Sales growth of electric vehicles (EVs) in 2022 and the first half of 2023 have held pace with 2021. And there was more good news related to EVs throughout 2022. Passage of the Inflation Reduction Act in the US—heavily focused on climate change initiatives—prompted a next wave of investment announcements in EV supply chains globally, including over 500 gigawatt hours of new battery cell manufacturing capacity to be built outside of China, which has dominated EV battery manufacturing. The new CEO of Toyota, the world’s No. 1 automaker, stated publicly that “now…the time is right” to accelerate toward an all-electric future. And in some markets, mostly because of continued incentives, EV sticker prices achieved parity with comparable internal combustion engine (ICE) vehicles.

More positive developments have emerged in 2023. In just the past six months, the US Environmental Protection Agency (EPA) upped its 2030 EV market share projections to 62%, from a previous target of 50%, while the European Union (EU) formally adopted legislation that set a goal of zero carbon emissions from all new vehicles by 2035 and reshaped incentives for electric vehicle R&D and subsidies for purchases. Meanwhile, EV price competition has heated up as automakers in virtually every major global auto market jockey to capture the wallets of increasingly enthusiastic EV customers. And the first sodium-ion battery cars—potentially much less expensive to produce than lithium battery EVs—were announced for sale this year.

Arguably the most convincing evidence of the EV’s positive trajectory is that as dealer inventories return to pre-pandemic levels and new manufacturing plants reach higher levels of production, some EV brands still have extended backlogs. For instance, China’s BYD had 700,000 people in line for cars near year-end 2022; the Ford EV Lightning pickup truck had a three-year waiting list of about 200,000 customers as of February 2023; and Volvo sold out all its planned current-year EX90 output by April.

However, all these positive data points may be masking some important signals that should not be ignored. After a decade of dramatic decline, primarily due to scaling and innovation, EV battery costs rose in 2022. Geopolitical uncertainty has inflated electricity prices. And prospective customers are increasingly wary of pure battery electric vehicle (BEV) performance, in particular their range in cold weather and maximum charging speeds. Models that do not qualify for incentives—generally, the more expensive vehicles—are proving harder to turn over now that there are sufficient less-costly alternatives in the market. Also, there has been little improvement in eliminating the grid interconnection obstacles that hinder a faster rollout of charging infrastructure. In part because of these factors, mid-year new demand for EVs appears to be slowing as overall inventories grow and economic growth in China, the major EV sales center, slipped. New and better solutions will be needed to spur the next wave of sales.

The most troubling long-term factor pertains to something we highlighted in our prior year report, Electric Vehicles are Finding a New Gear. Raw material supplies, particularly lithium for batteries, will be insufficient to meet EV demand at current rates of investment. Given the seriousness of this looming challenge, BCG assessed how raw material shortages might impact the trajectory of EV market share. It turns out to be quite a bit—possibly reducing BEV global market share by as much as 6% by 2030, putting at risk some six million new EV sales.

These trends combine to create interesting juxtapositions of an EV future that has never been more certain—and more uncertain—at the same time. These include healthy EV sales, yet wide variances in popularity across models. Improved average total cost of ownership (TCO), but greater volatility in purchase prices and operating expenses. Automakers are more firmly committed to the EV transition, yet increasingly acknowledge they must navigate a chronic set of challenges. Regulations are tightening, but structural underpinnings, such as raw material and infrastructure availability, are not keeping pace. Navigating these near- and long-term countervailing trends successfully will determine the EV leaders and laggards.

A Solid, If Not Spectacular, 18 Months

Plug-in vehicles, which include BEVs and plug-in hybrids (PHEVs), accounted for 13% of global light-vehicle production in 2022, up 5% from the year before, while production of ICE vehicles was down 5%. Full hybrids (HEVs) and mild hybrids (MHEVs), which cannot run solely on electric power, gained only 1% market share. A strong case could be made that more buyers are jumping straight from ICE to plug-in vehicle ownership as opposed to stepping from ICE to HEV to plug-in.

