So far, 2025 has been a tumultuous year, marked by high energy prices, inflation, tariffs, and rising geopolitical tensions. To understand how European consumers are feeling and how willing they are to spend, BCG surveyed more than 16,000 of them in nine countries. (See “Methodology.”)

Methodology

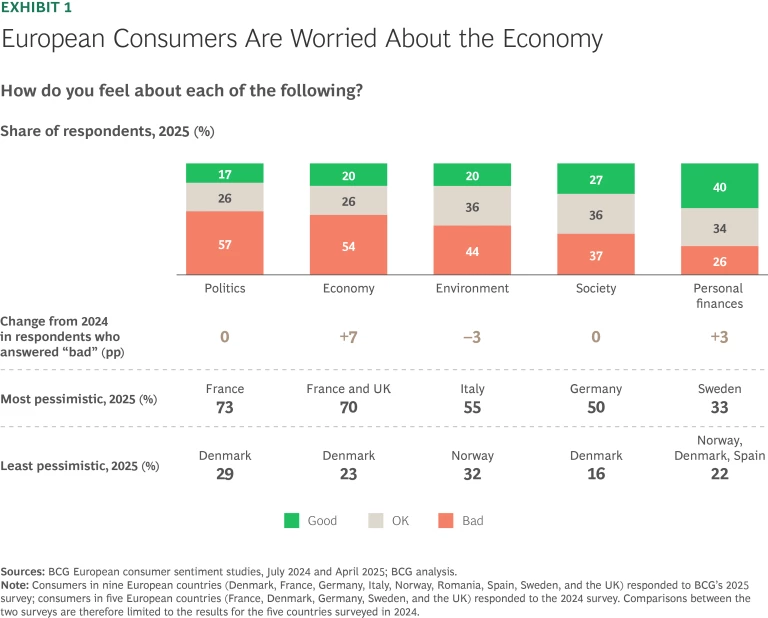

The short answer is that European consumers are feeling gloomy. (See Exhibit 1.) More than half, 54%, are pessimistic about the economy of their home country, a 7 percentage point increase since July 2024. The share of consumers who feel good about their personal finances fell by 4 points, to 40%.

This shift in sentiment means consumer companies and retailers should be revising their approach to their customers and to their business. For customers, value matters most of all. They are looking for bargains. Companies should respond to this demand while preserving profit margins and preparing for the return of growth—a daunting but doable set of tasks.

Pessimism Is Rising Across Europe

Consumer pessimism is not equally distributed. About 70% of consumers in France and the UK are worried about the economy, compared with 36% in the Scandinavian countries; consumers in Germany, Italy, Romania, and Spain fall in the middle.

European consumers are even more discouraged about the political situation than about the economy, with 57% expressing pessimism. Political anxieties, too, are unequally distributed, with 73%, 71%, and 70% of consumers in France, Romania, and Spain, respectively, feeling pessimistic, compared with just 38% in Scandinavia.

These concerns increasingly drive consumer decisions. More than one-third of survey respondents told us that they boycott brands because of the ethical or political position of their owners, a 6 percentage point increase from last year.

Another source of gloom is the environment, especially in southern Europe, where recent extreme climate events may have intensified anxieties. More than half of consumers in Italy, France, and Spain are pessimistic about the environment, compared with 40% in Scandinavia.

The share of consumers who remain optimistic about their personal finances (40%) is greater than those who are optimistic about the economy (20%), the environment (also 20%), or politics (17%). Even so, more than half (52% ) worry daily about personal finances, up 9 points from last year.

European consumers seem calm about the potential for tariffs to raise prices and create shortages. BCG’s survey launched on April 2, the day US President Trump announced a series of new tariffs on countries around the world. And yet, over the three-week duration of the survey, only 30% of consumers cited potential tariffs as a concern.

