The companies that connect manufacturers, retailers, and consumers in multiple sectors are in an unmatched position to advance and implement circular solutions for end-of-life products.

Remember the milkman? He (or sometimes she) would deliver farm fresh dairy products to the door and take away the empty bottles for cleaning, refilling, and redelivery.

COVID-19 has caused a resurgence in milk delivery, keeping alive a time-tested application of circularity—a back-to-the-future approach that rethinks the take-make-dispose economic model that has become the norm and envisions a new model that is regenerative by design. Glass is an easy example because it is infinitely recyclable as well as readily reusable. But many other products, including consumer electronics, appliances, catalytic converters, and lithium-ion batteries, can be recycled and their inputs reused, and this has big implications for resource efficiency, landfill usage, and emissions reduction. Circularity reduces the amount of trash that has to be processed and put somewhere. Many raw materials, such as copper and aluminum, can be recycled while producing just a fraction of the emissions of mining or manufacturing virgin inputs.

A substantial proportion of paper, plastics, and metals are already being recycled in many markets. But overall, the world economy is only 8.6% circular today, according to the Circularity Gap Reporting Initiative, meaning that more than 90% of inputs are new rather than recycled or reused materials.

Distributors have a unique opportunity to advance and implement circular solutions, creating high-margin revenue streams in the process.

Herein lie significant opportunities for both business growth and improved sustainability. Distributors are well placed to realize both. The trucking and logistics firms, warehousers, inventory managers, and merchandisers sit at the center of ecosystems of manufacturers, retailers, and consumers in multiple sectors. They have a unique opportunity to advance and implement circular solutions. In the process, they can create new revenue streams, some of which may carry higher margins than their core business. Here’s how.

Squaring Circularity

We have observed before that leading global companies are setting big goals to increase the use of recycled materials in their manufacturing, but flat recycling rates and poor processes in the US and elsewhere threaten to derail those green ambitions. General Motors, for example, plans to increase the share of sustainable materials in its vehicles to 50% or more during this decade. Coca-Cola wants to use recycled materials for at least half of its packaging by 2030. Meanwhile, US recycling volumes for household waste have barely changed since 2005. Only about 19% of durable goods and 14% of plastic containers and packaging discarded by US households by volume were recycled in 2018. Only about half of all used aluminum beverage cans in the US were recycled in 2020 (compared with 99% in Germany).

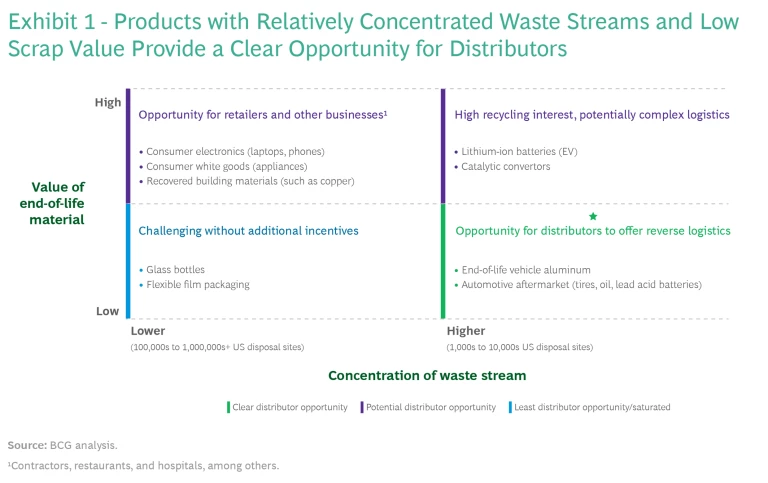

Gaps between supply and demand are good for companies that can build the necessary bridges. But this is not always easy for recycling and circular use as economic factors can undercut the attractiveness of the market. Two of the biggest barriers for circularity are the value of the end-of-life materials and the concentration of waste streams. (See Exhibit 1.)

At one end of the spectrum, highly concentrated waste streams may merit on-site processing or material reintegration, such as on-site recycling or anaerobic digestion systems. High-value raw materials, such as the lithium, cobalt, and aluminum found in spent lithium-ion batteries or the precious metals used to make catalytic converters, attract high rates of recycling despite moderate or low waste concentration.

