The global media landscape has undergone a huge transformation over the past few years, driven by exciting new technologies and shifts in consumer behavior. Innovations such as digital streaming, social media, and generative AI have received a great deal of attention from chief marketing officers, while retail media—another exciting emerging channel—has gone relatively unnoticed. Although retail media has been shaking up marketing practitioners’ day-to-day activities for some time, it has not enjoyed the same level of interest from the C-suite.

Retail media deserves better. With the proliferation of media channels, it has never been easier for companies to reach consumers. But with the fragmentation of audiences, it has never been more difficult to engage them. Retail media has the potential to revolutionize how brands speak—and engage—with consumers, making it a powerful strategic tool in marketers’ arsenal.

Consider one possible scenario. A beverage maker launches a new energy drink. The brand works with its retail media network (RMN) partner —such as Walmart Connect or Target’s Roundel—to reach energy drink consumers on social media (using advanced analytics on previous purchases to select the target audience) and offer them a first-time purchase coupon in the retailer’s loyalty app. When a consumer next visits one of the retailer’s outlets, in-store digital screens encourage them to check the app to see if they have received a special offer. Once the consumer has redeemed the coupon to buy the drink, they are given a “streak” offer or a bulk-buy discount to build long-term loyalty—reinforced by advertisements both in-store and on their mobile devices.

This example shows how the tools of retail media can drive sales and build brand loyalty across multiple channels. Currently, however, retail media is far from this potential. Meanwhile, brands have nearly tapped out the shopper marketing and trade budgets largely funding retail media’s growth to date. And brands are reluctant to turn to other funding sources without a step change in retail media and its results.

To discover what’s needed to unlock additional brand dollars, we interviewed industry leaders from both brands and retail media networks and surveyed over 100 brand marketers and their agencies.

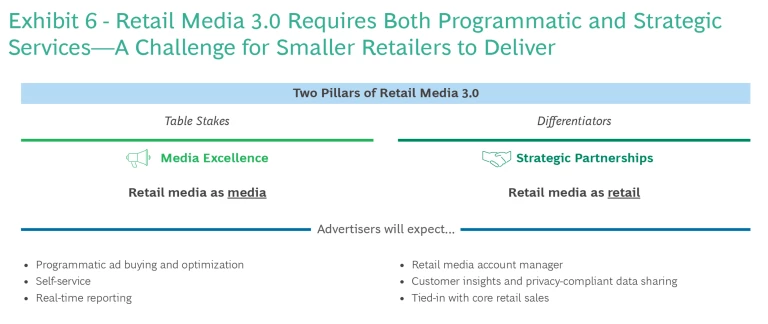

Our findings showed that, to secure brands’ continued support, RMNs will need to take retail media to the next level—Retail Media 3.0—by offering advertisers far more than they do today. Specifically, half of the brands we contacted are looking for retailers to offer data and insights in a way that they have never received from their traditional partners, the retailers’ merchandising departments. But media excellence—including programmatic ad buying and real-time reporting—will need to become table stakes as retail media competes squarely in the digital advertising market.

Time for Retail Media 3.0

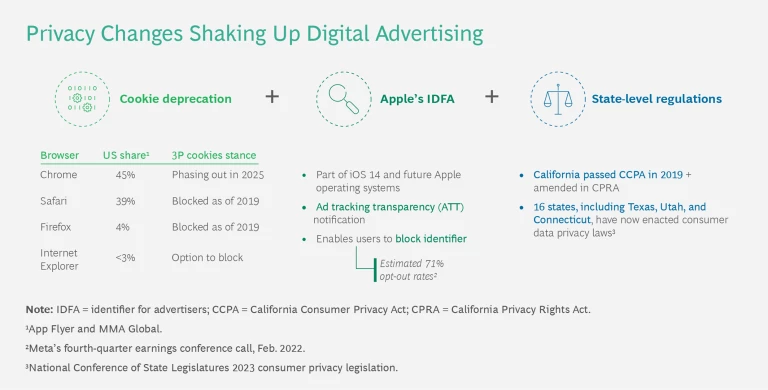

For years, major advertisers, particularly consumer packaged goods companies, have struggled with being disintermediated from a direct relationship with their consumers by retailers. This has created two groups: the “Data Haves” (retailers) and the “Data Have Nots” (brands). Historically, that disparity has been mediated by 3P cookies, which have enabled targeted advertising without 1P data. But with third-party cookie deprecation, this fragile equilibrium is already being disrupted. Retailers need to flip the script on data. Rather than hoarding it, retailers need to share data-driven insights with brands to allow the ecosystem overall to thrive and grow. Retail media is the vehicle for achieving that.

