The technology, media, and telecommunications (TMT) sector is experiencing turbulence, volatility, and a dizzying loss of equilibrium. During the final months of 2018, the shares of Facebook, Amazon, Apple, Netflix, and Alphabet’s Google (FAANG) bounced around wildly before ultimately shedding $1.1 trillion from their all-time peaks.

These ups and downs are manifestations of the great uncertainty surrounding the industry. The growing influence and reach of the FAANG companies and their counterparts in China raise serious concerns over privacy, security, fair taxation, and the troubling ways in which data from platforms such as these can be used for questionable purposes, such as aiding criminals and influencing elections. These concerns have emerged against the backdrop of a global economy that is both slowing—as the post-financial crisis expansion cycle and quantitative easing wane—and becoming more insular as bruising trade battles leave their mark. Unsurprisingly, investors have also grown cautious. (See “Investors Brace for a Downturn and Look to the Long Term,” BCG article, January 2019.)

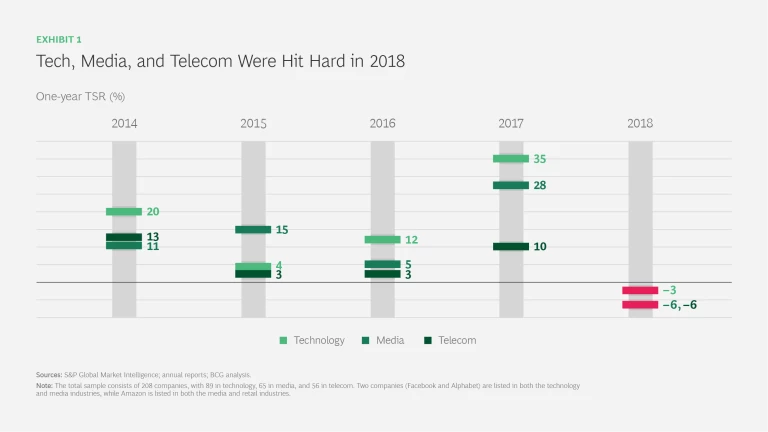

Total shareholder returns in the sector reflect this turbulence and decline. For the five-year period covered in BCG’s 2014−2018 TMT value creators study, the median annual shareholder return of these companies was 9.9%—almost half that of the prior five-year period (2013–2017), at 18.1%. The one-year performance for each of the three industries in 2018 was negative. (See Exhibit 1.)

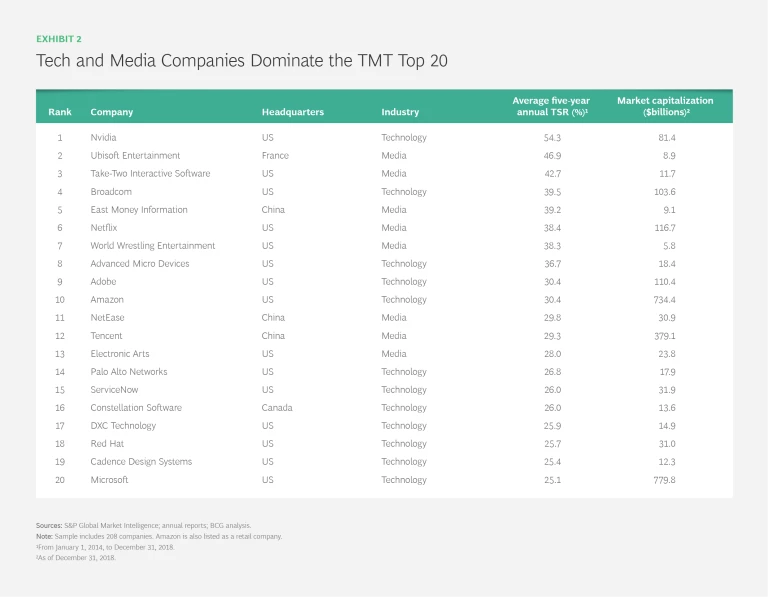

Despite these industries’ overall performance, the top 20 TMT value creators still performed strongly. (See Exhibit 2.) Strong value creation in the sector benefits the overall economy, as technology and digitization pervade even the most basic industries. Indeed, digitization is creating the same sort of fundamental shift that occurred a century ago with electrification, only exponentially faster.

TMT companies have the opportunity to lead consumers, companies, and the public sector into an increasingly digital world. Their innovations can help improve lives, livelihoods, and productivity and bring the world closer together. In helping others in these ways, they can also create shareholder value.

