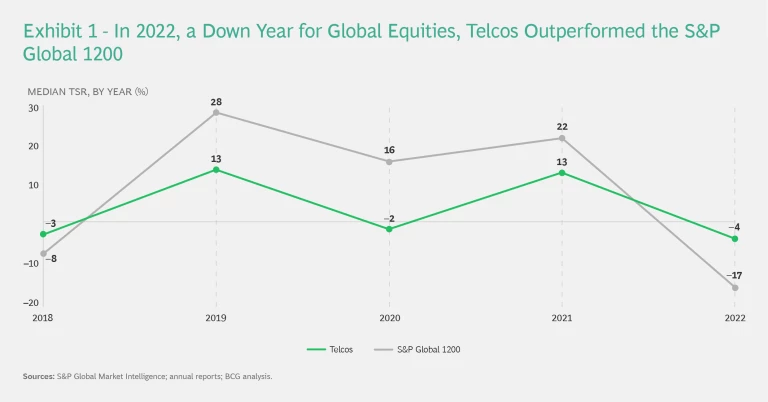

In 2022, the worst year for equity markets since 2008, investors in the telco sector benefited from the sector’s utility-like characteristics. The median total shareholder return (TSR) for the S&P Global 1200 was –17% for the year, but the median TSR for telcos was –4%. (See Exhibit 1.) In fact, this was an encore from the last time capital markets sputtered in 2018, when global telcos were down 3% compared to the overall market down by 8%.

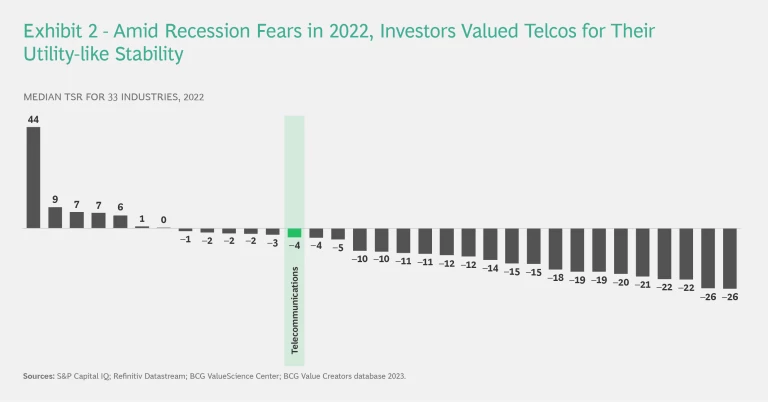

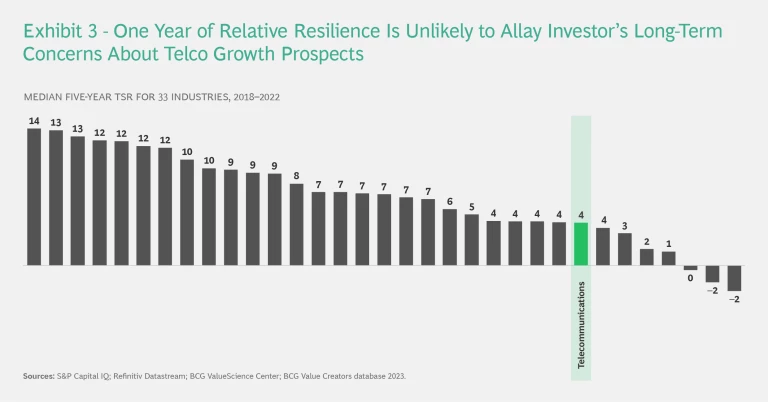

As inflation, rising interest rates, and geopolitical risk roiled financial markets, telco share prices reflected the steady revenues generated by the essential services the sector provides. Overall, telcos’ one-year TSR performance ranked 13th among the 33 industries tracked, moving the sector up three notches in the five-year TSR ranking, from 29th place to 26th. (See Exhibits 2 and 3.)

But possessing traits similar to those of a utility remains a long-term handicap for telco operating companies. Risk-averse business cultures impede the digital transformations that many telcos still need to embrace if they are to compete effectively. In addition, companies committed to delivering rich dividend payouts may have less financial flexibility as they seek to finance 5G and fiber rollouts—which can increase capex needs by 5% and 20%, respectively—and other key initiatives. In short, the sector’s structural challenges remain to be dealt with, and company valuations reflect the market’s view of these challenges.

