AI in Financial Services

Banks have all the data they need to understand their customers, but they often struggle to uncover insights that can drive personalized service and deeper relationships. AI in financial services can close the gap.

About Smart Banking AI by BCG X

When it comes to being customer centric, banks have an advantage: a trove of data, everything from transaction histories, product usage, and risk profiles to online searches and campaign responsiveness. But they also have disadvantages: legacy technology, data scattered across the organization, silos instead of synergies. This makes it hard to create a comprehensive customer view—let alone to leverage AI in banking solutions.

Smart Banking AI from BCG X addresses these challenges head-on, making it simpler to bring data into a single platform, apply the latest technology for AI in financial services, and reach out to the right customer with the right action, when and where it matters.

How Smart Banking AI Works

Generative AI

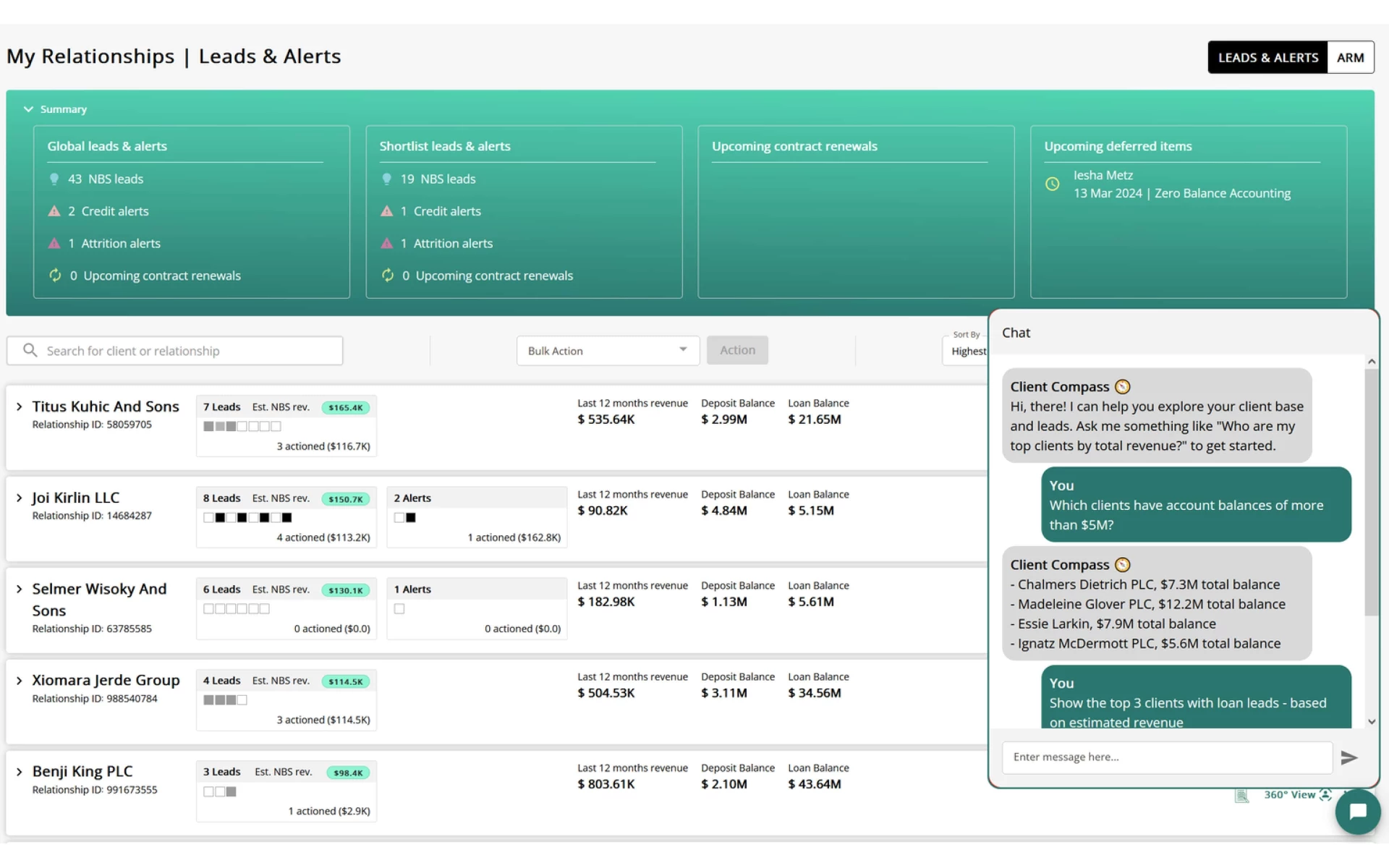

Smart Banking AI employs generative AI to draft hyper-personalized emails, create summaries of key reports, produce investment memos, and identify high-potential clients.