At the other end, markets with waste streams that have low value and low concentration have much lower adoption. It’s hard to make a business case for collecting and processing the scrap flexible film packaging materials found in hundreds of millions of trash cans around the US without economic incentives, such as subsidies, or without participants in other parts of the value chain chipping in. The ten US states with government mandated deposit schemes for bottles and cans have recycling rates of about 90% compared with 25% elsewhere. For low-concentration, higher-value scrap, such as e-waste, the circular opportunities may first require retailers to provide an initial collection service to concentrate the waste streams.

But what about everything in the middle? This is where the opportunity lies for distributors: currently unrecycled scrap that comes through moderately concentrated or complex waste streams.

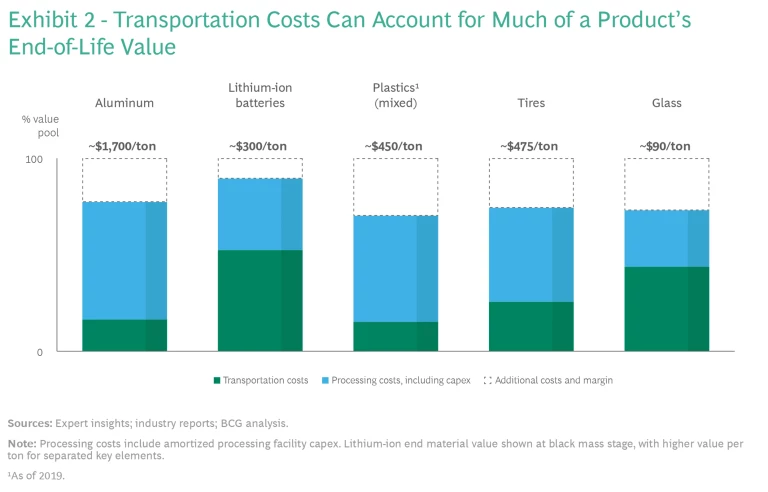

High-value, moderately concentrated waste often is not recycled because of the difficult logistics involved. The materials can be subject to a patchwork of regulations or require specialized handling capabilities. For other waste such as scrap tires, recycling is limited because rubber, steel, and carbon black have relatively little value. Transportation costs account for varying degrees of the end-of-life product value pool. For some product categories, such as lithium-ion batteries, these costs are substantial. (See Exhibit 2.) Still, there is an opportunity to extract value from these types of waste streams for those that develop the necessary expertise (which also serves as a high barrier to entry for competitors) or have a built-in advantage, such as the ability to leverage existing transportation networks.

The Opportunity for Distributors

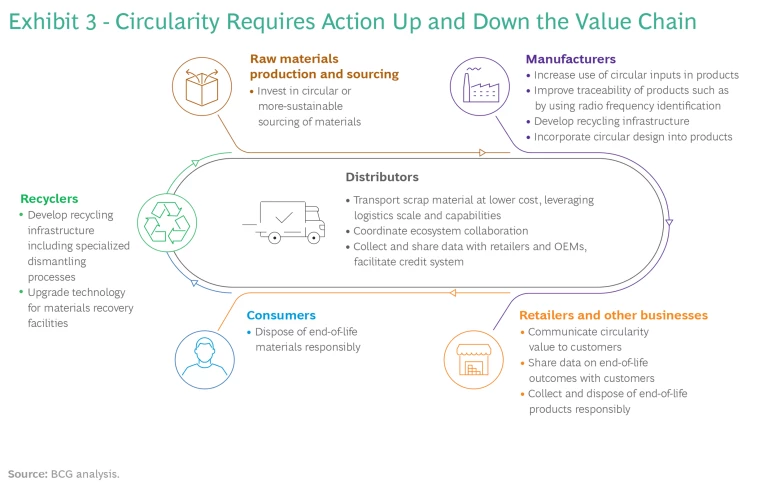

Increasing circularity requires material action and potential co-investment from players at each stage of the value chain. (See Exhibit 3.) In many cases, raw-materials providers need to invest in circular or more sustainable sourcing of materials. Manufactures can use more circular inputs. Retailers should convey data on end-of-life outcomes to customers who can dispose of those materials responsibly.

