Technology is one of the most powerful levers for financial institutions to build competitive advantage. Smart tech investments, including the deployment of emerging agentic AI capabilities, can reinvent the customer journey, increase speed to market, enable personalization of customer interactions, and drive efficiencies throughout the business. Yet, while banks are making ambitious investments in tech, they frequently miss out on capturing these potential opportunities. So, what’s stopping them?

A key part of the answer can be found by digging into where banks are—and are not—spending their tech dollars. A large share of bank technology investment today is directed toward “run-the-bank” (RTB) initiatives (think core tech activities such as running existing applications in the cloud) rather than “change-the-bank” (CTB) efforts that can build real competitive

To seize this opportunity, banking leaders must take three critical actions:

- Simplify business operations and refocus technology spending.

- Leverage investment in regulatory compliance to build resilience.

- Build powerful tech capabilities in data management, talent, and IT infrastructure.

Success, however, requires a fundamental shift in how banks align technology and strategy. Technology cannot exist in silos; it must be tightly integrated with corporate priorities through close collaboration between tech and business teams and treated as a core enabler of business objectives.

Stay ahead with BCG insights on digital, technology, and data

Simplify the Bank and Refocus Tech Spending

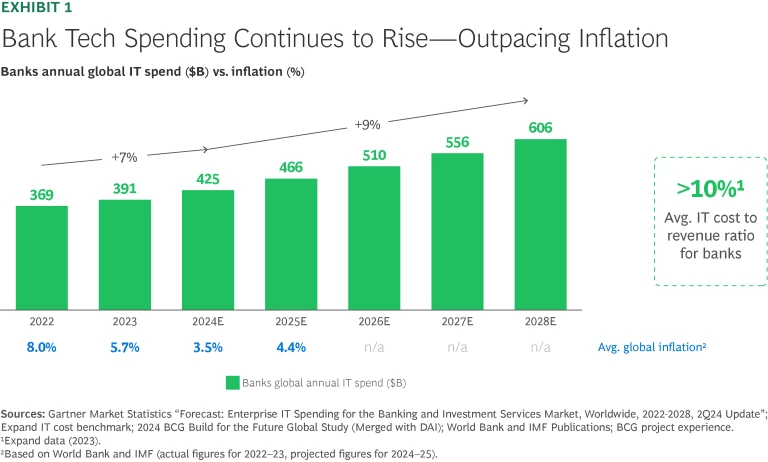

Technology represents a significant cost item for banks, absorbing on average more than 10% of revenues according to a proprietary database from BCG’s Expand Research, the firm’s in-house financial institutions benchmarking, data, and insight team. Bank IT spending globally is expected to rise at a 9% compound annual rate—well above the projected rate of inflation. (See Exhibit 1.)

A number of factors are contributing to this steady rise in spend, including:

- Limited tech cost ownership by business unit teams, which undermines business-tech value assessments and leads to investments in non-critical features;

- An overly rigid risk posture, which forces IT teams to unnecessarily limit the addition of new features for security purposes;

- Legacy infrastructure that is difficult to modernize and stands in the way of cost-efficient and seamless integrations;

- Rising vendor costs and issues such as vendor “lock-in” that make "cutting the tail" of significant numbers of smaller contracts difficult;

- Redundant tools and licenses due to lack of centralized governance and excessive customization;

- Disjointed integration of acquired technologies, which increases complexity and the number of applications.

These challenges create a dynamic in which complexity grows exponentially, not linearly. Unfortunately, individual tech business cases—whether for replacing an existing system, adding a new feature, or other projects—typically fail to capture this reality. As a result, RTB technology costs often steadily increase over time. Today, more than 60% of overall tech spend is allocated to RTB activities, diverting resources from innovation and transformation efforts, according to Expand Research. Meanwhile, tech costs are often seen as a “black box” from the business side of the organization, with limited transparency on exactly how that money is being deployed and what the true ROI is.

Tech and business teams, however, can work together to unlock resources for tech-driven innovation, and in parallel increase transparency into tech investment.