Stay ahead with BCG insights on the consumer products industry

Consumers Focus on Essentials

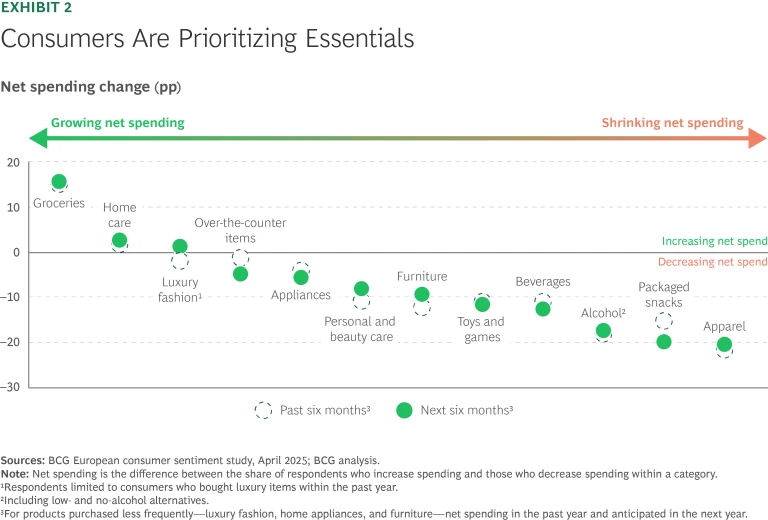

Consumers’ financial caution is profoundly shaping spending. In our survey, household essentials, including groceries and home care, were the only categories in which net spending—the difference between the share of consumers who increased spending and those who decreased spending—rose. (See Exhibit 2.) And it was inflation, rather than volume, that drove this increase.

Conversely, in a continuation of a trend identified in our 2024 survey, consumers have sharply cut back discretionary spending over the past six months. The most affected categories were apparel (a 22-point decline in net spending), alcoholic beverages (an 18-point decline), and snacks (a 15-point decline).

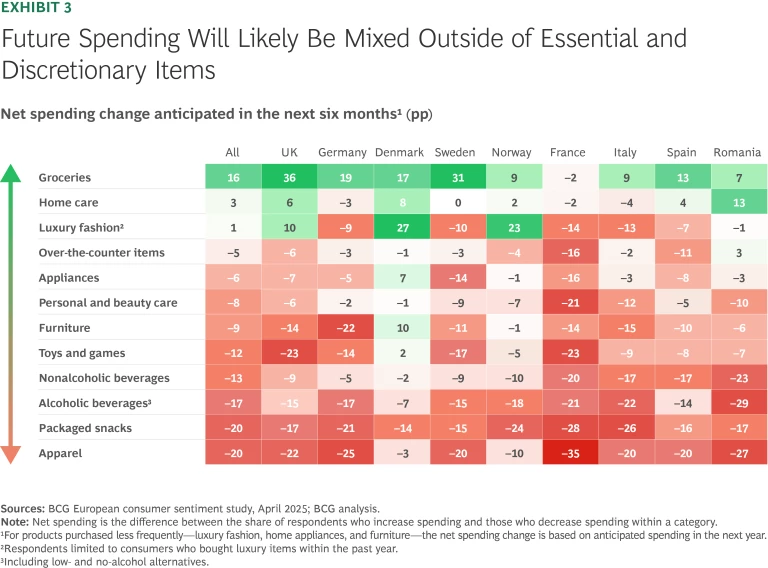

These dueling trends—more spending on essentials, less on discretionary items—will likely continue for the next six months, according to the survey. In other categories, expected spending is more mixed. Expected net spending on appliances is up 7 points in Denmark but down 16 points in France. Net furniture spending is expected to be down 22 points in Germany but up 10 points in Denmark. (See Exhibit 3.)

Luxury fashion is in a category of its own. While net spending on luxury goods fell in the past year, consumers intend to slightly increase spending on these items in the next 12 months. This shift reflects purchases by wealthy consumers. In the past six months, net spending on luxury items was down or flat for households earning less than €100,000 annually.

