pursued strategically, can create significant value. Cross-border transactions within the same geographic region typically outperform deals within the same country or farther afield as they enable companies to achieve international growth while addressing manageable integration complexity.

A Downward Trajectory in Cross-Border M&A

This upward trajectory began to reverse in the mid-2010s, as heightened geopolitical tensions, growing regulatory scrutiny, and a sharpening focus on domestic markets made international acquisitions less attractive or harder to justify from a value perspective. The COVID-19 pandemic accelerated the downward trend, reinforcing corporate tendencies toward domestic consolidation and supply-chain regionalization. In 2024, cross-border M&A accounted for approximately 30% of global dealmaking value.

The overall decline in cross-border M&A is especially clear when viewed in relation to global economic output. In 2024, cross-border deal values represented only 0.7% of global GDP, well below the long-term average of 1.3% and a low not reached since 2009.

Yet success in cross-border M&A is far from guaranteed. Companies must navigate not only regulatory complexity and geopolitical volatility but also the more subtle—and often underestimated—challenges of cultural integration. As the barriers to cross-border transactions rise, so too does the importance of disciplined strategy and execution, marking a landscape where only the most skilled and informed acquirers will thrive.

Revealing the Hidden Value

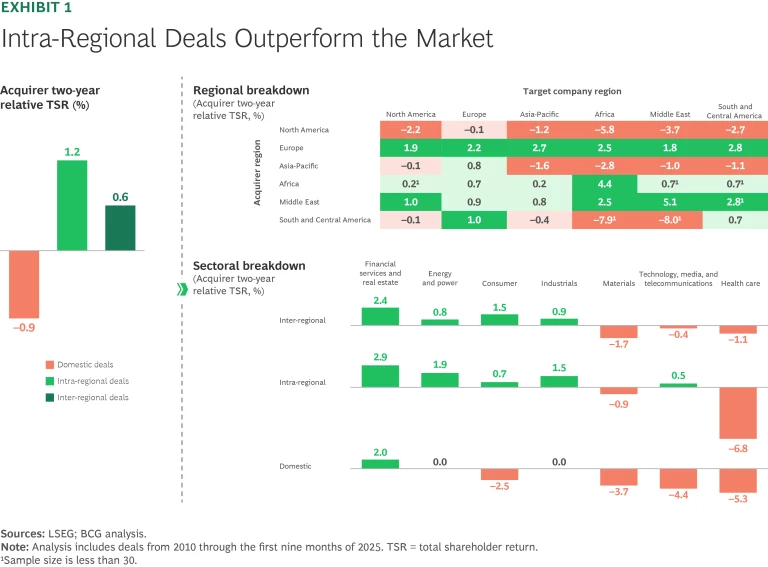

Despite the current downward trend in international deals, cross-border M&A continues to offer substantial value creation opportunities, particularly when executed strategically. To understand why, it is important to distinguish between intra-regional deals, involving buyers and targets in the same geographic region (for example, Western Europe or North Africa), and inter-regional deals, involving parties in different global regions. Historically, inter-regional acquisitions have constituted the larger share of cross-border activity.

BCG’s analysis reveals clear performance differences among the three deal types. (See Exhibit 1.) Domestic deals generally underperform, with acquirers seeing an average two-year relative total shareholder return (rTSR) of approximately –0.9%. In stark contrast, intra-regional deals significantly outperform the market, delivering an average two-year rTSR of 1.2%. These deals allow companies to capitalize on cross-border synergies while navigating familiar cultural landscapes and regulatory environments. Inter-regional transactions yield a more modest positive return of about 0.6%, demonstrating that while global diversification holds promise, it often entails greater complexity and execution risk.

Regional patterns provide further insights. European companies notably excel at cross-border dealmaking, frequently achieving superior outcomes compared with their counterparts in other regions. Conversely, Asia-Pacific and North American companies—particularly the latter—typically face greater challenges in realizing value from cross-border acquisitions.