What to do and how to do it.

Banks that want to refocus and optimize their tech spending should take two key steps. First, they must move to simplify the business itself by taking the following actions.

- Refocus the product portfolio.

Banks can reduce complexity, consolidating undifferentiated, low-returning products and focusing on fewer clearly distinct offerings with high strategic value. Such efforts can be difficult as many existing customers may hold those products. That’s why banks should also push to simplify and rationalize products’ underlying features, policies, and procedures—for both existing customers and for new business. Organize customer journeys with a front-to-back platform approach.

Banks should create common processes across customer segments and streamline customer interactions by leveraging a core set of horizontal platforms. While standardized journeys across all customers and products are not a viable or desirable option, an effort to streamline and harmonize these where sensible—such as when consistency is desired or efficiency can be achieved—can drive meaningful simplification. Better integration between customer-facing and back-end operational systems through carefully designed application programming interfaces (APIs) can also improve information flows.Ultimately, horizontal platforms combined with APIs provide banks with a richer view on customers and prospects across services, enabling better targeted cross-selling and upselling. As an example, a large European bank recently moved away from having a different onboarding setup for every product, with customers being asked to repeat the same information for each application. To drive simplification, they created three onboarding platforms (consumer, commercial, and international), with each platform being shared by multiple product teams. Once in place, the new approach improved customer experience and simplified interactions, delivering cost savings of 50% to 80% depending on factors such as the type of product or location.

- Streamline internal processes and workflows.

Depending on the overall risk appetite, a bank may reduce the number of steps in the customer journey, including by removing certain checkpoints in the loan application process, streamlining the number of gates for approving a loan or other service, and reducing the number of teams involved in a particular decision. This is not about taking on more risk but rather removing unnecessary steps that add time and cost but do not improve the quality of underwriting. Leading banks today assess the value of every step in the customer journey, not only for customers but also for users and employees, avoiding adding new steps when not necessary and ultimately driving business simplification. - Reduce overhead roles and simplify organizational structure.

Banks can increase the percentage of developers and engineers (“doers”), while reducing the number of overhead roles and project managers (“orchestrators”). Best-in-class banks today are pushing the share of “doers” toward 75%, but most banks are below 50%. An imbalance in the mix of these roles—with a significant portion of the workforce dedicated to planning and orchestrating rather than building and delivering technical solutions—creates inefficiencies in resource allocation. A shift in that mix, combined with outcome-oriented performance measurement (as appropriate to each role), can lead to streamlined decision making and increased agility and cost efficiency.

The second way for banks to refocus and optimize tech spending is by leveraging technology to drive automation, increase efficiency, and reduce costs. They should take the following actions.

- Improve tech development efficiency.

This requires a push to drive cross-functional cost optimization, focusing on sourcing (for example, contract negotiation and renewal management) and developer productivity. Promising moves include the deployment of pipelines and tools with automated security and vulnerability checks and the use of a build-to-test approach under which a functional piece of code is built first and then followed by testing to ensure quality and functionality. Such efforts can significantly reduce the time it takes to build and deploy applications and increase the frequency of low-to-no defect releases. - Lean in on AI.

Artificial intelligence (AI), particularly agentic AI, can further accelerate automation in the software development life cycle. Moreover, agentic AI workflows can simplify the technology stack by removing costly, redundant software-as-a-service (SaaS) applications such as tools for credit risk assessment, customer relationship management, and other peripheral systems. BCG project experiences have found that the cost of many SaaS applications increases by 15% or more each year. Ultimately, simplifying the tech stack can help banks reduce RTB costs and expand the share of CTB investment. - Measure productivity and learn.

Simplifying the business and deploying new technology will only get you so far. When banks adopt new tools to drive these new processes, they need to measure how it impacts overall productivity—not just the impact on a discrete set of processes or workstreams. That insight can help banks determine what is working and what is not.

