BCGの事業売却へのアプローチ

BCGはあらゆる主要産業において多くの事業売却案件の成功を支えてきた実績を有し、クライアントからは「BCGとの協働でより大きな価値が引き出せた」と評価を頂いています。BCGの事業売却エキスパートは、買い手の候補を見定め、表面的な指標を超えて事業の真の価値を評価するノウハウを持っています。これが売却先候補の幅を広げ、買い手が支払う意思のある金額を最大化することにつながります。さらに、クライアントと一体となって取り組むことで、クライアントが最も注力すべき中核事業に専念できるよう支援します。

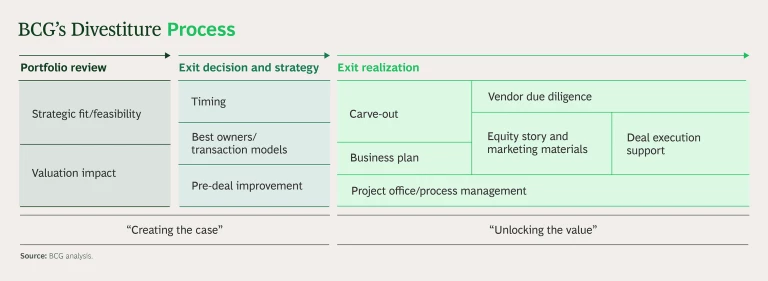

私たちの事業売却へのアプローチは、画一的なプロセスの実行とは対極の、各企業固有の状況や目標に合わせて精密にカスタマイズされたアプローチです。BCGは、事業売却プロセスから取引実行に至るまでを、「事業売却のためのケース策定」フェーズと「価値の実現」フェーズという2つの大きな局面に分け、エンドツーエンドで包括的にご支援します。

事業売却のためのケース策定

事業売却プロセスのフェーズ1 では、売却に適した資産の選定を含むポートフォリオレビューから、売却資産の価値向上を目指すオペレーション改革を含むエグジット戦略の策定に至るまでが対象になります。

価値の実現

フェーズ2 には、事業売却の準備と実施が含まれます。事業売却は通常、 カーブアウト、つまり親会社から対象部門を切り離すプロセスから始まります。後回しにされがちですが、カーブアウトにおいては価値の流出を防ぐため、監視のもとに行うことが必要になります。

BCGはまた、このフェーズのカギとなる2つの要素、説得力のある投資の根拠を含むエクイティストーリーと、大きな価値を生むオペレーション改善を踏まえた詳細な事業計画を構築する支援を行います。

他企業への事業売却にあたって、BCGは徹底したベンダー・デューデリジェンスを実施し、買い手候補の意思決定を支援する独立した評価を提供します。BCGの客観的かつ高い信頼性を備えた事業価値と将来性の評価は、買い手候補の信頼を高め、提示価格の上昇につながることもあります。

さらに、BCGは売却契約の交渉・締結プロセス全体、ならびに買い手候補との協議・調整の各段階においても伴走し、最適な条件での取引成立を最後までご支援します。

The BCG M&A Report Collection

事業売却 最近の論考など