During periods of uncertainty, whether driven by market conditions or company circumstances, corporate leaders seek fast and flexible paths to growth. Organic expansion is often slow, while a traditional acquisition may entail commitments and risks that are not justifiable in certain cases. Leaders instead may look for a “sweet spot” approach—one that provides many of M&A’s advantages without risking the typical drawbacks, such as regulatory hurdles, high costs, and long-term obligations.

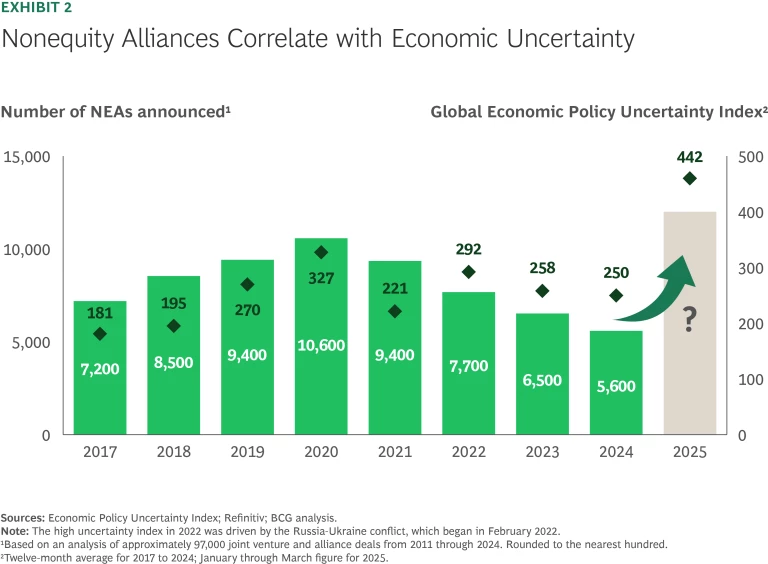

Nonequity alliances (NEAs) represent an attractive alternative. These medium- to long-term collaborations enable companies to jointly pursue strategic goals by exchanging monetary and nonmonetary benefits. Through NEAs, organizations can efficiently co-develop products, engage in co-sourcing or co-manufacturing arrangements, and expand their go-to-market reach, all without shared ownership. Historically, the number of new NEAs consistently spikes during periods of heightened uncertainty, demonstrating their versatility.

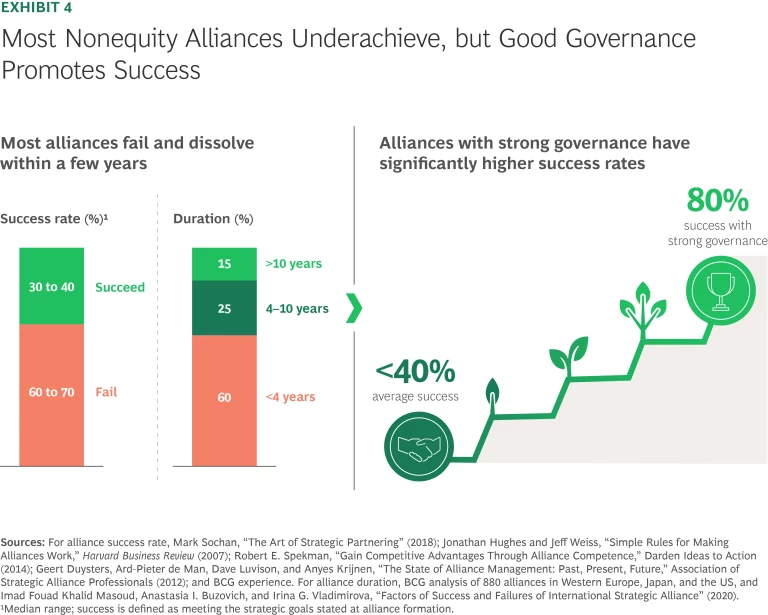

Despite their agility and adaptability, NEAs encounter distinct challenges. Without a joint legal entity, partners may lack explicit agreement on scope, strategy, and objectives. If the alliance lacks a shared profit-and-loss framework, partners may struggle to align incentives and sustain value creation. With no formal board of directors, senior-executive engagement can wane, and decision making can easily become fragmented. The consequences are real: 60% to 70% of alliances fail to achieve their intended outcomes, and 60% dissolve within four years of their formation.

To unlock the value promised by NEAs, deliberate and thoughtful governance is essential. In this context, effective governance encompasses more than just partner roles and decision making; it also includes clearly defined strategies and objectives, as well as transparent mechanisms for creating and sharing value. By addressing these three essential elements of governance, companies ensure that NEAs promote sustained competitive advantage for each partner.

Stay ahead with BCG insights on corporate finance and strategy

Nonequity Alliances Help in Navigating Uncertainty

In 2025, the Global Economic Policy Uncertainty Index reached record highs, driven by trade disputes, inflation fluctuations, and persistent capital market instability. This uncertainty is making significant strategic moves harder to justify in the immediate short term—and harder still to close.

