Following a decade-long boom and a two-year recession, Brazil’s economy seems finally to be approaching something like stability despite several tumultuous months in early 2017. The country is expected to fully recover from the current contraction by 2020, but growth rates at that point could be considerably lower than in the past decade and comparable to those of developed markets. Yet for private equity (PE) firms, the country still presents opportunities.

Brazil’s government is currently trying to pass reforms aimed at reducing bureaucracy and improving the business environment. And although overall growth is expected to be relatively slow, certain industries continue to expand at double-digit rates, thanks to strong underlying trends. In addition, Brazil’s PE market, while more mature than those of other Latin American countries, has more room for growth than large developed markets such as the US.

This combination of factors—particularly Brazil’s maturity relative to that of peer countries and the low penetration relative to developed markets—makes it one of the preeminent countries for general partners (GPs) and limited partners (LPs) looking to diversify in emerging markets. The challenge, however, is that investors can no longer ride the growth wave or trust that most companies will see steady revenue growth. Investors’ strategies must be far more targeted and proactive.

Success requires a deep understanding of the country’s overall macroeconomic situation and—more important—the distinctive aspects of Brazil’s PE market, which have implications for how firms identify and make investments, create value, and exit investments. (In this report, we focus on PE firms, but the same principles apply to sovereign-wealth funds, pension funds, family offices, and other principal investors.)

Specifically, to succeed in Brazil, PE firms should focus on five strategic priorities:

- Looking beyond conventional targets and making early-stage investments to fuel growth through M&A (as part of a consolidation strategy) or even creating new assets from scratch

- Revamping the screening process for a slow-growth environment by looking at broader trends and screening targets with greater rigor

- Leaving no stone unturned in creating value and relying less on sales growth than on improving margins

- Bringing teams with industry-specific experience to the table, both when assembling deals and when improving portfolio company performance

- Protecting against economic volatility by establishing long-term funds that are not so susceptible to currency exchange issues

Slower but Steadier Growth

From 2001 through 2011, Brazil posted unprecedented economic growth, swiftly rising from 11th to 6th place in the ranking of world economies. Since then, changes in the political and economic climates slowed—and then reversed—this staggering growth trajectory. Most economists project that the country will recover after a two-year recession, growing slower but more steadily.

According to the Economist Intelligence Unit (EIU), Brazil is expected to grow at modest real rates: approximately 1.8% per year from 2017 through 2021, slightly faster growth than that of the G7 countries (forecast to grow at 1.5%). Other emerging economies, such as India and China, are projected to grow more slowly than in the past decade, but still at 7.6% and 5.2%, respectively, in real terms.

The sources of much of Brazil’s growth over the past decade—such as consumer credit, demographic shifts, and high commodity prices—have largely been depleted. Regarding credit, household debt (as a percentage of income used to service debt) rose from 25% to 46% during the boom years, but since then, it has decreased to 42%. In addition, Brazil benefited from demographics as its workforce expanded dramatically and contributed more than twice as much to overall growth as did productivity gains. (See “Creating Value in Brazil’s No-Growth Environment,” BCG article, November 2015.) However, that source fueled a one-time gain and is now mostly exhausted. On top of that, prices for Brazil’s main exports (in most part, commodities) peaked in 2010 and then declined sharply, though some export prices have recently started to recover.

