BCG’s Approach to Sourcing and Procurement

Building relationships remains important to sourcing and procurement, but personal experience must be balanced with a rules-based process that uses digitization—such as AI-powered and analytical solutions—to speed up outcomes and reduce costs. Creating value requires enablers and a strong data foundation. To implement an effective digital procurement strategy and take full advantage of the opportunities that digital offers, BCG helps sourcing and procurement leaders define the core value that their function brings to the organization.

To identify the investments needed to create value, through increased savings, quality, speed, innovation, sustainability, and risk mitigation, we examine your organization’s strategic priorities and assess its digital maturity, including opportunities to unlock approaches that combine AI, technology, and human capabilities.

Using our extensive library of client use cases to speed our work—and tapping into the complementary capabilities of INVERTO, a BCG specialty business that focuses on procurement and supply chain management—we then select and run use cases that match your specific needs. The results help pinpoint technology interdependencies and anticipated pain points, which in turn helps shape your custom digital roadmap. To turn that roadmap into reality, we work with BCG X to develop and deploy user-centric digital solutions, address users’ needs, and help generate value.

Using AI to Build Needed Supply Chain Resilience

Our offering, enabled by AI-based tools such as Inflation Control Tower and Supplier Risk Monitor, helps provide transparency, predict and mitigate supply risks and prevent supply shortages, analyze inflation impact on product costs, and adjust end-product pricing.

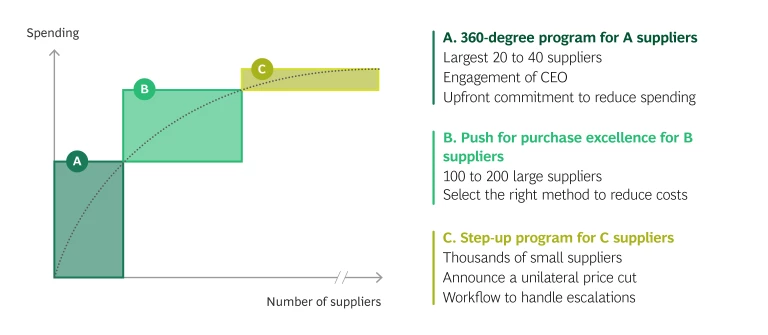

The New Pareto: Focusing on Suppliers Instead of Categories

- A Suppliers. Our innovative 360° Program for A Suppliers engages the most senior levels, including the C-suite, to get the right decisions in place. The ambition is bold: to double the savings in a partnership mode.

- B Suppliers. We push for procurement excellence, an approach that focuses on using the right commercial and technical levers, backed by the right preparation, to cut costs. BCG’s AI Negotiation Coach tool helps make this a reality, suggesting to the buyer the right go-to-market approach and analysis. Over time, the coach—an algorithm—learns from the outcomes and becomes increasingly strategic and effective.

- C Suppliers. Our step-up-to-contribute program harnesses potential savings from the smaller vendors (which tend to fly under the radar) by increasing their visibility and making them contributing partners. Our AI Tail Cutter tool generates an appropriate savings target and steers the communication with an individualized approach.

Inverto, a BCG Company

Our Client Work in Sourcing and Procurement

Change Management Is Inherent to Our Procurement Approach

Change management is critical to ensuring that procurement becomes a source of competitive advantage. It is integral to almost all of our procurement projects. To ensure that results are swift and sustainable, we work side by side with your teams so that they are clear on what procurement achieves in savings, sustainability, and competitive advantage. We are here to answer questions, integrate team-specific needs, and overcome pain points.

How BCG Works with Organizations to Reach Sustainability Milestones

Suppliers must comply with comprehensive environmental, social, and governance (ESG) legislation and directives. But meeting requirements isn’t enough. Leading companies across industries are already pushing beyond mere compliance, and are working to CO2-positive supply chains and socially responsible procurement. To deliver value through sustainable operations, our procurement consulting team supports companies in:

- Translating company targets into supplier targets

- Defining relevant measures

- Building the abatement curve with a clear business case mindset

- Setting up relevant measurement systems

- Integrating sustainability into procurement’s target operating model and KPI set

- Upskilling procurement teams and suppliers to accelerate Scope 3 decarbonization efforts through our Supply Chain Net Zero Academy

Profit from the Source: BCG’s Book on The New Role of Procurement

Explore Our Insights on Procurement

Meet Our Procurement Consulting Leaders