The automotive industry is on the cusp of a major transformation driven by significant advances in automotive software. Historically, this software primarily served as an enabler for hardware sales. Today, the industry is entering a new era in which software takes center stage, transforming vehicles into “computers on wheels” and becoming a distinct value pool.

What does the transformation mean for the auto industry? After delving into the market context and emerging revenue pools, we present our five core beliefs about this impending shift and explain why “co-opetition” is essential for success.

Software Is Emerging as a Distinct Value Pool

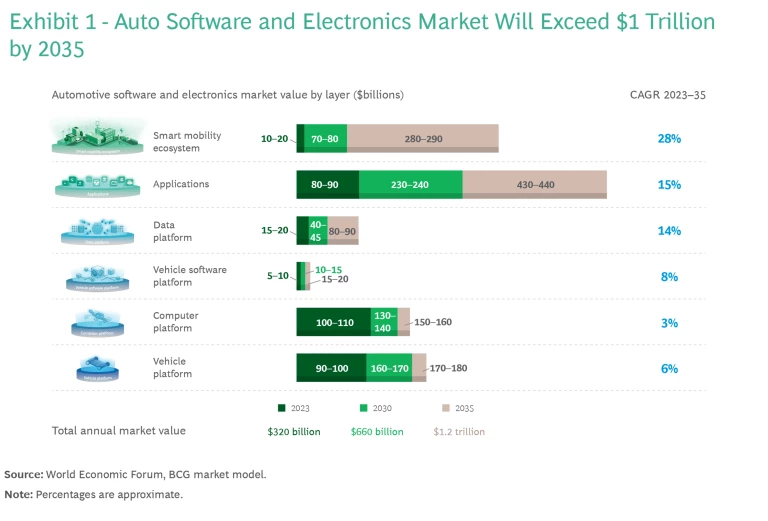

The overall automotive software and electronics market, including the supplier and consumer segments, is projected to grow to nearly $660 billion by 2030, more than doubling today’s size of $320 billion. (See Exhibit 1.) The supplier segment will grow to $411 billion by 2030 (8% CAGR) while the consumer segment will reach $248 billion (16% CAGR).

From 2023 to 2035, we expect the overall market to experience 12% annual growth, reaching $1.2 trillion. Of this amount, the software and electronics supplier market will account for $600 billion, representing 25% of the general automotive supplier market. The software and electronics consumer segment, consisting of revenues from software-based services marketed to end consumers, will account for $550 billion, representing 15% of the general automotive consumer market. A disproportionate share of the market growth will come from applications and the smart mobility ecosystem. (See “Under the Hood of Software-Defined Vehicles.”)

Under the Hood of Software-Defined Vehicles

Under the Hood of Software-Defined Vehicles

Vehicle Platform. Core mechanical platforms, such as sensors and wiring, that take information from signal input to initiate an action or response from the vehicle.

Compute Platform. Control units, semiconductors, and communications and connectivity infrastructure. In other words, the hardware that enables high-performance computing with minimum energy consumption.

Software Platform. The control center of the vehicle that orchestrates functions and operations of the vehicle, consisting of the operating system and middleware.

Data Platform. The information-gathering module that generates relevant vehicle performance insights and predictions through uninterrupted data collection about the driver, the automobile, and the use of AI and analytics, among other things.

Applications. Intelligent features and functions that provide a more animated, compelling, connected, and even autonomous driving experience.

Smart Mobility Ecosystem. The vehicle ecosystem that helps to interact seamlessly with other traffic participants, intelligent traffic infrastructure, electric vehicle chargers, smart grids, and smart homes, to name a few possibilities.

Source: World Economic Forum

Core Beliefs About the Auto Sector’s Transformation

We have developed five core beliefs about the market and industry landscape that will emerge from this period of transformative growth. The insights arise from our market model, which was developed through in-depth discussions with various leading stakeholders in the automotive software industry as well as independent research on each of the software layers.

1. Consumer Monetization Will Grow to $248 Billion by 2030

Monetizing consumers through features of the mobility ecosystem and consumer-facing applications offers vast potential for automakers. This includes, for example, selling consumers subscriptions to advanced driver assistance systems (ADAS). In general, we estimate that consumer monetization will grow from $87 billion in 2023 to $248 billion in 2030. The applications layer will drive the lion’s share of the growth, contributing $209 billion to total revenue.

