Ask executives about their company’s prospects for future sustainability, and you’ll hear considered strategies for net zero and nature-positive ways of doing business. It’s a remarkable shift in just a few years among investors, corporations, and policy makers, as well as in consumer expectations, and it has created demand for new energy sources, products, services, and processes. But if you press those same executives to name the most critical elements of their sustainability transition, you’re likely to get a questioning look.

Even though most businesses see the need for sustainability in their business plans, they aren’t wrestling seriously enough with the implications of that need. A prime example here involves what we call “sustainability scarcity”—instances of scarcity that emerge from and are deeply connected with the sustainability transition. Such scarcity is already emerging in certain areas and will only intensify as the transition to sustainable practices accelerates across a greater number of industries. Every business faces the threat of potential scarcity at different points along its value chains, whether it is aware of them or not.

For example, in April 2023 the Organization for Economic Cooperation and Development (OECD) raised the alarm on potential resource scarcity stemming from a surge in export taxes on raw materials that are critical to the green energy transition. The OECD reports that export controls imposed by extracting countries on resources such as lithium and cobalt have increased fivefold over the past decade, just as demand is exploding. That change in the economic landscape has prompted the US to try to incentivize domestic production of rare-earth magnets through tax credits to ensure that its companies have access to them.

Addressing these sustainability scarcity risks strategically, however, can enable forward-thinking businesses to flip them into a competitive advantage. Not only can such companies make better decisions about their transition pathway and mitigate the most critical risks they identify (for example, by securing their future supply needs earlier than competitors do), but also they can generate new revenue streams.

Stay ahead with BCG insights on climate change and sustainability

Beyond the Headlines

In talking with executives across industries, we’ve found that most businesses are still slow to recognize where, how, and when issues related to sustainability scarcity will affect—and possibly derail—their transition. This is, in part, because these points of vulnerability are often buried deep within companies’ extended supply chains or arise from their industry’s transition toward sustainability.

Finding workable and lasting solutions goes far beyond simply identifying the raw materials or components needed to make batteries to power electric vehicles. The infrastructure needed to generate renewable energy, for instance, requires huge amounts of copper: nearly 5 tons of copper go into a single 3-megawatt wind turbine; and new offshore wind installations can require up to 10 tons of copper per megawatt of productive capacity. The resulting spike in demand for the mineral has contributed to scarcity in developing new capacity for wind power generation—a clear risk to sustainability. A less obvious factor in future copper availability is uncertainty related to continuing reliable market access, which depends to a large extent on the internal political stability of key copper-producing countries such as Peru.

That sort of supply chain risk is harder for companies to gauge accurately. In 2022, readily available warehouse inventories of all key metals on the London Metals Exchange hit a 25-year low, due in part to constrained supplies, but also to various demand uncertainties including recessionary threats and evolving demand for certain key metals. And it’s not just natural resources that are limited; shortages in skilled labor can also lead to sustainability scarcity. For example, climate-smart farms in UAE and Egypt lack skilled workers to operate the high-tech greenhouses used to produce food in inhospitable climates. Likewise, the US has too few workers trained to meet the rapid increase in demand for retrofitting HVAC with more energy-efficient heat pumps.

Businesses need to bring an analytical approach to the task of understanding how to implement the pathways of their transition and identifying where areas of scarcity may develop in their new ecosystems and value chains. To illustrate how such a systematic approach works on the ground, we’ll trace the journey of a dairy cooperative business. Although this example involves a relatively straightforward transition story, it is still useful for companies that face transitions of varying degrees of complexity.

A New Approach to Addressing Sustainability Scarcity

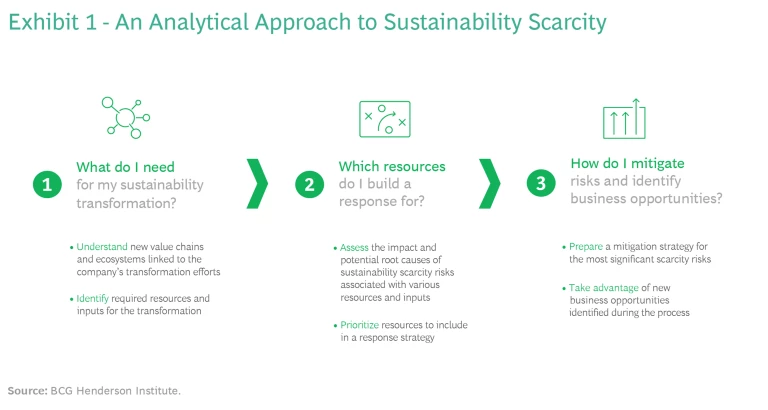

The first step for a company to take is to answer three big questions that will enable it to make better, more informed decisions (see Exhibit 1):

- What do I need for my sustainability transformation?