The growth rates of existing digital technologies, such as the cloud, the Internet of Things, and artificial intelligence (AI), are high—and hard on their heels will come other emerging technologies, such as 5G and quantum computing. In both relative and absolute terms, these sweet spots represent massive opportunities for TMT companies. Promising examples of these companies helping others to enter the digital world abound:

- Tech companies, such as Amazon, Google, and Microsoft, are providing the cloud infrastructure that powers the data and analytics revolution. They are also allowing others to create new business models around AI. For example, number-one TMT value creator, Nvidia, has launched its Drive Constellation project to improve the testing of autonomous vehicles through AI-enabled simulation of actual driving conditions. (Nvidia also ranks 9th on our list of value creators across all industries, out of more than 2,200 companies in the overall sample.)

- In media, streaming companies such as Netflix and iQiyi, its counterpart in China, are relying on AI to improve the audience experience in ways that go far beyond their well-known recommendation engines. For example, iQiyi, which is owned by Baidu, used AI to validate a hip-hop talent show idea and to recommend a celebrity judge. Rap of China turned out to be a huge hit, generating 2.7 billion online views in its first eight months.

- Telecommunications companies, such as Safaricom of Kenya—the number-one telecom value creator—and NTT Docomo, are bringing digital services to consumers. Safaricom’s well-known M-Pesa branchless banking service has improved financial inclusion in emerging markets, while Docomo offers health care, commerce, financial, and lifestyle services under its Smart Life banner.

BCG’s Value Creators series has historically taken a five-year view of corporate wealth formation in order to identify trends and play down “one-hit wonders.” Five years is an eternity in today’s world. Five years ago, the cloud was more than a blip but not yet a blob on the corporate radar screen. Today, the cloud is commonplace and has been a tremendous source of value creation both for cloud providers, such as Microsoft and Amazon, and for customers that have taken advantage of the cloud’s flexibility. Looking ahead five years, AI may be one of the next fundamental sources of value creation, within TMT and the broader economy as well.

The AI Imperative

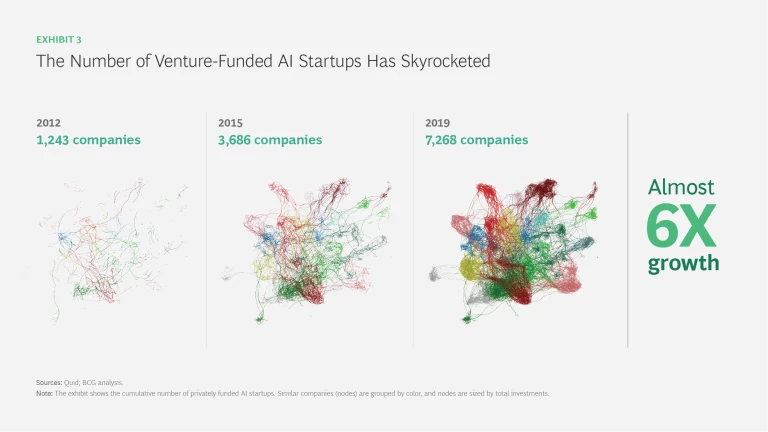

Advances in machine vision and natural language processing now allow machines to expand into activities commonly performed by humans, such as those involving speech and vision, while exponential advances in computing power are opening up new uses for AI. (See “Competing in the Age of Artificial Intelligence,” BCG article, January 2017.) A technology that has already gone through several boom-and-bust cycles over the past several decades, AI is certainly booming—and may even be experiencing a bubble—in the venture market. The number of venture-funded AI startups has increased almost sixfold since 2012. (See Exhibit 3.)

But for established TMT companies, the hype surrounding AI is real this time. It offers opportunities to create new business models, accelerate revenue, or drain costs from existing businesses—or some combination of all three. (See the sidebar, “Six Questions for IBM’s Dario Gil on Artificial Intelligence.”)

Six Questions for IBM’s Dario Gil on Artificial Intelligence

Six Questions for IBM’s Dario Gil on Artificial Intelligence

As the director of IBM Research, Dario Gil oversees a global organization with more than 3,000 researchers pushing the boundaries of AI and other information technologies such as quantum computing and blockchain. An IBM lifer, Gil himself has explored such diverse topics as nanofabrication, immersion lithography, and smart grids during his more than 15 years at Big Blue. Below, his view of AI in business.

