To prepare for the emergence of software-defined vehicles, the World Economic Forum in collaboration with BCG launched the Automotive in the Software-Driven Era initiative. This initiative aims to unlock the potential of cross-industry and public-private collaboration to help improve safety, inclusivity, sustainability, and overall system resilience in the automotive sector. To date, the initiative has engaged over 30 leading companies from the automotive, new mobility, and tech industries to join the effort.

It has become almost routine to hear about the remarkable automobile transformation occurring before our eyes. Much of the discussion today has to do with electric vehicles (EVs) entering the mainstream and some of the new sensor-based safety features becoming increasingly standard in new cars. As this transition accelerates—ultimately resulting in self-driving vehicles—there is another, often unnoticed way to describe this radical change: Cars are becoming tech products. And with this shift from analog machines to software-defined vehicles (SDVs), the boundaries between the automotive and tech industries are blurring.

The magnitude of change that the software-defined vehicle represents cannot be overstated. They can benefit individuals and society at large—and will alter the auto industry. Upwards of 90% of traffic deaths could be prevented through SDV autonomous driving (AD) functions, which will also provide disabled people with the independence to travel by car by themselves. While AD functions control the vehicle, commuting drivers have the liberty of making dinner or vacation plans or watching recaps of last night’s game. A once static machine will be managed, maintained, and improved daily by invisible software updates. Innovation will be experienced on a rolling basis, as people no longer must wait to purchase a new car to enjoy new features.

For automakers and tech companies, both of which are essential for the successful evolution of software-defined vehicles, the challenges are noteworthy. Automakers carry the burden of a hundred-year-plus legacy building traditional internal combustion engine vehicles with decade-long innovation cycles. And tech firms are quickly learning that, despite their significant skills, building a vehicle is a much more complex undertaking than making a mobile device. To come out on top in the SDV environment, automakers and technology firms will have to change their mindsets substantially—from proprietary operations focused on insular profit growth to joint value creation businesses based on cross-industry collaboration and strategic partnerships.

The emergence of software-defined vehicles will create over $650 billion in value for the auto industry by 2030, making up 15% to 20% of automotive value. OEM revenues from automotive software and electronics will grow nearly three-fold between now and 2030, from $87 billion to $248 billion, according to a BCG analysis of SDV growth. And the supplier market for automotive software and electronics will nearly double, from $236 billion to $411 billion.

These gains will be driven by the confluence of several trends that are already being felt. Among them:

- Willingness to pay for additional functionalities. These include autonomous vehicles (AVs) and connectivity capabilities, as well as in-car subscription-based services.

- Demand for sophisticated, high-value vehicle electronics hardware. This includes computing and safety equipment, among them, digital control units and sensors.

- Growing regional sales for EVs and AVs in big markets, such as China. It is estimated that by 2030 as many as 26% of automobiles sold will have Level 2+ and above automation (conditionally, highly, and fully autonomous vehicles).

Based on our research and extensive experience in the automotive and tech industries, we have identified five essential insights to help companies successfully navigate the shift towards software-defined vehicles.

Insight #1. The industries’ SDV transformation is overshadowed by complexity, and cross-industry collaboration will play a critical role to regain scale.

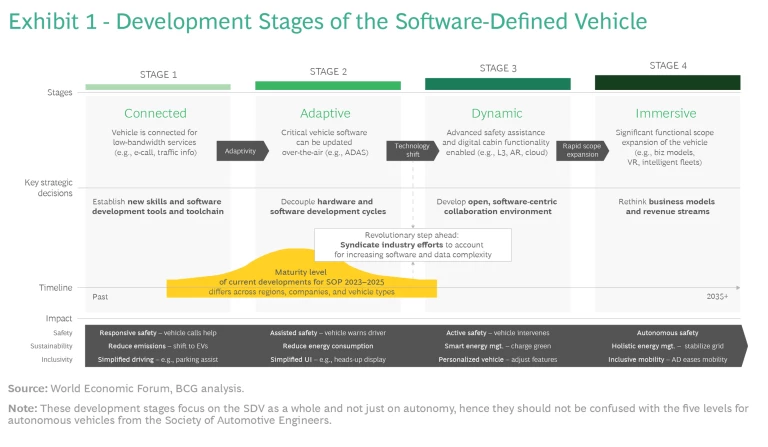

In each phase of the SDV’s evolution, complexity will increase, and innovation will come at a premium. Automotive and technology companies must partner to unlock the benefits of scale and speed-up the transition to software-defined vehicles. Equally so, the ground is still shifting, and determining which companies and sectors will add the most value and reap the most rewards will be an ongoing industry challenge. With each stage of SDV development, the dynamics will change, and the industry will almost certainly look a lot different from today. To provide clarity for strategic decisions going forward, the World Economic Forum’s Automotive in the Software-Driven Era initiative, launched in collaboration with BCG, envisions four development stages for the SDV. (See Exhibit 1.)