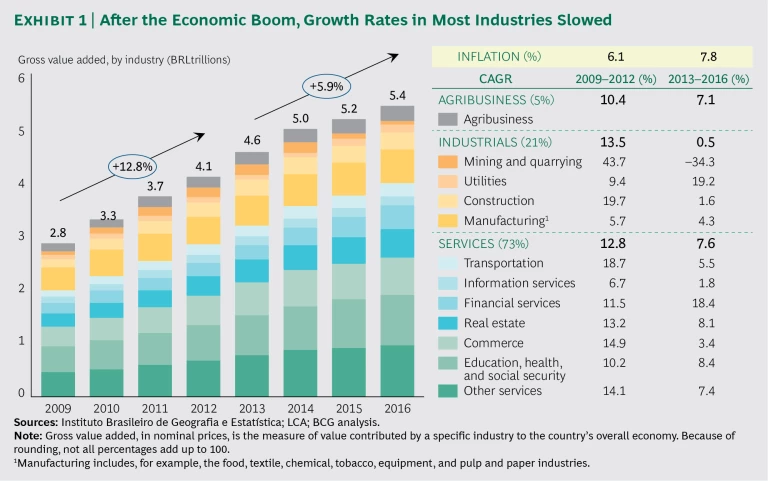

Among the economic sectors, industrial companies were hit hardest by the crisis, growing only 0.5% per year from 2013 through 2016, compared with a 13.5% growth rate from 2009 through 2012. Services and agribusiness were also impacted, but at least their growth rates have stayed close to inflation. (See Exhibit 1.) On the positive side, utilities and financial services grew the most, at 19.2% and 18.4%, respectively.

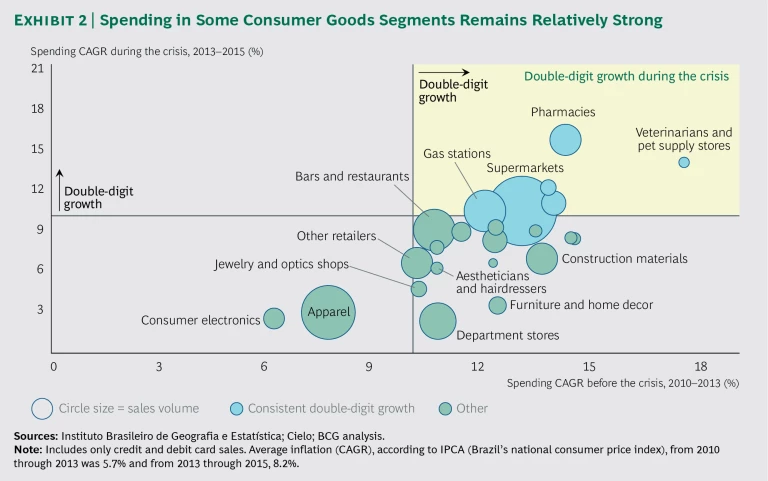

Specifically in consumer goods companies, the double-digit growth rates of the past—once widespread—are now scarce. Yet some segments—including pharmacies, pet supply stores, and gas stations—managed to post strong growth even during the crisis. (See Exhibit 2.) (See Finding Islands of Consumer Spending Opportunity in Brazil’s Crisis, BCG Focus written in collaboration with Cielo, October 2016.)

For PE investors, one of the most immediate consequences of Brazil’s unstable macroeconomic environment has been exchange rate volatility. Brazil’s real is one of several national currencies—including those of Russia, South Africa, and Mexico—that historically have shown high volatility.

From 2003 through 2008—a typical five-year investment window—a PE firm funded in US dollars could have seen an investment in Brazil gain 70% in value, solely the result of currency effects. Conversely, from 2011 through 2016, the value of such an investment would have dropped almost 50%. Such volatility is extreme, but it is a part of doing business in Brazil and in most other developing economies.

A Decline in Bureaucracy but a Need for More Progress

Another pressing concern for PE firms investing in Brazil is its complex and bureaucratic business environment. Thanks to government reforms, the country made substantial progress during the past decade. For example, the number of days typically required to start a business dropped from 152 to 80, and the number of days to register property dropped from 47 to 31. However, because other countries have made more dramatic gains, Brazil’s position has actually worsened in relative terms.

Furthermore, shareholder liability is not as “limited” as it is in other countries. In some cases, managers and shareholders can be held liable and their personal assets put at risk in lawsuits filed by customers, tax authorities, and, particularly, employees.