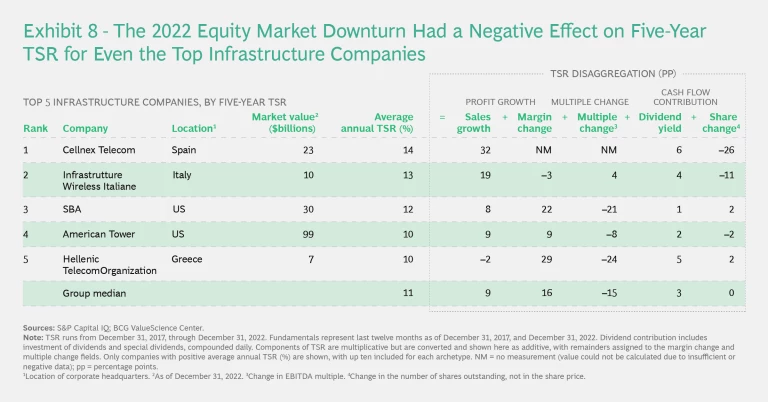

In contrast, infrastructure companies were a bright spot in the telco universe in recent years. The performance of companies managing network assets—many of them spun off from operators—boosted the five-year TSR for the telco sector, despite a sharp reversal in one-year TSR momentum, from a median of 32% in 2021 to a median of –27% in 2022. Low interest rates had fueled past outperformance by enabling M&A and making infrastructure companies attractive to income-seeking investors; higher rates were a bane.

Currently, infrastructure companies account for only 6 of the 59 companies in our sample and only 10% of the telco sector’s market value. Even in a climate of higher interest rates, these numbers may continue to grow as more operating companies decide to spin off their physical networks and free up capital for other initiatives. A few telcos have gone further, separating into a network company (managing the network as a whole, rather than just the physical assets) and a service company (handling products and executing sales and customer care). Others are now weighing the pros and cons of carving out a network or service company. These decisions indicate the tough choices that confront companies in the sector.

Unpacking the Numbers

Thanks in large part to dividend payouts, telcos have achieved a positive median annual TSR of 4.2% over the past five years. This figure somewhat masks the underlying reality that the telco sector as a whole experienced a net decline of about $300 billion in market value during this period. Although 24 companies combined to gain $311 billion in market value, 35 companies combined to post a loss of about $610 billion. A single operating company (T-Mobile US) was responsible for more than a third of the positive contribution, and four infrastructure companies generated another quarter of the gains. Large incumbent operators were well represented on the negative side of the ledger, although divestitures played a significant role in these results.