The surge in consumer-generated revenue is primarily driven by two factors. First, the emergence of advanced driver assistance technologies is promoting significant revenue growth (see belief #2). Second, the adoption of subscription models for consumer-facing applications may increase a consumer's lifetime value (particularly related to advanced driver assistance systems) by 1.5 to 2.0 times compared to lump-sum or one-off business models. By 2030, we anticipate that subscriptions will be the underlying business model for 30% to 60% of the consumer-facing applications sold, depending on the region.

In addition, OEMs will see a significant upside from the increased loyalty of customers, who tend to stick with a brand once they adopt digital services and customized software. Beyond robust revenue growth, the consumer segment’s attractiveness originates from the promise of double-digit margins for certain software-enabled services.

To capitalize on the opportunities, automotive OEMs must adopt the practices that telecommunications and tech firms have honed over many years in delivering digital services, employing up-selling and cross-selling techniques, and resolving issues. They also must build technical infrastructure that can continuously update consumer-facing software. This requires offering over-the-air updates via the highest-performance computing platforms (see belief #4).

2. Autonomous Vehicles Will Contribute $305 Billion to Software and Electronics Revenues, the Largest Share of Growth

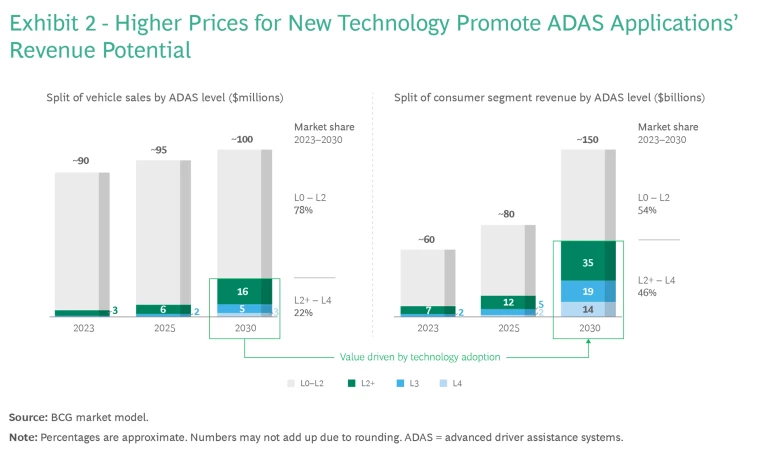

Assisted and autonomous driving technologies, often hailed as the “holy grail” of the automotive industry, will promote significant market growth. ADAS and autonomous driving (AD) systems represent the largest potential among all software-related features. We estimate that by 2030 they will contribute $305 billion in revenue along the entire software and electronics stack, including applications, data, and the software, compute, and vehicle platforms. Of this amount, the consumer segment will contribute $150 billion via the application layer. The supplier segment will contribute $155 billion along the entire stack.

Players that quickly master high levels of ADAS/AD will enjoy disproportionate benefits from consumer revenue. Autonomous vehicles with ADAS technology of Level 2+ or higher are projected to constitute only about one-fifth of the vehicle parc in 2030; however, they are expected to account for roughly half of ADAS/AD revenues in the consumer segment. (See Exhibit 2.)

Autonomous driving will not only serve as a significant additional revenue pool but also will be crucial to meeting customer requirements. There is high customer demand for autonomous vehicles—60% of middle-income individuals express a desire to own one. Meeting customer demand is particularly important for premium OEMs, as more than 70% of high-income consumers indicate a preference for autonomous vehicles.