Retail media networks enable brands to buy advertising space across the retailer’s owned channels (such as its website, mobile app, or in-store screens) and paid media (with RMNs using first-party data to target relevant audiences across programmatic display ads, search, or social media). With either approach, RMNs use data and access to the consumer purchase journey to connect with consumers, measure the impact of the advertising that reaches them, and provide these measurements to the brands.

Retail media networks have gained favor among brands because they provide an effective route not only to target consumers but to engage with them at critical moments during the consumer journey. Furthermore, RMNs’ closed-loop measurement capabilities enable companies to gauge how successful media campaigns are at generating sales, which as any CMO or CFO will tell you is the holy grail of marketingmarketing.

Within the next two to three years, the US retail media market is projected to be over $100 billion in revenues, more than three times the amount in 2021. Out of the additional market value that is expected to be created in this period, about two-thirds will be net new spending with retailers over and above historical trade dollars. About one-third will come from brands shifting existing budgets. However, getting to these projections will depend on retailers upping their game. If they want to capture the new money on the table and demonstrate real value creation and return on investment, Retail Media 3.0 will need to be an essential part of the strategy and have the buy-in of the CMO.

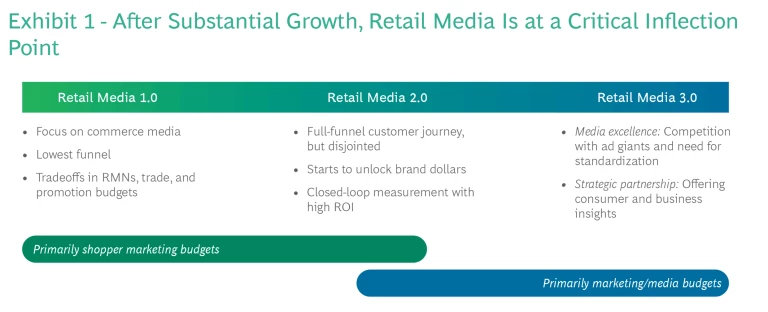

To understand the growth trajectory of retail media networks, we examined their development to date across three overarching phases. (See Exhibit 1.) Retail Media 1.0 relies primarily on traffic to retailer.com, supporting sponsored products and branded banners while the customer is shopping online. Retail Media 2.0 offers nascent omnichannel activation: it begins to rely on first-party data for customer targeting and to introduce in-store and broader channel offerings, such as digital screens and programmatic displays, though often in a disjointed way.