The Hunt for Deals

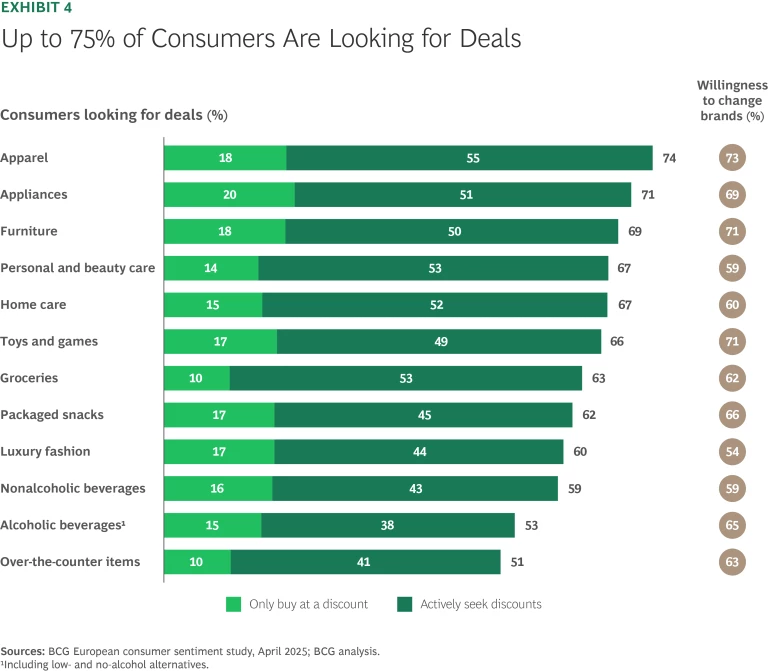

Inflation has intensified consumers’ search for discounts in all categories. The most important purchasing criterion in all nine European countries surveyed is good value for money, cited by 59% of consumers as very important. The second- and third-most-important criteria are saving money and low price, at 48% and 47%, respectively.

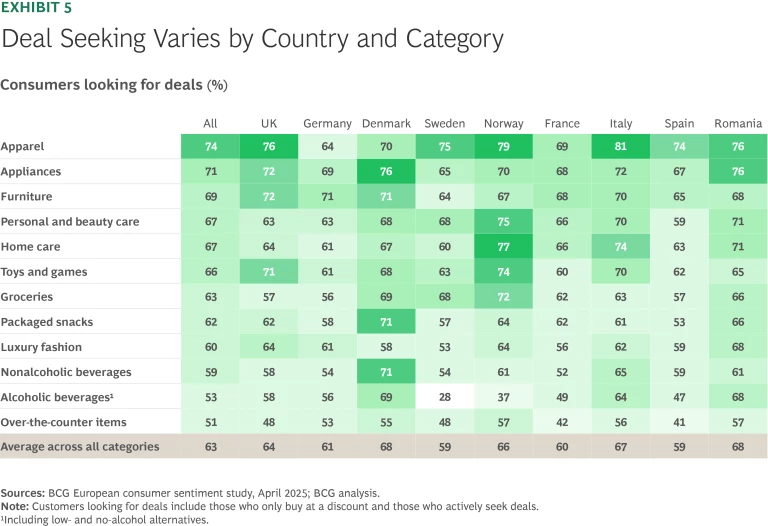

Even in the category that lends itself to the least amount of bargain hunting—over-the-counter medicine and supplies—more than half of consumers are still looking for deals. At the other extreme, close to three-quarters of consumers are deal driven and willing to change brands when it comes to apparel and appliances. (See Exhibit 4.)

Wide variations exist across countries even in categories in which bargain hunting is common. (See Exhibit 5.) In apparel, for example, 81% of Italian consumers are looking for discounts, compared with 64% of Germans. Denmark and Romania are the most deal-driven countries, with 68% of consumers seeking bargains. In Spain and Sweden, by contrast, only 59% shop for bargains.

Online Purchasing and Rapid Delivery

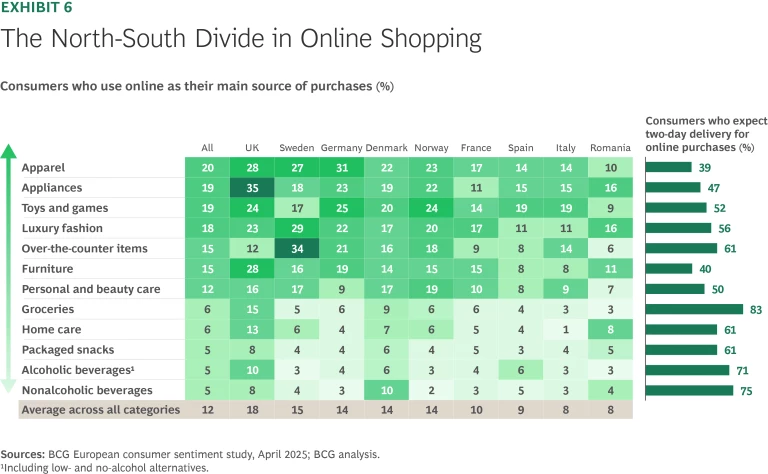

Online shopping behaviors vary widely by category and region. Consumers are more likely to go online for items such as apparel, appliances, and toys, which are purchased relatively infrequently. (See Exhibit 6.) They are more likely to visit a physical store for frequently purchased items, such as groceries, snacks, and alcohol. Indeed, the physical store is not disappearing anytime soon. Nearly three-quarters, or 72%, of European consumers say that brick-and-mortar stores are essential or important, suggesting that they prefer an integrated shopping experience across physical and digital channels.

