Shifting investor priorities and volatile markets changed the rules of the game for technology, media, and telecommunications (TMT) companies in 2022—yet the industry’s longer-term track record remains remarkable.

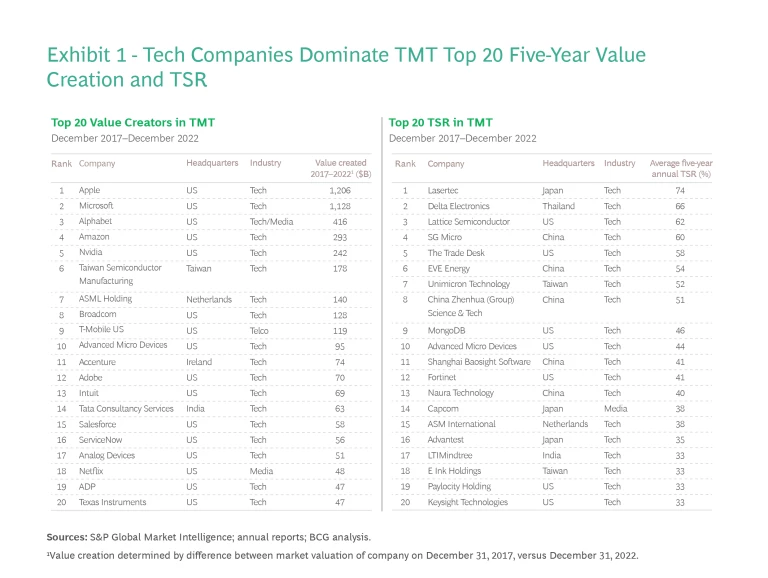

The 2023 TMT Value Creators Report shows that many companies, mostly in the tech sector, have generated immense value during the past five years. In total, our global list of 335 publicly traded TMT companies created $4.7 trillion in value based on market valuation changes over the five-year period ending December 31, 2022.

Most of the top 10 value creators each generated more than $100 billion, and Apple and Microsoft each created over $1 trillion. Notably, all but 2 of the top 20 value creators were tech companies benefiting from the digitization of business and personal life. (See Exhibit 1.)

The playing field changed for TMT companies in two ways in 2022. First, they were subject to the broad market turmoil triggered by the war in Ukraine as well as rising inflation and interest rates. Along with these macro developments, many TMT players were hit hard by the change in investor focus from “growth at all costs” to “efficient and profitable growth.”

This focus on profitable growth has continued into the first months of 2023 as markets have recovered some of their losses. The market recovery has benefited tech stocks in particular, but in keeping with the new mood, those that have bounced back furthest are those demonstrating both profits and growth, such as Apple, Microsoft, and Alphabet.

This report digs into how TMT companies can create value in this environment, including leveraging disruptive opportunities in generative AI and the metaverse.

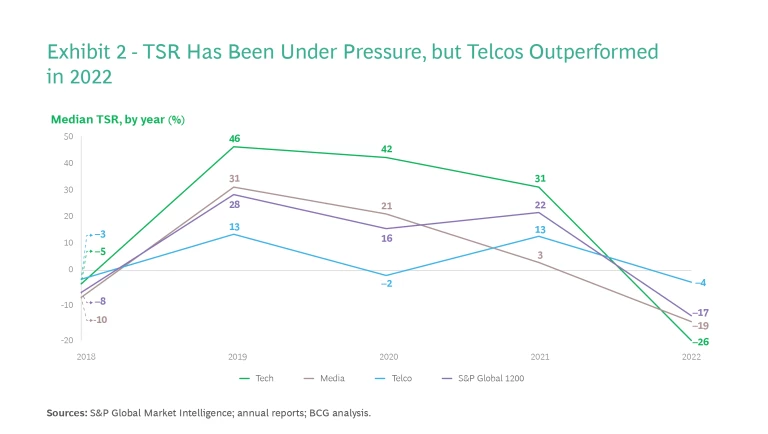

The telco sector outperformed in 2022 as investors sought its more utility-like returns amid the difficult market conditions. The sector’s median total shareholder return (TSR) beat the tech and media sectors as well as the S&P Global 1200, an index of worldwide stocks. (See Exhibit 2.)