As an additional challenge, many companies struggle to hire skilled management teams and employees. A large portion of Brazil’s population has relatively low skills, and its education system cannot satisfy the local demand for talent. In a recent survey by Fundação Dom Cabral, 81% of 130 employers (representing nearly one-fourth of Brazil’s GDP) reported that the lack of professionally qualified people is a problem in the country.

The government, aware of these concerns, announced a broad set of measures to improve the business environment in Brazil, including the following:

- Further reducing the time required to start a business or register property by establishing a nationwide company registration system and an integrated registry of property information

- Reducing the paperwork and labor required for companies to pay taxes by using a unified accounting and tax-reporting platform and a simpler system to process employee-related payments

- Lowering credit risk and creating more transparency for both personal and corporate risk profiles by instituting an automated credit risk system and ultimately reducing financing spreads

Although hardly exhaustive or revolutionary, these measures, if rolled out correctly, have the potential to improve the business environment in Brazil.

Unique Aspects of Brazil’s PE Market

Despite challenging macroeconomic factors and a bureaucratic business environment, the PE market in Brazil is much more vibrant than those of its Latin American peers. Although Brazil includes only 33% of Latin America’s population, it attracted 46% of the $56 billion in private capital that was raised for the region from 2008 through 2015, according to the Emerging Markets Private Equity Association. Mexico is the runner-up with about 16% of the investments, despite being home to 20% of the region’s population.

Regardless of this activity, the Brazilian PE market still has room to grow. PE investments represent only 0.31% of GDP, compared with 1.41% for the US and 1.95% for the UK, according to the Brazilian Private Equity and Venture Capital Association. This distinctive combination of factors (maturity relative to peer countries and lower penetration relative to developed markets) makes Brazil one of the preeminent countries for PE firms and institutional investors seeking diversification in emerging markets.

To profit from these factors, however, firms must understand and contend with a wide set of unusual attributes across all phases of a deal. The Brazilian PE market differs significantly from that of other relevant markets in the world—developed or developing.

Screening and Bidding

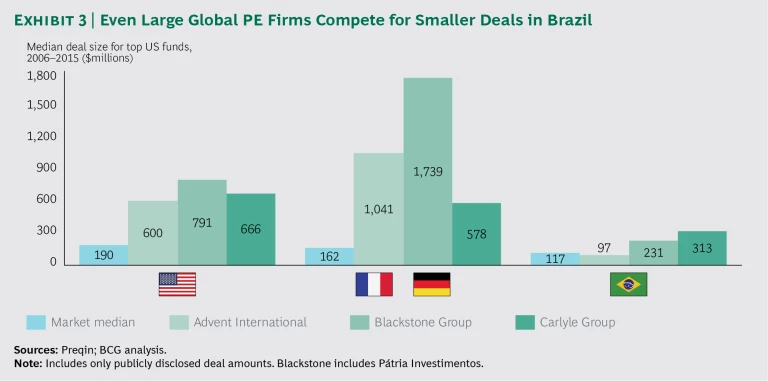

First, the average deal size in Brazil is smaller than those in other relevant markets. According to Preqin data on disclosed deals from 2006 through 2015, 63% of all deals were in the $50 million to $200 million range. (In the US, during that period, only 47% of all deals were in that size range.) Similarly, only 2.3% of deals in Brazil during that time exceeded $2 billion, compared with 9.7% of US deals.

That clustering means that firms must operate on a smaller playing field, increasing the competition for assets. Even such global megafirms as Blackstone Group (represented primarily by its partner in Brazil, Pátria Investimentos), the Carlyle Group, and Advent International, which focus on much larger deals in other markets—such as the US, France, and Germany—compete for smaller deals in Brazil. (See Exhibit 3.)