3. Software Platforms Will Account for 2% of the Market, Requiring Scalability Across Automakers

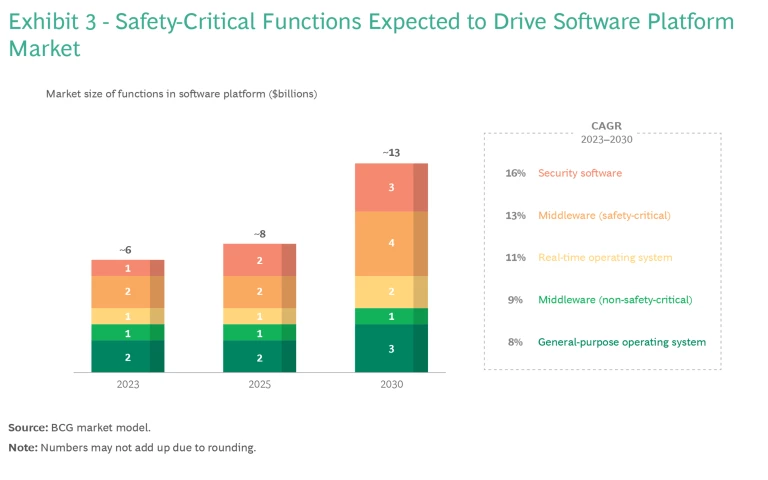

We project that the software platform market will represent only 2% of the overall software and electronics automotive market by 2030. It will have a CAGR of 12% from 2023 through 2030, growing to $13 billion. The main contributor to this growth will be safety-critical software, driven by the adoption of ADAS/AD systems. While safety-critical software currently accounts for only half of the market, it will account for 70% in 2030. (See Exhibit 3.)

There is a paradox at play for software platforms. This layer is among the most unstable parts of the stack, leading to millions of bugs and malfunctions in cars. Yet most OEMs still prefer to build software platforms in-house, rather than using external solutions from specialized providers. In these efforts, they rely heavily on open-source software (the related investment is not visible in our market forecast). In fact, many large suppliers and tech players have considered entering the market but are deterred by the low current value.

Industry participants should have a keen interest in developing a more sustainable, industry-wide solution. Scaling solutions across multiple players necessitates collaboration and standard setting, potentially involving neutral parties. Developer ecosystems form around such highly scaled solutions, further enhancing the value of the software platform through external innovations. These innovations ultimately generate value for end customers, reinforcing the platform’s importance. Developing an industry-scale platform and open sourcing could be the answer, but the challenge lies in identifying the best party to do this: an OEM, supplier, tech firm, or consortium.

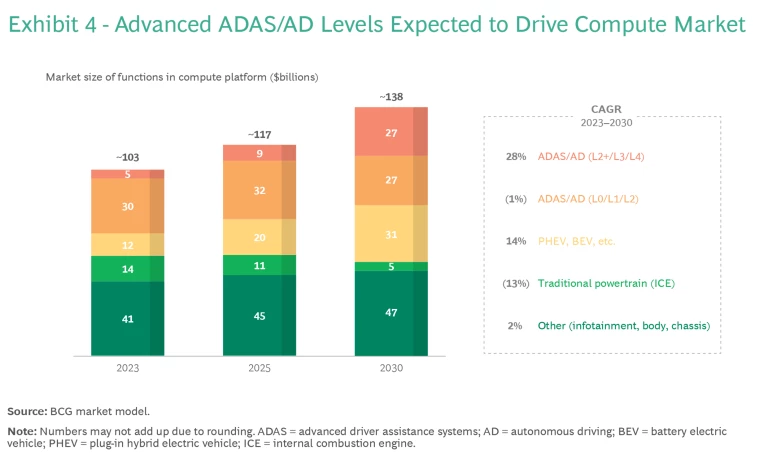

4. Compute Platforms Will Be a $138 Billion Market, with Assisted Driving and Infotainment Promoting Centralized Architectures

We estimate that the market for compute platforms will grow from $103 billion today to $138 billion by 2030, a 4% CAGR. The main growth driver will, again, be the adoption of higher levels of ADAS/AD (L2+, L3, and L4). This market will reach $27 billion in 2030, a 25% to 30% CAGR. The purchase of electric vehicles will also play a significant role, with a market size for electric powertrains of $31 billion in 2030. (See Exhibit 4.)

Growth in the market size for compute programs will be accompanied by changes to vehicles’ electrical and electronic (E/E) architecture. The auto industry will transition from electronic control units (ECUs) to domain control units (DCUs) and more centralized compute architectures over time. This shift promises several advantages:

- Reduced Complexity. The benefits extend to both the software stack and vehicle hardware (such as wiring).

- Lower Costs. Although the per-unit cost for zonal and central control units significantly surpasses that of ECUs, the overall expenses are lower because fewer control units are required.

- Enhanced Computing Power. Centralized computing provides greater computational capabilities to support ongoing software and application updates. As a result, it also facilitates the decoupling of software from hardware, enabling faster development cycles.