Next Best Solution

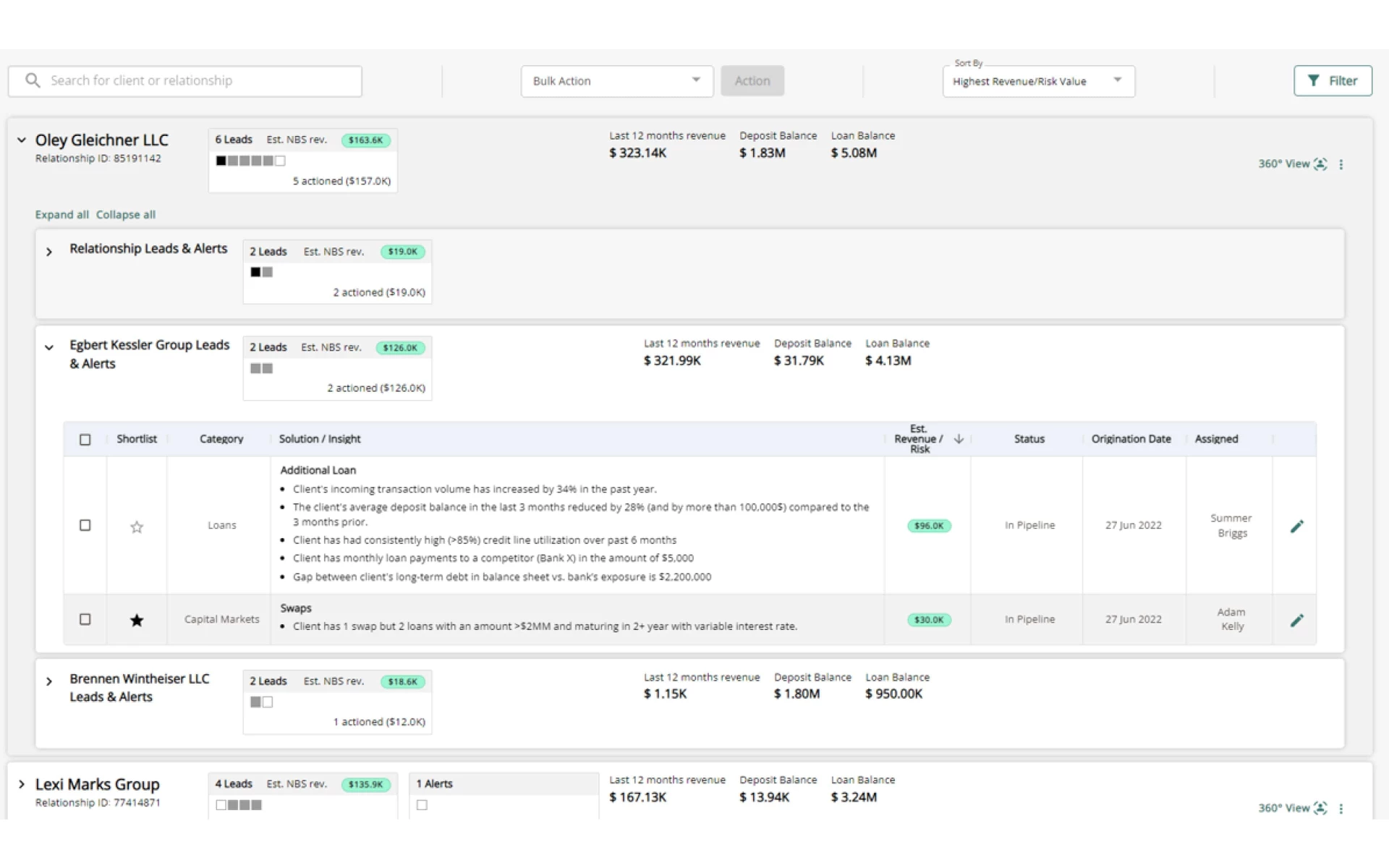

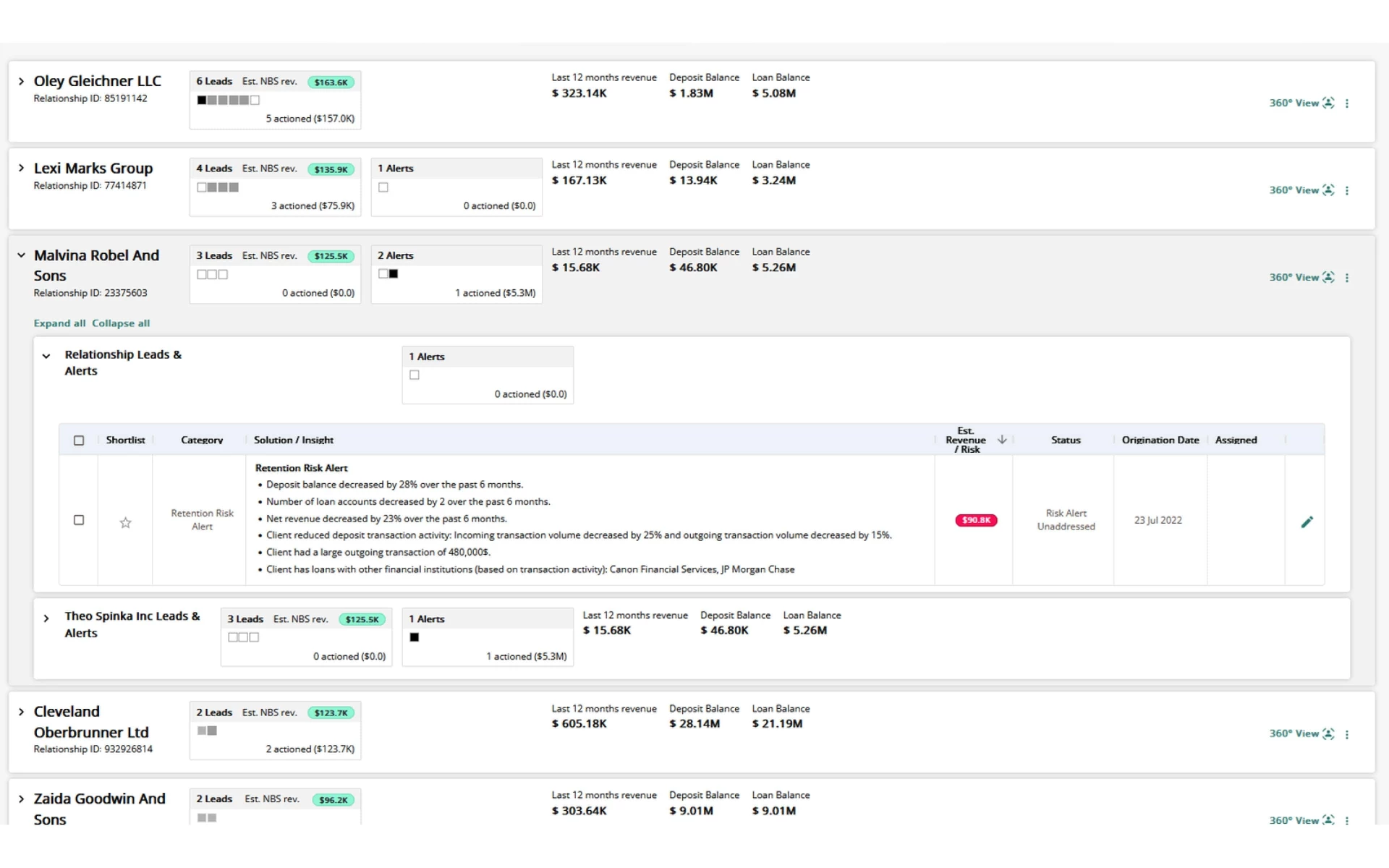

Through machine learning models, Smart Banking AI reveals customers’ needs—and how they may be changing, suggesting products likely to resonate.

Retention

By spotting warning signs of churn, such as a drop-off in transactions, Smart Banking AI can identify at-risk clients and spur proactive engagement to retain business.

