The world of payments remains in constant flux, reflecting an ongoing rebalancing of power among incumbent banks, digital giants, financial technology (fintech) startups, card networks, and, of course, consumers and merchants.

At the top of the collective agenda in 2016 is the digitization of payments, which has come with more than its share of hype. Historically, transformation in the payments industry has tended to occur more like a crescendo than a big bang. Today, although the momentum brought about by fintech startups is strong, there is still uncertainty as to whether they—either in collaboration or in competition with digital giants and banking incumbents—will drive a true shift in competitive dynamics. Over the next ten years, we are likely to hear a fintech cacophony, but much of it will eventually subside because success in payments-related businesses remains difficult to achieve. Still, it’s safe to assume that at least a few fintechs will prosper and be highly disruptive to the status quo: witness the lesson learned by long-established banks in China, where fintechs have become dominant players in payments. A competitive eye on the digital giants, a few of which are also staking claims to the payments landscape, will be necessary as well.

What can banking incumbents do in the face of these developments? First, they need to forge a digital strategy that enables them not only to survive meaningful incursions by nonbanks but also to thrive and take control of their own digital destinies. They must deliver compelling end-to-end customer experiences that maximize security, minimize complexity, and add value beyond pure payments. Given current pressures on revenues, they must also prioritize investments and review their sourcing and operating models in order to reduce costs. And time is of the essence. As Bill Gates once said, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.”

It is therefore critical for incumbent banks to map out diverse scenarios with some key questions in mind. How will customers’ payments behavior change over the next decade? How will control of customer engagement and brand image diminish as the Internet of Things evolves, as so-called

This year’s Global Payments report, BCG’s 14th annual study of the industry, addresses these dynamics across the various payments-related businesses. This year also marks the third edition of our Global Payments 2015: Listening to the Customer’s Voice, which explores how regions and segments of the payments market will shift from year-end 2015 through 2025. The interactive provides extensive detail on the volume and value of noncash transactions and also on revenues.

A note about our Global Payments model: payments revenues include direct and indirect revenues generated by noncash payment services (excluding interbank transfers). They are the sum of the following:

- Account revenues: spread (net interest) income on current account balances (also known as checking or demand-deposit accounts) plus account maintenance fees

- Transaction-related revenues: transaction-specific revenues on cards (interchange fees, merchant acquiring fees, and currency conversion fees for cross-border card transactions) and noncard payment methods (typically assessed on a percentage or fixed basis), as well as fees for overdrafts and nonsufficient funds

- Nontransaction-related card revenues: monthly or annual card membership fees, credit card spread (net interest income), penalty fees, and other service fees

Retail payments are defined as transactions initiated by consumers. Wholesale payments are transactions initiated by businesses or governments.

As always, our aim in Global Payments 2016: Competing in Open Seas is to provide institutions in the payments and transaction-banking businesses with a clear understanding of the fundamental changes shaping the industry, and to offer recommendations on which specific actions should be taken by various types of players.

Global Overview: A Shifting Leadership

With more than $870 billion in industry revenue growth up for grabs through 2025, and with competition stiffening, it is imperative that payments stakeholders understand revenue trends and the factors that are driving shifts in the competitive landscape.