Against this challenging backdrop, traditional M&A has cooled. Faced with unpredictable valuations and the prospect of protracted regulatory approvals, companies are being more cautious about capital-intensive deals. BCG’s analysis of executive communications reflects this shift: mentions of M&A in earnings calls of large-cap companies have declined approximately 50% over the past 18 months.

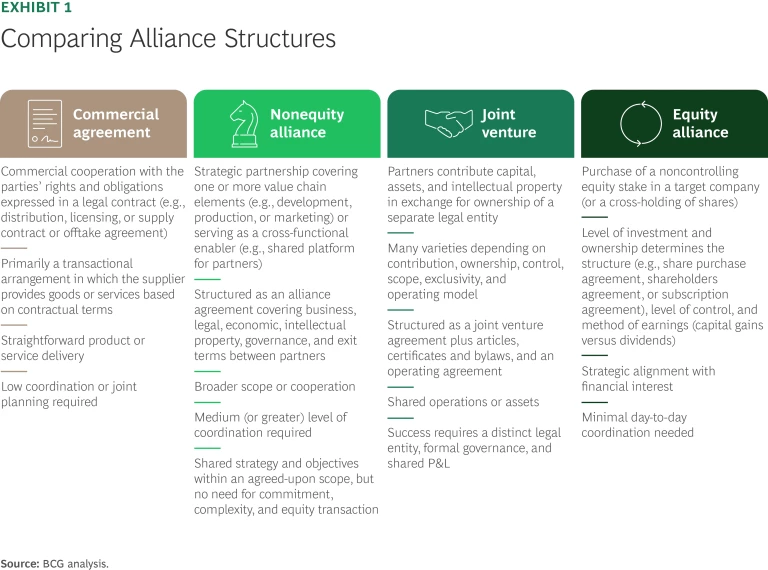

Instead, companies are exploring partnership models, including commercial agreements, joint ventures, and equity alliances, as well as NEAs. Each structure offers distinct strategic advantages depending on the desired level of control, coordination, and commitment. (See Exhibit 1.)

Among these options, NEAs are poised to gain traction because they offer distinct advantages in the current environment. We expect NEA activity to increase as uncertainty rises, just as it has in the past. (See Exhibit 2.)

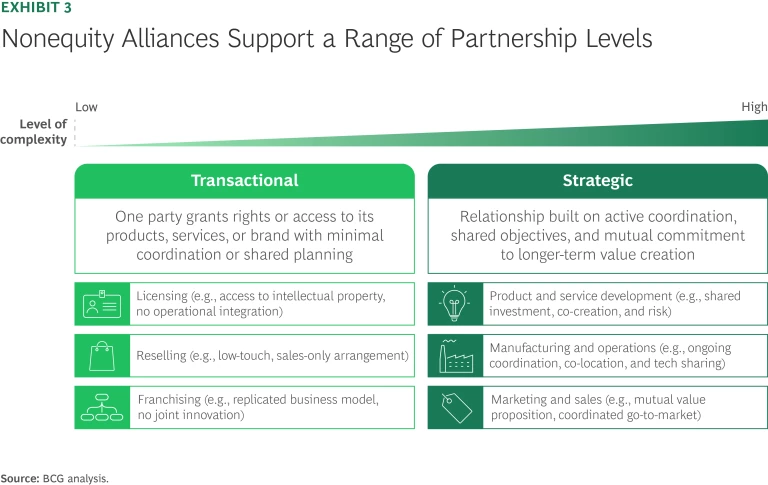

NEAs are attractive amid uncertainty because they allow companies to jointly source, develop, or manufacture products and to enter markets without needing shared ownership or complex integration. These arrangements support various levels of partnership, from transactional licensing and franchising arrangements to more strategic joint-development or go-to-market efforts. (See Exhibit 3.)

Consider this illustrative example: Two regional consumer goods companies, traditionally competitors in adjacent markets, form an NEA to respond to rising tariffs and ongoing supply chain disruptions. Rather than duplicating manufacturing in each region, they agree to produce selected products in each other's facilities. This arrangement reduces cross-border shipping costs, minimizes tariff exposure, and enhances overall efficiency.

To operationalize this NEA, each partner makes investments in its own sites. These include modifying selected production lines, installing new tooling, updating digital systems, training staff, and integrating supply chains to support each other’s product requirements. Such commitments represent meaningful capital and operational expenditures, typically governed by long-term service agreements or shared-cost frameworks. The alliance preserves each partner’s autonomy and enables both to avoid conducting valuations and committing capital to acquisitions; however, it demands a level of operational interdependence that requires proactive planning, budgeting, and management.

Beyond the benefits of autonomy, this approach gives the partners the flexibility to adapt to market shifts, including the opportunity for deeper collaboration on sourcing or product development. Moreover, if circumstances change or the arrangement loses its strategic rationale, partners can dissolve the alliance according to pre-agreed terms. This eliminates the complexity and resource drain associated with exiting a joint venture, carving out and selling a business unit, or managing a full-scale shutdown.