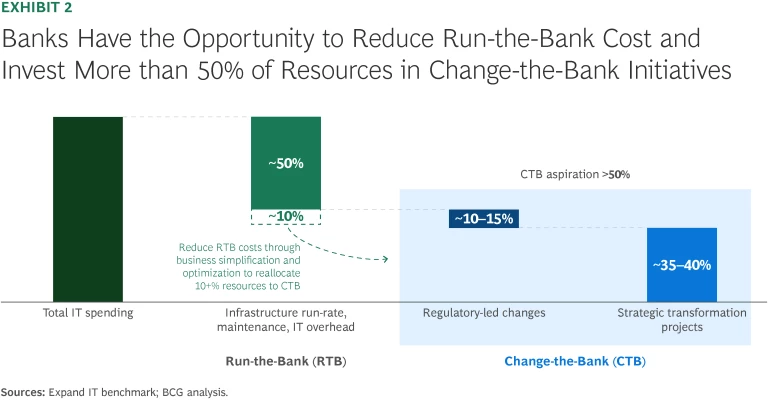

The bottom line is that a simpler business operating model leads to simpler tech architecture. Combined with tactical cost optimization, a streamlined operating model can reduce RTB spend and allow banks to channel more than 50% of their IT spending on high-impact, “change-the-bank” initiatives. (See Exhibit 2.)

Leverage Investment in Regulatory Compliance to Build Resilience

Regulations on financial institutions continue to become increasingly stringent—partially due to disruptive events such as Silicon Valley Bank’s collapse and outages at CrowdStrike and Azure. The European Banking Authority, Bank of England, and regulators in other markets have intensified oversight and stress-testing on how banks monitor and report tech risk and ensure tech resilience.

In this context, banks have typically thought about regulatory compliance as an unavoidable expensive constraint. All told, regulatory compliance absorbs roughly 10% or more of overall IT spend, costing more than $10 billion for the largest 25 banks globally in 2023, according to Expand Research and GlobalData. We believe banks should take a more holistic approach, leveraging compliance investment as an opportunity to enhance operational resilience and build competitive advantage.

What to do and how to do it.

To make operations more resilient, banks need to take a comprehensive approach towards their people, process, and technology systems, including gaining insight on and managing the interdependencies among those systems. Three key actions can drive this change:

- Align on a consistent definition of business operations and map each one to the appropriate level of criticality.

- Define and document appropriate risk tolerance levels and run severe, yet plausible, scenarios testing exposure to key risks.

- Maintain an updated prioritized backlog of contingency measures and remediation plans.

A multi-national bank headquartered in the UK adopted this type of comprehensive approach, implementing stress tests that factored in internal tech outages, global disruptions, and third-party supplier failures. These stress tests enabled better visibility on potential risks and improved resilience.

Other leading financial institutions are using advanced tools and approaches to turn compliance-driven efforts into a means for building overall operational resilience. Consider the deployment of a digital twin. This virtual replica of a system reflects not only all the components of the system but also dependencies, data lineage (including third-party integrations), and the impact of external factors (such as market movements). Through a centralized control center, banks are able to run advanced “what if” scenarios through the digital twin, including assessing the impact of:

- Cyberattacks, such as data breaches or the introduction of ransomware;

- Third-party failures, such as cloud or cyber provider outages;

- Geopolitical developments, such as varying degrees of protectionist policies across geographies;

- Infrastructure disruptions, such as the severing or damage of undersea cable;

- Market shifts, such as interest rate hikes and liquidity pressure.

Based on insights from those scenarios, banks can set up processes to automatically generate compliance reports based on predefined triggers. And they can establish a business-tech taskforce to coordinate new resilience management strategies based on simulation output, for example, implementing AI-powered automated responses to certain disruptions or enhanced data encryption.

More broadly, banks should invest in building strong relationships with regulators and closely monitor official communications to anticipate and prepare for regulatory changes. Ultimately, banks leveraging regulatory constraints as transformation opportunities can develop critical capabilities (including risk monitoring) and enable faster compliance and decision-making.