Globally, plug-in sales rose by nearly 3.5 million vehicles to 10 million, equal to the combined totals of 2020 and 2021, which were record-breaking years in their own right. In 2023, after a good, but not great, first half of the year, EV sales are likely to hit 14 million. In short: the pace of EV adoption has on the whole remained robust.

BEVs account for over 75% of total plug-in sales and continue to outpace PHEV sales growth, having gained four percentage points of plug-in share since 2021. Plug-in range-extenders (EREVs)—a subset of PHEVs which have a small onboard gasoline-fueled generator to recharge the battery—have done particularly well among large SUVs. And EV upstarts dominate market share, with incumbent automakers feverishly playing catch up. Technology improvements and heightened competition are benefitting customers, who get access to better products and better prices.

China deserves much of the credit for the results of the last 18 months. Plug-in sales in China, already the largest by volume of any country in 2021, grew by 1.8 times. That amounts to about one in every four light vehicles sold in China and represents more than 50% of the global total.

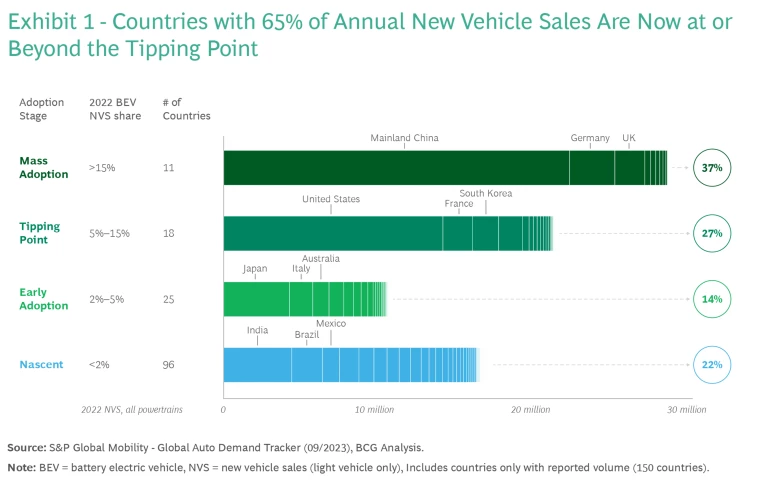

Still, 35 countries are now above 5% plug-in market share. (See Exhibit 1.) It is noteworthy that in 2022, developing economies with large light-vehicle markets, such as India, Mexico, and Brazil, topped the important 1% plug-in adoption mark.

There is volatility in month-to-month country-level numbers due to changing government subsidies, introduction of additional models to new markets, and timing of EV shipments. For example, in Germany plug-in vehicles accounted for 55% of all vehicle sales in December 2022 versus 31% of sales for the full year, an increase explained mostly by PHEV incentives expiring at the end of the year. In January, Germany’s plug-in sales fell to only 15%. And while BEV sales in Germany were strong in the second quarter of 2023, PHEV sales show no signs of recovery.

National regulations that ban sales of new ICE vehicles and policies that support removing ICE vehicles from the road continue to be implemented. Norway, long the leader in EV adoption, is set to implement the first nationwide ICE ban in 2025. Moreover, two large Norwegian cities, Oslo and Bergen, are now seeking state approval to ban gasoline-based vehicles in their city centers by the end of the decade. London has just expanded to all its boroughs a levy on cars that fail to meet Ultra Low-Emission Vehicle standards. This has led to near-term acceleration of EV adoption. Longer term, Hainan Island, with a population twice as large as Norway, became the first region in China to announce an ICE ban (slated for 2030). California has scheduled its ICE ban for 2035. And the EU finalized an agreement to outlaw most ICE vehicles by 2035, after making a compromise in March with Germany to allow newly registered ICE vehicles that burn only carbon-neutral fuels.

Meanwhile, to bolster EV sales in the US market, the Inflation Reduction Act put in place rules aimed at improving new and used electric vehicle affordability and provide incentives and tax credits to both EV buyers and supply chains. In April 2023, the EPA added additional muscle to these pro-EV policies through a proposal that calls for automaker fleet carbon emissions to be reduced by an average of 13% per year between 2026 and 2032.