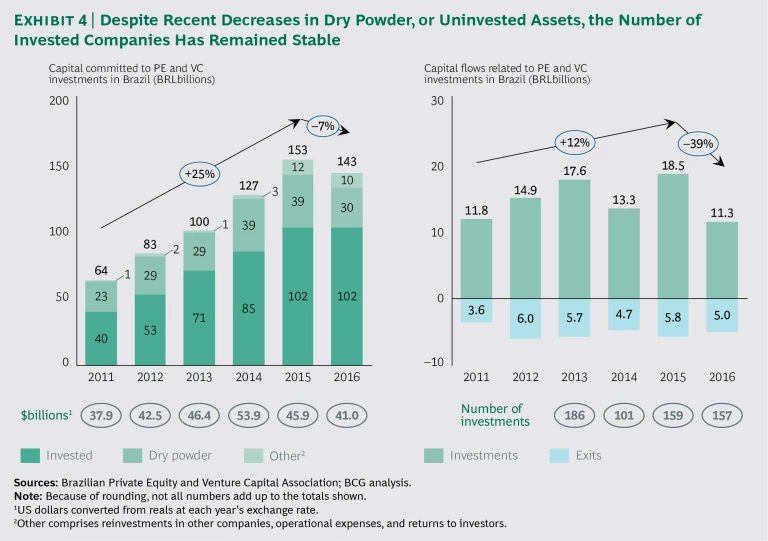

In 2016, after a series of record-breaking years, the assets committed to investments in Brazil decreased by 7%, and the total value of PE and VC investments in the country reverted to 2011 levels. (See Exhibit 4.) Despite those factors, the number of investments remained stable, so the competition for attractive investments should remain just as fierce as in the past several years.

Creating Value in Portfolio Companies

Once a firm closes a deal in Brazil, the means of creating value from that portfolio asset changes as well. According to surveys conducted by INSEAD, leading GPs and LPs investing in Brazil attributed 50% of returns to revenue growth and 33% to margin improvements in 2014, up from 45% and 25%, respectively, in 2011. That means that companies are now relying less on multiple expansion and leverage: they attributed only 14% and 3% to those factors, respectively, in the most recent survey. By contrast, in developed markets, the 2014 figures were 26% for growth, 24% for margin, 17% for multiple expansion, and as much as 33% for leverage.

Given Brazil’s high interest rates, it is not surprising that leverage contributes so little to value creation in the country. This is a reflex of Brazil’s country risk premium. Taking inflation-adjusted yields of long-term government bonds as a measure of country risk, EIU data shows that returns in Brazil from 2008 through 2016 averaged 5.9%, compared with 1.1% in the US over the same period.

Exiting Investments

The most common PE exit strategy in Brazil—representing 45% of exit deals since 2006, according to Preqin—is a sale to a strategic, nonfinancial buyer. IPOs, at 19%, are the second-most-common option, and they are prevalent particularly among large investments. The country is slowly emerging from an IPO drought: after only one IPO per year from 2014 through 2016 (Ourofino Saúde Animal, PAR Corretora de Seguros, and Alliar Médicos à Frente), 2017 started off well, with three offerings (Azul Linhas Aéreas Brasileiras, Movida Participações, and Instituto Hermes Pardini). It is noteworthy that each company that has gone public since 2014—except for Movida—had a PE firm or another principal investor as a shareholder.

The third-most-frequent exit type, accounting for 15%, is the sale of stakes in a public company, either because the PE firm had bought stakes in a public company or because it had retained a portion of the shares during the IPO. Secondary sales (to another PE sponsor) and other exits (including management buyouts, mergers, restructurings, dividend recapitalizations, and write-offs) represent, respectively, 13% and 8% of all exit strategies.

Five Strategies for Adapting and Thriving

Boasting a unique combination of opportunities and challenges, Brazil’s PE market is an attractive place for investment among developing economies. In spite of the concerns discussed above, PE firms can thrive in Brazil by focusing on five strategic priorities.

Look Beyond Conventional Targets

Given the smaller playing field in Brazil, firms face significantly heightened competition for larger, more mature PE targets. Rather than paying inflated prices for conventional targets, firms can seek to acquire earlier-stage companies and grow them through M&A or even create new companies from scratch.

