In 2024, the world discarded enough clothing to fill more than 200 Olympic stadiums—highlighting a growing crisis of textile waste.

As global apparel production steadily increases, so too does the mountain of clothing sent to landfills, burned in incinerators, or shipped overseas. Each year, textile waste worth an estimated $150 billion in raw materials value is lost—resources that are extracted, processed, and then quickly discarded. Recovering even a quarter of these wasted resources could offset the combined annual materials expenditures of the world’s 30 largest fashion companies. The environmental and economic case is clear: reducing textile waste would conserve valuable resources and minimize environmental and social impact.

Current recycling systems weren't built to handle the sheer scale of today's textile output. Addressing the shortcomings requires reshaping the fashion industry into a truly circular economy. Such a transformation would dramatically increase recycling efficiency, driving market demand for recycled fibers and promoting investment in technologies capable of processing current textile waste.

To turn ambition into reality, fashion brands, investors, innovators, and consumers must collaborate. Encouraging consumers to opt for garments made from recycled materials and creating convenient channels for responsibly discarding clothing are essential steps. Although the task ahead is substantial and calls for concerted effort across the supply chain, eliminating textile waste is an achievable goal that will benefit businesses, consumers, and the environment.

A Problem of Global Proportions

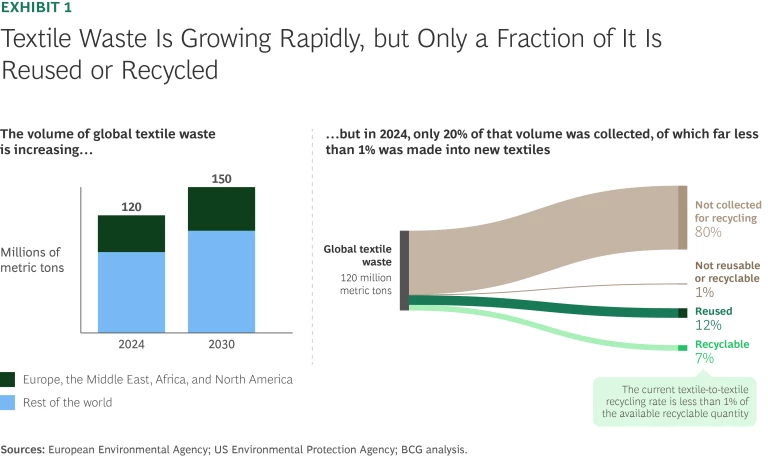

In 2024, discarded clothing worldwide reached 120 million metric tons—a clear indication of how dramatically fashion consumption has changed. Rising incomes, evolving trends, and shifting consumer habits mean that people buy more clothing but wear each item less frequently. As a direct result of these trends, global fiber production has more than doubled since 2000, amplifying both consumption patterns and waste.

The increase in textile waste imposes significant economic and environmental burdens. In 2024, approximately 80% of discarded clothing ended up in landfills or incinerators, while only 12% was reused, and substantially less than 1% was recycled into new textile fibers. (See Exhibit 1.)

The environmental toll is particularly high. Producing textiles—from extracting raw materials to manufacturing—accounts for 92% of the fashion industry's greenhouse gas emissions. Disposal exacerbates such emissions: burning just one metric ton of textiles produces emissions equivalent to one passenger taking six round-trip flights between London and New York, and landfilling the same amount generates emissions comparable to eight such round-trip flights. Open dumping adds another layer of risk, releasing harmful microplastics into the environment.

As the volume of textile waste grows, disposal options are dwindling. In the US, textile waste surged by 50% between 2000 and 2018. At this pace, the country's landfills could reach capacity by 2038.

Stay ahead with BCG insights on the consumer products industry

Efforts to collect and reuse clothing, while well-intentioned, often shift rather than resolve the problem. In high-income countries, discarded garments that can't be resold domestically are frequently exported to developing regions for

Pressure to Act Is Rising...

As the volume of textile waste grows, regulatory pressure and supply chain volatility are compelling the industry to reconsider its practices.

The regulatory pressure reflects a broader push by governments to reduce the impact of consumer products on the environment, with textile waste reduction emerging as a key part of that effort. In the EU, for example, textiles are among the top five household product categories contributing significantly to climate change, prompting governments to pass a broad set of recycling laws. The EU’s extended producer responsibility (EPR) regulations will shift accountability for managing textile products’ end of life onto producers, requiring them to finance collection and recycling efforts where their goods are sold. Additional mandates may require companies to design products to be easier to recycle or to contain recycled content. Similar regulatory movements are emerging in the United States, Canada, and Chile.