Price Volatility

Even as plug-in sales rose, price inflation in 2022 took some of the luster out of the EV success story. These increases stemmed mostly from battery prices, which were higher for the first time since EVs emerged in 2010 on the heels of price spikes for raw materials. In 2022, the price of lithium carbonate increased by as much as 500% year-over-year on the spot market, and nickel spiked 250% after the invasion of Ukraine and on average was 50% higher for the year. The result: battery pack prices ballooned some 7%, according to Bloomberg New Energy Finance.

Global supply chain disruptions, energy market volatility, and economic uncertainties impacted prices of all types of vehicles. But due to battery price turmoil, EV sticker shock outpaced that of its ICE counterparts in 2022. Chip shortages remained particularly acute—and keenly impacted EV manufacturing capacity since they require more semiconductors than traditional cars. Still, despite multiple price increases during the year, EV profitability lagged.

Drivers, especially in Europe, also felt the first bite of rising electricity costs. For example, ESB, the state-owned electricity company of Ireland, announced a 50% hike in rates for EV charging earlier this year. Public fast-charging costs now exceed those to refuel petrol tanks on an apples-to-apples basis. The result is up to a $500 increase in annual operating costs for BEV drivers versus two years ago, challenging what was once a consistently attractive pillar in the EV cost-of-ownership narrative.

By comparison, through the first half of 2023, new EV prices have moved downward. The impetus varies from inventory surpluses due to a marked increase in total EV production capacity, to the entry into Europe of more affordable Chinese models, to relief from battery and semiconductor shortages that had plagued the sector. However, the durability of these price decreases is in question. At least in the near-term, acute price competition appears to have subsided. During the China Auto Forum in Shanghai in June, over 15 EV players signed a pact to maintain “fair pricing,” thereby protecting against a further race to the bottom.

In periods of price volatility, customers must grow accustomed to the realities of a dynamic EV marketplace.

New EV price volatility also offers a golden opportunity for prospective buyers of used EVs. In early 2023, year-over-year used EV prices on average fell nearly ten times faster than used ICE vehicle prices. Consequently, new EVs that sold at a premium in 2022 are losing their residual value quickly in the current environment. A long-simmering but increasingly relevant pricing question that could impact the used EV market in the future involves how readily automakers support these drivers needing battery pack replacements, as well as the costs of this repair.

Customers have advocated for more vehicle purchase price transparency for electric vehicles and a “same price for everyone” model, which is increasingly being delivered through direct-to-consumer and agent sales models. Moreover, through the Internet and social media, prospective customers have at their fingertips more information than ever on out-the-door prices, incentives eligibility, and which automakers are matching price drops of their competition. Yet in periods of price volatility, customers also must grow accustomed to the realities of a dynamic marketplace: seeing prices drop a month after they made a purchase or jump days before they planned to place an order.