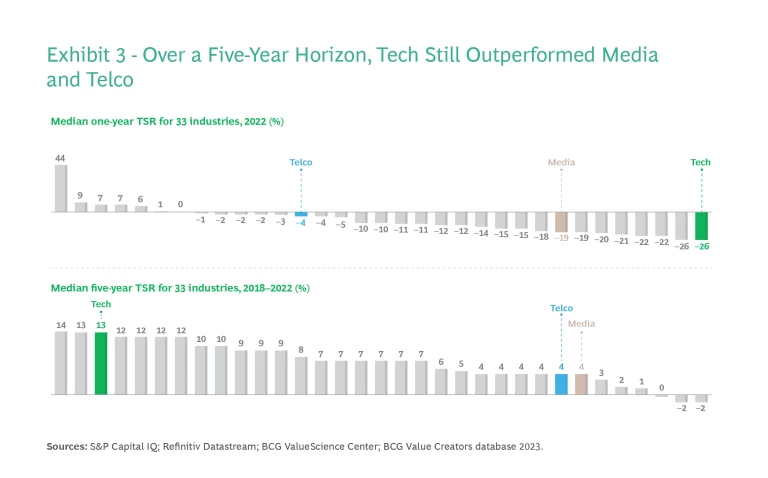

The telco sector’s relative outperformance in 2022 pushed its median annual five-year return to 4.2%. It also helped its ranking versus other sectors: in a list of 33 industries ranked by five-year median annual returns, telcos improved from 29th to 26th. (See Exhibit 3.)

The tech sector, in contrast, endured the “tech winter” as it fell out of favor with investors. The sector’s median one-year TSR was a remarkable –26%. Yet its long-term record meant its five-year median annual return remained a strong 13%. Given the change of investor sentiment, tech no longer had the highest five-year return of the 33 industries—but it remained a strong third.

For the media sector, the story in 2022 was somewhere in between. But the tough market conditions of 2022, combined with the sector’s weaker long-term record, meant it slid a long way down the sector-by-sector list, from 15th to 27th. The sector’s five-year median annual return was marginally worse than telcos at 3.7%.

A Consistent Performance in Difficult Times

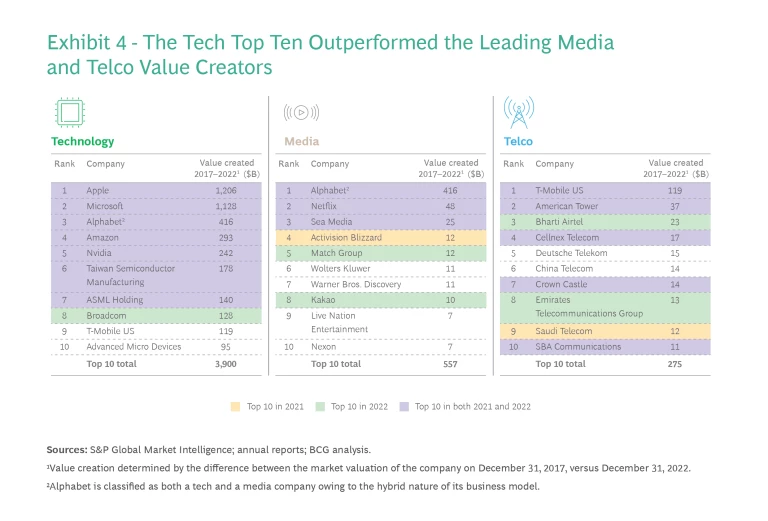

As mentioned earlier, the most significant value has been created by well-known tech mega-caps, with the top ten in tech contributing more than 70% of the sector’s five-year absolute value creation. (See Exhibit 4.)