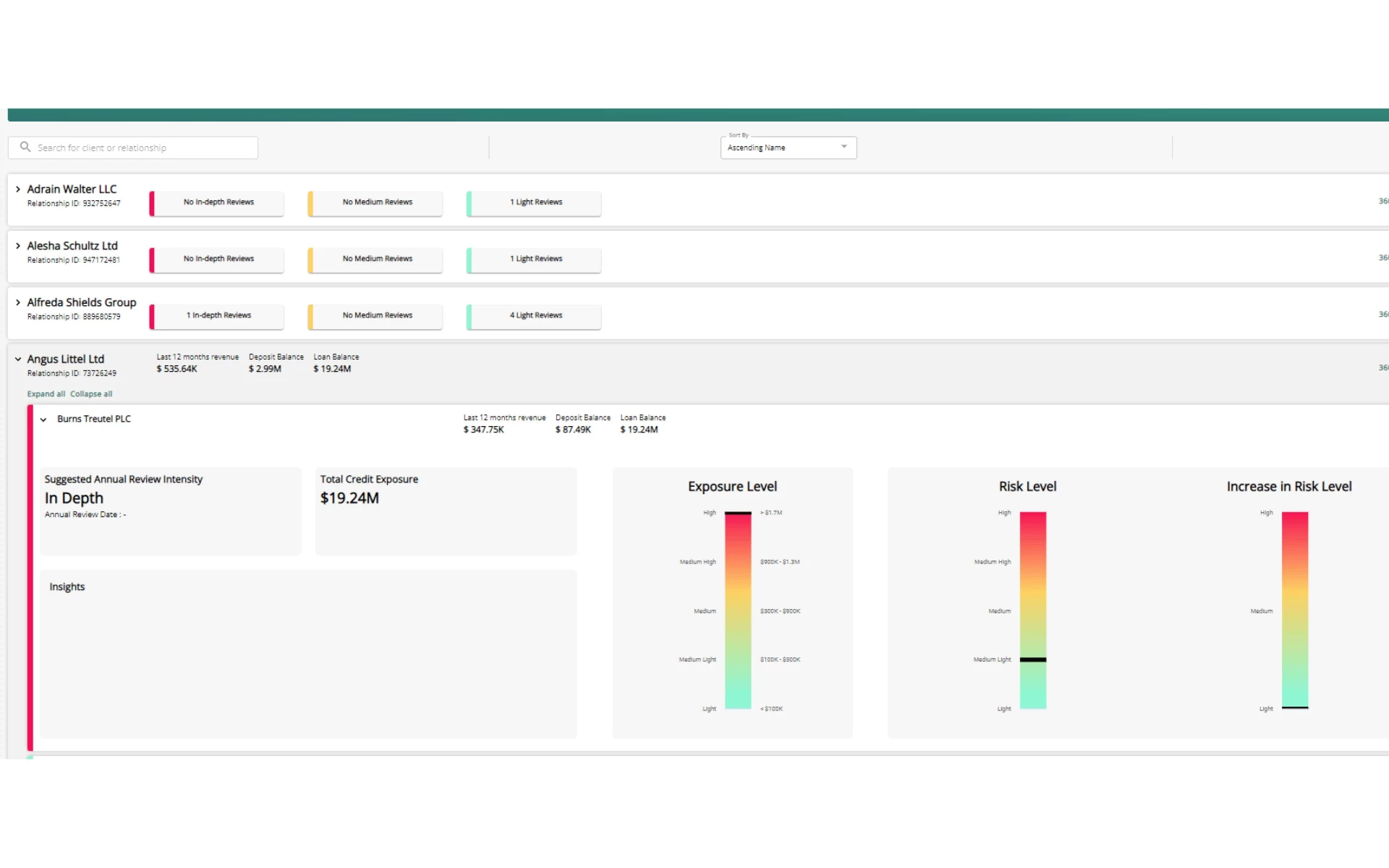

Analytical Risk Monitoring

Smart Banking AI leverages analytics to assign customers to one of three review lanes (in-depth, moderate, or light), reducing credit review costs by up to 30%.