Our Unconstrained View of the EV Market

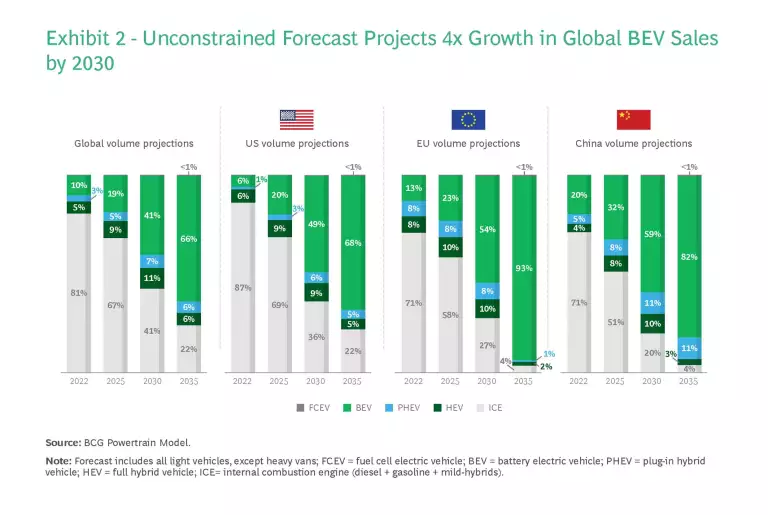

Given the substantial impact that battery pack prices have on OEM materials costs and, consequently, on consumer sentiment towards EVs—and considering that lithium and nickel availability may in fact fall short of demand for the next decade—we are providing two sales forecasts this year. The first is an unconstrained view: a world in which there is a sufficient supply of essential metals at relatively stable prices. (See Exhibit 2.)

This near-term forecast is largely unchanged from last year’s EV report. There is a modest reduction in our BEV projection for 2025—from 20% to 18%—driven primarily by downward revisions to European sales in our forecasts, the result of higher cost-of-ownership models in that region. Even with this slightly more pessimistic view, European BEV sales are still on a fast-growing trajectory, forecasted to increase from 13% of vehicles now to 23% in 2025. By 2025, global BEV sales should exceed one million monthly.

We believe that there will be new regulations supporting EV sales and manufacturing promulgated through 2030 and that incentives for EV purchases will remain in force until at least then in most regions. This supports our view that the EV market will maintain a strong and rising floor through the next decade. Note that in last year’s report, BCG assumed that incentives would be renewed or expanded; consequently, we baked their impact into our projection, resulting in similar 2030 BEV projections in this report (40%) and last year’s (39%). Moreover, we have strengthened our BEV market share projection for 2035 to 62% from 59%. That slight improvement comes from growing confidence that Chinese Tier 2 and Tier 3 cities will be able to support rapid electrification.

Another positive force on future BEV projections is India, which had one of the largest upward revisions in our forecast—a 50% increase in our 2030 sales forecast, from 600,000 to 900,000 vehicles, representing a 5-percentage point market share gain for BEVs in the country. India’s burst of growth is propelled by significant tailwinds on the supply side: OEMs have been ramping up their offerings in EV segments and there are large investments in EV supply chains initially through government grants and real growth in the two-wheel and three-wheel electric vehicle segments. But India is an outlier, as other developing economies are still approximately a decade behind the world’s largest four-wheel markets in percentage of EV market share.

Globally, hybrid shares will likely peak by the end of the decade—and sooner in Europe. Increasingly, mild hybrids are not viewed much differently than traditional gasoline and diesel vehicles, so we have collapsed them into the ICE category for simplicity.

Our confidence in a strong EV forecast is also buoyed by a series of EV-bullish automaker moves. By the end of 2022, eight of the top 20 automakers committed to ICE phaseouts of their product lines, keeping in step with a 1.5o C climate pathway. Among them, the Stellantis Chrysler nameplate will launch its first battery electric model in 2025 and achieve a 100% electric fleet by 2028. At the same time, last year we saw the debut of truly mass-market EVs outside of China, such as $30,000 base price vehicles in North America. In terms of earnings, Tesla net profits neared $10,000 per vehicle during the third quarter of 2022, an achievement that other EV and ICE makers would be thrilled to match.

In addition, a significant number of new battery deals have been inked, with announced capacity that technically exceeds expected 2030 demand. Many of these deals involve lithium iron phosphate (LFP) chemistry, which trade-off range and cold-weather performance for lower cost and a greater number of recharge cycles. And as batteries have improved, some EVs have crossed the 5 miles per kilowatt-hour efficiency marker, a significant threshold that equates to 160 miles per gallon equivalent (160+ MPGe) and further highlights the operating costs savings of BEVs compared to internal combustion vehicles and hybrids.

New technology innovations are occurring, but at a relatively slow pace. For instance, we are still waiting for mass-market and global rollouts of 800-volt batteries that will enable fast charging; bi-directional charging, in which vehicle energy storage can be used to power homes and devices; seamless charging systems like plug-and-charge; and battery swapping services to exchange a depleted battery for a new one instead of waiting around to recharge the vehicle. The introduction of sodium-ion battery-based vehicles is one of the most significant EV innovation breakthroughs of the past year, and solid-state battery announcements among major OEMs are expected in the months ahead.