BCG research into sustainable business model innovations has found that companies working on their own frequently run into economic or operational constraints that limit their ability to achieve environmental or societal benefits. For example, many consumer brands are looking to reduce the use of virgin polyethylene terephthalate (PET) in plastic packaging, in part by using recycled PET (rPET). But we estimate that by 2025, demand will exceed rPET supply by about 45%, requiring alternative solutions, such as partnerships, alliances, or joint ventures. Part of the rPET shortfall can be met through a business ecosystem: a collection of independent businesses, orchestrated by a business at the center, that comes together to address a specific need in the market—in this case, increasing the circularity of PET.

Distributors are squarely placed to use their industry position and relationships throughout the value chain to orchestrate this kind of collective endeavor, in which action at all stages is required to overcome the barriers at each one. They can boost their own businesses by taking advantage of their access to a large universe of waste suppliers on one side and a large market of buyers or users of the waste on the other. Distributors can collect and transport scrap material at lower cost than any other participant by leveraging their logistics scale and capabilities. They can aggregate demand for products with circular potential from retailers and motivate circular design by manufacturers. They can also facilitate ecosystem collaboration and efficiency by serving as a neutral third party and data-sharing hub for retailers and OEMs.

The economic models will need to be worked out, and they may vary from sector to sector. But in industries such as appliances, automotive, building products, consumer electronics, food and beverage, food service, office products, and technology hardware (to name a few), distributors should be able to charge fees or take commissions at each step while they help partners demonstrate progress to their own stakeholders on three critical sustainability dimensions: emissions reduction, resource scarcity, and waste and pollution reduction. Distributors may also be able to facilitate credit systems, similar to carbon credits, for tracking and facilitating investments in circularity.

Breaking Down Barriers

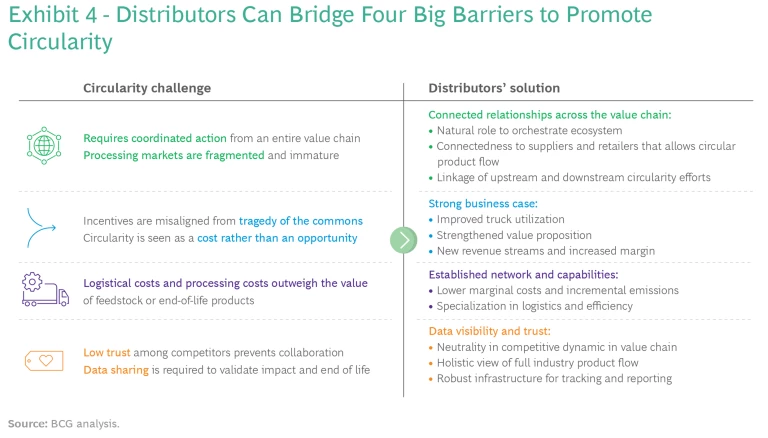

Much of the opportunity for distributors is rooted in their ability to overcome four of the biggest barriers to greater circularity. (See Exhibit 4.) Here’s a look at each one.

Circularity requires coordinated action from entire value chains that are ill prepared to deliver. Companies looking to engage in greater circularity face a two-part dilemma. First, they cannot go it alone. Full circularity can only be achieved by coordinated collective action from all players in the industry, and every entity faces its own impediments and disincentives. OEMs and recyclers struggle to access feedstock at a low cost, a prerequisite for their circular technologies reaching necessary scale. Recyclers are hesitant to invest in additional capacity without nearby offtake partners to purchase their recycled output. Retailers and waste collectors typically do not have the financial means to incentivize consumers to recycle or to provide collection services. And even when retailers do have the means of collection at the point of sales, they typically do not have the capability to ensure the offloaded materials are properly recycled and reused. They must rely on the recycler to do its work responsibly and the manufacturer to take and use the recycled feedstock. In addition, for low-value scrap, complex logistics thwart the business case by making it financially infeasible.

Second, an immature end-of-life processing landscape is characterized by fragmented, subscale businesses, a situation that is perpetuated by multiple factors. For example, supply and demand are mismatched in many processing markets. Circular technologies that can produce high-quality outputs with low emissions are still in development. The US is a complex and variable landscape of jurisdictional regulations and conditions. High-capital outlays are needed for sophisticated collection, sorting, and recovery operations.

