後進企業と比べ約1.7倍の売上高成長率を実現

【参考資料】

(本資料は、2025年9月30日に米国で発表されたプレスリリースの抄訳です)

ボストン発、2025年9月30日 ―― 経営コンサルティングファームのボストン コンサルティング グループ(以下、BCG)は、企業のAI導入とその効果について調査したレポート「 The Widening AI Value Gap: Build for the Future 2025 」(以下、レポート)を発表しました。レポートでは、AIエージェントの台頭などによって、AI導入が先行している企業と遅れている企業の間で業績面の格差が急速に拡大していることが明らかになっています。

調査対象企業の60%がAIで十分な成果を出せていない

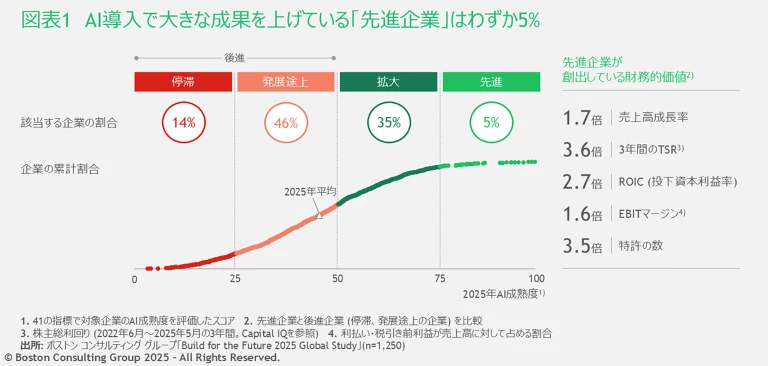

レポートでは、9業界・25以上の業種における1,250人の経営層およびAIに関する意思決定者を対象としたグローバル調査に基づき、戦略、テクノロジー、人材、イノベーション、成果といった、AIに関する基礎能力を示す41の指標からAI成熟度を評価。それに応じて「先進」「拡大」「後進(発展途上または停滞)」の企業群に分類しました(図表1)。

AI導入で「先進」に該当する企業は、世界全体でわずか5%にとどまっています。先進企業は、最先端のAI活用の能力を部門横断的に構築し、AIによって継続的に大きな財務的価値を創出しています。一方、「拡大」に分類される35%の企業は高度なAI戦略と組織能力のもとAI導入を拡大し始め、価値につなげつつあるものの、十分なスピードは伴っていない状態です。残る60%は「後進」で、そのうち基礎的な組織能力を整えてAIへの取り組みを始めている「発展途上」は46%、ほとんどAIへの取り組みを行えていない「停滞」は14%となっています。どちらの企業群も、AIによる収益向上・コスト削減の成果が上がっておらず、取り組みの拡大に必要な能力もまだ整っていません。

AI導入で先行している企業は、財務・業務オペレーションの両面で大きな恩恵を得ており、後進企業との差はさらに広がっています。先進企業は、2025年に後進企業の2倍以上のAI投資を計画しており、その結果として、売上高の伸びは2倍、コスト削減効果は40%増になると見込まれています。さらに、BCGの分析によると、先進企業は後進企業と比べて売上高成長率は1.7倍、3年間のTSR [注1] は3.6倍、EBITマージン [注2] は1.6倍といった、多方面の価値を創出しています。

AIエージェントが企業の格差を拡大、2028年にはAIによる価値創出の29%を占める予想

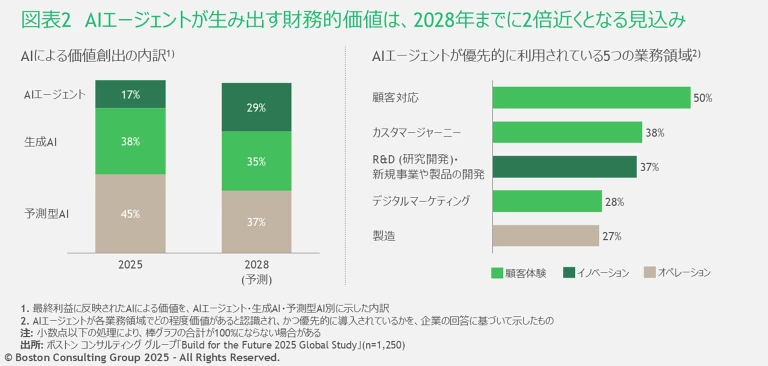

企業がAIで生み出している価値に大きな差が生まれている理由の一つが、AIエージェントの台頭です。AIエージェントは、学習、推論、意思決定、実行を自律的に行い、複雑かついくつもの工程が必要な課題を解決できます。調査によると、AIエージェントが生み出す財務的価値は、2025年時点ですでにAIが生み出している価値全体の17%を占めており、この割合は2028年までに29%へと増加する見込みです(図表2)。

先進企業では、AIに投じる予算のうち15%をAIエージェントに割り当てています。こうした先進企業の3分の1がAIエージェントの実運用に至っている一方、「拡大」に分類された企業で実運用に至っている割合は12%にとどまり、後進企業ではほぼ運用されていないことも明らかになりました。

AIは営業・マーケティングや製造など中核機能のほか、IT業務でも価値を生む

業種別で見ると、AI導入は、特にソフトウェア、通信、ペイメント・フィンテックといった領域で先行しています。一方、ファッション・ラグジュアリー、化学、建設などでは相対的に進行が遅い状況です。

調査ではさらに、業種を問わず、AIが全社的に生み出す価値の70%は営業・マーケティング、製造、サプライチェーン、価格設定など、直接的な業績に関わる中核機能に集中していることも明らかになりました。ただしIT業務ではAI導入による価値のうち13%が創出されており、この割合はサポート機能の中では例外的に高くなっています。

レポートでは、先進企業はその業種や企業規模にかかわらず、業務の中心にAIを据える「AIファースト」のオペレーティングモデルを採用しており、以下5つの有効な取り組みを実践することで価値を創出し、競争優位性を拡大していると指摘しています。

- 中長期的なAI戦略を経営トップ主導で策定・実行する

- AI関連施策を価値に基づいて優先順位付けし、成果を追跡する

- 人間とAIが協働し能力を拡張し合う、AIファーストのオペレーティングモデルへ転換する

- 将来的な人材ニーズを見据え、サプライヤーなど外部パートナーも活用しつつ、人材を中長期的に確保・育成する

- 目的に合ったITシステム・データ基盤を整備する

BCGミュンヘン・オフィスのマネージング・ディレクター&シニア・パートナーで、本レポートの共著者である マイケル・グレーベ は次のように述べています。「テクノロジーは週単位で進化しており、先進企業は加速度的に前進しています。いま大多数の企業に求められているのは、単なる投資ではなく、AIによるビジネスそのものの『再構築』です。先進企業が実践している取り組みは、どの企業でも明確な指針として取り入れられます」

[注1] 株主総利回り

[注2] 利払い・税引き前利益が売上高に対して占める割合

■ 調査レポート

「 The Widening AI Value Gap: Build for the Future 2025 」

■ 日本における担当者

中川 正洋

マネージング・ディレクター & パートナー

日本における生成AIトピックのリーダー。BCG X、BCGパブリックセクターグループ、およびテクノロジー&デジタルアドバンテッジグループのコアメンバー。

早稲田大学理工学部卒業。同大学大学院理工学研究科修了。グローバルコンサルティングファームなどを経て現在に至る。

■ 本件に関するお問い合わせ

ボストン コンサルティング グループ マーケティング 中崎・中林・河西

Tel: 03-6387-7000 / Fax: 03-6387-0333 / Mail:

press.relations@bcg.com