Notably, our unconstrained forecast does not presume that all government goals are achieved by 2030. In particular, we exclude EPA targets, primarily because reaching 62% EV market share by 2030 in the US will be difficult when the current EV sales figure is only 8%. Based on our discussions with many US automakers, a 50/50 split between EVs and ICE vehicles is a more likely sales outcome for 2030. Our forecast assumes that OEMs that fail to meet EPA mandates will either pay fines for non-compliance or will attempt to buy offset credits from other automakers.

A Constrained View of the Market

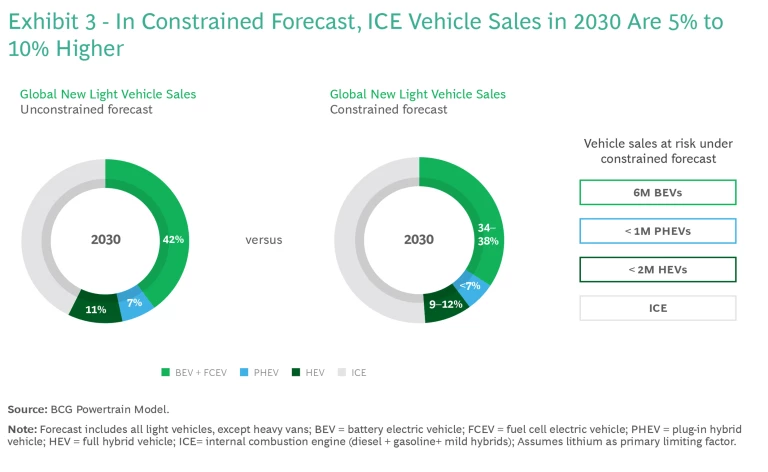

Our constrained forecast reflects an assumption that the supply of essential metals falls short of anticipated demand for EV batteries. In particular, lithium represents the true choke point given that it is present in all major battery chemistries used in vehicles. EV charging infrastructure is also at risk of shortage, but is less an issue if there are insufficient battery materials available to put more EVs on the road.

The impact of a lithium shortage on BEV sales in 2030 could be as much as 6 percentage points below our unconstrained view. (See Exhibit 3.) And in 2035, BEVs may only account for half of all vehicle sales, rather than approaching two-thirds. The constrained scenario highlights how much work must be done to ensure that the battery supply chain is sufficiently healthy.

For lithium stocks to keep up with expected demand, supply must expand at a 27% compounded annual growth rate (CAGR) between 2020 and 2025, a pace faster than ever before. In the subsequent five years, CAGR would have to increase another 15%. Working against that accelerated rate is a lack of new lithium production projects in the current pipeline, particularly since their exploration, permitting, and financing can be a decade-long process.

Although lithium is plentiful in the earth’s crust and lithium producers made record-breaking profits in 2022, new investments in projects have lagged chiefly because lithium prices are volatile and have spiked before, only to tumble again. Given that instability, investors are wary about risking capital on a commodity that is non-diversified—more than 90% of the supply is used for batteries—and that generates revenue at orders of magnitude smaller than copper, iron, silver, gold, nickel, and other traded metals.

The availability of battery-grade nickel is also a challenge, primarily from an environmental perspective. There are limited known reserves that meet the standards required to make sure that the transition to EVs does not exacerbate human impacts on land, freshwater, or the atmosphere. The conversion process of some nickel ore types is greenhouse gas intensive—consuming significant amounts of energy, much of it from coal—and some recent nickel mining projects have led to widespread deforestation. Also problematic, nickel production is not geographically diverse; Indonesia accounts for over 45% of annual global production.