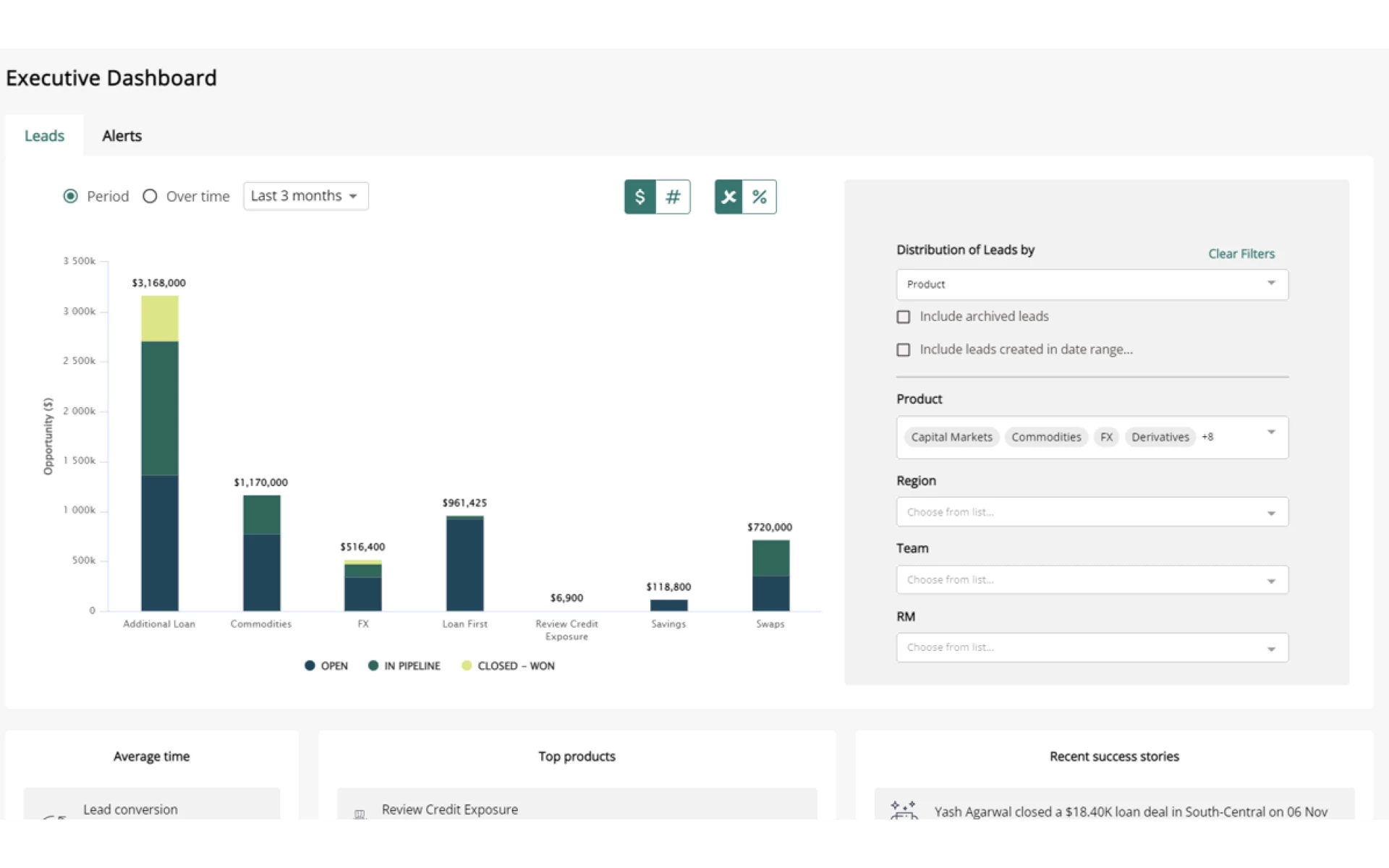

Executive Dashboard

A mission control for relationship managers, Smart Banking AI’s dashboard provides an overview of customer leads and alerts, which can be filtered by region and product.

The Benefits of Smart Banking AI

Smart Banking AI creates visibility by consolidating customer information from different departments and systems (including data on products, transactions, behaviors, and interactions) onto one central platform. Then it leverages that data to do even more:

Identify Signals

Generate Insights

Take Action

Our Unique Approach to AI in Banking Solutions

Who Benefits from Smart Banking AI by BCG X

Our Clients’ Success in AI Banking

Our AI in Financial Services Consulting Team

Our Insights on AI in Financial Services