Build Powerful Tech Capabilities

To fully capitalize on the tech value creation opportunity, banks must build muscle in three key areas: data and content foundations, talent, and IT infrastructure. There are concrete steps that will help them build these core capabilities.

Strengthen data and content foundations.

Compared to other industries, financial institutions on average have richer data and content and more organized data sourcing, publishing, and monitoring processes.

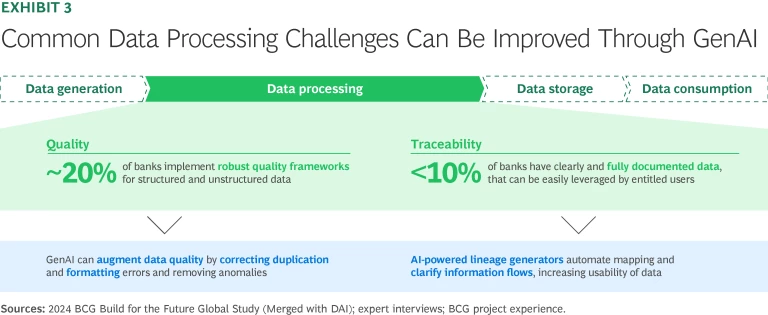

Nonetheless, many banks still struggle with several aspects of data management, in particular related to data processing. These challenges have only become more evident recently due to increasingly stringent regulatory requirements. In particular, just 20% of banks implement robust quality frameworks for structured and unstructured data, and only about 10% have clearly and fully documented data that can be easily leveraged by entitled

What to do and how to do it.

To address these challenges, banks can move in three areas.

First, banks need to treat data and content as core assets, with clear ownership and accountability. To this end, each data domain (such as customer, transaction, or market data) should have an owner with deep understanding about who contributes, as well as which teams and applications have the right to consume the data. Such clarity ensures that no aspect of the data lifecycle is overlooked, enabling better alignment between the supply and demand of information. Meanwhile, banks must design modular, scalable, and flexible data management systems to meet the evolving demands of their growing ecosystem of data consumers.

Second, banks must enhance structured and unstructured data and content. This can include leveraging lineage generators to automatically map information flow based on existing sources and systems. This reduces manual effort to capture end-to-end lineage, creates consistent labels for data paths, and clarifies the source of data, how the data changed over time, and its intended use.

Additionally, the usability of unstructured data can be increased by creating descriptions via metadata labels that help business teams define use cases by specifying details such as the source of the data, applicable usage rights, and how the content connects with or complements related datasets. For example, a global financial institution recently leveraged generative AI (GenAI) to automate data lineage capture and metadata generation, achieving 40% to 70% productivity gains in specific tasks and a 20% to 25% improvement in data onboarding during the pilot phase.

Finally, GenAI can also be used to enhance data quality by correcting duplication and formatting errors and removing anomalies. At the same time, GenAI tools can improve traceability by automating mapping and clarifying information flows. (See Exhibit 3.)

Third, banks can leverage enhanced data to tap into new value-creation opportunities. The list of possibilities is long:

- Improving security, such as using AI/ML models to automate fraud detection through continuous signal monitoring;

- Increasing product personalization, such as offering AI-driven financial advice based on transaction history;

- Boosting cross-selling, such as using AI to present customers with a compelling related offering;

- Elevating customer experience, such as deploying an AI-powered support chat that adjusts based on customer profile and chat history.

One large global bank is currently leveraging machine learning to assess customer spending data, generating insights that help customers better manage their spending and save more money with the bank.

Banks that embrace such applications of AI and automation can improve data quality, revenue uplift, and operational efficiency and effectiveness.

Leverage global reach and tech talent partnerships.