At the same time, supply chains face increasing vulnerability. Factors such as extreme weather events, geopolitical tensions, and volatile pricing threaten the stability of sourcing conventional fibers. For instance, forecasts suggest that by 2040, nearly half of the global cotton crop could experience shorter growing periods due to rising temperatures.

The industry clearly recognizes the need to act. Major global brands, including Adidas, New Balance, and Puma, are beginning to invest in textile-to-textile recycling initiatives. These companies are proactively future-proofing operations, achieving sustainability goals, and ensuring access to emerging next-generation raw materials. Although these early movers currently represent a relatively small portion of the industry, other companies are likely to follow their lead. That’s one reason we expect demand for recycled textiles to exceed supply by 30 to 40 million metric tons by 2030.

…But Barriers to Reducing Waste Persist

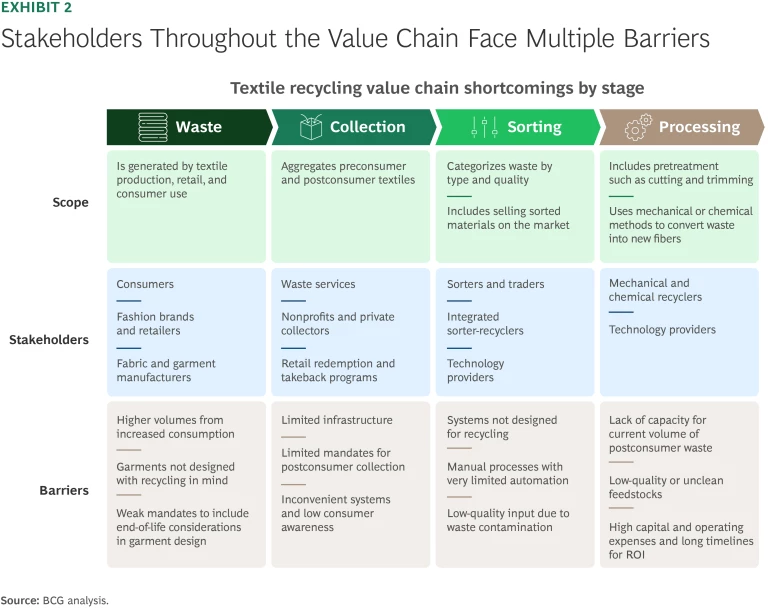

Despite the growing momentum for change, the existing textile value chain includes many barriers to recovering and reusing more waste. (See Exhibit 2.)

Three, in particular, pose challenges to meaningful change.

First, several factors often make recycled materials less desirable economically and practically than virgin fibers. While enthusiasm for recycled fibers is rising, concerns about quality, availability, and integration into established supply chains can make them less appealing. Moreover, the cost disparity is significant: recycled polyester can be more than twice as expensive as virgin polyester, and recycled cotton usually commands a higher price as well. These higher prices stem from decades-old global supply chains optimized to deliver virgin materials, as well as from the effects of subsidies—and the fact that in many cases the environmental damage caused by producing new materials is not reflected in their price.

Second, today’s textile waste management infrastructure falls short. Current textile recycling systems simply weren't designed for the immense volumes the world generates—some 120 million metric tons annually. Most collection channels primarily support resale markets, both charitable and commercial, rather than recycling initiatives. Consequently, sorting processes rely heavily on manual labor that is optimized for resale rather than recycling. These manual processes cannot efficiently categorize textiles by recyclability, fabric composition, and color, or effectively remove disruptors such as buttons and zippers.

Consumer confusion further complicates this already strained system. Many consumers remain unclear about proper disposal methods for their garments, resulting in mixed and contaminated waste streams that are challenging to sort effectively. As a result, only about 7% of all textile waste is available as feedstock for textile-to-textile recycling.

Third, complex fabrics require innovating beyond current recycling capabilities. Most modern fabrics are made from blends of different fiber types—often combinations of natural and synthetic materials such as cotton, polyester, and elastane. However, most existing industrial recycling solutions, which are primarily mechanical, can handle only single-material textiles. This mismatch between waste and technology has led to an urgent need for innovative solutions that can handle a broad range of modern textile waste and deliver products that are competitive in cost and quality. Such techniques have yet to reach the scale necessary to tackle current waste volumes.