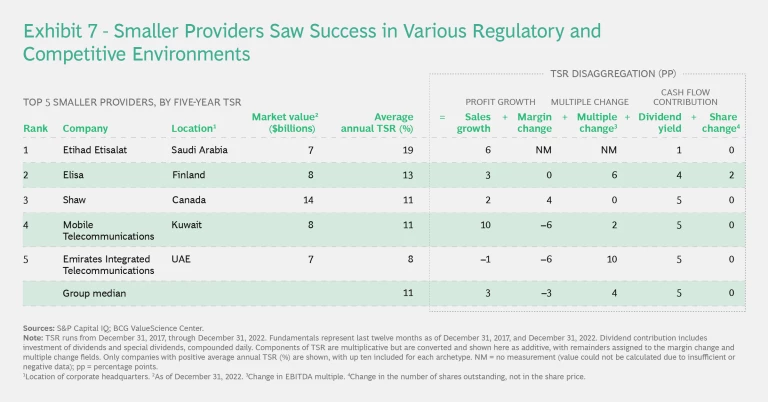

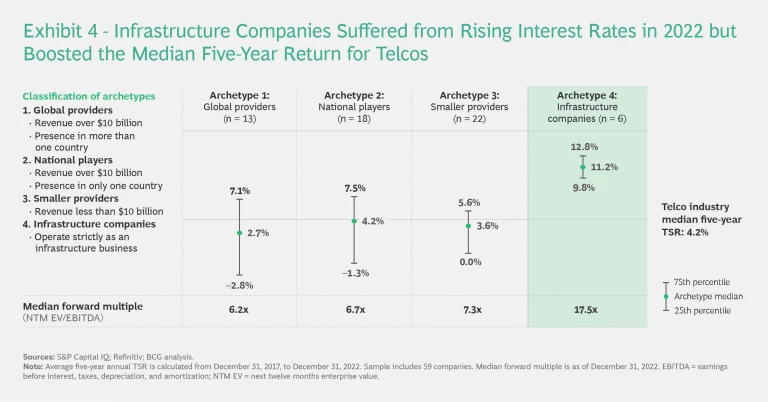

After sorting the operating companies into three archetypes (global providers, national players, and smaller providers), we found that the global providers underperformed the other two segments. Global providers had a five-year median TSR of 2.7%, while national players delivered 4.2%, and smaller providers returned 3.6%. (See Exhibit 4.) In some instances, size may be a key factor: large companies can be less nimble, and rapid growth can be harder to achieve from a larger base. But given the geographic diversity in our global list, it is important not to overlook the role of local regulatory and competitive landscapes.

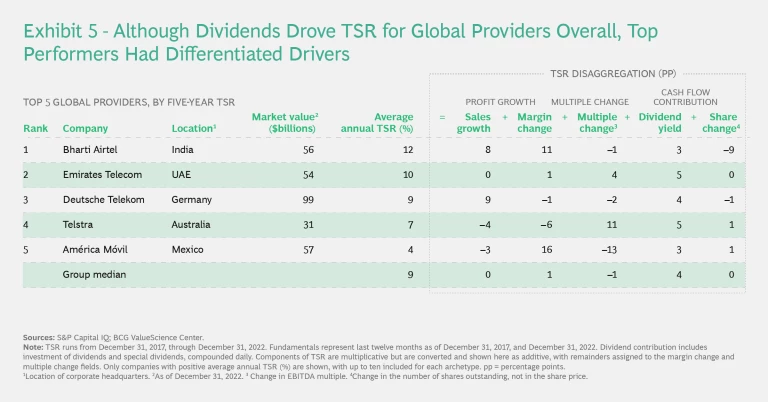

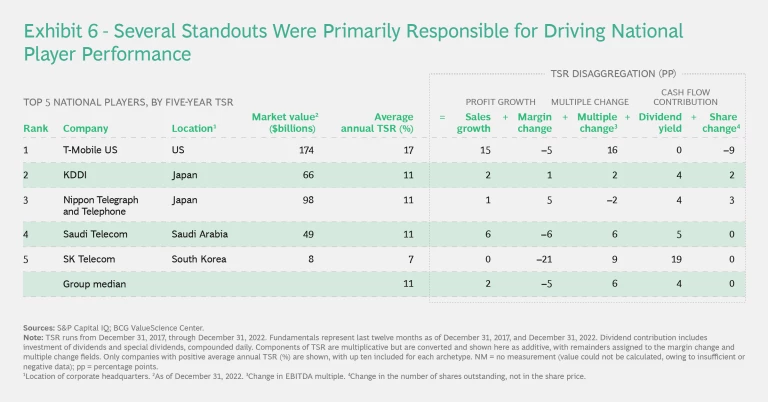

One way to obtain a snapshot of the performance drivers for the top companies in each archetype is by disaggregating the factors contributing to each company’s TSR. (See Exhibits 5, 6, 7, and 8.) For the median global telco in this group, dividend yield and margin change were the only two positive contributors to five-year TSR. Dividends were important for the top national and smaller telcos, too, but those archetypes also received contributions from sales growth and multiple expansion.

As demonstrated by Bharti and T-Mobile US—the leaders in the global and national categories, respectively—top companies may rely on different performance drivers. For Bharti, sales growth and margin improvement were critical; for T-Mobile US, multiple expansion was the strongest driver of TSR.

As a group, infrastructure companies, our fourth archetype, continue to stand well above operators, posting a median five-year TSR of 11.2% despite their tumble in 2022. However, this figure is a big step down from the 24% TSR that infrastructure companies delivered for the five years ending in 2021. For a typical infrastructure company, sales growth and margin improvement were the biggest contributors to TSR. These two factors were strong enough to overcome a large negative effect from multiple contraction in 2022.

Telco Value Standouts

The December 2022 BCG article “What Five Trends Mean for Telcos” describes five strategic vectors that telcos can follow to create value amid trends such as the push for 5G-enabled B2B applications, the potential rewards for telcos of structural separation, and the impending emergence of Web3. A look at some of the top telco value creators over the past five years reveals the results that some companies have achieved by following these vectors.