Sector-specific dynamics reinforce the necessity of tailoring acquisition strategies. Financial services and consumer sectors often achieve strong results from ambitious inter-regional expansions, capitalizing on global market reach and customer bases. In contrast, energy and industrial sectors tend to generate greater value through intra-regional consolidation, leveraging operational efficiencies and regional market familiarity. Health care and technology sectors present notably higher risks, especially in domestic deals, where overlooked integration complexities often lead to value-destroying transactions.

Stay ahead with BCG insights on M&A, transactions, and PMI

Deal Strategy: Actionable Insights from Research and Experience

To navigate the complexities of cross-border M&A, companies must define deal strategies that apply lessons learned from past experiences. Our research and experience point to five actionable insights for companies to maximize value from cross-border deals.

Embrace cross-border opportunities, especially close to home. Despite current market hesitancy, cross-border transactions typically outperform purely domestic deals. Expanding internationally—particularly to nearby countries with similar cultural and economic profiles—can unlock valuable synergies and access new markets. Intra-regional deals have consistently emerged as the optimal “sweet spot,” providing companies with meaningful international growth opportunities combined with manageable integration complexities.

Tailor your approach to sector-specific dynamics. Understanding the historical performance and unique challenges of your industry should inform your cross-border acquisition strategy. Financial services and energy sectors, for example, have historically benefited from ambitious global expansions, pointing to the potential for transformative deals. Conversely, companies in technology and health care face greater integration hurdles and value creation challenges, making a clearly articulated value thesis and integration plan indispensable in these sectors.

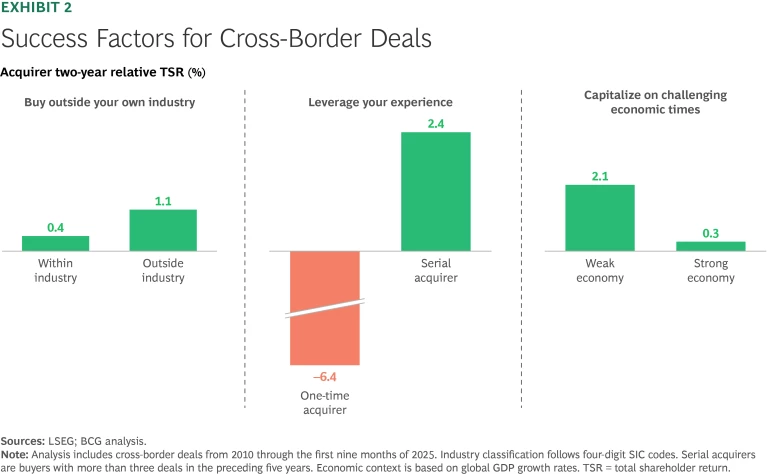

Seize opportunities amid adversity. Downturn periods present strategic opportunities for bold, well-prepared acquirers. With reduced competition and potentially attractive valuations, acquisitions completed during downturns have historically yielded superior returns. (See Exhibit 2.) Companies with robust balance sheets and risk appetites should consider adopting contrarian acquisition strategies during these slower phases.

Explore opportunities beyond your core industry. Successful cross-border acquisitions often extend beyond a company’s traditional industry, targeting adjacent or entirely new sectors. This strategic diversification allows companies to acquire innovative capabilities and technologies, enhancing their competitive edge and driving new revenue streams.

Develop an early view on the operating model and culture. Invest time in understanding the target company’s geographic footprint and culture. Develop initial hypotheses about the future operating model and cultural design to inform integration planning from the outset.