But even in other sectors, innovative management can lead to substantial value creation; T-Mobile US topped the telco sector for value creation with $119 billion over five years. The mobile operator has broadened its longstanding and innovative “un-carrier” strategy to new customer segments, it’s a US leader in deploying 5G, and the all-stock, $26 billion acquisition of Sprint has yielded synergies larger than forecasted.

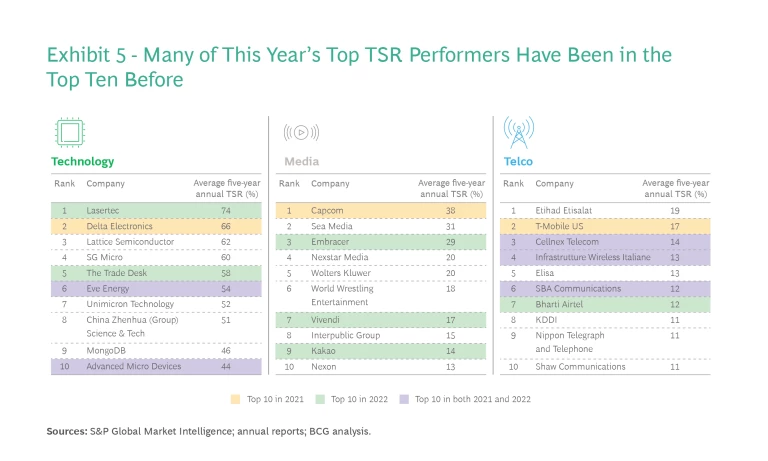

Looking at TSR, which highlights relative performance, it is clear that many companies outside the mega-caps have retained their track record of consistent, strong returns even after 2022’s challenges. These repeated outperformers include video game publisher Capcom, chip-testing company Lasertec, and telco Cellnex. (See Exhibit 5.)

For Tech Firms, a Transformed Approach

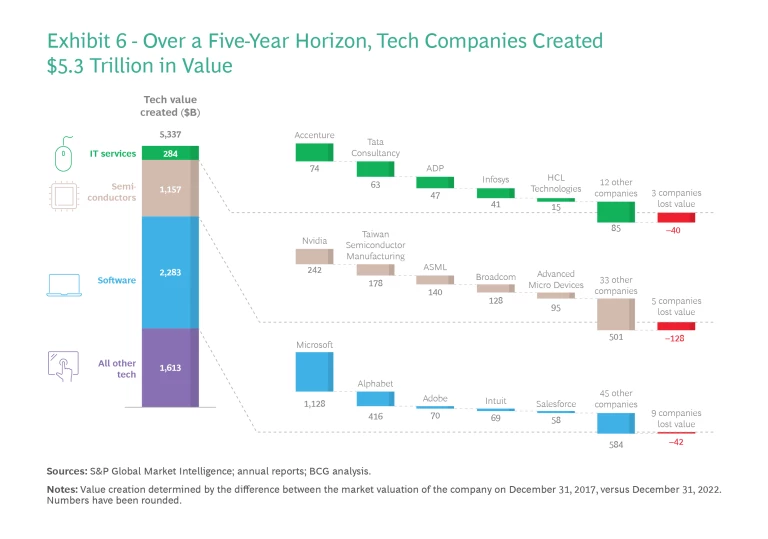

Looking at value creation over the five-year time horizon, only about 20% of companies had a negative five-year record despite 2022’s declines. The tech sector’s strong value creation story remains largely intact with $5.3 trillion created, underpinned by the $2.7 trillion in value generated collectively by Apple, Microsoft, and Alphabet alone. (See Exhibit 6.)

The recent slew of tech sector job cuts is one example of how many public tech firms in this report are focused on hitting bottom-line targets rather than just top-line revenue growth. Yet even in 2022, some companies thrived, posting enviable one-year TSRs. The top three one-year TSRs in tech were posted by hardware companies benefiting from investment in global decarbonization such as electric vehicles and renewable energy. These three—Delta Electronics, Walsin Lihwa, and Guangzhou Great Power—each had one-year TSRs above 50%.

