From 2010 through 2014, the global travel and tourism sector delivered strong value creation, thanks to increased demand among travelers and a payoff from measures that many companies took during the great recession to reduce costs and improve performance.

In 2015, The Boston Consulting Group conducted its annual study of the total shareholder return

During the five-year period of our study, the travel and tourism companies in the sample returned an annualized TSR of 19%. The sector ranked fourth overall among the five consumer sectors we analyzed—fashion and luxury (which ranked first), consumer durables, retail, and consumer nondurables were the other four—and eighth overall among the 27 industry sectors we analyzed. (For an overview of the entire group of consumer sectors, see “The Return of Growth,” the BCG 2015 Consumer Value Creators Series, November 2015.)

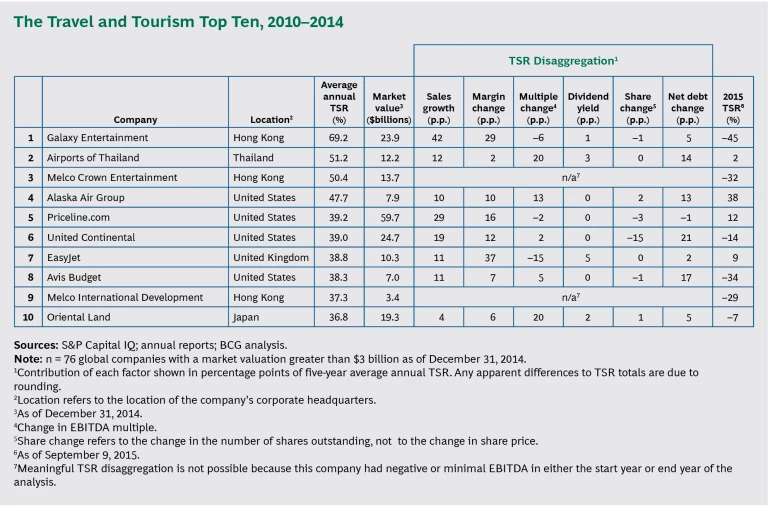

The top ten companies in travel and tourism reflect the wide array of companies within the segment overall; they include several gaming companies and airlines, a car rental company, and a leisure-property developer. (See the exhibit, “The Travel and Tourism Top Ten, 2010–2014.”) As in last year’s analysis, the best performer was Galaxy Entertainment, a Hong Kong gaming company (and Hang Seng Index constituent) that primarily develops and operates hotels, gaming facilities, and integrated resorts in Macao. Galaxy delivered an average annual TSR of 69.2% for the five-year period we analyzed, and it ranked tenth overall among the companies in the cross-industry sample.

For the travel and tourism top ten, the predominant factor in value creation was sales growth, which reflects the increased demand for travel, particularly among new entrants to the middle class in emerging markets in Asia. Margin change and debt repayment were also large drivers of value creation among the top ten. In contrast to other consumer sectors, the best-performing travel and tourism companies created less value through an expansion of investor multiples.

US Airlines Return

A central theme of this year’s analysis is the return of the US airline industry. Two of the top ten companies were US carriers (Alaska Air, which finished fourth, and United Continental, at sixth place), and several others—including Delta, Southwest, and JetBlue—finished in the top 30 (of 76 total travel and tourism players). After decades of difficulties that led to multiple bankruptcies, the US airline industry is returning to a position of strength. The industry has restructured through consolidation, investment, and debt reduction; United Continental and Delta both generated more than half of their TSR from changes to net debt. In addition, the relatively strong US economy has led to increased demand for air travel, and reduced oil prices have allowed carriers to increase profit margins. Perhaps most important, airlines have invested in new aircraft, technology, and other measures to improve service, reliability, and other elements of the passenger experience.

In addition to US companies, several low-cost carriers (LCCs) in Europe generated strong value creation as well. EasyJet ranked seventh, and Ryanair ranked twentieth, for the five-year period of our study. Although they have not experienced the same degree of consolidation as US carriers, European LCCs have clearly capitalized on sustained passenger demand. EasyJet also benefited from stronger operational performance. In 2010, the company’s new CEO took deliberate steps to improve on-time performance—a key element that affects customers’ choice of carriers—and brand perception, particularly among business travelers.

Hotels Are at an Inflection Point

Notably, the top ten do not include global hotel brands. Larger companies performed fairly well in absolute terms, but their relative value-creation performance declined compared with other subsegments. Why the drop-off? Five to seven years ago, many global hotel companies took measures to respond to sluggish demand following the recession. Specifically, they strategically sold off assets and used the gains to increase TSR through financial measures, such as paying down debt and increasing dividends. Those are short-term levers, however, and many of the available gains have already been captured. As a result, valuation multiples for some hotel companies have leveled off. Over the next several years, these companies will differentiate themselves through growth; investments in new products and services, such as guest technology; and next-generation distribution.

Another challenge for hotel companies comes from online distribution companies, specifically Priceline.com (fifth in this year’s rankings) and Expedia (seventeenth). These companies continue to deliver value to shareholders by creating direct relationships with hotel properties. But these stronger relationships threaten part of the value proposition of large global hotel operators, which includes driving demand based on consumers’ familiarity with their brand. For online distribution companies, sales growth has been a key driver of TSR over the past several years, as they expand into new regions and use marketing effectively. There are signs that this model may face stiffer competition, however. Travel suppliers—and particularly hotel brands—are investing to build more direct relationships with customers.

The Power of Data

Another trend in the travel and tourism sector is the growing importance of data. Companies have access to an enormous amount of data that they can potentially use to create a better travel experience for customers. Part of the reason that distribution companies have become so powerful in such a short time is that they deal directly with consumers through digital interactions that can yield tremendous insights into both the demand for travel and the preferences and habits of individual travelers. For example, TripAdvisor can generate detailed insights into where travelers might want to go, as indicated by destination inquiries that are made months in advance of booking any travel plans.

Data embodies the way power is shifting in the travel and tourism industry. It also answers the question of how suppliers can respond to this shift. By capturing and leveraging data, suppliers can better meet the needs of their customers, thus building stronger relationships over time. Some companies may require investment in technology—and a new culture and mind-set, especially for suppliers that have focused more on operational elements in the past. Yet in the current environment, digital infrastructure and capabilities have become an investment that many travel companies are no longer able to put off.

The top travel and tourism performers over the past five years cover a variety of subsectors and approaches to value creation. As the sector continues to change in response to new technology and evolving preferences among travelers, the winning companies over the next five years will be those that understand how to best meet continued demand and apply new business models and digital solutions to grow profitably.