Five Actions for Scaling a Circular Textile Economy

If recycling efforts proceed at their present pace, the industry will continue to recover only a fraction of the estimated $150 billion lost annually to textile

With the right pieces in place for a large-scale circular textile economy, we believe the industry could see waste recycling rates surpass 30%, generating new fibers with a raw material value worth more than $50 billion and creating approximately 180,000 new jobs.

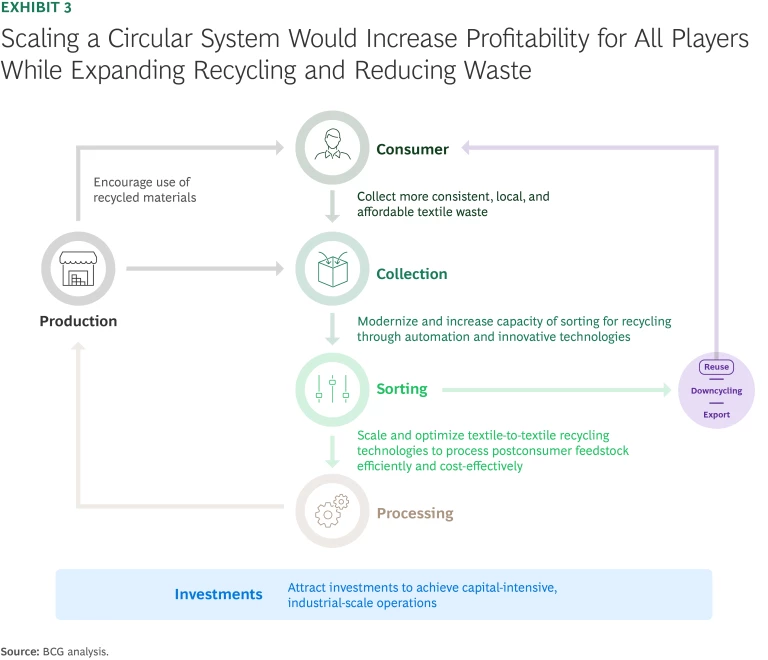

To achieve this vision—and build a profitable system for all stakeholders—the industry should focus on five key actions designed to work across all of the barriers mentioned above. (See Exhibit 3.)

Promote demand for textiles with recycled fibers. In an industry where many players are too small to transform supply chains on their own, leading companies can take the initiative by collaborating to create higher-volume demand for textiles containing high-quality recycled fibers. Small and medium-size brands, in particular, can pool their demand and use shared transition-financing tools to manage the upfront cost of shifting to next-generation materials.

Collect more waste. Meeting that increased demand will also require access to large amounts of consistent, local, and affordable textile waste. Achieving this means scaling existing waste collection systems and creating new ones.

Collection strategies should be designed around local factors, including population density, geography, and infrastructure. They can also build on existing waste collection networks as well as on redemption and take-back programs from brands and retailers. In the EU, combining new public and private initiatives with existing programs could boost textile waste collection rates by 20% to 25% by 2033, bringing total collection rates up to 50% to 55%.

Modernize sorting. To handle the larger volumes needed for textile-to-textile recycling, sorting processes must become more effective and affordable. Advanced technologies—like near-infrared spectroscopy, AI, and robotics—can boost speed, throughput, and precision, enabling sorters to quickly process larger quantities of textile waste, including lower-quality materials. A benchmark study of commercial and pilot-stage sorting technologies showed that automation increased capacity by up to 90%, nearly doubling daily processing volumes. These innovations also permit better targeting of recycling requirements.

Scale effective recycling solutions. Better collection and sorting processes need to be paired with effective recycling methods. However, recycling currently is the least-developed stage in the textile value chain, with few industrial-scale solutions in place.

Scaling up textile recycling will require significant improvements in technology, infrastructure, and operational practices. It will also require making strategic decisions about where and how recycling networks are established, maximizing efficiency, reducing costs, and ensuring commercial viability. Additionally, recycling technologies need to tolerate a broader range of feedstock, accommodating the diverse needs of sorters, collectors, and other stakeholders.

Invest in innovation. Upgrading to a high-functioning circular ecosystem that can meet today’s textile waste challenges won’t be possible without additional across-the-board investment in innovation. Several companies working on next-generation recycling technologies have already secured initial rounds of financing.