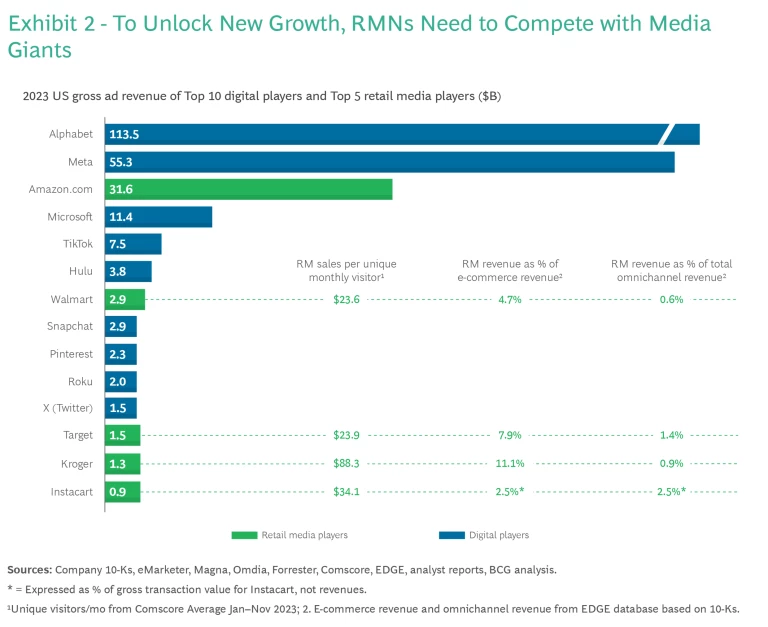

Retail Media 3.0—only now starting to emerge—has the power to unlock the full potential of retail media and elevate it to a truly strategic media option. In this phase, RMNs will tap broader brand and media budgets beyond shopper marketing and basic brand dollars by investing in technology, offering media excellence on par with the big advertising giants, leveraging partnerships with brands, and providing brands with something Google and Meta don’t have: access to point-of-sale first-party data. (See Exhibit 2.) This is the phase where senior-level marketers evolve their view of retail media from a tactical channel to a powerful, strategic opportunity to reach and, more importantly, engage with valuable audiences.

While the expanding capacity of retail media will drive higher utilization, more onerous data privacy laws and curbs on third-party browser cookies look set to further drive brands to spend at least part of their marketing budgets on retail media as other forms of targeting become increasingly challenging. (See “How Privacy Curbs Are Set to Change the Retail Media Landscape.”)

How Privacy Curbs Are Set to Change the Retail Media Landscape

Through their retail media networks, retailers are well-placed to bridge the gap caused by these limitations on consumer data gathering by offering brands privacy-friendly access to aggregated first-party data and its unique consumer insights. But it is essential that retailers stay on top of the emerging regulations.

To safeguard their role as strategic brand partners—and their position as the most brand-safe media option—retail media networks must be ready to act quickly and proactively to ensure full compliance with rule changes. Investing in strategic legal counsel who can be part of ad product design will become a competitive edge for RMNs that are differentiating with data and insights. This can allow networks to build best-in-class products from a brand safety and consumer trust perspective. “Customer behavior is the heartbeat of retail media. Our loyalty program is the key to understanding our customers and guarding their trust in us,” an executive at Kroger Precision Marketing told us.

RMNs and other media players are still trying to fully understand the implications of new state-level data privacy regulations. In 2019, the California Consumer Privacy Act underlined the right of consumers to know how their personal information was being collected and used by businesses they interfaced with. Since then, several other states have enacted similar laws, governing everything from children’s online privacy to personal health data.

As part of the compliance requirements for these regulations, state attorneys general are demanding an opt-out choice (or requiring opt-in for sensitive data!) for consumers when it comes to internet-based advertising where their personal data is shared with other parties. “The attorney general has been very active in sending letters to media companies. These are very real letters saying ‘you must enable your website to allow people to opt out of data sharing.’ They are warning companies that they have to comply,” said a privacy lawyer at In-House Privacy. Being able to manage these opt-outs and propagate them through the system will be critical to remain in line with evolving regulations.

Data clean rooms are a useful tool to aid compliance with privacy laws. These can support the propagation of consumer opt-outs through an advertiser’s systems. They also have the potential to allow different parties to securely share pseudonymized, aggregated consumer data in a privacy-friendly way without compromising the effectiveness of ad targeting, although the exact parameters are still being finalized. Data privacy providers, such as Relyance, Ketch, or Transcend, can also help retail media networks comply with regulations in different states and without using as many internal resources.

Retail Media 3.0 will see the continued strength of top players—including Amazon Advertising and Walmart Connect—as walled gardens, although higher brand expectations will mean they start being held to the same standards of media ease of use and performance as the media giants. However, our survey findings and interviews suggest a programmatic open ecosystem will also emerge. Standardization will be an essential component for the “long tail” of retailers interested in entering the space; retail media networks will behave more like publishers; and advertisers will demand a way to purchase across them without having to manage a dozen or more networks individually.