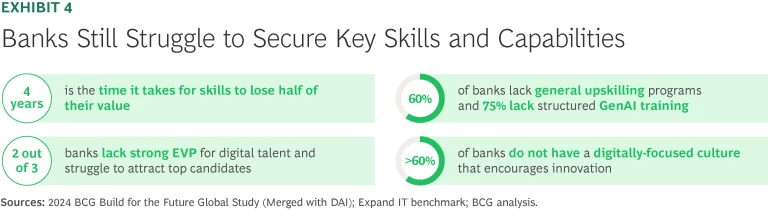

To fully harness the power of technology to create competitive advantage, banks must have the right talent in place. However, many struggle to attract employees with the necessary skills and capabilities, with roughly two out of three of banks admitting they lack a strong employee value proposition (EVP) for digital

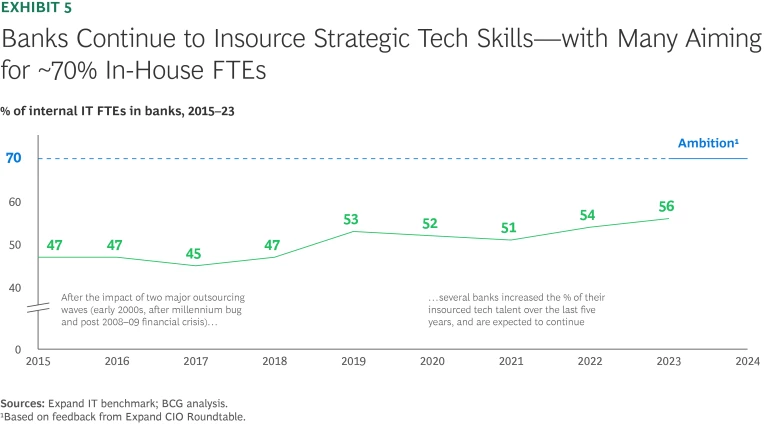

The importance of the tech talent challenge in banking reflects two additional dynamics. For one thing, banks are increasingly focused on building their own internal IP, prompting many to insource strategic skills. (See Exhibit 5.) Major banks now aim to have roughly 70% of their overall tech staff inhouse, with just 30% or so coming from external contractors. Of course, a bank’s insourcing approach may vary depending on geographic footprint. For example, banks operating in regions with strong labor protections may need to hire for some positions in a different region to preserve flexibility.

At the same time, leading banks are shifting their overall talent mix towards advanced capabilities. In recent CIO Roundtables held by BCG’s Expand Research, some banks outlined their ambition to have 80% of their tech staff be developers, with the remainder focused on areas such as network administration and IT support.

What to do and how to do it.

To ensure their tech efforts are supported by the requisite skills and capabilities, banks need to make two shifts.

First, they should move from a role-based talent strategy to one centered on skills. This means reshaping the end-to-end talent strategy, which includes defining the requisite skills, hiring, onboarding, and training to be built around skills rather than roles.

To get started, banks should assess the existing tech skills supply within the bank and develop a skills-based workforce plan. This starts with defining a clear skills taxonomy (100–150 skills, not 1,000s) and a job architecture (no more than 20–30 roles). Then, they need to establish skills criticality, forecast future skill needs (based on factors such as market trends and regulatory shifts), assess current skill levels versus those projected needs, and define upskilling and sourcing plans to fill prioritized gaps.

Second, banks must rethink how to acquire the tech skills they need. Banks should selectively insource strategic skills in core markets, focusing on increasing the proportion of “doers” (versus “orchestrators”). Tailored recruiting and upskilling programs, as well as clear career paths, can help attract and retain technical talent, ultimately building IP and fostering internal tech–business cooperation.

At the same time, banks can forge strategic alliances with tech leaders, for example through talent secondments and joint innovation labs. Such efforts can help banks source highly specialized tech talent faster and with greater flexibility. One leading European bank with global operations is collaborating with Microsoft, HCL, and IBM on three different innovation labs where its tech talent works closely alongside tech workers from those companies.

