Companies’ lifespans are shorter than ever before. Digital disruption has become so intense that pure players in digital are no longer disrupting just incumbents, they are disrupting other pure players as well: HomeAway has emerged as a strong rival to Airbnb. Apple Music is nipping at the heels of Spotify’s streaming music service. The tech giants—Google, Apple, Facebook, and Amazon—are in the driver’s seat, setting new standards for digital.

To understand how leading companies are responding to the dynamism and unpredictability of today’s marketplace, The Boston Consulting Group partnered with IBM and Electronic Business Group, a leading French think tank, to interview the leaders of 70 B2C companies (60 incumbents and 10 leading pure digital players) on the topic of digital transformation.

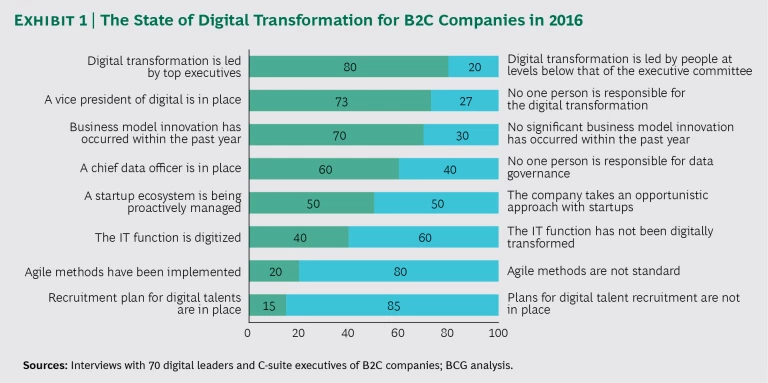

The results are striking. With new attackers appearing all the time, digital transformation is seen by many as the only path to survival. But while many companies are restructuring their governance to become digital ready, there is still much to be done in terms of implementing agile at scale, capitalizing on open innovation, and hiring new digital talent. (See Exhibit 1.)

Where Companies Are Today

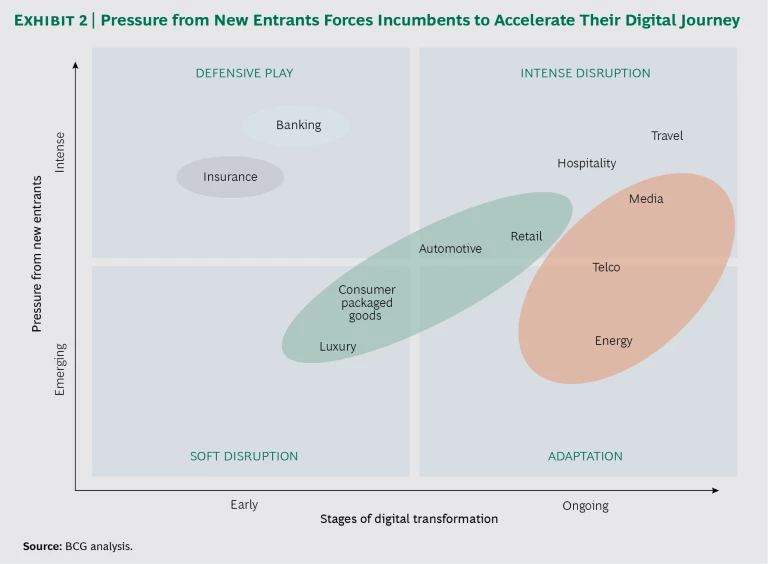

Every industry is impacted by digital, but companies’ approaches to it vary according to how much pressure they experience from new entrants and the extent to which digital is transforming their particular sector. (See Exhibit 2.) Some sectors, such as hospitality, retail, and travel, are already contending with intense competition from digital startups, many of which are flush with cash from venture capitalists. Others, such as banking and insurance, are playing defense because they are at least somewhat protected by legal barriers that make it hard for new entrants to gain traction, though banks are heavily under attack from financial technology companies, particularly in the area of payments. The luxury and consumer packaged goods (CPG) sectors are facing stiff competition from new entrants; without legal protections, these companies are being forced to adapt rapidly. In response, most incumbents now regularly scan the horizon for new technologies and patents to acquire attackers before they become too dangerous. Unilever’s $1 billion acquisition of Dollar Shave Club offers a striking example of this strategy in action.

In all sectors, the pressure to digitally transform the business is only getting more intense owing to five trends:

- Evolving Customer Behaviors. Digital newcomers are transforming customers’ expectations. Users want a simple, fast, user-friendly digital experience in all of their online transactions, but most say that they are dissatisfied with their online experiences. Companies need to reinvent their customer engagement model to allow seamless switching between channels, mobile-friendly services, and first-time fixes (with no handoffs).

- Technological Leaps. Increased connectivity and mobility, cloud-based services, artificial intelligence, and the Internet of Things are helping companies improve efficiency in almost every aspect of the business, including digital marketing, manufacturing, R&D, and supply chain.

- Data Explosion. The increasing volume and diversity of data generated through digital channels are providing companies with valuable market insights that inform real-time, data-driven decision making and improve customer targeting.