How to Incorporate Cultural Dynamics into Deal Strategy

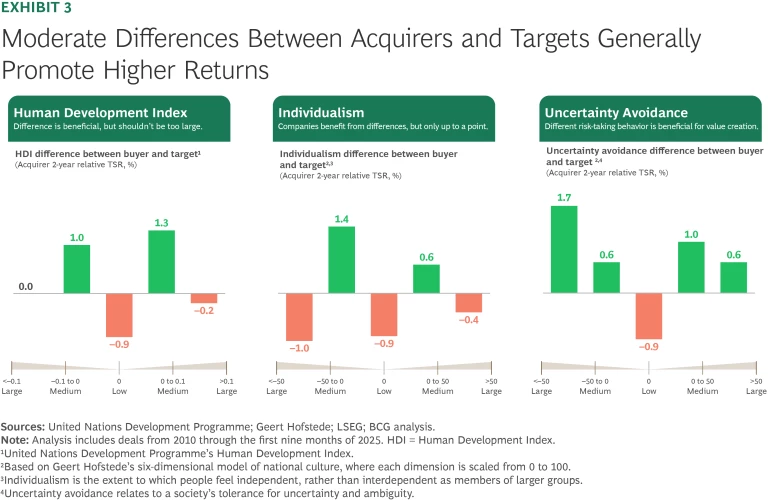

Cultural dynamics are critical considerations in defining a cross-border M&A strategy. Three insights stand out.

Leverage regional and cultural familiarity. Acquiring targets within the same geographic region allows companies to benefit from shared cultural characteristics. In combination with regional trade agreements, similar consumer behaviors, and aligned regulatory frameworks, cultural familiarity contributes to intra-regional deals’ higher average two-year rTSR of approximately 1.2%. Conducting rigorous cultural due diligence early in the process helps identify potential integration challenges.

Prioritize strategic fit and manageable differences. Selecting acquisition targets requires thoughtful consideration of strategic alignment and cultural distance. Ideal targets provide complementary capabilities while maintaining manageable differences in development levels, cultural norms, or business practices. Moderate differences can stimulate new ideas and foster market diversification, promoting higher two-year rTSR. (See Exhibit 3.) However, acquisitions involving substantial disparities—especially stark differences in regulatory environments, organizational structures, or fundamental cultural norms—significantly elevate integration risks and can erode potential value.

Utilize existing regional, customer, and channel relationships. Companies can improve integration outcomes by leveraging existing relationships, whether regional, customer-based, or maintained via established distribution channels. For example, following existing customers into new markets can offer natural synergies, accelerating market entry and reducing integration friction. Using these established connections helps mitigate cultural barriers, providing familiar reference points that facilitate smoother transitions and faster realization of synergies.

Deal Execution: Core Principles for Success

Achieving consistent success in cross-border M&A requires disciplined execution and integration guided by several core principles.

Focus on fundamentals. Don’t overlook the basics. Align every acquisition rigorously with your overarching strategic objectives—such as market entry, operational scale, or new capabilities. Successful deals demand clarity of purpose, as transactions more often fail due to weak strategic alignment or unclear logic than because of excessive valuations.

Develop robust M&A and integration capabilities. Experience dramatically improves outcomes in cross-border deals, with seasoned acquirers consistently outperforming novices by approximately 7 percentage points in TSR. Building a repeatable internal M&A capability or engaging skilled external advisors is crucial. Successful cross-border deals require specialized skills across deal sourcing, comprehensive due diligence, cultural integration, and meticulous post-merger integration planning. Treat M&A as a skill to be honed, not a one-off gamble.

Invest heavily in comprehensive due diligence. Cross-border acquisitions add significant complexity through differing accounting standards, less transparent local data, divergent business practices, and cultural or language barriers. To mitigate these challenges, allocate additional time and local expertise to thoroughly understand the target’s financials, operational environment, and market position. Tailor due diligence processes to reflect local realities rather than relying on standard assumptions. Early and thorough due diligence sets a strong foundation for informed decision making.

Prepare for geopolitical and market uncertainties. Build flexibility into your deal structure to withstand geopolitical shifts, regulatory changes, and market volatility. Scenario planning, covering best-case and worst-case outcomes, provides strategic agility. Employ flexible deal structures—such as phased acquisitions or earn-outs—to accommodate changing conditions, enabling agile integration pacing and risk mitigation.

Evaluate strategic alternatives. M&A is one of several options for achieving international growth. Carefully evaluate alternatives, including joint ventures, alliances, and foreign direct investment. Often, combining approaches—using foreign direct investment to establish an initial market presence before scaling with strategic acquisitions—can enhance outcomes. Strategic partnerships and alliances also offer valuable alternatives, particularly when market uncertainty is high or integration complexities appear daunting.