How do you see the field of AI maturing over time?

Artificial intelligence is not a fad. A narrow form of AI has begun to work, powered by deep neural networks trained on large amounts of labeled data. There is massive enthusiasm in the technical community. More than 20,000 AI papers were published in 2018 alone. And we should continue to expect rapid progress. AI is going to be everywhere, just like software.

I like to compare the emergence of AI to what happened with IT. In the 1970s, as the concept of IT began to take hold, businesses intuitively understood that to be a modern enterprise they needed computers, even if they didn’t yet have all the skills and could not anticipate their full potential. Over time, they realized how it could be used in payments, payroll, supply chains, and so on. In the 1980s, CIOs came on the scene, and computer science really blossomed as an academic discipline, producing generations of programmers that entered the workforce.

By the 1990s, companies realized that they did not necessarily need to manage IT themselves. Hence, outsourcing. More recently, cloud computing is yet again transforming how we create and consume IT.

With AI, companies are also intuitively realizing that the category is a big deal, the path to becoming what we call a cognitive enterprise. We are even seeing the first examples of chief AI officers. AI departments and functions are being created everywhere, similar to IT in the past. Overall, it is a bit like in the Wild West, with all sorts of organizational setups, tools, and proofs of concept in play. But this too will mature, and AI will become embedded in the business as pervasively as IT is today.

What are the most effective ways that companies should be using AI?

A critical step in building a successful AI strategy is to discover which business processes can be reimagined through the use of machine learning. This approach represents the next frontier of productivity to be layered on top of recent robotic process automation advances. It generally makes sense to focus first on a few well-defined use cases in core internal processes or in improving the customer experience.

In customer support, for example, while it is still not possible for AI to automatically answer all questions that come into a call center, it can address many customer inquiries automatically, allowing agents to spend more time on complex tasks. The Royal Bank of Scotland uses Watson Assistant in its call centers and has an 86% customer satisfaction score, with 44% of all conversations no longer requiring human intervention.

Can you describe the role of AI for IBM?

AI is an absolute priority for IBM, and it is a silver thread that we weave into our core products and services. We have been very focused on delivering AI products, methodologies, and services that meet the needs of enterprises: how to train with less data, how to create trusted models that are explainable, fair and auditable, and how to develop AI skills and integrate AI into workflows.

How do you see the war for talent in AI?

It is fiercely competitive. There is a scarcity of talent, but universities are responding quickly. We are seeing record levels of enrollment in machine learning classes. Some universities are even offering undergraduate degrees in AI. We are also seeing an explosion of online enrollment in deep-learning classes, and companies are ramping up their internal training efforts. At IBM we have created an AI Academy to continue to bring the latest skills to our employees.

At the same time, AI tools are becoming easier to use. In a few years, it will be relatively easy to create an AI-enabled process in the same way that nonprogrammers today can create simple apps or websites. You are not going to need a whole host of PhDs to meaningfully take advantage of AI for your business.

Is AI experiencing a bubble?

There is a lot of hype in AI, but the progress is real. If businesses or investors are expecting general AI—a machine version of human intelligence—they are going to be disappointed. General AI is not around the corner. It’s decades away. But AI can achieve superhuman accuracy at well-defined tasks, and plenty of use cases can be scaled today with terrific ROI’s.

How difficult is it to scale AI in an organization?

Data is the nucleus that enables today's AI solutions. In order to scale AI, it is imperative to have the right information architecture. It is useful to think of an AI ladder, designed to first collect and organize data, so that we can then infuse AI models into workflows with trust and transparency.

You need the right skills, capabilities, and tools, and you need a receptive culture that understands that AI is here to stay and that we have to get with the program. I do worry that sometimes people spend too much time talking about all the “cool stuff” that AI can do, instead of setting the right data foundation and scaling what works. The lion’s share of the work involves data preparation and having a trusted way to deploy AI at scale.

From our research with MIT Sloan Management Review, we know that sophisticated companies in all industries are doubling down on their AI investments. We also know that such companies are widening their capability lead over their competitors. This gap could continue to grow. By increasing their investments, the most sophisticated AI companies also increase their knowledge. So the smart get smarter and the gap between leaders and laggards widens.