The Real Deal with Retail Media Networks

In October 2022, we published the results of the first BCG survey of 100 industry-leading brand and agency marketers in which we asked participants what they really wanted from retail media networks.

In March 2024, we re-ran this survey, while also interviewing a number of industry leaders from brands and retail media networks, to obtain further insights on what remains a challenge, what has changed, and what developments they are looking forward to.

The answers we received echoed our earlier findings, yet with an even greater emphasis on the importance of partnerships, including in-store, and data-driven insights. Significantly, marketers were also more outspoken about their frustration with retail media’s failure to live up to its promise. Here’s a summary of what we found:

Brands want retailers and their RMNs to act as strategic partners.

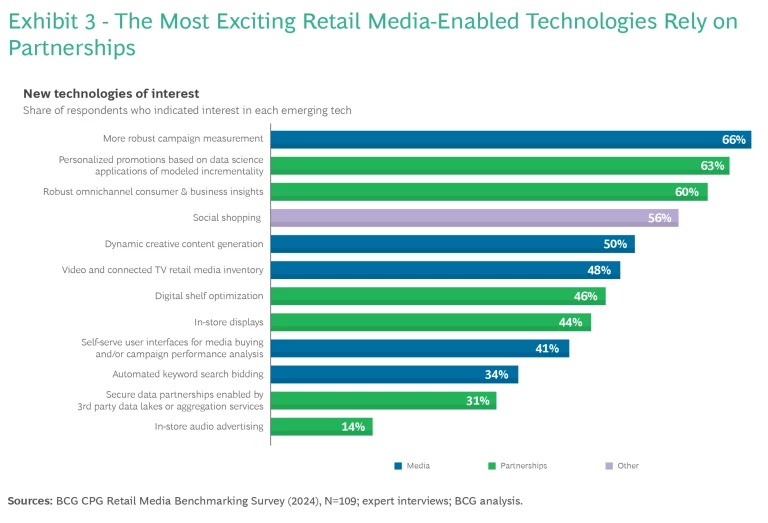

When asked what emerging retail media technologies spark their interest, our survey found that 63% of respondents would like data-driven personalized promotions, while 60% expressed an interest in omnichannel-based customer and business insights—both of which depend on deeper partnerships between retailers and brands. "We need the media and retail sides of retailers to come together,” said one brand media director. “As a pure media play, the performance of retail media networks doesn’t live up to the hype or justify incremental investment.”

Brands are primarily turning to retail media networks because of their access to unique first-party data.

We asked respondents what they wanted from media networks that they can’t get from their merchant partners at retailers. Half said they wanted data-driven insights into customer behavior (including about similar products consumers were purchasing and whether promotions were driving new sales or simply providing discounts for existing customers).

Brands want to combine data and insights, while respecting consumer privacy, to strengthen their campaigns, enable effective ad performance, and reach a bigger audience. The ability to target consumers and fulfill their orders when advertising is effective is a huge value-add for brands. “Retail media should become data-as-a-service, with a warehouse attached for fulfillment,” one brand senior director suggested to us.

Brands expect retail media networks to deliver full-funnel reporting (from awareness to customer action) that yields deep customer insights.