This transition will be in full swing by 2030, when we expect DCUs to contribute 40% to 50% of the market value. However, the application of DCUs across different domains will be uneven. We anticipate that, as of 2030, DCUs will primarily support features for ADAS/AD and infotainment—together accounting for 80% to 90% of the DCU market. Subsequently, DCUs and more centralized computation will be adopted for the powertrain, body, and chassis. As a result, while the overall compute platform market may only see moderate growth, certain segments, such as DCUs and system-on-a-chip, will experience above-average growth and cannibalize other subsegments.

These shifts underscore that it is more important than ever for semiconductor companies to be at the forefront of innovation. Recent strategic moves and collaborations focusing on the development of chips for higher ADAS/AD levels highlight the need to be innovation leaders in this rapidly evolving landscape.

5. Collaborating with Local Champions Is Essential to Tap into China’s Market, Surpassing $200 Billion by 2030

The growing need for customization in the automotive software industry is leading to the emergence of local champions. This is particularly true in China, where region-specific software solutions are increasingly essential to meet unique customer preferences and specific governmental requirements, such as those relating to data collection and sharing, high-definition map development, and ecosystem features.

Today, automotive software spending per vehicle in China is significantly lower than in Western markets. This is driven by two factors. First, adoption rates of key technologies trail Europe and the US. For example, 40% of vehicles sold in China in 2023 are still not equipped with ADAS/AD technologies, compared with only 25% to 30% in Western markets. Second, prices in China are 55% to 70% of European and US levels. As a result, the average consumer spending on automotive software in China today is less than $1,000 per new car sold.

By 2030, the dynamics will change. Not only will China catch up with Western markets in terms of ADAS/AD adoption, but price levels will surge to 85% to 90% of those in Western markets. Although we will continue to see lower adoption of subscription models in China, the overarching developments will result in average consumer spending of more than $2,500 on automotive software per new car sold.

In 2030, the regional Chinese automotive market is expected to be worth more than $200 billion, accounting for more than 30% of global growth. (See Exhibit 5.) The consumer and supplier markets will generate revenues of $80 billion and $125 billion, respectively. China’s global leadership in market growth will result from the rapid rate of AD adoption, the high share of BEVs, and sales volume exceeding 30 million cars. We expect robust growth to persist beyond 2030. The market’s considerable size will allow local players to reach a critical scale and form their own ecosystem within China, to some extent independent from the rest of the world.

The most recent Shanghai auto show demonstrated that Chinese OEMs and their supplier ecosystem have surpassed Western ecosystems in speed, quality, price, and functionality. Chinese start-up OEMs are innovating with dramatically faster cycles due to their capabilities in E/E architectures and software. They are likely to win a significant share globally soon. This may intensify geopolitical tensions and dependencies. For Western ecosystem participants, these developments underscore the urgency to understand their own strengths, collaborate in strategic partnerships, and find points of joint opportunity. The collaboration between Ford and Chinese technology company Baidu is an early example of such a strategic partnership.

Success in the Evolving Market Requires “Co-opetition”

The market values forecasted by our analyses underscore that no player can single-handedly conquer the software and electronics market. The various challenges—such as inadequate technological capabilities, lack of scale, limited access to end customers, and local market differences—are too formidable. Each of our five core beliefs is implicated. For example, to capture consumer revenue, OEMs and big tech players must combine capabilities and assets, such as end-customer access or experience in developing and deploying consumer-facing technologies.

Consequently, the industry is set to witness a surge in new partnerships and supplier deals, including collaborations between auto and tech companies, and between tech firms themselves. As their capabilities gain importance, we expect to see emerging tech players capture significant parts of the market. In 2030, up to $350 billion will be at stake, with traditional auto players and emerging tech players all seeking their share. In this context, companies will gain a competitive advantage by jointly creating offers that combine their capabilities and assets. This approach requires a blend of competition and cooperation, hence the term “co-opetition.”

For more insights into how new partnerships will reshape the industry, please see our joint publication with the World Economic Forum, “Rewriting the Rules of Software-Defined Vehicles.”

We anticipate that the market for automotive software and electronics will soar to $660 billion in 2030, more than twice its current size. The adoption of customer-facing technologies will contribute $248 billion in consumer revenue. Strong market growth in China will generate more than $100 billion in new revenue. To realize the opportunities, auto industry participants will need to combine their capabilities. Each participant brings strengths that are essential for competing in the new landscape, yet no player possesses the full set of necessary capabilities. The path to success thus requires a collaborative approach in which players join forces and collectively monetize software. The winners’ mantra is clear: “Co-opetition is the new competition.”