- Legal Factors. In some sectors, laws and regulations constrain incumbents by lowering competitive barriers for new entrants. Conversely, laws and regulations that deter new entrants can protect incumbents. New laws can also provide a strong incentive for innovation. In the automotive industry, for example, heightened emissions standards have supported greater investment in fuel-efficient hybrid or electric vehicles.

- Pricing. Many startups are focused above all on moving quickly to gain market share, not turn a profit, which can put significant pressure on incumbents’ margins. In this environment, it’s more important than ever for companies to reduce costs, improve efficiency, and explore new ways of generating revenue.

With so many factors in play, companies need to set a bold course toward digital transformation. Some have already begun to do so: more than 70% of the executives we surveyed said that they have named a chief digital officer who stays alert to disruptive threats and opportunities and drives a digital-first agenda. More than 60% have launched a startup incubator, and 45% have invested in new ventures. Nevertheless, more remains to be done.

Where Companies Need to Be

To capture the full value of digital, companies need to advance five fundamental strategies.

Harness the power of data. With an endless stream of data flowing from smartphone apps, website browsing, social media messages, and customer transactions of all kinds, companies have enormous opportunities to harness the power of big data. But this data needs to be stored and managed in such a way that it yields accurate predictive modeling and meaningful customer insights. Enterprise data warehouses, commonly called data lakes, can be used to store and structure data from multiple sources into a single repository, and they can model the data so that it supports decision making, research, and innovation.

Companies also need to hire the right talent, such as data scientists, to gain an edge in analytics and create tangible value for the business. For example, AXA Equitable Financial Services, the multinational insurance firm, hired approximately 60 data scientists to fuel data-driven innovation and respond to requests from affiliates. They are supported by data specialists in charge of embedding culture throughout the company to ensure that data is being mined across business units.

Redefine the customer journey. The customer journey is more complex than ever. Today’s consumers have become accustomed to 24-7 availability and seamless interactions across platforms and devices, and they have very limited tolerance for service delays and handoffs. To meet these demands, companies—whether B2C, B2B, or B2B2C—need to put the end user at the center of their enterprises, which means mapping the customer journey, identifying customer pain points, developing prototypes, and testing solutions. This kind of “design thinking” approach allows companies to create a superior user experience. The bank Crédit Agricole, for example, has created a multichannel model that meets clients where they are—moving fluidly between online and offline channels. First contacts are almost 100% mobile, and bank advisors equipped with tablets routinely travel to client sites for in-person visits. Companies that get this effort right will find themselves with a legion of loyal consumers.

Build digital capabilities throughout the enterprise. Digitization is not an add-on. Rather, it is a fundamental transformation of the core business, which includes functions as diverse as logistics, supply chain, operations, and the back office. Companies have the opportunity to create digital factories that simulate an entire production process. Such digital simulation can be used, for example, to optimize factory layout, identify and correct flaws in the production process, and model product quality. Furthermore, cloud-based solutions, application programming interfaces, and agile operations can be used to improve flexibility and time to market. Companies also need to manage IT by implementing new digital platforms and integrating them with legacy systems. Total, the international oil and gas company, has achieved this by establishing a digital IT team with a “fast and flex” structure to manage continuous IT delivery and rapid prototyping, while the legacy IT team integrates apps into core enterprise resource planning.

Transform governance and explore collaborative ways of working. To move at the speed that digital requires, companies need to adopt a new way of working. Cross-functional teams must collaborate to brainstorm ideas, conduct prototyping, run A/B testing, and incorporate feedback from users. This, in turn, will require a new form of governance, in which teams are given more autonomy. While corporate management defines global goals and sets strategic objectives (for instance, capturing a greater percentage of business online by 2020), local teams are given the freedom to operate in a way that ensures they maintain the optimum speed and contribute to corporate objectives. In some cases, companies may want to jump-start the digital transformation by developing partnerships with digital players. For example, Danone, the global food company, created a digital board—including the chief data officer, the chief information officer, and the chief human resources officer—to work in concert with the executive committee. The board aligns on overall objectives but allows local divisions to develop their own content.

Reinforce innovation capabilities. It’s important for companies to carry out their digital transformations across three dimensions: transforming the core to be more digitally sophisticated; restructuring the business to become more agile and flexible; and exploring new avenues for breakthrough innovation. To make headway in all three areas, companies should explore new opportunities that arise with regard to open innovation, incubators, innovation centers, and corporate ventures. Many companies have successfully named (or hired) a chief disruption officer to drive change and safeguard the business against emerging digital attackers. Diageo, a global premium drinks business, has deployed a wide variety of innovation capabilities, including agile processes, prototypes, the ability to scale up new products in less than 18 months, and corporate ventures that monitor the startup ecosystem and accelerate acquisitions.

Digitization, automation, the Internet of Things, and other technological advances are rapidly changing the global economy, and companies that fail to evolve are at risk. Digital attackers are going after the most profitable parts of incumbents’ businesses, disconnecting them from their customers, stripping away profit centers, and leaving incumbents to manage activities that are more costly and less valuable (as we’ve seen with payments processing in banking). For companies that develop digital capabilities too late, the shakeout can be merciless. With these five strategies in their arsenal, CEOs have an opportunity to drive successful digital transformations and reshape their companies’ digital destinies.