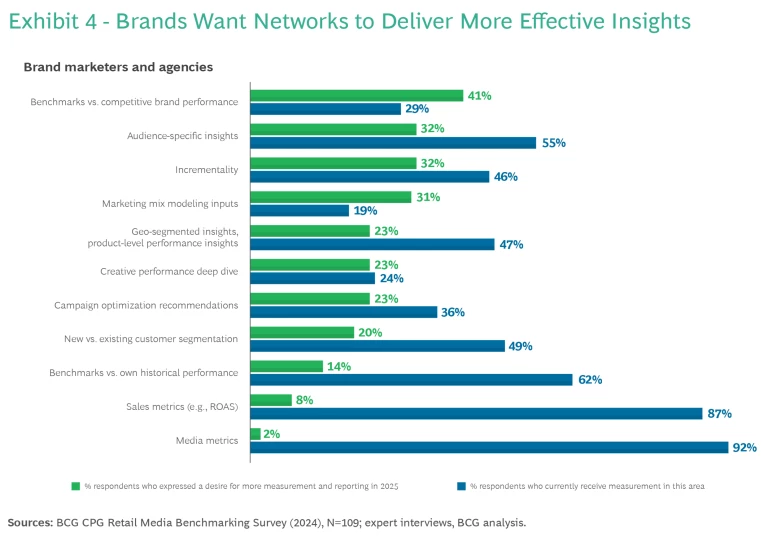

Our survey showed that, in 2025, 41% of brand and agency marketers want more benchmarks of their performance against competitors; 32% want more audience-specific insights; and 23% want more insights on campaign performance at the geographic and product level. In addition to traditional return on ad spend metrics, brands and agencies want to understand incrementality through either RMN analysis or inputs into the brand’s own marketing mix models. “Your point of difference is I can actually see a credit card swipe versus trying to be a ‘me-too’ big media player,” said one vice president responsible for both e-commerce and marketing.

Brands want digitally enhanced in-store retail media.

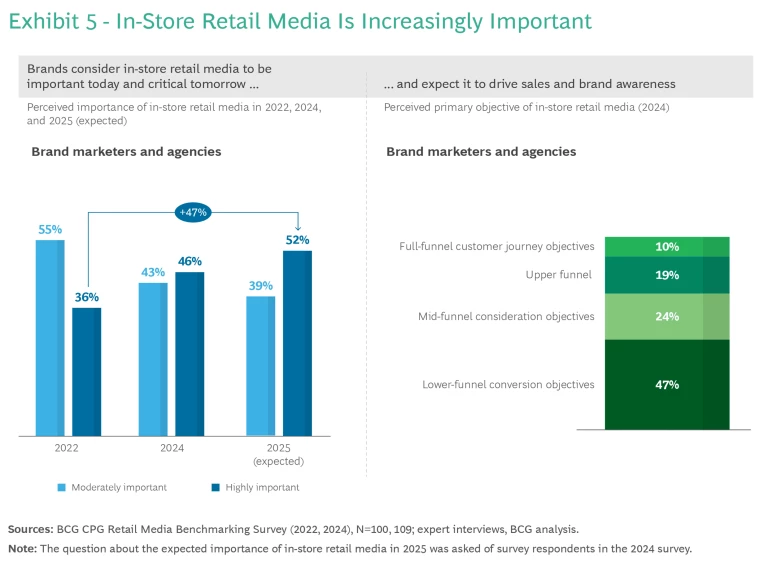

Our survey found that in-store retail media networks are growing in importance as a means of driving sales and brand awareness. While only 36% of respondents rated in-store networks as highly important in 2022, 46% rated them as highly important in 2024. And 52% said they expected in-store networks to be highly important to them in 2025.

Beyond in-store advertising placements, brands also want retail media networks to provide hybrid consumer experiences that combine in-store and digital elements but retain the flexibility and responsiveness of pure digital channels. An example would be dynamic creative updates and programmatic in-store inventory. “I want in-store products that go beyond signage or QR codes on the price tag,” said a brand head of e-commerce. “I want data signals that can actually drive the value of the media placement and play into the in-store experience, whether that is via the app, a dynamic electronic shelf, or an RFID tag.”

How Smart Retailers Are Mastering the Market Shift

We also spoke with leading RMNs to get a sense of how they are adjusting to marketers’ evolving requirements. We found that networks are either doubling down on media excellence or they are focusing on building deeper strategic partnerships that leverage data-driven insights. However, we believe that RMNs will need to do both to achieve Retail Media 3.0 and unlock the next growth phase in retail media. (See Exhibit 6.)

Our interviews revealed that leading RMNs are focusing on the following areas in a bid to make themselves more attractive to brands:

Media Excellence

Leading retail networks are investing in technology so that they can offer self-service solutions that are easier for brands and marketing agencies to navigate and implement. “We’re making a lot of technology investments, so it feels more like media investment and less like forced fun,” said a former president of RMN and media for a large specialty retailer.