The popularity of online shopping is higher in central and northern Europe, where the UK leads. In apparel, nearly a third (31%) of German consumers shop online, followed by 28% in the UK and 27% in Sweden. Consumers in Spain (14%), Italy (also 14%), and Romania (10%) are the least regular online purchasers of apparel.

Consumers report a modest drop in online shopping from 2024. This change may simply reflect belt tightening on discretionary items in uncertain times. The drop is more pronounced for infrequently purchased items—such as apparel, appliances, and toys and games—than for everyday purchases such as groceries.

When they do shop online, shoppers increasingly expect delivery within two days. For groceries and alcohol, 83% and 71% of consumers, respectively, expect two-day delivery. In comparison, only 39% and 47%, respectively, expect two-day delivery for apparel and appliances. Consumers in Scandinavia, however, where Amazon has a smaller market share than in many of their neighbors to the south, are less likely to expect fast delivery.

Sustainability: A Rising Priority, but Reluctance to Pay a Premium

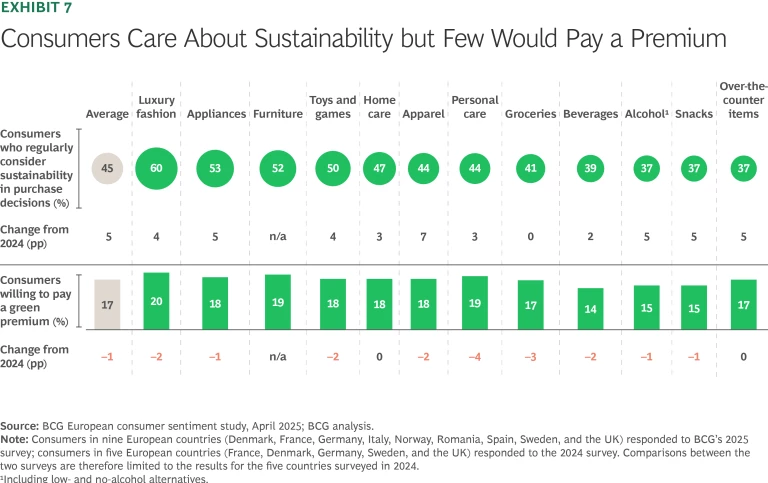

European consumers have contradictory attitudes toward sustainability. Overall, 45% consider sustainability in their purchase decisions, up 5 percentage points from 2024, but only about 17% are willing to pay extra, a 1 percentage point drop. (See Exhibit 7.) In Germany, Sweden, and the UK, markets with a tradition of valuing sustainability, the willingness of consumers to pay a green premium dropped by 5 percentage points, perhaps an indication that they consider sustainability a core feature rather than a luxury.

A practical response to sustainability concerns is secondhand shopping. Approximately 20% of European consumers regularly buy previously owned apparel, toys, luxury fashion, and furniture. Secondhand shopping is notably higher in Scandinavia (25% to 35% of consumers) than in southern markets like Spain and Italy (10% to 15%).