- Which resources do I build a response for?

- What should I do to mitigate risks and identify business opportunities?

To answer the first question, leaders must understand the value chains and ecosystems in which their company operates, anticipate the ways in which they are likely to evolve, and identify the resources required to enable their sustainability transition. To address the second question, they must assess the sources of potential scarcity and prioritize the sustainability risks they find throughout their often-changing value chains. And to resolve the third question, they must respond by mitigating or exploiting these scarcity risks.

Understanding Changing Value Chains and Ecosystems to Identify Required Resources

Most companies, including forward-thinking ones, are still in the early stages of their sustainability transition. As a result, they may not yet fully understand the dynamics of the value chains and ecosystems in which they operate and of all the factors and forces that underpin their transition pathways. Shifting business operations toward sustainability—even in instances involving a well-established business or a well-known product—can thrust a company into unfamiliar supply chains and unpredictable competitive dynamics. For the dairy business in our example, new emissions-reduction targets might suddenly plunge it into competition with the cosmetics and packaging industries to source seaweed seeds.

Entering a new operating environment creates an urgent need to identify the raw resources and other inputs (such as energy, labor, enabling infrastructure, regulations, and capital investment) necessary to accomplish the transition to sustainability. For the dairy cooperative, this mapping task focused on its top supplier market and started with identifying and prioritizing its primary mitigation levers for reducing its emissions.

After identifying these levers, the business could map the associated value chains, including available raw resources, components, technologies, and skills, as well as the broader socioeconomic ecosystem of stakeholders and societal issues for each pathway.

For example, because cows are substantial emitters of methane gas, the dairy cooperative included four mitigation levers in its assessment:

- Using red seaweed as a feed supplement, which can reduce the animals’ individual enteric methane emission by up to 80%

- Fitting the cattle with methane oxidation masks, which are being tested as a way to convert the methane from cow burps into carbon dioxide and water

- Introducing anaerobic manure digesters to break down cow manure and capture methane from it

- Reducing herd size by optimizing the nutrition in livestock feed to increase each animal’s productivity

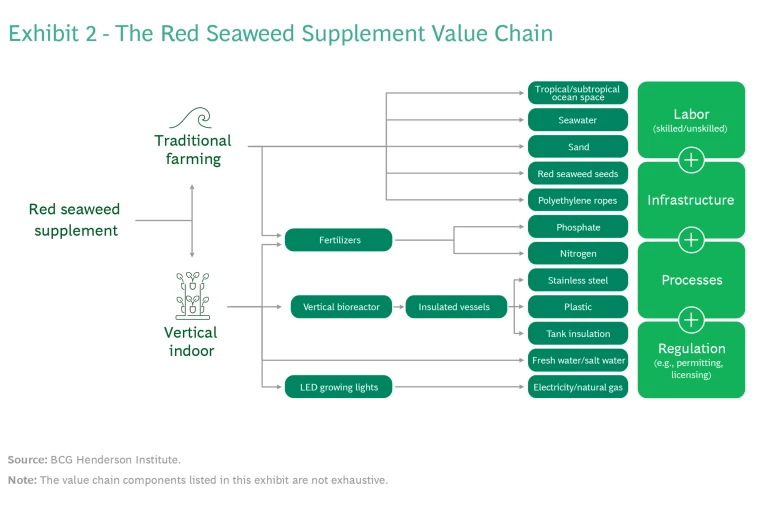

The next step—going from enumerating a list of abatement levers to identifying the related value chains, stakeholders, and the dynamics of each one—is crucial to early identification of areas of potential sustainability scarcity. Consider the red seaweed supplement lever. By mapping the two primary farming techniques for producing seaweed for commercial use—traditional ocean-based farming and vertical indoor farming—the cooperative uncovered a need for more than 15 specific raw materials and secondary inputs, including LED growing lights and vertical bioreactors. (See Exhibit 2.)

Accordingly, the business altered its recognized dairy value chain to include not just water, crops, and fertilizer, but also such variables as the estimated ocean area needed to support demand for the red seaweed supplement and the viability of indoor hatchery seeding techniques. Bringing new vertical seaweed farming technology into its value chain would require the business to source a host of new components and to seek new skills that only a limited number of experienced seaweed farmers possess. Furthermore, the dairy segment isn’t the only industry that sees value in red seaweed. The dairy cooperative had to assess the impact of existing and future demand for red seaweed seeds in adjacent markets, such as the cosmetics industry, which uses red seaweed as a thickening agent and accounts for approximately 35% of its current market.