For TMT companies not yet embracing AI, these results should be a wakeup call. As a general-purpose technology, AI will find its way everywhere, from the factory floor to the field force. TMT companies must play a pivotal role in facilitating this transition. (See “Putting Artificial Intelligence to Work,” BCG article, September 2017.) In fact, we believe that AI is becoming a capability that will increasingly set TMT companies apart. They should be taking steps to integrate AI across their entire value chains. And as they engage in digital transformations, we believe that AI initiatives should make up 10% to 50% of their overall programs.

Initially, TMT companies should undertake a set of narrow pilots that serve as proofs of concept and deliver tangible business value. Then, on the basis of those pilots, they should identify “unicorns”—use cases that can dramatically improve business performance when they reach scale.

AI is becoming a capability that will increasingly set TMT companies apart. They should be taking steps to integrate AI across their entire value chains.

Although early successful pilots may suggest otherwise, AI today is not a technology that can be plugged into existing architecture, scaled up, and managed by IT staff. First, companies need to make sure that their underlying data is organized and structured in such a way that it can be used by AI algorithms, a step that they often neglect. Next, a host of organizational and operating model issues arise as AI systems start to interact with one another and with employees. Companies need a platform, such as Google’s AI Hub, Amazon’s Sagemaker, or BCG Gamma’s Source AI, that can manage underlying data, data flows, and algorithms so they do not become entangled.

AI is not merely technically challenging to implement. If TMT executives want to deploy machine intelligence to solve essential business problems, they must actively engage in a fundamental transformation of their entire people strategy and operating model. (See “The Big Leap Toward AI at Scale,” BCG article, June 2018.) Eventually, simple and intuitive tools will allow even business generalists to take advantage of AI. But until then, companies will need to invest in their internal capabilities, setting up new teams and functions, hiring data scientists and engineers, and ensuring that executives are sufficiently fluent in AI to successfully leverage it for their business. While individual tech, media, and telecom companies will activate AI in different ways (as we explore in the other chapters of this report), staying on the sidelines is not an option.

The Broader Transformation Journey

TMT companies have to act with even greater urgency on digital and AI than other companies because they are in the crosshairs of the “big exponentials” and accelerating change. The status quo for TMT companies is characterized by ever-shortening product half-lives and ever-greater digital competition. They need to urgently address a broad agenda of challenges related to strategy, partnerships, execution, capability, innovation, customer experience, and agility.

Traditional TMT companies have a lot of work to do. Many of them are still encumbered by legacy mindsets and assets. They need to catalyze a transformation to an operating model built around AI and digital technologies and, just as important, around digital ways of working.

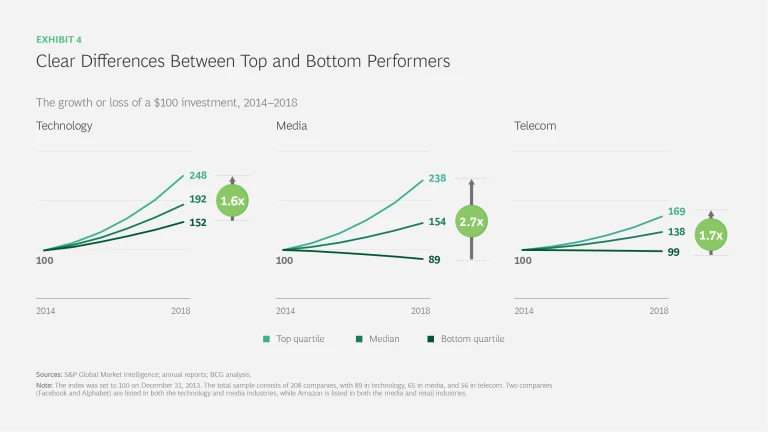

Unfortunately, up to three-quarters of transformations do not meet their objectives. These are costly misses for shareholders. Companies in the top quartile of value creators create several times more value than those in the bottom quartile. (See Exhibit 4.) Such companies as Orange and T-Mobile became the 7th- and 8th-ranked performers in the telecom industry, respectively, by beating the odds and turning around their fortunes. So did Microsoft, the 12th-ranking performer in the technology industry.

What does a successful transformation look like? There are five essential ingredients: a sense of purpose, boldness, an integrated plan, a new operating model, and fresh thinking.

A Sense of Purpose. Purpose is central to successful transformations. Companies with a deep and enduring purpose can motivate, recruit, and retain employees and engender trust in their customers. They outperform their competitors. (See “For Corporate Purpose to Matter, You’ve Got to Measure It,” BCG article, August 2018.) For example, during Microsoft’s transformation, its purpose—“to empower every person and every organization on the planet to achieve more”—helped keep employees focused on what was most critical.