In terms of inorganic growth, firms can pursue a roll-up strategy involving a series of small targets within one industry. This consolidation approach, a “buy and build” strategy, allows firms to generate economies of scale and enhance their bargaining power with suppliers, clients, and the government, increasing the asset’s valuation multiple. (See The Power of Buy and Build: How Private Equity Firms Fuel Next-Level Value Creation, BCG report, February 2016.)

Many industries in Brazil are relatively immature and fragmented, with players that have low market penetration and sparse coverage in terms of locations, channels, segments, or expertise. As a result, these industries are ripe for roll-up plays. There are opportunities to improve operations, finance, and management. In addition, recent regulatory and technological changes give firms the potential to create a first-mover advantage.

For instance, US-based Advent International helped consolidate the postsecondary-education segment in Brazil. In 2009, Advent acquired a stake in Kroton Educational, the ninth-largest player in Brazil. From there, the company completed eight acquisitions, increasing Kroton’s EBITDA by a factor of 14 in four years. Advent sold the asset in 2013, when Kroton merged with Anhanguera Educacional, a Pátria Investimentos portfolio company that also grew by consolidating postsecondary-

education providers in Brazil.

In some industries, however, either no consolidation platform exists or the market itself is too immature for a traditional roll-up thesis. In these cases, PE firms should search for business opportunities by taking on the perspective of an entrepreneur. This could mean buying companies at a much earlier stage of development or even building a business from the ground up. Pátria Investimentos applied this approach in the eldercare segment, creating Brasil Senior Living from the ground up and setting up a new company called Odata to operate in the data center market.

Although this model is relatively new to most PE firms in Brazil, it is common in other markets. For example, Warburg Pincus has created several new companies, including Venari Resources, a deep-water oil exploration company located in the Gulf of Mexico, and Targa Resources, a US-based natural gas processor. In these cases, Warburg deployed dry powder, or uninvested assets, in industries whose large capital requirements tend to prevent traditional startups from disrupting the long-

established status quo. And it reaped sizable profits: in the case of Targa, Warburg made an initial investment of $400 million and later sold the holding for $1.8 billion.

In Brazil, investors can identify opportunities by analyzing long-term megatrends. One such trend is the rising relevance of interior cities. Residents in these cities will account for 46% of incremental annual consumption in Brazil by 2020. (See Brazil’s Next Consumer Frontier: Capturing Growth in the Rising Interior, BCG Focus, June 2014.) Despite this relevance, interior cities have historically proved difficult for many consumer companies to reach, given Brazil’s vast size and infrastructure challenges. PE-backed companies that focus on logistics could develop important competitive advantages over traditional companies by using their available capital and superior management skills, making the right investments, and scaling up to distribute products and services efficiently and consistently to cities across the country.

Furthermore, PE investors could capitalize on demographic changes, including the aging of Brazil’s population, which has triggered demand for specialized health care services and products, and the increasing participation of women in the workforce, which has created a market for products and services such as prepared meals, childcare, and housekeeping. As a side benefit, this entrepreneurial mindset fosters the healthy habit of building an investment thesis before looking for potential acquisition targets. This habit is particularly important in Brazil, given the immaturity of many industries.

Revamp the Screening Process for a Slow-Growth Environment

During the growth boom, when many sectors in Brazil were thriving owing largely to an expanding middle class with more disposable income, companies could ride the wave and enjoy rising revenues. In the future, revenue growth will be much harder to achieve. As a result, GPs need to alter their screening approach in several ways.

Identifying Pockets of Growth. Even though the period of easy growth is over, firms can still find pockets—segments and companies—that are expected to show promising growth rates. For example, among consumer segments, categories related to food and health are projected to grow the fastest, according to Euromonitor International. In the B2B realm, agribusiness and infrastructure look promising. In addition, Brazil’s government is developing concessions for private investment partnership programs in areas such as roads, airports, railways, and ports.