The Revenue Stakes

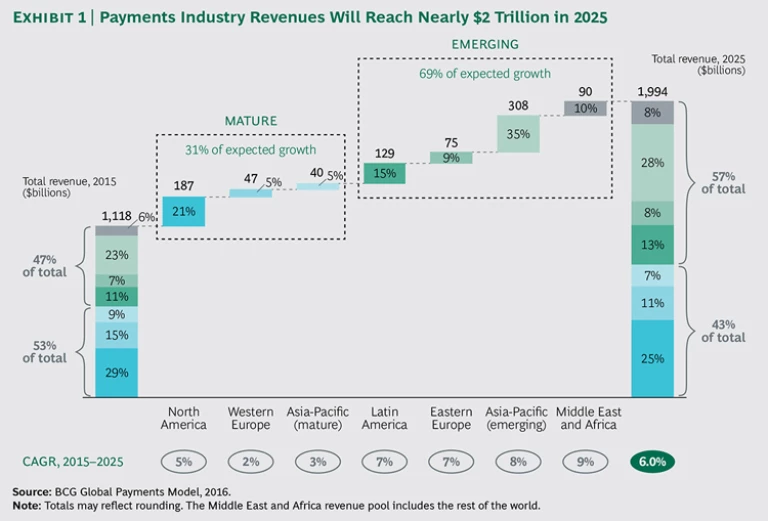

In 2015, payments industry revenues hit $1.1 trillion, representing 29% of global banking revenues. By 2025, they are projected to reach nearly $2 trillion, a compound annual growth rate of 6.0%. (See Exhibit 1.) The growth engines will be transaction-related revenues (an estimated 40% of the total) and account revenues (34%). Account-revenue growth will be driven by increasing average account balances and numbers of accounts. Transaction-related revenues will be fueled by rising transaction values and volumes, mainly in rapidly developing economies (RDEs)—stemming from the migration from cash to e-payments and from broader financial inclusion. Indeed, RDEs are already enjoying stronger growth than mature markets in all metrics, although macroeconomic drivers such as GDP and per-capita income have slowed somewhat.

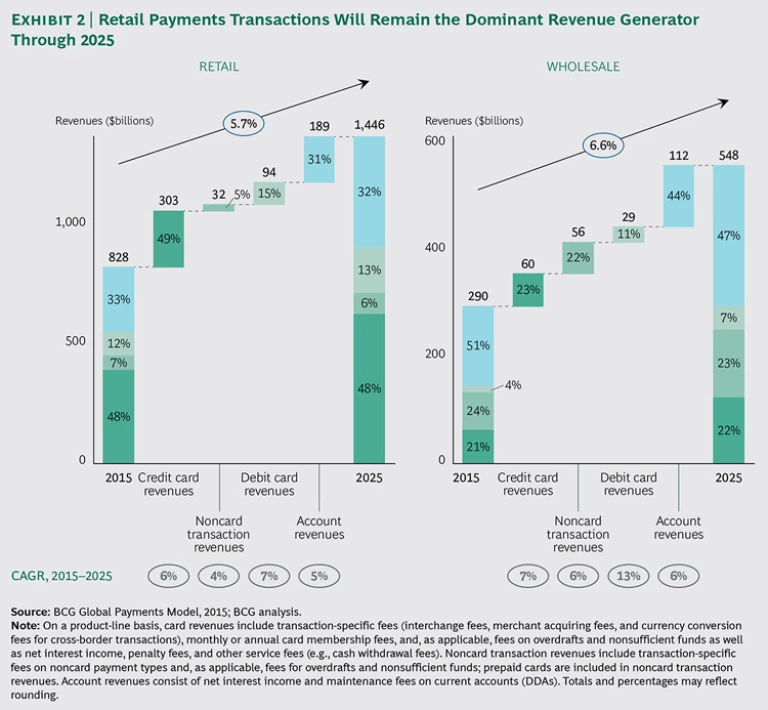

Retail payments generated 74% of total payments revenues in 2015, and will continue to dominate through 2025—accounting for 71% of total revenue growth and reaching nearly $1.5 trillion in 2025. (See Exhibit 2.) However, growth in wholesale payments revenues is projected to outpace retail payments growth—a compound annual rate of 6.6% versus 5.7%—with account revenues representing 44% of that growth. Higher wholesale growth is being driven by increases in card revenues, which face less price pressure than on the retail side.

Agents of Change

A confluence of forces is reshaping the payments industry. Three in particular will continue to influence the pace and path of transformation over the next few years: technological advances, shifting customer expectations and behavior, and regulatory initiatives.

Technological Advances. Improvements in cloud computing, sensors, and wireless communication are enabling the Internet of Things to become a reality. Cloud computing is powering software-as-a-service (SaaS), which is driving new consumer and merchant value propositions (such as easier financial management and integrated point-of-sale systems, respectively). Application programming interfaces (APIs) are revolutionizing data and service delivery among providers and their customers. In addition, biometrics are enabling quantum leaps in user-friendly authentication, and blockchain technology is increasingly being used to enable transactions. Further down the road, chatbots and virtual personal assistants will yet again alter the shopping value chain and payment experience. For example, a bot can enhance the purchase experience by providing information such as the name of a popular restaurant near the site of a concert for which tickets have just been bought.

Shifting Customer Expectations and Behavior. As fintechs and digital giants such as Apple and Google harness technological advances, consumer expectations are shifting and becoming ever more challenging. People now expect seamless and transparent end-to-end experiences that permit unprecedented levels of ease and convenience. Given the short product-development cycles of fintechs, it can be difficult for incumbents to keep up. At least one major survey in 2015 indicated a decline in US consumer satisfaction with mobile banking, with inadequate clarity of information and difficult navigation cited as specific pain points.