The foundations are already being laid for the next wave of value creation. Late in 2022, BCG worked with Nasscom, India’s tech trade association, to identify 12 technologies generating high funding momentum globally that will drive strong R&D and trigger disruption. The technologies named: autonomous analytics, augmented reality and virtual reality, autonomous driving, computer vision, deep learning, distributed ledgers, edge computing, sensor tech, smart robots, space tech, sustainability tech, and 5G/6G.

Investment has poured into some of these technologies that are anticipating the creation of whole new industries. The top-ranked area of investment is sensor tech, where applications vary from personal-health wearables to factory automation. Publicly disclosed deals reflecting private investments in the past five years have put more than $80 billion into the sector. Also receiving large publicly disclosed private investments is autonomous analytics, where applications can be anything from “what to watch next” recommendations on streaming platforms to predictive maintenance of jet engines. Investors have put more than $50 billion into companies in this area over the same period.

Let’s look at the tech subsectors in more detail.

Software. Despite a median one-year TSR of –27%, in line with tech’s broader market slide, the subsector’s median annual five-year return was 16%. The highest returns were generated by companies that have occupied important verticals, such as online advertising platform The Trade Desk and cybersecurity specialist Fortinet, or that provide vital subservices to other software firms, such as database company MongoDB. The broad trends that have driven software’s value creation—the digitization of personal and business life and the move to the cloud—will continue to propel the subsector forward, accelerated by generative AI, smart robotics, edge computing, and other technologies where innovation is driving new applications.

Semiconductors. If there was a tech winter, the semiconductor subsector was in the middle of the blizzard: in 2022, semiconductor firms posted a median annual TSR of –33%, with supply chain issues still looming large. But the median annual five-year return remained at 17%. The outlook is mixed. There is a glut of the DRAM and NAND memory chips used in PCs and smartphones, yet chips used in electric cars are expected to be in short supply for years. Meanwhile, governments continue to rethink the risks caused by the geographic concentration of supply.

IT Services. Businesses’ drive for digital transformation is a key reason this subsector’s median annual five-year return was 16%. To continue creating value, providers must position themselves firmly in technologies that IT buyers continue to regard as strategic priorities, such as cloud, analytics, app development, and AI.

Stay ahead with BCG insights on technology, media, and telecommunications

For Media, a Long List of Problems

Returns from the media sector were hit by the broad market turmoil, but the sector also had plenty of its own problems. Some of these are a hangover from the lockdown era in major Western economies, with consumer spending in 2022 normalizing after two years in which locked-in consumers boosted their spending on digital entertainment.

The economic slowdown also has an outsize impact on media companies. Some 50% of the sector’s revenue is from advertising, which is highly correlated with GDP. Year-over-year growth in US advertising slowed from 11% in the first half of 2022 to 6% in the second half, according to media intelligence company Magna. Many media players are also suffering as ad revenue gravitates toward global platforms such as Facebook and Google.

Among companies showing a positive return in 2022 against this challenging backdrop, a high number of them were from the US, underlining the continued dynamism and entrepreneurial management of some US media firms. Looking over five years, however, the picture is more international owing to the globalized nature of the video game market, which has provided 25% of the top 20 media performers.

For value creation, Alphabet stands out. Without it, the sector would have lost substantial value. Of the 66 companies in the sector, 31 dropped in value over five years, adding up to $561 billion. For many media incumbents, large investments in content have not paid off. Because of Alphabet’s gain of $416 billion, however, the sector managed a narrow $60 billion value creation. But even Alphabet came under pressure last year as advertising spending declined and competitors to YouTube, such as TikTok, gained market share in short-form video. Those challenges continue this year with Microsoft announcing the integration of OpenAI’s ChatGPT functionality into Bing, potentially putting pressure on Alphabet’s core search business.

The outlook for value creation in 2023 is mixed. Economic factors such as inflation and the threat of a recession will likely continue to impact consumer and ad spending. In addition, in 2023 there are fewer marquee media events such as the FIFA World Cup, the Olympics, or a US presidential election.