They are automating their media buying and optimization processes in response to advertiser demands. This shift away from manual approaches streamlines networks’ operations because it requires fewer resources and supports rapid scaling for both top-tier and long-tail customers.

RMNs also are improving their reporting of customer activity across the funnel, with the goal of matching the advertising giants. More mature networks are offering enhanced measurement and reporting capabilities that demonstrate the value of their data in real time. For example, they are able to provide brands with granular ad-attributed performance metrics and broad audience insights (including about customer segmentation and basket building).

Strategic Partnerships

Leading networks are also developing mutually beneficial partnerships with their top vendors. These partnerships provide brands with premium account management and bespoke solutions. Closer collaboration enables networks to influence not just vendors’ marketing plans but also their business strategies.

Several leading networks, meanwhile, have gone to market with insights-focused products that give brands broader access to data to drive their decision-making. “The third wave of retail media is about business impact, not just marketing impact. How do we get closer to the data signals in the right way to unlock value for all stakeholders?” said a strategy director at Roundel, Target’s retail media network.

To engage more fully with their customers, leading networks are also creating experiences that work across channels and the consumer journey. Innovative omnichannel advertising solutions can surprise and delight customers in-store and online. But they also provide data insights that give advertisers greater clarity about the effectiveness of their campaigns from an omnichannel perspective. “There are many more experiences that we are looking to bring forward. A lot of activity has been about how we enable brands to talk to shoppers in-store,” said an executive at Kroger Precision Marketing. “This is part of the continued modernization of the store environment. A lot of experiences on digital devices can help inspire customers.”

Preparing for Retail Media 3.0

There are several actions that brands and both retailers and their media networks will need to take to get ready for Retail Media 3.0 and (in the case of networks) future-proof their operations.

Action Steps for Brand Vendors

Restructure for growth.

- Redesign your organization and funding strategy to drive collaboration between e-commerce, shopper, brand, and media teams to prevent silos.

- Partner with RMNs to identify and design products that meet your full-funnel needs. Use creative retailer audiences to design full-funnel retail media campaigns.

Develop a data capability.

- Build your capabilities to be able to fully leverage value from retailer data that is newly accessible through RMNs.

- Use insights from retail media networks and clean rooms to support broader strategic planning.

- Establish clear performance benchmarks and a measurement framework that allows comparison across media networks and other media channels.

Prioritize key retail media networks.

- Concentrate efforts on a select group of high-impact RMNs.

- Use a tech solution to manage your long tail of retail media networks.

Action Steps for Retailers and Their Media Networks

Flip the script on data.

- Use first-party data to offer highly targeted, full-funnel marketing strategies.

- Share audience insights—beyond ad campaigns!—with brands, where relevant.

- Make the legal department part of the product team. For the largest RMNs that are doubling down on a data- and insights-led 3.0 strategy, privacy and adtech laws need to be baked into product design. Dedicated legal counsel integrated into product design can make consumer privacy protection a competitive advantage.

Publish the store.

- Build out a network of digital screens, audio, and sampling in store that enables brands to touch the consumer across their journey.

- Create high-impact, hybrid physical-digital brand experiences, such as a store-mode for the app, with bonus points for ones that lend themselves to social sharing!

- Offer unified campaign messaging across channels.

Prepare for programmatic.

- Standardize retail media inventory and explore working with aggregators (such as Pacvue, Skai, and Criteo) to enable buyers to easily purchase across networks.

- Deliver self-service, real-time, and ad-attributed campaign metrics and tailored performance read-outs.

- Standardize reporting and align with the Interactive Advertising Bureau’s retail measurement guidelines.

Update your commercial strategy.

- Adapt go-to-market strategies to serve both top-tier and long-tail accounts. Networks should foster strategic partnerships with top-tier accounts while offering self-service solutions to long-tail ones.

- Align incentives across merchandising, sales, and other key stakeholders to match these different strategies.

Brands have been willing participants in the retail media experiment up to now. To justify greater investment, however, RMNs will need to deliver far more than they do currently. Retail Media 3.0 will enable networks to future-proof their operations and meet brands’ evolving requirements. But to get there, retailers and their networks must act with urgency on several fronts.