Proactively manage legal and regulatory risks. Cross-border deals inevitably face complex regulatory, antitrust, and compliance challenges. Anticipate these hurdles by thoroughly researching approval processes, engaging local counsel early, and proactively addressing potential national security or foreign investment concerns. Planning for extended timelines ensures that regulatory processes do not derail deal timelines.

Communicate transparently and consistently. Clear and frequent communication with employees, customers, investors, and regulators is essential. Given today’s extended deal timelines and heightened uncertainty, prolonged silence can undermine trust, triggering anxiety among employees and customers. A consistent, transparent narrative about the deal’s benefits and integration progress builds confidence, mitigates rumors, and maintains stakeholder engagement throughout the transition.

Begin integration planning early. Start planning post-merger integration well before the deal closes. Effective integration requires clearly identified integration teams, well-defined synergy targets, and critical early decisions, all determined during the diligence phase. While rapid and structured integration is often ideal, some scenarios may call for a more measured approach. Nonetheless, preparing integration plans early creates confidence among stakeholders and ensures swift realization of anticipated synergies after closing.

Prioritize cultural alignment and leadership stability. Proactively manage cultural integration by understanding and reconciling differences in leadership styles, decision-making processes, and workplace norms. (See “Navigating Cultural Integration in Cross-Border M&A.”) Develop comprehensive cultural integration plans featuring transparent dialogue, joint team-building activities, and clear guidelines for the new organizational norms to prevent “us versus them” dynamics.

Navigating Cultural Integration in Cross-Border M&A

- Decision-Making Differences. Decision-making styles vary across cultures, creating potential for misunderstanding and frustration. Some organizations emphasize decentralized, consensus-driven approaches, while others rely on centralized, hierarchical decision making. Additionally, the pace at which decisions are made can vary widely—some cultures prioritize quick, decisive actions and risk-taking, while others prefer thorough analysis and deliberate evaluation. Recognizing these differences and bridging them are essential for aligning teams effectively.

- Diverse Meeting Styles. Meeting practices also differ markedly from culture to culture. In certain organizations, meetings are formal, structured, and hierarchical, with top-down decision making. Elsewhere, meetings may be informal, collaborative spaces where decisions evolve organically through open debate. When these styles clash, one side may perceive the other as either overly rigid or inefficiently informal.

- Communication Challenges. Differences in communication approaches further complicate cross-border integration. Some cultures favor direct, transparent, and frequent interactions, while others adopt more reserved, diplomatic, or nuanced methods. Language barriers amplify these challenges, often leading to misunderstandings that can erode trust and delay progress.

- Prioritize face-to-face meetings. In-person interactions foster openness, clarify and help resolve misunderstandings quickly, and capture nonverbal communication cues that digital exchanges might miss.

- Cross-pollinate teams. Integrating team members from both organizations into joint leadership roles and key committees accelerates cultural alignment and encourages mutual understanding.

- Clarify accountability and decision rights. Creating transparent frameworks for defining decision-making authority, required inputs, and escalation processes significantly reduces ambiguity and conflict.

- Apply change management tools. Structured workshops, collaborative problem-solving sessions, and informal team-building activities help bridge cultural divides and foster stronger interpersonal relationships.

- Agree on shared meeting protocols. Establishing meeting norms—including expectations for participation, documentation, and follow-up—ensures smoother collaboration and consistent interactions across diverse teams.

Establishing unified leadership structures swiftly is critical. Rapidly identify and appoint top talent from both entities who align with the combined organization’s vision. Quickly filling key roles reduces uncertainty, preventing competitors from exploiting instability to lure away valuable employees and customers. Establishing retention programs for critical talent and clearly communicating their roles will further enhance stability.

Although cross-border deals undeniably present challenges, the data reveals a clear opportunity: when executed thoughtfully, international acquisitions can deliver significant value and position a company for global growth. Indeed, today’s environment of lower deal activity and heightened selectivity presents favorable conditions for well-prepared and visionary companies that are ready to capitalize on them. For dealmakers that are prepared to act strategically and decisively, now could be precisely the right moment to cross borders and capture lasting value.