Customers are also demonstrating a willingness to adopt new form factors and payment types, although predicting the pace of adoption is challenging. While overall consumer response to the m-wallet launches of the “Pays” (such as Apple Pay, Android Pay, and Samsung Pay) has been tepid, there are examples of both strong early adoption and accelerated late adoption. Consumers in China, for example, have been enthusiastic adopters of new payment types such as WeChat Pay. Consumers in Europe have recently warmed to the use of contactless payments, following four years of only modest enthusiasm (other than in select countries such as Poland). In fact, growth in contactless cards in Europe spiked between 2013 and 2015, growing from less than 2% of card transactions at the point of sale (POS) to nearly 20%, suggesting that incumbents cannot rely on early take-up rates as indicators of medium- to long-term adoption.

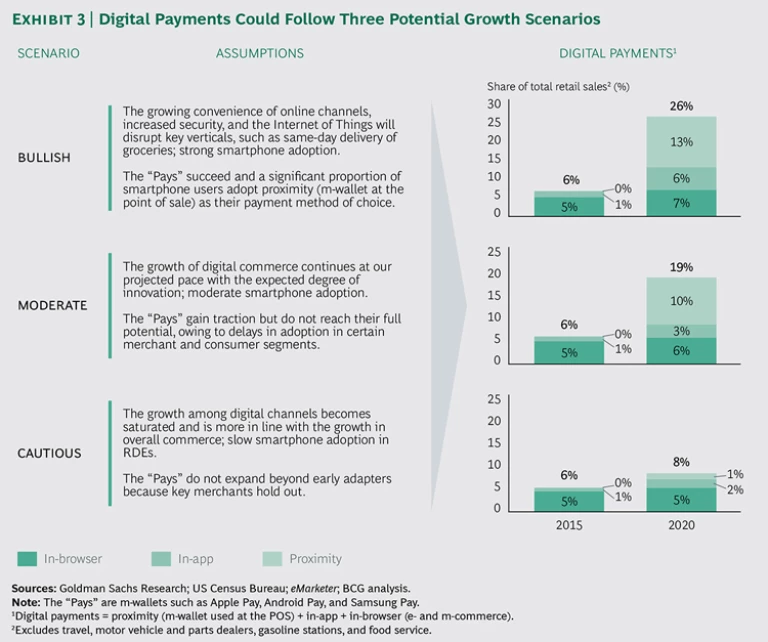

Further, consumers are increasingly embracing in-browser e- and m-commerce, as well as in-app purchases. Given three possible growth scenarios, BCG forecasts that all digital payments—in-browser, in-app, and proximity (such as the use of m-wallets at the POS)—will grow from around 6% currently to nearly 20% of total retail sales worldwide by 2020 under a moderate growth path, with the strongest rise recorded by proximity payments. (See Exhibit 3.)

The needs and expectations of commercial customers are also shifting. Corporate treasurers are increasingly being called upon to understand how technology can make their operations more efficient and effective. Many now expect banks to behave like tech companies and to assist them in enhancing their IT infrastructure.

Regulatory Initiatives. Of course, transformation in payments is being further propelled by regulatory initiatives aimed at driving financial inclusion, consumer protection, competition, and infrastructure improvements. For example, governments in RDEs are making a concerted effort to reduce their rates of unbanked consumers and to migrate cash transactions to e-payments. Domestic regulators as well as supranational entities are opening payments channels to nonbank competition through measures such as the second Payment Services Directive (PSD2) in Europe, the Unified Payments Interface (UPI) in India, and Measures for Payment and Settlement in China. And regulators in mature markets and RDEs alike are pushing for a faster-payments—also known as instant payments or real-time, low-value payments— infrastructure in order to allow for clearing, posting to the account, and payment confirmation within a matter of seconds (although settlement can be deferred). (See “Faster Payments: ‘Uber-izing’ the Order-to-Reconciliation Cycle.”)

FASTER PAYMENTS: “Uber-izing” the Order-to-Reconciliation Cycle

Imagine a seamless order-to-reconciliation process. First, a buyer sends an electronic purchase order to a supplier, who flips it into an e-invoice back to the buyer with a one-click pay button that initiates immediate payment and transmits rich remittance information back to the supplier. Welcome to the potential brave new world of the faster-payments infrastructure, which combines e-invoicing and payment with contextual data, and delivers instant fulfillment through immediate payment confirmation.