Improve Transformative Enablers. Its strong value-creation record marks T-Mobile US—which tops the national player list as well the complete set of companies in our study—as a conspicuous and agile outlier among large telcos. The company has achieved significant growth in a competitive market, bolstered by its 2020 acquisition of Sprint, its US leadership in 5G deployment, and its extension of its long-running “Un-carrier” marketing strategy to new customer segments.

T-Mobile US acquired Sprint partly for its midband 5G spectrum assets. After adding to them in a recent auction, the company now expects to be able to reach a population of 300 million with 5G service by the end of 2023. A report from research firm Ookla found that T-Mobile US—previously a laggard in network quality—topped its rivals in speed and availability in the third quarter of 2022. The Sprint deal has also broadened T-Mobile US’s customer base, and the company now expects to surpass the $43 billion in synergies projected at the time of the all-stock, $26 billion acquisition.

“Telco to Techco”— Growth Outside the Core. Bharti Airtel, the top value creator among large global providers, operates in India (its biggest market) and two other South Asian countries, as well as in 14 African countries. In India’s fast-growing but highly competitive market, Bharti has achieved significant sales growth by enhancing the customer experience and pursuing a “premiumization” strategy.

Digital tools play a key role for Bharti. AI and machine learning (ML) help networks self-optimize and improve service. Better management and integration of customer data enable more precisely targeted campaigns and a consistent customer experience across touchpoints. These efforts support the premiumization push, encouraging customers to migrate from feature phones to smart phones, to switch from prepaid to postpaid plans, and to install home fiber connections. The company offers high-value customers Airtel Black packages, which bundle wireless and fiber. So far, Bharti has outpaced its competitors in improving average revenue per user (ARPU) in a country where ARPUs have been comparatively low.

Tech + Us: Harness the power of technology and AI

Bionic Core Business. Finland’s Elisa, which ranks second on our smaller providers list, achieved its five-year average annual TSR of 13% partly through its skill in acquiring and integrating other local companies, first in telecommunications and more recently in international digital services. Tech-focused acquisitions—along with a self-organizing network that the company developed in-house—have made Elisa a standout in delivering analytics at scale, including to other telcos. Investments in automation and ML support its culture of continuous improvement, both in network management and in customer service. Offerings outside the company’s core telco business include entertainment services for consumers, cloud-based IT services for corporate customers, and ML/AI software solutions for the telecom and manufacturing industries.

The potential for telcos in B2B services and in the Internet of Things (IoT) is underlined by Saudi Arabia’s STC. In part because of the performance of its subsidiary STC Solutions, STC ranks fourth among national providers, with sales growth and multiple expansion contributing to an average annual TSR of 11%.

Next-Gen Operating Model. For Australia’s Telstra, the fourth-ranked company in the global telecom archetype, multiple expansion has been the most important contributor to TSR over the past five years. In 2021, Telstra sold almost 50% of Amplitel, its mobile towers subsidiary, to a consortium of institutional investors. Last October, the company announced further unbundling and restructuring plans, which include (among other steps) moving its fixed-line infrastructure, real estate assets, and related cash flows to a separate unit. The simpler, less capital-intensive core business going forward will include retail operations and the technology and wireless spectrum that support them.

Tower divestitures have likewise played an important role for infrastructure companies such as Spain’s Cellnex, Europe’s biggest tower operator and the top value creator on our infrastructure company list. Since its IPO back in May 2015, Cellnex has taken advantage of ultralow interest rates to assemble a portfolio of 130,000 towers across 12 countries. Sales rose from almost €800 million in 2017 to €2.5 billion in 2021, and margins improved significantly as well. In last year’s ranking, Cellnex topped all telco value creators, thanks to its average annual TSR of 40% from 2017 to 2021.

In 2022, however, Cellnex put further acquisitions on hold as a result of lack of visibility of transformational deals and increased competition, and amid rising interest rates, stubbornly high inflation, and falling investor enthusiasm for debt-heavy tower companies. The company’s current financial focus is on lowering its debt load and limiting capex in order to reduce interest expenses and pursue an investment-grade credit rating. Despite the turn in market sentiment, Cellnex’s most recent five-year average annual TSR of 14% ranks third among all the companies for the period from 2018 to 2022.