Assessing Scarcity Risk and Prioritizing Pathways

Although companies are starting to take a more comprehensive approach to identifying what goes into their sustainability transitions, a gap remains in how they assess the dynamics of each value chain and how they prioritize the associated scarcity risks. For any company, this process of assessment and prioritization is vital and will depend on each individual business’s objectives, budgets, and expertise.

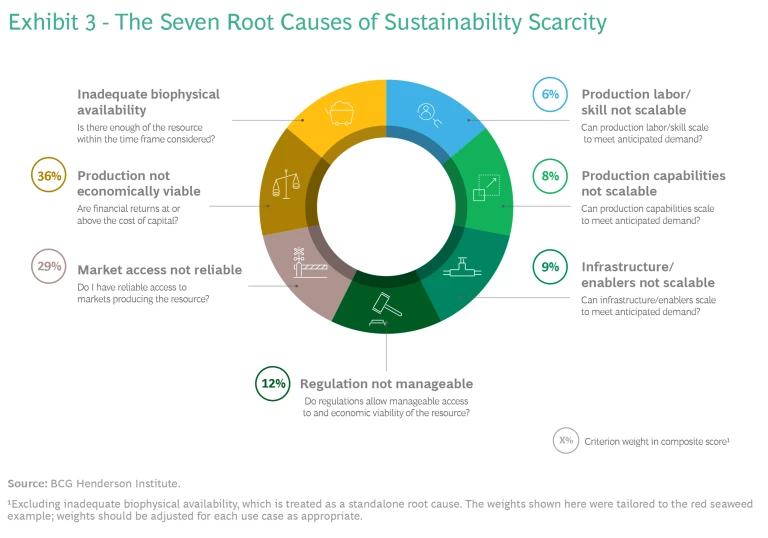

Generating the right level of insight, including identifying non-obvious areas of scarcity and unrealized business opportunities, requires finding the right degree of depth and breadth in the analysis. We have identified seven root causes of scarcity risk that companies can use to evaluate exposure in each mitigation lever and its intermediary inputs. (See Exhibit 3.)

When assessing the seaweed supplement, the dairy cooperative identified issues with regulation manageability and market access as possible sources of increased scarcity risk. The regulatory risks stem from the possibility that market regulation may need to be quickly updated when seaweed supplement manufacturing—now in its infancy—enters the commercial phase. If the process for permitting and licensing farms and farmers is onerous or requires long lead times, for instance, dairy farmers could find it difficult to access those credentials, creating bottlenecks for the dairy cooperative’s sustainability adoption. Similarly, access to seaweed producing countries and their markets, most of which are located in Asia today, depends on geopolitical relationships and international trade agreements. The accessibility risk is even more pronounced in situations where the pool of producing nations is small.

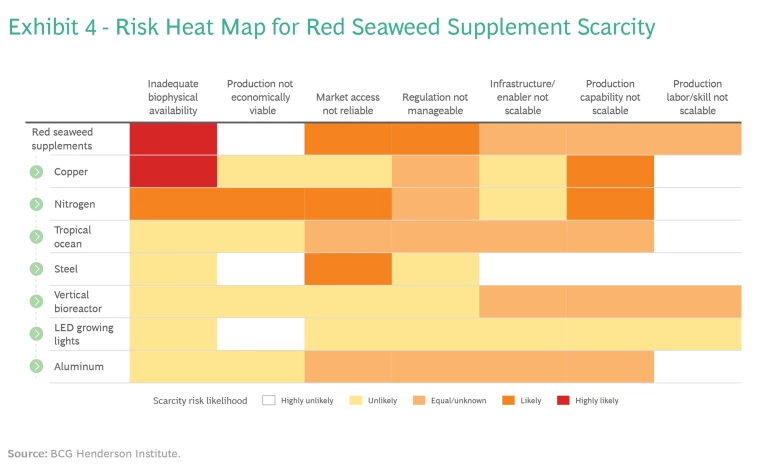

The dairy cooperative then built a comprehensive heat map for the seaweed supplement and its intermediary inputs. (See Exhibit 4.) The mapping showed that red seaweed supplements are at high overall risk for sustainability scarcity, along with copper and nitrogen.

Detailing the root causes of each resource, however, would not be enough to enable the dairy business to identify which resources require a strategic response. For instance, should it treat copper—an in-demand metal with many uses across sectors and, therefore, a high biophysical availability risk—as more or less of a risk to the cooperative’s supplement mitigation strategy than nitrogen? Both are essential to producing the seaweed. While nitrogen has only a lower biophysical availability risk than copper, it has a higher risk in the areas of production economic viability and market access reliability.