Collectively, investors have provided more than $250 million in funding for ventures such as Circ, Syre, and Infinited Fiber. Yet, despite these promising early steps, the textile recycling industry hasn't attracted enough funding to scale operations to the capital-intensive, industrial levels needed.

To bridge this gap, brands, manufacturers, and financial stakeholders could coordinate their investments—for example by forming equity investment consortiums to share the financial risks and upsides of supporting early- and middle-stage ventures.

Accelerating the Transition

The actions outlined here can lay a strong foundation for an effective textile waste management system, one that the industry is uniquely positioned to develop. However, without deeper industrywide collaboration or central orchestration by the public sector, it will be challenging to build a system capable of scaling quickly enough. Consequently, success will also depend on creating meaningful economic incentives for businesses and consumers, and harnessing synergies across the value chain.

The textile industry can draw inspiration from other sectors that have successfully transformed through a combination of public subsidies, regulatory incentives, targeted investments, and consumer engagement. Germany’s bottle deposit program, for example, paired clear regulations with accessible infrastructure and consumer incentives, achieving a return rate of 98%—the highest globally. In another example, the cost of electricity generated from solar worldwide fell 89% within a decade through coordinated investments, supportive regulations, and infrastructure improvements, making solar power cheaper than coal.

Several efforts can accelerate a similar transition in the textile industry.

Craft public policy to turbocharge change. Governments can accelerate progress by supporting EPR programs and other public measures that distribute value more evenly across the textile supply chain and encourage investment in critical operations.

An increasing number of countries are adopting EPR frameworks as key elements of their textile circular economy strategies. For example, the Netherlands requires that by 2030, companies must prepare 75% of the textiles introduced to the Dutch market in the previous year for reuse or recycling. The regulation also mandates that by the same year at least 33% of fibers from discarded textiles must be incorporated into new textile-to-textile recycled products.

Collaborate and integrate. Companies in the private sector can explore new models of collaboration, such as partnerships, joint ventures, or vertical integration, to tap into valuable synergies. These approaches can improve feedstock quality and availability, reduce costs, and share the burden of capital investments.

Textile manufacturers, in particular, can integrate backward by partnering with or acquiring recycling companies to scale operations, secure steady supply, and boost quality and efficiency. The Sanko Group did exactly this when it launched RE&UP, a business dedicated to converting postconsumer waste into advanced recycled materials. We estimate that entering into these types of collaborations and integrations could transform the textile waste sector while yielding operational synergies of up to 30%.

In addition, textile players can team up with companies from adjacent industries—like electronics, chemicals, or industrial automation. Such partnerships can allow them to tap into specialized expertise, advanced technologies, and established infrastructure that will help address technical hurdles. These cross-industry collaborations can also deliver logistical efficiencies and help companies expand their product offerings. Siemens, for instance, developed AI-powered software designed to automate and optimize textile sorting.

Get the public involved. Consumers need to be more involved in helping build a circular textile economy, not only as suppliers whose discarded clothes become recycling feedstock, but also as users of new recycled products. However, although the industry has long counted on consumers to help drive sustainability efforts, recycling participation remains limited.

Achieving meaningful scale depends on engaging people more effectively. The industry can encourage consumers by making textile recycling as simple and convenient as recycling plastic bottles. Awareness campaigns can play a crucial role, too. In France, for example, the 2022 #RRRR campaign—which encouraged reducing, reusing, repairing, and recycling clothes—reached 52 million impressions on social media. Efforts like these can boost participation significantly and may ultimately help France reach its goal of collecting 60% of textile waste by 2028. Similar initiatives worldwide could mobilize consumers as essential partners in building a thriving circular economy.

The path toward a circular textile economy is in sight, but it requires decisive action across the entire value chain. Industry players must boost demand for recycled fibers, streamline textile waste collection, upgrade sorting infrastructure, expand proven recycling methods, and invest in cutting-edge recycling technologies.

By coordinating targeted efforts, strategic investments, and stronger public-private collaboration, stakeholders can move circularity from aspiration to reality. Achieving this goal will not only generate economic value and enhance the industry's competitiveness, but it will also help companies to thrive and to build lasting resilience. Just as critically, a circular textile economy will deliver meaningful, long-term benefits for both the environment and society.