Screening for Investments Using a Domain-Based Approach. In addition, companies should shift their approach from one that screens traditional product categories to a domain-based approach that uses megatrends as the starting point in developing an investment hypothesis. (See, “The Domain-Based Approach to Screening Investments.”) This approach lets firms break free of conventional thinking and cast a wider net for investment opportunities. It also helps PE firms identify markets at earlier stages, in which deal multiples will likely be lower.

THE DOMAIN-BASED APPROACH TO SCREENING INVESTMENTS

THE DOMAIN-BASED APPROACH TO SCREENING INVESTMENTS

The traditional approach to identifying investment targets—starting at the industry level—can limit results. Some firms are instead using a domain-based approach, which entails starting with large-scale megatrends and deconstructing them into specific subtrends and finally to domains, or clusters of opportunities, that can span several industries.

Consider, for example, a megatrend that will affect Brazil over the coming decade: the aging of the country’s population. That consists of several subtrends, one of which is the increasing need for businesses that provide the growing base of elderly people with quality-of-life products and services: for example, eldercare and senior housing, as well as fitness, leisure, continuing-education, and employment marketplace services. In addition, each subtrend has underlying factors. For example, given that both members of a married couple likely work full-time, elderly people can no longer count on their adult children to be their caregivers. That sociological change leads, in turn, to a related investment opportunity: providing support to working parents in segments such as childcare.

The advantage of the domain-based approach is that it gives firms a wider lens for screening investments, and it helps them see how multiple industries can capitalize on a single underlying megatrend.

Considering the Acquisition of Noncore Assets of Distressed Companies. To remain competitive in challenging market conditions and raise capital, some companies have decided to focus on their core operations and divest noncore assets. Several important Brazilian companies—particularly those with high leverage—have already started to sell off such assets. And some PE investors are taking advantage of the resulting opportunities.

Firms using this strategy will need to be opportunistic in the coming years, because debt will most likely become cheaper in Brazil. (The short-term interest rate, which was higher than 14% during the recession, is expected to fall below 10% by the end of 2017.) Moreover, capital markets are now more open to IPOs and follow-on offerings than they were during the past three years. That said, to fully seize some of these opportunities and put the assets they acquire on a stronger trajectory, PE firms must have turnaround capabilities in place.

Leave No Stone Unturned in Creating Value

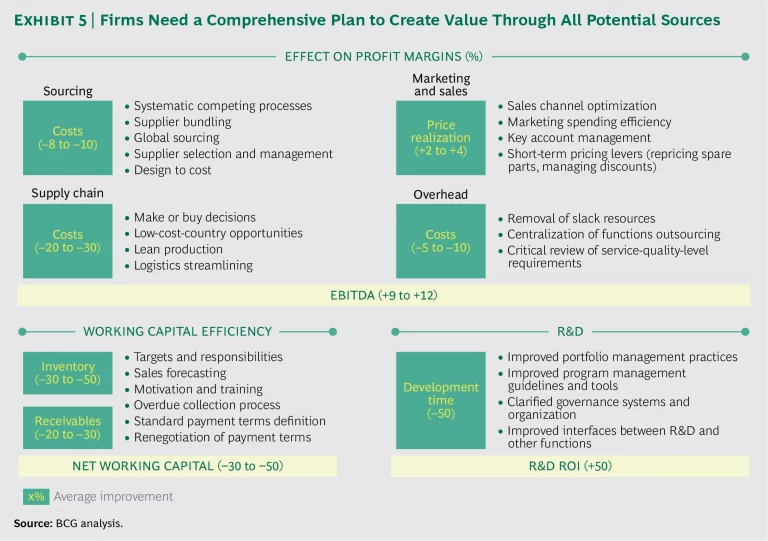

Because Brazil’s economy has slowed, revenue growth has become a less important means of creating value for investors. Instead, firms need to focus on other levers—particularly profit margins—to generate the returns that LPs demand. Specifically, PE firms should develop a full-potential plan for capturing all sources of value creation over the entire lifetime of a deal. Regarding operational improvements, BCG experience shows that this holistic approach may lead to a 9% to 12% increase in EBITDA, a reduction in net operating working capital of 30% to 50%, and improvement of up to 50% in R&D ROI. (See Exhibit 5.)