- Stage 1 – Connected: Low-bandwidth services, the beginning of EV penetration, and simplified safety features, such as parking assistants. This stage of adding isolated technology- and software-based features has been underway for a few years and is coming to a close. To a large degree, automakers, with nascent support from tech companies, have led the initial advances in this stage.

- Stage 2 – Adaptive: Vehicle software, such as advanced driver assist systems, and digital cabin features can be updated over-the-air. This stage is just starting to come into view and is already creating the initial tech sector breakthroughs and partnerships between tech and automotive companies. This stage is also characterized by many companies adopting “do it yourself” approaches, resulting in diverging development programs that create technological incompatibilities instead of standardization, thereby driving integration complexity.

- Stage 3 – Dynamic: This stage is a few years away, but is technologically advanced. Vehicles that look more like AVs hit the market with advanced safety and autonomous driving features. Software innovation is focused on new architecture concepts that, among other things, allow consumers to better customize their vehicles with the programs and features they want and be able to update functions within minutes while they are driving. Both automakers and tech companies will need to prepare for this stage by adopting efficient pathways for technology development and innovation.

- Stage 4 – Immersive: The final stage is marked by significant expansion of the functional scope of a vehicle, with full self-driving features, virtual reality, and AI, among other new technologies, creating new usage opportunities and revenue possibilities. The SDV seamlessly integrates into an individual’s daily life, monetizing time spent while driving with various subscription and on-demand services. For companies in the ecosystem, revenue sharing, micropayments, and other joint arrangements will be adopted to simplify and scale rolling out software updates, customized content, and menus of functions and features. At this point, the nature of SDV partnerships and decisions about prioritization and product differentiation will be a strategic question rather than a technical one.

These four stages are a continuum. Positive impact and innovation increase with each stage, driving improvements in sustainability, safety, features, ecosystems, and inclusivity.

Today, most vehicles on the road are barely connected, and travelling the distance between legacy automobiles and SDVs will be a significant challenge for both automotive and tech companies. Getting started now by figuring out their suitable role in this new environment is crucial for both industries. In the past, partnering has been limited as most companies were trying to develop individual solutions to occupy potential control points on their own. In future stages, technology complexity and ecosystem dynamics are making partnering and cross-industry collaboration essential to scale, improve safety, and meet customer demands.

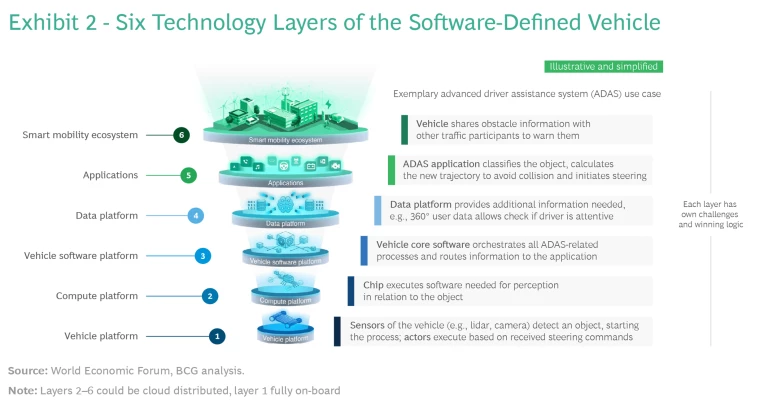

Insight #2. Collaboration needs to start on the basis of a shared, cross-industry tech stack taxonomy.