There is also an opportunity to rethink the role of global capability centers (GCC). Since the early 1990s, banks have relied on GCCs as cost-arbitrage hubs, focusing on labor cost advantages and operational efficiency to support back-office functions and routine tasks. In recent years, leading banks have embraced GCCs with a different objective. They are leveraging these centers to improve their access to advanced skills globally, diversify concentration risk, increase resilience, and fuel innovation.

To transform low-cost offshore centers into proper centers of excellence, banks should set a bold top-down ambition. With that foundation they need to ensure a sustained, multi-year focus on the GCC evolution, establish robust governance and coordination to build a “one organization” mindset, attract senior leadership to show commitment, and develop a strong EVP to secure top talent.

Transform IT architecture.

Traditionally, banks have looked at their IT infrastructure as an (expensive) cost center—a necessary operational expense that absorbs more than a quarter of their total IT spend without directly generating

Banks can meet this challenge by developing the ability to conduct IT infrastructure management as a value-creating, service-driven center. This paradigm shift can motivate IT organizations to focus on efficiency and performance, as they are now accountable for revenue-like goals, ultimately enhancing standardization, scalability, speed, and cost transparency.

What to do and how to do it.

To drive this shift, banks must transform IT into a set of standardized, modular on-demand services. With the support of a mandated architecture function, there are several key steps to get there:

- Define common reusable services.

Create a prioritized set of standard and modular services, such as ready-to-use databases or GenAI services. The group developing these services must take ownership of ensuring their utility, identifying clear use cases, and defining service-level agreements. Such steps are critical to ensure the services actually meet the needs of end users. Bank should also identify required infrastructure components and enable a self-service model to reduce dependency on IT teams. - Increase visibility into “consumption” of the services.

Monitor usage, spend, and performance across platforms and business units to help identify patterns and the impact of technical failures on critical business activities, enabling rapid decision making. - Ensure continuous dialogue between business and tech leaders.

Refine services based on business needs and innovative product options using best-of-breed cloud/on-prem capabilities.

We have seen a number of financial institutions embracing this sort of innovative approach. One large US bank, for example, virtualized its IT infrastructure and created software-based versions of physical servers and storage. The move established the foundation for a large-scale transition to the cloud and pre-empted potential regulatory concerns.

Banks that approach tech infrastructure along these lines are rewarded with improved scalability and capacity management, a simplified IT infrastructure portfolio (with standardized assets), cost transparency, operational simplification, faster response to innovation, and faster time-to-market.

Across industries, technology and business will only become more intertwined in the future, and banking is no exception. For banks to win in this environment, the role of tech needs to be elevated from support function and service provider to a true strategic partner for the business.

This shift demands a comprehensive and forward-looking approach. Banks must simplify business operations and strategically refocus technology spending to break the cycle of high “run-the-bank” costs and suboptimal “change-the-bank” outcomes. Additionally, institutions should leverage their investments in regulatory compliance, turning these necessary expenditures into opportunities to enhance organizational resilience. Finally, building powerful technological capabilities in critical areas such as data management, talent development, and robust IT infrastructure will be essential to drive sustained growth and competitiveness in an evolving market landscape.

Ultimately, these combined efforts will position banks to optimize free cash flow, strengthen operational resilience, and drive sustainable competitive advantage.

The authors would like to thank Jeanne Bickford, Vanessa Lyon, Max Merlini, Benjamin Rehberg, Jürgen Rogg, Inderpreet Batra, Allard Creyghton, Rajiv Gupta, Vlad Lukic, Saurabh Tripathi, Joppe Bijlsma, Ruth Ebeling, Marianna Leoni, Brian O’Malley, Lucas Quarta, Filippo Scognamiglio, Yashraj Erande, Thomas Foucault, Pim Hilbers, Sumit Kumar, Pinaki Roy, Toshihiko Kubo, Rajeev Singh, Colin Troha, Hrishi Hrishikesh, Marc Roman Franke, Julianna Lisi, Shekhar Marathe, Prashanth Premkumar, Steve Sall, Matthew Barton, Alexander Holbrook, Giacomo Corti, and Noah Austin for their expertise and guidance in preparing this report.