To answer questions of this sort, companies aggregate multiple streams of data in order to compute a single sustainability scarcity score for each resource. This, in turn, allows companies to compare resources and prioritization across a potentially extensive list of inputs. In addition to weighing considerations related to sustainability scarcity risk, this layer of analysis factors in how critical each component is for the transition—including how mature its technology and market is, and what power the business in question has to shape the input market. For the dairy cooperative, this dynamic assessment revealed that red seaweed supplements raise the need for a mitigation response, whereas nitrogen would not require immediate strategic action.

Respond to Mitigate Risks and Exploit Business Opportunities

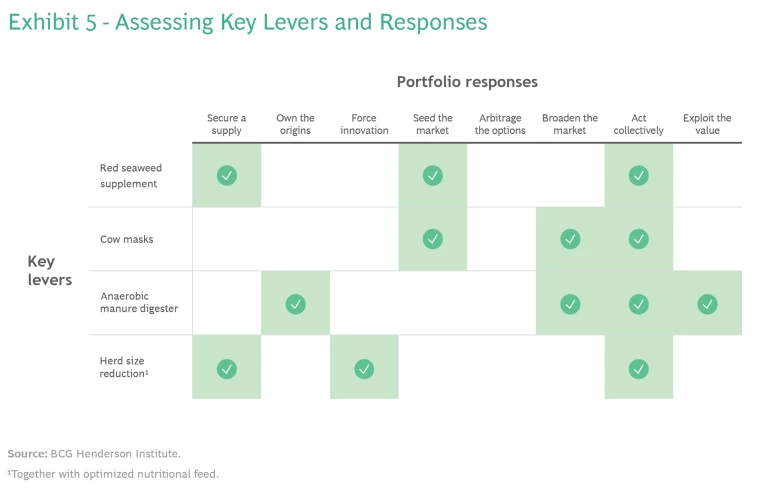

When a company understands where it is at risk of sustainability scarcity and has prioritized its vulnerabilities and opportunities, it can build a more robust portfolio of responses. In a previously published Harvard Business Review article, we highlighted eight of these key responses. (See the sidebar, “Eight Key Responses to Scarcity.”) The additional insight gleaned from this new analytical approach might not change the range of responses available, but it does offer companies finely tuned data to use as the basis for making more nuanced decisions.

Eight Key Responses to Scarcity

Eight Key Responses to Scarcity

- Secure the supply through long-term contracts.

- Own the origins to ensure future supply demands can be met.

- Force innovation to reduce or eliminate the need for the resources in question.

- Extract value by establishing price premiums on existing products or by providing sustainable resources to others.

- Arbitrage the options by taking advantage of different supply and pricing dynamics to deal with potential sustainability scarcity across different geographies.

- Seed the market and hedge new scarcity risks through investments aimed at resolving resource bottlenecks.

- Broaden the market by advocating for public policy and investments that enable technological innovation and expand supply.

- Act collectively with industry and cross-sector coalitions to address supply constraints.

The dairy cooperative’s prospective use of red seaweed supplements earned one of the highest composite sustainability scarcity scores and was therefore among the highest-priority targets to address with a mitigation strategy. The analysis underpinning this score suggested three possible responses that the business could pursue to mitigate this sustainability scarcity risk and perhaps even build a competitive advantage: secure a supply; seed the market; or act collectively. (See Exhibit 5.)

The dairy cooperative could seed the market by acquiring, investing, or partnering with relevant startups or existing players. Doing so would help these companies expand into regional markets and share the fruits of a future boom of red seaweed supplement production, while enabling the cooperative to secure its own supply in the process.

Another option would be to act collectively with other industries that would also benefit from ramped-up red seaweed production and to engage with government bodies from an early date to implement the right incentives and regulations for developing the country’s commercial seaweed farming capabilities. The cooperative could also support labor groups and sustainable dairy farms to lobby for collective seaweed farm licenses that would help accelerate production of red seaweed supplements nationwide.

Customize and Continue

Our approach to sustainability scarcity does not generate one-size-fits-all answers. For example, evaluating the importance of copper versus nitrogen in the context of the dairy cooperative’s sustainability transition will be different from evaluating it in the context of other companies or industries. That’s why this approach must be tailored to each company’s unique circumstances, taking into account its specific business, industry, geography, and relevant time frame.

Moreover, making the most of this approach is not a one-off exercise. It is a dynamic process that will change as markets evolve, as new technologies rise and fall, and as resource priorities shift. To achieve a successful transition, companies must engage in ongoing assessment and prioritization to keep their sustainability transition strategies up to date and optimized.

Those that do so will find answers to their most pressing sustainability transition questions—illuminating the details that will make or break their corporate sustainability strategy—and will have the opportunity not just to mitigate risk, but also to transform it into competitive advantage.