Aligning on a joint cross-industry understanding of the parts, features, and functions of a software-defined vehicle must be the first step towards efficient and shared innovation. To enable automotive and tech companies to speak the same SDV language, the thirty-plus automotive, technology, and mobility industry leaders taking part in the Automotive in the Software-Driven Era initiative created a six-layer model of a software-defined vehicle. This can help provide structure in future developments and collaborations. (See Exhibit 2 for examples of the activities that each layer supports, from bottom to top.)

- Vehicle Platform: Core mechanical platforms—such as sensors and wiring—that take information from signal input to initiate an action or response from the vehicle.

- Compute Platform: Control units, semiconductors, and communications and connectivity infrastructure. In other words, the hardware that enables high-performance computing with minimum energy consumption.

- Software Platform: The control center of the vehicle that orchestrates functions and operations of the SDV, consisting of operating system and middleware.

- Data Platform: The information-gathering module that generates relevant vehicle performance insights and predictions through uninterrupted data collection about the driver, the automobile, and the use of AI and analytics, among other things.

- Applications: Intelligent features and functions that provide a more animated, compelling, connected, and even autonomous driving experience.

- Smart Mobility Ecosystem: The vehicle ecosystem that helps to interact seamlessly with other traffic participants, intelligent traffic infrastructure, EV chargers, smart grids, and smart homes, to name a few possibilities.

Beyond these layers, it is essential to have a development platform for creating, deploying, and maintaining the underlying software. This includes an integrated common toolchain for software development, testing, and validation, as well as continuous integration and delivery.

Insight #3. Industry alignment forges ahead with interoperable platform development, driving industry profitability.

In the first stage of the transition to SDVs, automakers often tried to do it alone, relying on their own in-house R&D to solve new technological challenges. Aspects such as new infotainment and digital safety features often were seen as potential proprietary selling points for their vehicles. However, this approach resulted in redundant efforts across the industry, with little scaling potential. OEMs had hoped to differentiate their vehicles with their own “operating systems” but instead increased development complexity and costs as they had to maintain distinct versions for individual vehicle series and update the software frequently.

This approach is already being phased out, as it has become increasingly clear that differentiation opportunities do not necessarily arise from specific vehicle features, but rather in how seamlessly these new features work and how well they integrate with driver expectations. To achieve these goals, new platforms, often developed by technology-oriented companies, must be implemented in all layers of the SDV—playing a role in everything from large ecosystems to autonomous and connected driving solutions. Purchasing a software platform or collaborating on building a platform can be substantially more efficient and far more scalable for auto OEMs than in-house development. As the ecosystem’s long tail extends, the quality, quantity, and financial returns of features and services are boosted as well. Ultimately, automotive and technology companies must understand the dynamics behind vehicle-based software platforms in each layer and identify where they best fit in this development environment.

Viewed broadly, the benefits of a scaled platform include:

- Reduced software R&D and maintenance costs.

- Lower error rates in software integration.

- Faster deployment of new functions that improve updates of critical safety features and user experience.

- Simplified integration with other platforms that people use inside and outside of the vehicle.

For scalability, platforms in the different SDV layers must be highly flexible and able to integrate with platforms on other layers. To do this, technology architectures must be built around a set of industry-wide principles that enhance scale despite a competitive, non-standardized environment. (For a possible strategic pathway for developing a vehicle software platform, see “An Efficient Approach for Developing a Vehicle Software Platform.”)

An Efficient Approach for Developing a Vehicle Software Platform

Several characteristics mark the updated approach to vehicle software platform development. First, virtual testing software in the cloud deployed over-the-air during runtime allows faster, more seamless updates. Second, a standardized, modular architecture enables better fault isolation and software re-use. Third, an integrated, common toolchain for software development—adopted by the auto industry and its technology partners—speeds software development from feature identification to deployment and eases collaboration and co-creation across partners. Ultimately, the vehicle software platform needs to be interoperable with other layers, so that the code runs and successfully meets performance requirements on different types of chips and can be integrated with multiple clouds.

