同族経営についてのBCGの支援アプローチ

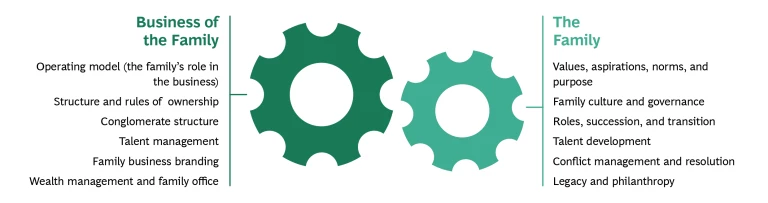

BCGは、コーポレートファイナンス&ストラテジー、組織、マーケティング&セールス、オペレーション、デジタルトランスフォーメーションなど幅広いコンサルティングサービスに加えて、同族経営企業の経営者が特有の課題を乗り越えるための支援も行っています。その課題には次のようなものがあります。

私たちは、同族経営企業のオーナーと深いリレーションを築きます。彼らの独自のリスクプロファイル、長期的な成長の視点、ステュワードシップ(責任ある経営)の考え方を理解し、重要な問いに向き合いながら、同族経営企業向けにカスタマイズされたソリューションをつくり出します。

同族経営についての7つの重要な問い

- 経営に関与する親族にとっての企業・事業のパーパス(存在意義)は何か。

- 同族経営企業のガバナンスはどのように構築されるべきか。

- 特に大規模なコングロマリットの場合、オーナーシップとマネジメントの望ましい関係はどのようなものか。

- たとえば後継計画や世代交代など、同族経営の移行を企業としてどのようにマネジメントすべきか。

- 経営に関与する親族は、どのように感情的な緊張を和らげ、調和を保つか。

- 親族のコントロールを弱めずに成長の資金をどのように調達するか。

- 同族経営企業は、どのように親族以外のきわめて優秀な人材を惹きつけ、パートナーや投資家にとっての明確な期待を設定するか。

同族経営のガバナンスに関するBCGの焦点

企業には法的に整備されたガバナンス規程の遵守が求められますが、その企業を所有する「親族」には同じ義務はありません。しかし、同族経営における良好なガバナンスは極めて重要です。

明確で相互に合意したガバナンス構造が欠如すると、不要な対立を生み、企業価値を損なう可能性があります。そのため親族は、効果的な同族経営のガバナンスモデルを定義するために、次の4つのステップを踏む必要があります。

- 親族の包括的目標に同意する。親族はオーナーとして、選択したとおりに事業を経営する権利を有していますが、選択をしなければなりません。事業経営の目標は、現在の株主としての親族の富の創造を最大化することでしょうか。それとも、この世代だけでなく将来の世代にも機会を創出することでしょうか。

- 親族の潜在的ホットスポットを予測する。親族の調和を脅かす危険性が最も高い問題を理解したうえで、ガバナンスの枠組みを設計する必要があります。親族によりそれぞれ異なりますが、一般的な例として、リーダー交代、富の共有、世代間の公平性などに関する葛藤の可能性があげられます。これらの問題を事前に考慮しておかなければ、小さな紛争が大きな亀裂を生み、親族とビジネスの両方を脅かす可能性があります。

- 親族とビジネスの背景を理解する。オーナーとして、親族は事業とその直面する課題を理解することが重要です。オーナーシップ構造と後継者育成計画はどのようなものですか。企業の保有資産とその将来の戦略はどのようなものですか。財務面、規制面、社会面などにおいて、どのような制約に直面していますか。

- 親族のためのガバナンス構造を構築する。ガバナンス構造には、前の3つのステップによる意思決定と学びが反映される必要があります。多くの親族が、親族の定義と同族オーナー・経営幹部のための規則を明確にした株主間契約を作成しています。そして、ガバナンス機関を設置し、親族の行動規範を定めています。

同族経営に関するBCGの新刊書

同族経営 最近の論考など