As for other metals used in EVs, natural graphite is in short supply currently but can be supplemented by synthetic graphite production. Cobalt availability, which had been a concern previously, now appears to be stable, although social concerns remain about poor labor practices at mining operations. Manganese is in ready supply. And the range of other metals—copper, rare earths, sulfur, and fluorspar—will need continued investment to meet demand.

EV market share will be determined by the degree to which automakers lock in a sufficient supply of battery materials.

It is becoming increasingly clear that EV market share will be determined by the degree to which automakers lock in a sufficient supply of battery materials. To do this, some OEMs and battery cell manufacturers are taking stakes in mines and forming joint ventures with companies that can recycle materials for new uses.

Some governments, viewing EV production as essential for national security and global economic standing, especially in the wake of climate change, are enacting policies to support their automotive sectors by helping to expand battery supply chains. The goal is to create jobs while reducing dependency on other countries for critical materials and supplies. Provincial and local governments are getting in the act, too—pledging financial, worker training, and infrastructure support to encourage EV makers and suppliers to set up shop in their borders. While these efforts should take some pressure off supply chains, Chinese companies are currently better positioned to withstand a supply crunch. China has a significantly more developed domestic battery supply chain, and the large amounts of Chinese capital invested in overseas metals production could be used to steer materials to the home country as needed.

BCG believes that by 2035 over $100 billion in capital investments in lithium extraction and refining will be needed to provide sufficient supply for the transition to EVs. Including other battery materials and the processing necessary to use them for battery components, such as cathodes and electrolytes, over $400 billion in capital will be required upstream of cell manufacturing. Given current committed funding, BCG estimates more than half ($200 billion) still needs to be activated by 2035.

Emissions Impact of Each View

In the unconstrained view, BEV vehicles in operation will grow from 20 million today to 450 million by 2035, which would amount to about one of every four vehicles on the road. BEVs will overtake ICE vehicles on average miles travelled per year by the end of the 2020s due to greater use in ride-sharing and weekly commutes. And ICE vehicles will continue to demonstrate improved fuel efficiency, further muting their carbon impact. As electrical grids become markedly greener, the well-to-wheel impact (from mining activities through production and charging) of BEVs will further reduce the automotive sector’s emissions.

Still, global light vehicle emissions will remain stubbornly constant between now and 2035 due to the expectation that the number of vehicles in operation will continue to grow. On the positive side, some countries, chiefly in Europe, will have long since reached peak vehicle emissions. There will be less immediate emissions improvement in China, despite a heavy push to market EVs, both because of the sheer growth of all types of vehicles sold in the country and the relatively limited use of renewables (and heavy use of coal) in electricity production today. In developing regions, such as in Africa, the peak of emissions will not occur until at least 2040, given likely robust new vehicle sales. More solutions are needed to rapidly chart a path to net-zero.

The constrained view is, of course, a more disturbing picture. With fewer EVs available each year—leaving drivers no alternative but to purchase a new ICE vehicle—additional emissions from vehicles on the road could be on the order of 50 megatons annually for another 10 to 20 years.

Staying on a Positive Supply Path

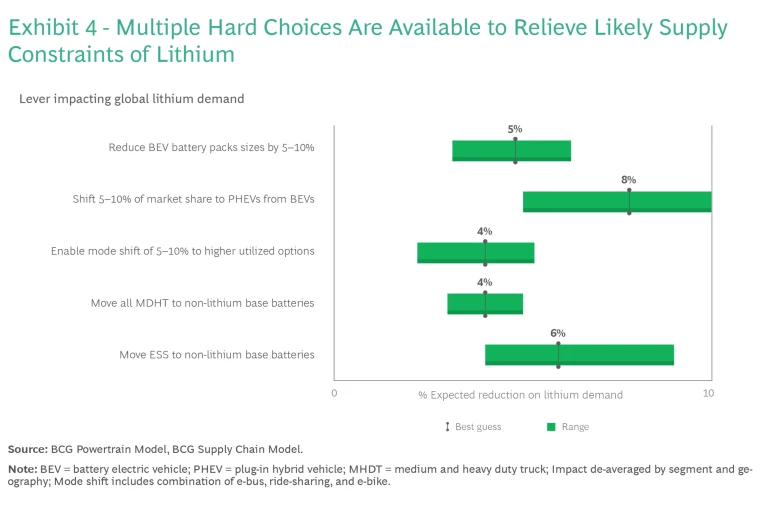

It is critical that the unconstrained forecast ultimately bears out. But it will take a lot of work to get there. For instance, there are several potential solutions to relieve battery material supply constraints. (See Exhibit 4.) For lithium, these could include:

- Offering more choices in battery sizes, including smaller kilowatt-hour (kWh) capacities

- Increasing vehicle efficiency and establishing additional efficiency targets (for example, kilometers per kWh) to calm range anxiety

- Prioritizing faster charging technology (for example, via use of silicon anodes) and charging infrastructure

- Focusing on hybrids (HEVs and PHEVs) versus going all-in on BEVs

- Steering stationary (battery) storage to sodium-ion alternatives, replacing lithium

- Steering heavy-duty, long-haul trucks to hydrogen-based solutions

- Promoting a shift from individual drivers to fleet ridership (primarily ridesharing or buses)

- Increasing circularity (collection rates, recycling yields, and return to battery-grade materials)

Several of these solutions will require cooperation among automakers and battery cell suppliers. Importantly, there will have to be significant innovations to rapidly decarbonize the EV ecosystem—from supplier through manufacturing—and to improve price stability of the metals. Both are essential to attract more investments to the EV supply chain.

Still, it will take time before some of these alternative options are ready to be widely adopted. For instance, hydrogen-based trucks are more expensive today than battery-based, and in most places, hydrogen fueling infrastructure is non-existent. And sodium-ion is still a nascent technology, so battery players may prefer lithium-ion for years to come, provided they can secure cost-competitive lithium-ion cells. Tradeoffs abound.

Action Steps for the EV Ecosystem

Beyond collaboration, individual sectors of the EV ecosystem have their own to-do lists to ensure that each can manage uncertainty, gain competitive advantage, and contribute meaningfully to the EV transition.

Automakers. Win with strategic sourcing—aiming to get it right on materials mix, geographic mix, contract types, and circularity. Continue to choose your EV portfolios wisely so that you can fund the journey from ICE to BEV. Quickly iterate on products, pricing, and business models related to EVs and EV charging to learn and adapt.

Tier 1 Suppliers. Determine which OEMs are likely to lead versus lag on EV sales. The speed and success of your own EV transition depends on being able to identify and prioritize the winners.

Mining and Processing Companies. Develop new projects (and do so with a low-carbon focus). To attract investors, target geographic diversification, partnerships that build downstream ecosystems, and a more agile supply chain to reduce price volatility.

Battery Cell Manufacturers. Innovate using new materials and processes, challenging the belief that producing automotive-sized cells is a capex-intensive endeavor and that quality issues are time-consuming to identify and correct.

Governments. Develop and implement an emergency-like response. In particular, enable rapid permitting for mining projects (while ensuring that projects meet environmental and social responsibilities) and support the expansion of electrification and sales of all types of EVs through subsidies and R&D support. Medium-term targets, sans China, are increasingly unrealistic without more comprehensive support of both supply (industry) and demand (consumers).

Investors. Get in the game now. There are huge opportunities opening in mining, recycling and circularity, alternative energy sources, and new EV designs and electrified solutions.

Individual OEM market share is likely to be quite different in 2030. EV-focused automakers, led by BYD and Tesla, have already captured 30% of the BEV market and 3% of overall auto sales. Traditional ICE leaders will need to grow their current BEV sales by anywhere from 6 to 100 times by 2030 to achieve the same market share in BEVs.

There are many factors that determine who will be on top and who falls from the perch by 2030. The driver of market success that we will be watching most closely is the ability of OEMs and their partners to secure raw materials, execute on battery cell production, and have a ready supply to meet demand. The recent chip shortage is a timely analog. But any market share gained through EV battery supply chain excellence could prove even more durable.