How Companies Can Ride These Trends

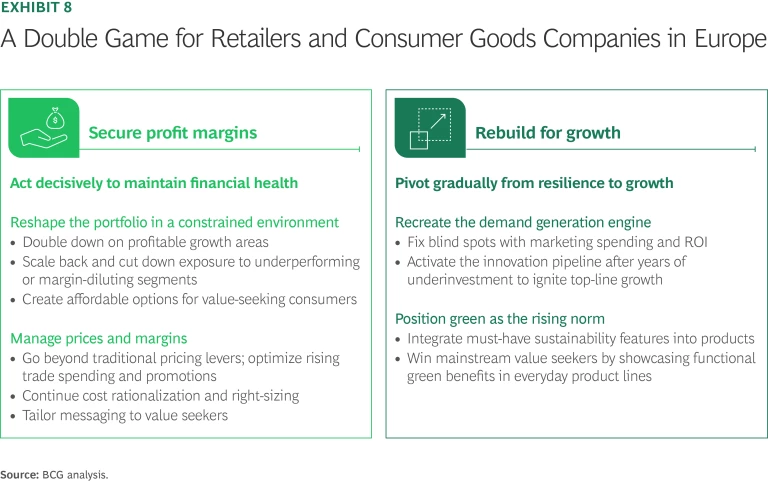

Against this backdrop of economic anxiety and spending restraint, how can consumer companies and retailers respond? They should play a double game: secure profit margins at every stage of the value chain while also starting to rebuild growth capabilities to prepare for the return of consumer optimism and spending. (See Exhibit 8.)

Secure Profit Margins

To maintain financial health, companies should act decisively in reshaping their business and product portfolios, rationalizing pricing, and managing costs.

Reshape the portfolio. In a constrained demand environment, not all categories or products deserve equal focus. Companies should double down on profitable growth areas, create affordable options for consumers, and scale back exposure to underperforming or margin-diluting segments.

- Identify which businesses to grow, cut, or exit. Prioritize investment in categories with margin resilience and strategic value.

- Resize product packages. Pursue innovations that will retain cost-conscious consumers by delivering acceptable quality at acceptable prices.

Manage prices and margins. With consumers scrutinizing every purchase, companies should go beyond pricing to manage trade spending, costs, efficiency, and communication strategically.

Rebuild for Growth

Lean times never last forever. Consumer goods companies and retailers will eventually pivot from resilience to growth. Many of them will need to rebuild their neglected demand generation capabilities. At the same time, they will have to meet rising consumer expectations on sustainability by treating it as a core requirement rather than a sideline business topic.

Recreate the demand generation engine. Years of cost cutting have hollowed out many companies’ demand engines. Companies should re-establish foundational marketing effectiveness and accelerate innovation cycles to seize growth when consumer spending rebounds.

- Fix marketing blind spots. Many companies often do not know which parts of marketing spending have the most impact. Drive higher marketing ROI by investing in the most profitable marketing channels, measuring the effectiveness of those channels, and dynamically adjusting spending.

- Reactivate the innovation pipeline. After years of underinvestment in growth, reviving innovation pipelines will be crucial. Fast-track launches in promising markets to accelerate top-line momentum.

Position green as the rising norm. Sustainability is becoming more important for European consumers, especially in northern countries.

- Meet sustainability expectations. Understand and integrate consumers’ must-have sustainability attributes into products.

- Win mainstream value seekers. Clearly communicate and showcase functional green benefits such as durability, low energy use, or minimal packaging in everyday product lines to appeal to value-driven yet environmentally conscious consumers.

The 2025 consumer landscape in Europe presents a complex but clear challenge. Economic pessimism, a focus on value, and high expectations for fast delivery and everyday sustainability are all in play. Companies can recognize and respond to these dynamics by playing the double game outlined above. Growth will eventually return, so companies need to manage for both today and a brighter tomorrow.

The authors thank Anna Hollming and Martina Scrocco for their helpful comments and suggestions. They also acknowledge BCG’s Center for Customer Insight--in particular, Flavia Gemigniani and Gaby Barrios--for its support and NativeResearch for conducting the research on which this article is based.

Explore the Country Deep Dives

Denmark: Cautious Optimism – Danish Consumers Pursue Value in Volatile Times

France: Caught in Uncertainty, French Shoppers Reveal Their True Selves

Germany: German Consumers – Saving Where They Can, Spending Where They Must

Download the analysis

Italy: Gloomy Outlook: Italian Consumers Reallocating Their Spending

Spain: Adapting Under Pressure – Insights into Spanish Consumer Behavior 2025

Download the analysis

Norway: Optimistic but Disciplined – How Norway’s Consumers Demand Value-First Choices in 2025

Download the analysis

Sweden: No Turnaround Yet – Swedish Consumers Rethink, Don't Retreat

Download the analysis

Romania: Romanian Consumers – Price-Driven Pragmatism in a Volatile Environment

Download the analysis

United Kingdom: UK Consumers – Saving Where They Can, Spending Where They Must

Download the analysis

Local data is available upon request for Denmark, France, Germany, Italy, Norway, Romania, Spain, Sweden and United Kingdom.