When designing the plan, firms need to consider how the timing and the sequencing of each improvement measure will affect the results. Firms also need to manage interdependencies and do a better job of estimating the returns. The plan should cover more than operational areas and include alternative exit strategies, even before the deal closes.

Bring Industry-Specific Expertise to the Table

Given that revenue growth is currently a less dominant means of value creation, operational improvements have correspondingly more importance. In addition, some industries in Brazil have particularly complex regulations and may lack strong management teams with proven track records. As a result, PE firms must bring industry-specific operating expertise to portfolio companies. Some funds—including Pátria Investimentos and Advent International—have built teams dedicated to this.

In addition to hiring specialized expertise, PE firms could consider recruiting industry executives with successful track records to provide insight and counsel on all deals within a specific sector. An executive in such a role—usually with the title of operating partner—serves as an intermediary between portfolio companies and the firm itself. Working with the portfolio companies, operating partners generally serve as advisors to existing management or as temporary replacements until new executives are found or, on occasion, for the lifetime of the deal.

Within a firm, operating partners may have a status that is similar to that of other in-house partners, even though they are usually transitioning from fund to portfolio and back to fund as deals happen. In other cases, they are not members of the firm’s core partnership, working instead as hired guns on a deal-by-deal basis. Either way, successful relationships tend to last through many deals.

In addition to industry expertise, many PE firms operating in Brazil have sought to increase their expertise in functional topics—most commonly in operations but also in marketing and pricing. In particular, digital technology is a critical means of improving the performance of portfolio companies and boosting deal returns. In other regions of the world, firms are hiring digital directors and chief digital officers whose sole responsibility is to drive the digital agenda across the companies in their portfolios. In Brazil, however, most firms can do far more with digital technology to create a competitive advantage.

To bring industry or functional expertise to the table, many successful PE firms have even established separate entities aimed at creating value through portfolio work. For example, KKR, Blackstone Group, TPG Capital, Bain Capital, Silver Lake Partners, and Cerberus Capital Management are among the companies that have created dedicated teams of operating partners for portfolio projects, including KKR’s Capstone, Bain Capital’s Portfolio Group, and Silver Lake’s value creation unit. In some cases, such as the Cerberus Operations and Advisory Company, the team constitutes a separate affiliate.

Protect Against Economic Volatility

Finally, given the volatility of Brazil’s currency, it is important for PE firms to shield gains from exchange rate fluctuations. One way to achieve this is by setting long-term investment periods—more than ten years—for funds. That gives firms the flexibility to time their exits appropriately when exchange rates are favorable, when portfolio companies are mature, and when market conditions are promising—all of which could have a major impact on sale multiples. With long timelines, PE firms can also pursue more entrepreneurial investments, even building companies from the ground up, as discussed above.

In fact, this approach has been gaining momentum in other markets as well, with large GPs raising long-term funds. Preqin estimates that 5% of funds set up globally in 2016 have a lifespan of more than 12 years. Carlyle Group, Blackstone Group, CVC Capital Partners, Altas Partners, and Altor Equity Partners are among the firms that have recently raised billion-dollar funds with lifespans of up to 20 years.

After its wild ride during the past decade, Brazil’s economy is poised for a period of slower growth. Yet this does not mean that PE firms must scale back their expectations. With a distinctive combination of opportunities and challenges, the Brazilian PE market is still an attractive place for investors and firms seeking diversification in emerging markets, and it has considerable room for growth. Firms that understand the market—and develop a clear strategy to mitigate risks and capitalize on long-term opportunities—can position themselves to win.