The outlook for value creation in 2023 is mixed for the media sector, but the industry may be more resilient than in previous recessions.

But the media industry may be more resilient than in previous recessions. One reason is that performance marketing and programmatic-based digital advertising are expected to remain strong. There has been, and continues to be, some interest in media from telcos and tech firms, although it is still unclear whether these companies will be satisfied distributing content generated by others or will want to build end-to-end services. (The answer may also vary from firm to firm.) We may see more hybrid business models after years of a subscription model focus, with companies such as Disney and Netflix offering hybrid services at lower price points that also generate advertising revenue.

Over-the-top streaming services likely will continue to see consolidation through M&A, service brand combination, or service discontinuation as companies look toward future value creation in an increasingly crowded and competitive market. Recent examples of consolidation include the WarnerMedia and Discovery merger as well as UK media company ITV’s combination of BritBox and its ITV hub into a single ITVX brand. As with the tech sector, profitability has become key.

Bright Spots for Telcos in a Downturn

The era of efficient and profitable growth fits telcos better than growth at all costs, and in the 2022 rankings, telcos made up three of the top ten TMT companies for one-year TSR—China Unicom, China Telecom, and Qatari fixed and mobile provider Ooredoo.

Looking at median five-year returns, national players generally outperformed global operators, with Saudi Arabia’s Etihad Etisalat providing the best five-year record. National players may be more nimble than larger rivals; global players may also find it harder to achieve growth from their larger base. But given the geographic diversity in our global list, it is important to recognize that national players may have beneficial local regulatory and competitive landscapes.

Investors’ new focus on profitable growth has created new opportunities for telcos to create value in 2023. They may find that tech firms targeting some of the same markets, such as IoT and collaboration, are now more interested in partnering than outright competition. As these same tech firms reduce headcount, telcos may find it easier to recruit the talent they need for their digital transformation agenda, which is extensive and includes upgrading networks for a software-defined, cloud-intensive future.

Investors’ new focus on profitable growth has created new opportunities for telcos to create value in 2023.

At the same time, the rise in interest rates and the slowdown in M&A reduce opportunities to create value. For instance, these trends may make it harder for telcos to sell some or all of their infrastructure, a move that can facilitate a next-generation operating model with a greater focus on growth and services innovation.

(For a deeper dive into value creation by telcos in 2022, see The 2023 Telecommunications Value Creators Report, Bright Spots for Telcos in a Downturn.)

Key Strategies for Future Value Creation

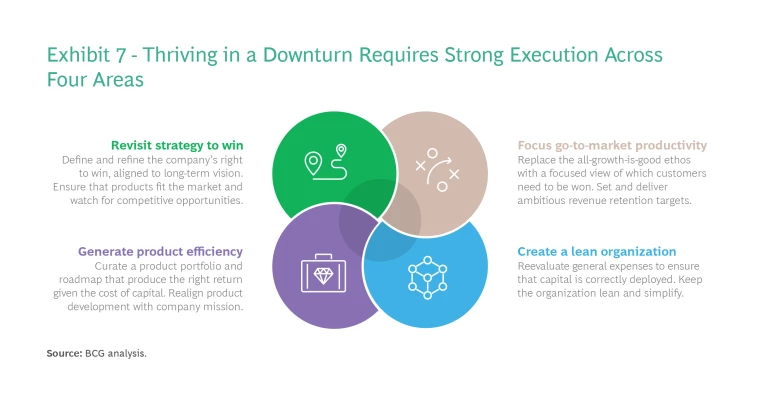

To create value in the profitable-growth era, companies need to focus on four areas. (See Exhibit 7.)

Revisit strategy to win. TMT players need to break with simplistic investment plans that prioritize growth with little regard for profitability. Priorities should include modernizing products and exploring new business models, vital moves that may have been overlooked in the dash for expansion. In an era of constrained investment related to higher interest rates, companies need to focus resources on both product development and go-to-market strategy. This makes customer profiling essential; these optimizations require a deep understanding of customers and the buying processes.