Boldness. Most TMT companies are not timid in their ambitions. T-Mobile US has embraced bold moves—and investors and customers alike have rewarded the 8th-ranked telecom value creator in our survey. Notably, T-Mobile rocked the US mobile industry when it did away with the traditional practice of tying the purchase of subsidized phones to onerous two-year contracts. It has followed up by eliminating caps on data usage and offering other customer-friendly features.

Bold visions need to be matched by boldness in execution. More often than not, shortcomings in organizational capability and digital enablers, rather than in vision, constrain a company, as we pointed out in our 2018 TMT Value Creators report. (See “Unlock Value Creation Through Digital Enablers,” BCG article, February 2018.) Too few TMT companies have embraced the pioneering people, data, technology, and ecosystem practices of digital natives.

An Integrated Plan. Transformations need to be comprehensive, binding together the “why, what, and how” of change. BCG’s three-part transformation framework has helped hundreds of companies beat the odds and improve and sustain their performance. The AI work described above fits neatly into this framework.

Too few TMT companies have embraced the pioneering people, data, technology, and ecosystem practices of digital natives.

Funding the journey, the first pillar of the framework, represents the early initiatives that can build momentum and free up cash in order to fuel longer-term initiatives. Winning in the medium term, the second pillar, covers a broader portfolio of initiatives that deliver innovation, growth, and value as well as supporting activities, such as investor relations to explain this journey to the market. Finally, organizing for sustained performance gives employees the ability to succeed by making changes to organization, culture, and ways of working.

A New Operating Model. This component is part of any integrated transformation plan, but it is so crucial that it deserves separate consideration. Companies will frequently make strategic, technology, and operational changes but neglect the operating model.

Agile is a perfect example. Many companies have had initial success with agile and its emphasis on empowered cross-functional teams that work by testing and learning. But when they try to introduce agile at scale, progress often slows as employees continue to run decisions up preexisting chains of command. Unless companies change the operating model and the context in which these teams operate, the bureaucracy that agile was meant to circumvent will prevail. Ways of working such as agile are especially crucial in introducing AI and machine learning, because the technology learns by doing and improves over time. It operates most effectively in a flexible and iterative context, such as agile. (See “Taking Agile Transformations Beyond the Tipping Point,” BCG article, August 2018.)

Fresh Thinking. Transformations require more than just changes in strategy, operating model, and ways of working. They also require new ways of thinking. One of the best ways to inject new thinking is with greater diversity in terms of ethnicity, gender, age, and experience at the top of the organization. A recent BCG study suggests that increasing the diversity of leadership teams improves both innovation and financial performance. (See “How Diverse Leadership Teams Boost Performance,” BCG article, January 2018.) Even more persuasive, companies can start generating gains with relatively small changes in the makeup of their senior teams. Companies are starting to make diversity a priority. Microsoft, for example, links executive compensation to progress on diversity and publicly shares data about pay equity across gender, racial, and ethnic lines.

The volatility and uncertainty that brought 2018 to a close continued into early 2019. But despite the turmoil, the TMT sector will continue to produce winners. These companies will generate outsized returns by transforming their business and operating models and riding the waves of change—such as AI today and quantum computing tomorrow—that start as ripples within the TMT sector before expanding into the larger economy and society. By generating value for their shareholders, TMT companies also help create a better world.

Acknowledgments

Acknowledgments

The authors would like to thank the following colleagues for their invaluable contributions to the research, analysis, writing, and marketing of this report: Pranay Ahlawat, Mehdi Aourir, Julius Biedermann, Mickey Butts, James Cooper, Lars Dalsegg, Joycelyn Eby, Val Elbert, Jody Foldesy, Nick Ford, Philipp Gerbert, JT Hsu, Amit Kumar, Martin Link, Rocio Lorenzo, Denis Litovsky, Franck Luisada, Andreas Lundmark, Dhananjay Mirchandani, Jan-Hinnerk Mohr, Paola Oliviero, Ching-Fong Ong, Alex Perez, Sana Qureshi, Brian Richards, Florent Rodzko, Michael Spira, Stella Su, Vikas Taneja, David Tjhin, Antonio Varas, Arnaud Voguet, Mark Voorhees, and Maikel Wilms. They would also like to thank Katherine Andrews, Francesca Bressan, Gary Callahan, Kim Friedman, Gina Goldstein, and Patty Mueller for editorial and production support.