Distributors can overcome these impediments. They have trusted relationships with companies throughout the industry or industries they serve and visibility into the strategic priorities of companies both up and down the value chain. They can therefore play an ecosystem orchestrator role, convening the industry on a commercial level and coordinating how it moves forward together on issues that cut across competitive lines, such as supply of, and demand for, end-of-life materials. They can create both the physical and commercial link between supply and demand of end-of-life materials and close the loop: their logistics networks can ensure waste is being directed to responsible end-of-life outcomes, which allows retailers and collectors to charge a premium for circular end-of-life use cases while connecting OEMs to the right processors.

Distributors provide a pathway for the logistics and transportation of scrap material, reducing the cost and making a business case plausible. Unlike existing feedstock collectors that only engage in logistics as way to gain access to material, distributors specialize in logistics and connecting markets. Furthermore, they can use their logistics networks to ensure waste is being directed to responsible end-of-life outcomes.

Down the road, distributors may play a central role in facilitating the data connections and even standing up credit systems to verify and account for circularity through the entire system.

Current players have misaligned incentives (stemming from a tragedy of the commons), leading to circularity being seen as a cost rather than an opportunity. Circularity faces a classic tragedy of the commons scenario. Each player in the value chain has ready access to the inputs and resources it needs (absent tightened regulations governing access and use). It therefore acts in its own best interests, which is contrary to the common good of all users, who benefit from reduced raw materials use, fewer emissions, and less pollution. Compounding matters, even though every player in an industry might recognize the unsustainability of the make-use-dispose model, and all face similar challenges in pivoting to a circular model, each individual player looks to others to make the first move. But any first mover incurs significant cost while all collectively reap the benefits. For example, if a consumer products packaging company decides to use mono-material polyethylene bags, it improves circularity by simplifying the recycling process and increasing yield of the recycled plastics that are being used in new packaging. The recycled materials can be sourced by a competitor that is still using multi-material packaging, and that company can claim it is increasing its sustainable sourcing by using recycled plastics.

Distributors are the sole player in the value chain with strong incentives for investment in circular solutions.

Distributors are the sole player in the value chain with strong incentives for investment in circular solutions. Circularity offerings diversify revenue streams and provide avenues for growth. For example, transportation and logistics company Ryder consolidates forward and reverse logistics services for health care companies focused on circular economy. Reverse logistics improve truck utilization, which makes being a first mover for distributors a lower-risk proposition than it is for other types of players. Backhauling products can be a source of advantage over competitors that offer less-comprehensive service. Circular services also strengthen distributors’ value proposition and reduce the risk of disintermediation.

Logistical and processing costs outweigh the value of feedstock or end-of-life products. Circular solutions can have high, or higher, embedded costs for several reasons.

The distance from the source of the feedstock to the processing venue is often long, and transportation is therefore costly. Transportation cost is a critical constraint on catchment areas, often putting smaller catchment areas out of reach of collection. Virgin materials may be cheaper than reprocessed end-of-life products. For example, recycled broken or waste glass can be up to 20% more costly than virgin materials. Recovery processing costs are often higher than less environmentally favorable options such landfill tipping fees. BCG research also shows that, depending on the sector, only 1% to 7% of consumers are willing to pay a premium for more-sustainable products, including those made from recycled content.

Distributors overcome the cost issue in two ways. First, their established networks mean the marginal cost and incremental emissions for collection is low. Distributors’ trucks typically reach close to full utilization on their outbound trips to retailers while utilization on return trips is close to zero. Most distributors can backhaul used products in the same trucks they use for delivery (except when regulatory requirements for circumstances such as hazardous waste or sanitary conditions intervene). At the same time, the trucks of waste and feedstock collectors are close to empty on their inbound trips to points of collection and full on their returns. There is an opportunity for distributors to backhaul end-of-life products to processors on their return legs at lower marginal costs and lower incremental emissions for waste and feedstock collectors.