Without Structure, Most Nonequity Alliances Fall Short

Despite their appeal, many NEAs struggle to deliver sustained value. Unlike equity-based arrangements, NEAs lack formal board structures or shared-ownership stakes that naturally align partner incentives and improve strategic coherence. Consequently, these partnerships frequently encounter fundamental operating issues.

In the typical scenario, objectives drift, incentives diverge, and decisions stall. Without clear governance structures, what starts as a compelling partnership often dissolves within two to three years, falling short of its initial promise.

The data is compelling and cautionary: up to seven in ten alliances fail to achieve their intended outcomes, and nearly as many dissolve within four years of their formation. (See Exhibit 4.)

However, failure is not inevitable. BCG’s client experience suggests that effective governance dramatically boosts the odds of success. Specifically, alliances with robust governance mechanisms succeed up to 80% of the time, twice the average success rate of NEAs.

The critical insight is that the absence of equity does not reduce the need for governance structures; in fact, it intensifies it. NEAs require deliberate, thoughtful frameworks to align partner objectives, define shared value creation, and manage decision making. When structured properly, NEAs are a powerful way to create value.

The Governance Foundations of Successful Nonequity Alliances

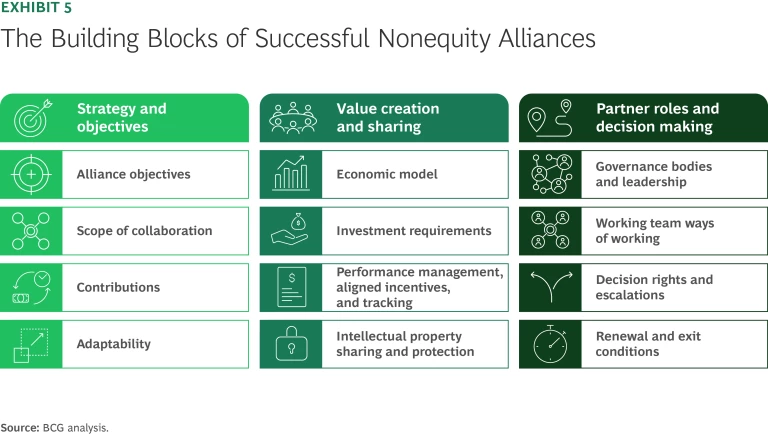

Drawing from BCG’s experience supporting hundreds of NEAs across diverse industries, regions, and models, we have developed a governance framework tailored specifically for these arrangements. This structured approach centers on three foundational areas, comprising 12 essential building blocks. (See Exhibit 5.)

The initial priority is to explicitly agree on the alliance’s scope, ambitions, and shared goals. Even experienced negotiating teams too often assume shared intent, only to find real differences when they operationalize the alliance.

Next, ensuring equitable value creation and sharing begins with agreeing on an economic model and investment requirements. In complex NEAs, partners make asymmetric nonmonetary contributions—for example, proprietary technology, manufacturing capabilities, or customer access—that do not appear on a balance sheet. As a result, a robust economic model must do more than tally financial inputs. It must establish a shared view of what each partner contributes, how these contributions enable value creation, and the criteria for assessing fair returns over the alliance’s life cycle. Tracking a balanced set of KPIs is critical, and embedding partnership performance in the incentives of alliance leaders and working group members helps partners maintain their commitment to the NEA over time.

Finally, partners must assign responsibilities for key roles and define decision-making structures. For example, complex NEAs often replicate a legal entity's formal governance system, such as by creating a steering committee to oversee the alliance, a partnership committee to execute the strategy, and working groups to deliver specific initiatives.

Returning to our illustrative example, suppose the partners face new tariffs that affect their agreed-upon pricing. A working group focused on sourcing escalates the issue to the partnership committee, which assigns a joint project team to perform a cost-benefit analysis of different strategic responses, such as absorbing the tariff costs, passing them on to end customers, or pursuing alternative sourcing options. Following the analysis, the partnership committee provides a recommendation to the steering committee, which evaluates it and responds with a decision. The partnership committee then assesses the implications and disseminates guidance to the relevant working groups for implementation.

This robust approach can help to maintain senior-level involvement in the alliance. However, it also may cause inefficiencies in decision making, given that many of the people involved are only partially assigned to the alliance. Careful balance is required to maintain both effective governance and agile operational efficiency.

Businesses require innovative ways to swiftly achieve their objectives without overextending their resources or commitments, especially during periods of uncertainty. Whether the goal is introducing joint innovations, enhancing supply chain or production resilience, or improving market access, NEAs can promote significant value creation while avoiding some of the complexities and long-term commitments of traditional M&A or joint ventures. They can also serve as a stepping stone, evolving into an equity joint venture or even a full merger as trust builds and market conditions shift.

Although every NEA is different, the fundamental governance needs are remarkably consistent. By proactively defining and tailoring these building blocks to each alliance's specific goals, risks, and practical realities, organizations can enhance the likelihood of success. Ultimately, the absence of equity makes governance more important, not less.

The authors would like to thank Wanlin Wang for her contributions to this article.