The momentum behind faster payments is accelerating as regulators—and to a lesser degree, the private sector—drive implementation. Nearly 75% of implementation has been government-driven, the primary objective being to build a next-generation platform, often including the use of ISO 20022, while at the same time reducing float. Eighteen countries, in both mature markets and RDEs, have already implemented some form of faster payments. Thirteen more, including Australia and the US, are in the process of adopting such a system. The next frontier could very well be cross-border functionality in high-transaction corridors (such as between the US and Canada and within the European Union).

Critical to the adoption of faster payments is the ability to add value by improving the end-to-end user experience and maximizing access. Value must be recognized by both businesses and consumers in order for providers to earn a reasonable return on their investment and be willing to innovate further. And while speed adds value, consumers are truly willing to pay only in a select number of time-critical situations. The greatest value-added will be generated by contextual data (such as rich remittance data) that travels with the payment, and by overlay services that could add tremendous value for business payments (such as Australia’s New Payments Platform, whose initial set of services includes fast payment, request for payment, and payment with attached PDF files).

Of course, value-added alone is not sufficient to drive adoption, because access must also be maximized (as several countries have pushed to achieve). For example, the UK has introduced a new access model that lowers barriers for smaller participants (such as technical-access and risk-management teams), and India is building its Unified Payments Interface (UPI) that will enable multiple payment-initiation channels to link to the faster-payments infrastructure.

Taken as whole, the above forces are driving the next phase of market evolution. And as the Internet of Things expands over the next decade, we will witness a multitude of new payment opportunities that reach far beyond the world of smartphones. These will involve watches and other devices, appliances, cars, and so-called purchase buttons such as the Amazon Dash Replenishment Service, already launched in the US. The Internet of Things will also introduce machine-initiated payments (such as a milk reorder sensor in a refrigerator) and, along with mobile apps, make “check-in”—the consumer simply logs in and makes a purchase, with no additional card or data entry required—a more commonplace way of transacting. In addition, an increasing share of payments may be made within social media networks, and payment initiation will be speech-enabled. Google’s Hands Free is a harbinger of things to come.

Dealing with New Dynamics

The current pain points and poor user experiences in many types of transactions make the payments business ripe for both further disruption by fintechs and digital giants and the emergence of new industry dynamics. But disrupters will not necessarily triumph over banking incumbents. Many that succeed will partner with traditional players—as have, for example, the “Pays” in C2B payments, as well as various e-invoicing and blockchain providers in B2B. Although there have been a few clear winners over the past 20 years—such as Alipay, WeChat Pay, PayPal, Square, and Stripe—these have been the exceptions rather than the rule.

Indeed, only a small number of current startups will generate the required network effect and scale to move forward on their own. As for the digital giants, despite their immense resources, the past five years have seen a few missteps—one common mistake being the belief that a technical solution will always resonate with the customer.

Of course, given that we are early in the crescendo, banking incumbents still have the potential to become digital maestros. They cannot wait too long, however. They must proactively either fight off or team with the fintechs and digital giants that are courting their customers and threatening to drain select revenue pools. They must develop robust strategic plans both to harness technological advances and to meet shifting customer expectations.

Acknowledgments

The authors particularly thank the following BCG colleagues for their valuable contributions to the development of this report: Romary Barbey, Kaj Burchardi, Pierre-Marie Despontin, Peter Dewey, Alex Drummond, Deepak Goyal, Ryan Hall, David He, Richard Helm, Sushil Malhotra, Maarten Peeters, David Ratajczak, Vinay Shandal, and Kuba Zielinski.

In addition, the authors are extremely grateful to core members of the BCG Global Payments Model team: Robin Berger, Nikhil Dangayach, Ankit Mathur, and Anubhav Mital. Raman Chawla provided helpful support.

Sincere appreciation also goes to Ashwin Adarkar, Lionel Aré, Brent Beardsley, Jorge Becerra, Trina Foo, Alasdair Keith, Sukand Ramachandran, Filippo Scognamiglio, Tjun Tang, Steve Thogmartin, Fabrizio Tiso, Andrew Toma, Juan Uribe, and André Xavier.

The authors are also deeply thankful to Laurent Mertens, Pedro Mullor, and Wim Raymaekers from SWIFT.

Finally, we thank Philip Crawford and Marie Glenn for their editorial direction and Janice Willett, our copyeditor, as well as other members of the editorial and production team, including Katherine Andrews, Gary Callahan, Angela DiBattista, Kim Friedman, Abby Garland, and Sara Strassenreiter.