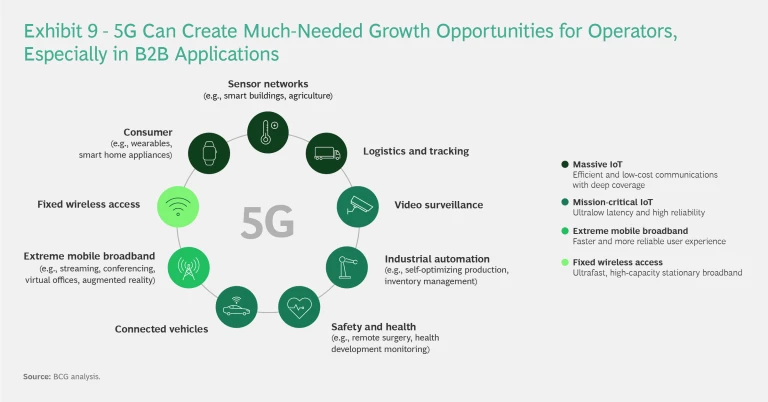

5G Applications as a Network Leader. Companies that have successfully pursued the fifth vector for value creation remain hard to find. This will almost certainly change, but 5G remains in its early stages in most markets, so the timing of its emergence as a key factor is uncertain. Even so, the opportunities related to 5G are considerable—especially in B2B applications such as industrial automation and logistics—and telcos are keen to reap some rewards from their investments in 5G. (See Exhibit 9.)

Same Movie, but with Some Tweaks to the Script

The trends that telcos are navigating are deep and long term. Still, given the magnitude of the changes in financial markets last year, it makes sense to consider possible ripple effects for telcos. Four such effects could pose especially significant challenges—and opportunities—for telcos going forward.

Cross-Industry Partnerships. Following a recent round of layoffs and cost-cutting, the internet giants are turning their focus from growth to profitable growth. This shift won’t lessen the hyperscalers’ interest in areas that telcos also target—such as collaboration and IoT products—but it may make some of them more inclined to consider partnering. Scarcer capital may also hinder development of the bandwidth-hungry metaverse. In line with broader tech industry trends, year-on-year investments in the telco sector fell in 2022, although we saw no instances of companies specifically pulling back from metaverse opportunities. The more important effect in this area may be a possible tilt toward one or more of the control models now gestating.

An M&A Slowdown. Higher interest rates and recession fears have already slowed the M&A market. Tower companies such as Cellnex have felt the economic effects of these forces, and operating companies must take them into account when contemplating a whole or partial infrastructure sale as they migrate to a next-generation operating model. The logic underlying carveout deals hasn’t changed: they liberate capital for network build-outs and investment in services innovation; and, if successful, they can help telcos develop an investor base with a more balanced focus on growth and income. Also unchanged is our view that the right decision with regard to selling infrastructure is highly company-specific, and that some telcos will do better if they retain their infrastructure assets. For them it will be important to identify a clear role for the assets in evolving the company, such as using their strong cash flows to invest in digitization or growth outside the core.

More Creative Deals Amid Lower Asset Values. A slower M&A market doesn’t necessarily mean a halt. Market conditions could lead some telcos to consider smaller, tech-focused acquisitions. And although the multiple that infrastructure assets are likely to fetch has changed significantly, such acquisitions remain an important lever for some telcos to pull as they forge their future. Moreover, private equity investors continue to have record amounts of capital to deploy, including a significant portion earmarked for telco and tech infrastructure deals. Creative deals may still bring the two together.

Certain markets may also see telcos opt to separate network companies from service companies—the more complex carveouts that some players have pursued. This remains an extremely high-stakes decision, however, and telcos need to reach a clear understanding of whether it makes sense in their strategic context. The jury is still out on these deals: so far, we have not seen a telco undertake a network/service separation and subsequently rank among the top performers.

Digital Talent for Digital Transformations. One aspect of the 2022 tech-market selloff could be a silver lining for telcos: as the tech giants reduce their headcounts, telcos may find it easier to recruit the digital talent they need for future success.

The digital transformation agenda at most telcos remains extensive. They need to digitize their core businesses, upgrade their networks, optimize the customer experience, and much more. They also need to seek growth outside the core in future B2B and B2C ecosystems, in areas such as logistics and gaming.

All of this will require an infusion of talent and a huge shift in culture from risk-averse to test-and-learn/fail-fast. It’s a transition that few industries have faced, now made more difficult by possible headwinds from inflation, recession, the urgent and complex task of reducing the carbon footprint of supply chains, and many other concerns.

But if not now, when? Companies that act boldly during downturns often outperform their peers when the cycle turns. Although the market reset hasn’t swept away telcos’ structural challenges, it may have created a few new levers for dealing with them.