Generate product efficiency. Investors may no longer fund speculative corporate adventures into new markets. Customers too have become more risk-averse and less keen to change suppliers. This means companies need new and more disciplined thinking in product development, closing down projects where returns are unclear. Managers need to create a balance between product innovation and adoption at the right willingness-to-pay to generate appropriate returns; this is another strategy to focus resources, increasing the accountability of R&D investment.

Focus go-to-market productivity. In the current environment, many companies need to discover new routes to growth. Previous expansion tactics, such as overinflating marketing budgets or aggressive price cutting, are no longer appropriate. Instead, companies must focus on growth through their existing user base, upselling, and adjusting pricing to enhance margins consistently over time.

Create a lean organization. Many firms overbuilt capacity during the growth era, and the tens of thousands of tech and media job cuts (as of the beginning of April) show that some of this is now being unwound. Companies that concentrate on the above three areas should find efficiency savings as they focus in on the core activities that drive the most value. At times of change like this, zero-based budgeting can save costs and free up resources to pursue the robust prospects for growth that still lie ahead.

Opportunities in AI and the Metaverse

It is important to underline that TMT firms still enjoy an abundance of growth opportunities. For example, earlier in this article, we identified 12 growth technologies with high funding momentum and strong disruptive potential. One of these, AI, has a multiplier effect, driving down the costs of automation to a level that opens fresh approaches to workflow and innovative business models.

TMT managers must watch for game-changing threats and opportunities with generative AI.

Managers must particularly watch for game-changing threats and opportunities with generative AI, a technology that can create images, text, and computer code. This has now reached a tipping point owing to new foundation models, the large, general-purpose AI models that have advanced significantly because of breakthroughs in algorithm development, the availability of enormous volumes of data, and an increase in available computational power at a reduced cost. In short, models are getting bigger and smarter. But high barriers to entry likely mean a few large players will control the core technology. We see big tech companies such as Microsoft and Google doubling down on building and owning foundation models, which can have billions of parameters (a measure for model power) and cost more than $50 million to create.

Other TMT companies have opportunities to enhance or fine-tune these models, however, and apply them to high-potential use cases such as software development in tech, content creation in media, or network operation optimization for telcos. The software development platform GitHub is already suggesting code in real time to software developers with its Copilot product, and BuzzFeed has said it will use the same model to generate quizzes and other content.

There are also opportunities to build tools that will assist developers in deploying foundation models for specific use cases, speeding up development, and helping connect to external end points of enterprise workflows. This will create new ways to differentiate apps, apart from the underlying capabilities of the foundation model. Examples of emerging players in this space include LangChain, Dust, Cognosis.ai, HoneyHive, and Humanloop.

The potential for value creation is immense. Opportunities will proliferate as the technology shows its true power, generating more complex output such as video, audio, and even intricate virtual environments.

As companies evaluate the use of generative AI, they should answer six questions to drive success:

- Which use cases or projects should receive focus to achieve the greatest return on investment?

- How should generative AI be integrated into the broader AI and tech transformation?

- How should an increasingly complex tech stack and infrastructure be built and managed?

- Which inherent risks must be considered and evaluated?

- What partnerships are needed to ensure the best solution for chosen projects?

- What required changes in operating model, people, and organization should be anticipated?

AI is a critical enabler for another opportunity: the metaverse. Often, this is narrowly defined as augmented reality and virtual reality, but we see the metaverse as much broader. To us, the metaverse lies at the intersection of three technologies:

- Significantly improved AR and VR technology with much wider uptake

- Web3 and virtual assets such as those stored in nonfungible tokens (NFTs)

- Metaverse-worlds, or m-worlds, immersive applications that can create real-time mini-economies with multiple players

Generative AI can power the metaverse by helping users and developers create immersive environments and worlds with less time, effort, and cost, as well as by boosting diversity, creativity, and personalization. Generative AI can also enable users to customize their avatars, assets, and interactions in the metaverse, enhancing their sense of identity and belonging.