Second, distributors specialize in logistics and efficiency while for feedstock collectors, transportation is primarily a cost of doing business. Distributors have fully optimized networks that often serve remote areas while collectors tend to stay close to their processing facilities. Distributors can therefore improve the utilization of assets while helping processors achieve scale, access a reliable flow of feedstock, and expand their catchment areas, all at lower cost and higher efficiency.

The ecosystem requires trust and transparency to operate successfully. Since each participant in an ecosystem has its own interests and priorities, and some participants may compete with others, trust and transparency are essential attributes. In a circular waste ecosystem, OEMs and retailers need to cooperate and share sometimes sensitive data, but competitive forces preclude that. Furthermore, waste needs to be tracked and accounted for in a transparent manner, so participants know that it was processed as promised and its end-of-life application was truly circular.

Since they sit outside of the competitive dynamics that hinder collaboration, distributors can fill the role of honest broker.

Since they sit outside of the competitive dynamics that hinder collaboration, distributors can fill the role of honest broker, dealing with each OEM or retailer (that may already be a customer) one-on-one, perhaps under the power of a non-disclosure agreement. They can also provide the tracking information and final-use certification that other participants require. In many instances they already serve as stewards of product-related data for tracking and reporting purposes.

Data and analytics are as important to circular solutions as they are to other sustainable practices. One waste management company, Rubicon, brings transparency to the recycling process with digital reporting for waste and recycling and offers software-as-a-service tools to companies and governments looking to improve their waste management capabilities. Distributors have a comprehensive view of product movement and life cycles. As ecosystems develop, distributors can put themselves in a position to facilitate credit systems for brands that participate to compensate for brands that do not.

Charting a Course to Circularity

Providing circular services and orchestrating a circular waste ecosystem will be new territory for most distributors. Our recent work in this area points a way to charting a course. Here are some steps to take.

Assess the opportunity. Explore the existing landscape, from retailers through recyclers, to identify industry or customer pain points and value creation opportunities. Investigate the desirability, feasibility, and strategic fit of a circularity offering and the potential of an ecosystem that in time could include an array of circularity-related services. Develop a solution that will be viable in the long term by creating a go-to-market strategy that telegraphs its full value to potential partners.

Develop and pilot a minimum viable product (MVP). Given that this is likely uncharted territory and a new line of business, pursue a test-and-learn approach starting with an MVP that you can develop over time based on real customer experience and feedback. Build the investment case around a strategic vision for what you want to accomplish, and start by piloting an MVP that delivers one aspect of the overall circularity solution, such as providing reverse logistics in select markets. The MVP approach minimizes risk because of the small initial investment needed.

Restructure internal logistical capabilities. If the pilot (or pilots) prove viable, you will need to redesign operating procedures, IT, data systems, and equipment to handle end-of-life products (especially more-complex products, such as batteries) at scale. You should also reexamine network and sourcing partnership capabilities and revisit KPIs (such as truck utilization measures).

Support new offerings. If successful, the new business will require its own organization and governance support. Ramping up the business rapidly will likely mandate setting up a separate organization with its own leaders and dedicated teams. They will need to align with process and function owners on other initiatives in the organization to avoid collision points and identify opportunities for synergies.

Stand up a data platform. Metrics are essential to success, and they require being able to collect, manage, and track the right data. You can build your capabilities to establish a baseline and track circularity across the organization, for example, using outsourced services. (BCG’s CO2 AI is one service that can help track company-wide emissions.) Connect partner data to your system so you can provide circularity reporting.

Jumpstart the ecosystem. You can build the ecosystem one partner at a time or by establishing a consortium. A circular service offering can reinforce existing relationships with OEMs and retailers and lead to new grounds for engagement, such as product end of life, renewable feedstock, and product design.

The low level of circularity in the economy today is both cause for concern and a sign of a big opportunity. No group of companies is better positioned to capitalize than distributors. But unlike in the days of milk delivery, scale will ultimately be integral to success, and early movers can establish an advantage that will also serve as an effective barrier to entry for competitors.

The authors are grateful to Jack Bugas, Matt Cooper, Miriam Benedi Diaz, Henry Fovargue, Erin Kelly, Timm Lux, Nathan Niese, Sebastian Torterolo, and Mark Verheyden for their assistance in the preparation of this article.