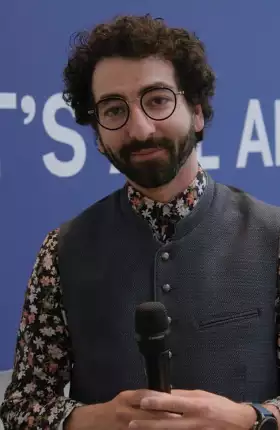

At CES 2026, BCG brought together leaders from Strattec Security Corporation, ZF Group, Cooper Standard, and BorgWarner to examine how AI, software, and deeper OEM–supplier collaboration can unlock scale, resilience, and sustained value across the automotive ecosystem.

Featured Insights

Artificial Intelligence, Digital, and Tech

Video

January 30, 2026

Smarter Together: AI, Cost & the Future of OEM-Supplier Collaboration

Article

September 18, 2025

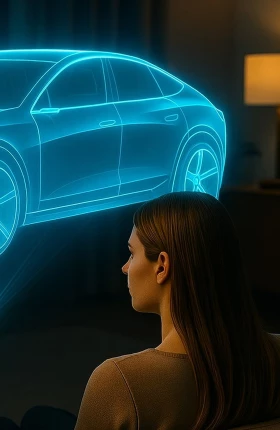

The rise of Generative AI is poised to completely transform every aspect of the car-buying experience. To thrive, every industry player must act now.

Video

October 23, 2025

BCG and BMW Group: Transforming Organizations- Agentic AI in the Supply Chain

BMW Group's Oliver Ganser and Markus Kronen , alongside BCG's Andrej Levin, discuss and share what it takes to transform the supply chain, and specifically the purchasing organization, with agentic AI at IAA MOBILITY in Munich.

The move to autonomous vehicles—part of the broader shift to software-defined vehicles—has profound implications not just for the automobile industry but also for society. Developing these technologies effectively and responsibly requires collaboration across the value chain and beyond.

Article

July 31, 2025

As governments increasingly assert export control over digital products, compliance design has become integral to a company’s product and business strategy—and can create a competitive edge.

Article

January 7, 2025

Beyond technical implementation, success hinges on design choices that promote adoption, thoughtful process reengineering, and an unwavering focus on savings targets.

Electrification and Mobility

Article

September 10, 2025

As EV adoption across the three largest auto markets diverges, OEMs will need to get comfortable with living in an uncomfortable world.

Article

February 24, 2025

As options for electric vehicles expand, similarities and differences are arising between the China, US, and EU markets.

Article

October 28, 2024

Congestion, accidents, emissions, and other challenges require cities to develop holistic mobility alternatives that will shift travel from private transport to public and active modalities.

Slideshow

August 28, 2024

Can the next wave of European luxury consumers turn the market for battery electric vehicles around? We look at the preferences and influence of this growing consumer segment.

Article

March 20, 2024

More than two-thirds of US consumers are considering buying an electric vehicle. Can OEMs meet their price and performance needs while still making a profit?

Retail and Aftermarket

Article

December 12, 2025

Navigating shifting loyalties, digital, and the evolving customer journey.

Article

November 4, 2025

Our survey of 9,000 consumers in ten countries uncovered evolving preferences, with younger cohorts particularly likely to embrace change and regional differences demanding localized strategies.

Video

September 15, 2025

Porsche’s Bold Approach to Sales & Marketing

Matthias Becker, head of sales for Porsche, illuminates the path ahead for the leading sports car brand, from product strategies to new tech innovations.

Article

March 26, 2025

Market pressures have made data, digital solutions, and AI-driven tools indispensable for competitiveness, while enhanced service offerings are essential for long-term revenue growth.

Article

September 18, 2024

The €64 billion aftermarket auto parts business in Europe faces challenges that will alter dynamics and threaten revenue and profits. We outline the findings of our research.

Article

January 9, 2024

While automotive companies spend billions to radically change their vehicles’ look, feel, propulsion, and features, the car buying experience remains burdensome and dissatisfying to consumers.

Weekly Insights Subscription

Stay ahead with BCG insights on the automotive industry

Cost Management and Operations

Article

September 8, 2025

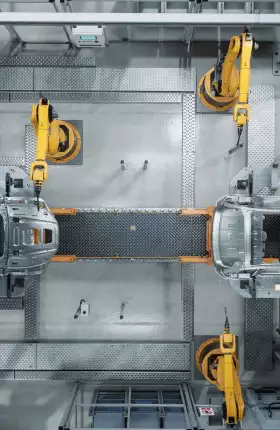

Established automakers face a dual challenge: slowing demand and new competition from companies with lower manufacturing costs.

Update

March 19, 2025

To remain competitive, traditional automakers must fundamentally rethink how their manufacturing plants operate.

Manufacturers need to optimize for increased productivity, improved sustainability, greater resilience, and a stronger workforce. How can they harness the latest technologies to realize these goals?

Update

November 12, 2024

Global market dynamics are shifting rapidly, and the structure of the auto industry is likely to experience fundamental changes.

Article

October 16, 2023

Five strategies automakers can deploy to lower manufacturing costs and tap into a profitable European market for smaller electric vehicles.

Suppliers

Video

September 12, 2025

MANN+HUMMEL's Transportation Division Meets the Future Head-On

As the filtration systems leader innovates new automotive solutions, Hasmeet Kaur, president of the Transportation division, details MANN+HUMMEL’s drive for resilience and sustainability.

Video

Auto Suppliers Should Stay Strategic

The market for many auto components is stagnating. OPmobility’s Augustin Tuaillon and BCG’s Thomas Weber say maintaining an always-on strategy is key.

Article

November 14, 2024

A new tech stack is taking shape in the auto industry. Tier one suppliers that are still trying to determine where to play risk being crowded out.

Commercial Vehicles and Off Highway

Slideshow

October 12, 2023

Despite having a positive effect on the medium- and heavy-duty truck sector overall, the clean-energy transition will disrupt business models and employment, requiring suppliers, OEMs, and other players to prepare for change now.

Article

October 11, 2022

Electrification of commercial road transport is still nascent, but switching to the fast lane. We explore what this electric transformation might look like in the future, using Australia as an example.

Turning Point – Trends, Shifts, and What’s Ahead

Article

May 8, 2025

Explore three potential tariff scenarios, their impact on auto sales, and what leaders can do to stay ahead.

Article

January 8, 2025

The way consumers buy automobiles has changed radically since the Mad Men era, but not automakers’ marketing. This shift calls for a faster, data-driven approach.

Article

September 5, 2023

The European automotive industry has been a critical force in the continent’s economy and industrial success for decades, but now the traditional sources of the auto industry’s strength are threatened.

Explore More

Industry

Capability