The metaverse concept might seem amorphous, but its use cases are easy to spot and are multiplying fast. They also serve as substantial new opportunities for value creation, opening up innovative business models for B2C and B2B companies and novel ways of connecting to customers. A Fortune 500 retailer, for instance, could improve margins by 1.5 to 2 percentage points through improved staff onboarding and training. Better inventory management and enhanced in-store experience could add more than $1 billion on top of that.

Winning in the metaverse requires:

- Owning or controlling the data and content as well as the surrounding “geography” of the metaverse consumer.

- Generating robust linkages between digital layers and the physical and virtual worlds (human-machine interface), including IoT sensors to enable human-to-metaverse connectivity and blockchain technology to create authentic and unalterable trusted ledgers.

- Providing the tools needed for consumers and businesses to spend more time in the metaverse. These include computing power, low-latency connectivity to ensure timely access to information, AI to provide continual learning, fault tolerance, and contextualization.

The metaverse opportunities go beyond tech firms. Media companies have unique content that may become more valuable inside m-worlds, and some (such as video game publishers) have highly relevant tech skills. Telcos can provide some of the high-grade connectivity needed for immersive m-worlds, with 5G playing a potentially vital role.

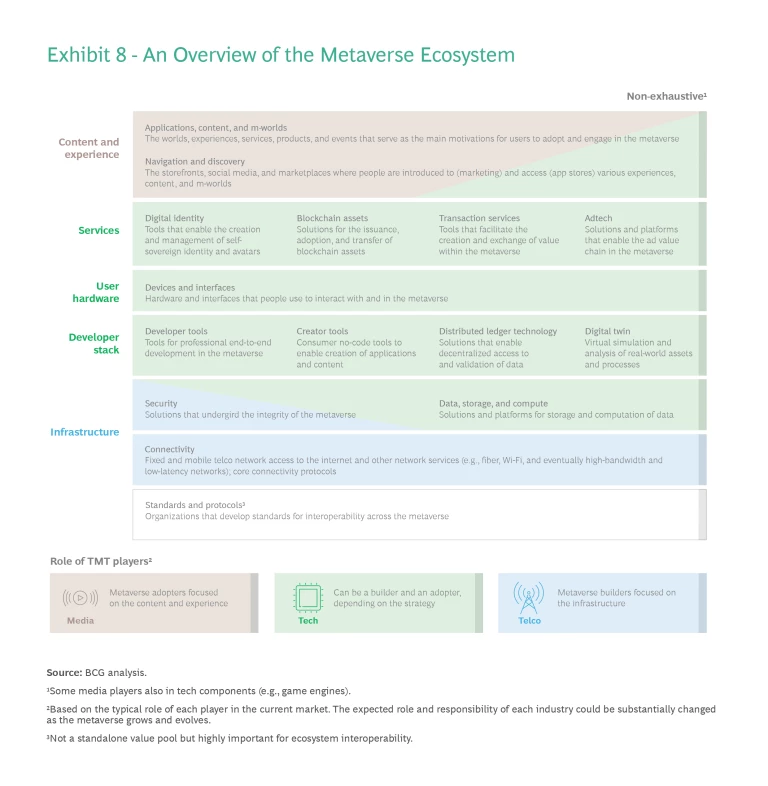

The metaverse will also create colossal value opportunities in areas such as development tools, cybersecurity, adtech, and digital identity management. Therefore, companies must scour the emerging metaverse ecosystem and find their opportunity space. (See Exhibit 8.)

Learning Lessons from the Past

From previous downturns, we know that moments of adversity are when strong businesses pull ahead. But the odds are long; a BCG study of companies with at least $50 million in revenue showed 28% of them increased sales and 42% boosted margins during the past four downturns—but only 14% managed both.

What can managers do to put their company into that 14%? Great strategy and outstanding execution are needed—themes throughout this report. The rules of the game have changed, but this report shows that the best-managed companies have many opportunities to create value in 2023 and beyond.