Several cross-industry initiatives have formed to accelerate the development of a vehicle software platform, such as SOAFEE, Eclipse Foundation, and the Connected Vehicle Systems Alliance (COVESA). Coordinating among the initiatives can help to maximize the synergies and impact of each initiative. For an in-depth discussion of scalable and interoperable vehicle software platforms, and required coordination, see

Ultimately, cross-industry collaboration focused on industry-wide advancements—instead of individual company value-capture—will speed-up the establishment of modular and interoperable platforms. Given the importance of interoperability across software platforms, accelerating collaboration among automotive companies themselves and with technology companies is crucial. However, this is not a comfort zone for most OEMs and even for many tech companies that are searching for their role in the SDV ecosystem. One way to overcome hesitance to collaborate is through open-sourcing efforts to develop templates, platform standards, and application programming interfaces (APIs) for integrated platform implementations. On the one hand, the good news is that there are an increasing number of initiatives involving automotive and technology companies, such as the Scalable Open Architecture for Embedded Edge (SOAFEE) and Eclipse Foundation, that design open-source architectures for automotive applications. On the other hand, efforts are not aligned with each other, as highlighted in the World Economic Forum’s Unlocking Safety and Innovation in Vehicle Software briefing paper.

Insight #4. Diverging regional innovation pace, user realities, and regulations require regional collaboration clusters.

As the role of technology in vehicle design and production becomes more prominent, the ability to scale innovation and manage supply relationships globally will become more essential than ever. Automakers will have to create strategies for supply chain resilience, ensuring that manufacturing and partnerships are not disrupted by trade restrictions, geopolitical differences, or natural disasters.

Virtually every layer of the software-defined vehicle can be influenced by regional differences. This requires companies to set up targeted approaches for developing products, platforms, and partnerships based on the rules of the major markets that they are operating in as well as the features and interfaces that local consumers find most attractive.

Perhaps the most illustrative example of distinct regional differences is the Chinese market, where user needs and dominating ecosystems vary substantially from those in Western countries as do payment standards and product or feature licensing rules. These regional distinctions can impact both SDV design and the choice of—or need for—partners.

Insight #5: To thrive in a partnering-first world, organizations need to build their internal and external collaboration muscles, anchored in their operating model.

With rapid innovation and frequent new features and services a hallmark of SDVs, new collaboration models are required to manage both the increasingly technical aspects of vehicles and greater levels of co-opetition. Partnering is becoming a super-skill even as the nature of partnering changes. Players in the automotive industry will have to (1) cultivate the capabilities to manage technical complexity via co-development, (2) connect to regional ecosystems, and (3) efficiently integrate platforms.

The specific ways that a raft of new partnerships will alter the contours of the automotive industry are hard to overstate—as are the skills that companies will have to gain to successfully collaborate. These industry shifts can be described in four distinct ways:

- Fewer intermediaries. From multi-tiered supply chains to more direct, one-on-one relationships between automakers and technology companies to implement, for instance, a full software platform.

- Reduced fragmentation. From a wide array of suppliers, each targeting a small number of parts and components for dedicated models, to more concentrated partnerships focusing on software and platform architecture across SDV layers and models.

- Longer timeframe. From clear termination schedules for supplier relationships, linked to the vehicle lifespan, to locked-in, longer-term commitments for ongoing software development decoupled from individual models.

- Stronger collaboration. From strictly transactional partnerships to relationships that share revenue, risk, insights, and knowledge.

To adapt to the SDV partnering-first environment, companies must approach joint efforts using different criteria than in the past. Since these relationships are likely to be long-term, high-profile, and deeply collaborative, companies need to check their cultural and strategic alignment. This will help ensure a mutually beneficial environment where quality standards and employee values match. Partnerships should be designed as being among equals, even while unambiguously portioned to establish clear ownership of deliverables and responsibilities. Moreover, to build successful partnerships, all key functions of the organization must be involved. (See Exhibit 3.)

The automotive world is in a radical transformation, in which two completely different industries—automotive and tech—are rapidly merging. With a massive opportunity in sight, the industry is also facing a huge challenge. In the midst of rapidly advancing technologies, shifting industry logic, changing customer demand, and geopolitical fragmentation, complexity is growing exponentially while scale is vanishing.

As we transition to the more developed stages of the software-defined vehicle, industry-wide, interoperable platforms are essential to simplify manufacturing processes and rebuild scale. Forging alliances and partnerships across all layers of the vehicle will be crucial. Cross-industry collaboration can create a fast track for developing cutting edge tech solutions or integrating platforms efficiently. In this new, partnering-first world, collaboration across organizational and industry silos becomes the new super-skill. The Automotive in a Software-Driven Era initiative can serve as a platform for industry leaders to jointly embrace and implement the transformation towards the software-defined vehicle.