Today’s corporate banking clients want the efficiency and convenience they experience every day on retail websites such as Amazon and eBay. While some banks have responded with an attractive online presence or new technologies, such as voice or facial recognition, most are well behind their retail counterparts in introducing digital tools. In fact, many still operate as they always have—gathering documents with cumbersome, manual processes and relying on meetings, calls, and emails alone to interact with customers.

There are good reasons for this. Corporate customers are demanding. The product universe is large and often tailored to the individual customer. Processes for verifying client identity and preventing money laundering are highly complex, as are credit analysis and credit risk management. And the cost of failure can be enormous: compliance breaches can lead to fines and reputational damage, important customers can defect to the competition, and even one defaulting client can result in substantial loan losses.

Nonetheless, corporate banks can differentiate themselves from the competition and generate real value. They can do so by fundamentally reinventing their customer journeys through a balance of digitization and personal service, supplementing in-person interactions with convenient online tools that allow relationship managers to focus on the essentials. Despite the obstacles and risks, some of the more innovative corporate banks have already begun to make great strides in this direction, creating digitally enhanced customer journeys and putting today’s technologies to their best use.

Rethinking the Customer Journey

Recent BCG interviews with bankers and corporate customers reveal that—along with cheap, reliable financing, of course—what corporate banking customers want most are simple, straightforward transactions and the option of self-service. For example, they want a single login page for all active services; seamless transfers of data between the website, their mobile device, and their relationship manager (RM); and the ability to view their balances and conduct transactions online. And they never want to complete the same form or send the same documentation twice.

Yet corporate banks have been slow to introduce new digital technologies. To catch up, they need to do much more than simply create a new user interface or introduce a new digital tool in isolation. They need to reinvent their most important customer journeys to resolve their clients’ key pain points and overcome internal challenges. And they need to support these new journeys by optimizing their business processes from end to end, integrating digital tools throughout.

One leading European bank chose to begin its transformation by rethinking the journey to becoming a corporate banking customer. It introduced a fully digital onboarding process, including revamped customer interfaces, digital capturing of customer requests and signatures, and an automated quality check for uploaded documents. It reduced the number of documents required by the process and created a common online workspace that enabled direct and efficient interactions—whether customers were uploading materials, using facial or voice authentication, or tracking the bank’s internal process steps. As a result, the bank reduced its turnaround time by more than 60%, greatly decreased manual rework, substantially improved customer satisfaction, and cut operating costs by 30% in some product areas. (For a more detailed example of a reinvented journey, see the sidebar “Digitizing the Credit Journey.”)

DIGITIZING THE CREDIT JOURNEY

DIGITIZING THE CREDIT JOURNEY

A leading Northern European bank chose to begin the digitization process with its credit journey for corporate customers. A number of pain points in the credit process were antagonizing customers; in addition, they were making the work of the bank less efficient, thus increasing costs.

To reinvent the journey, the bank first looked at its customers’ most pressing credit-related issues, including a time-consuming documentation process; poor transparency, with a limited view into current credit facilities and exposure; and insecure document handling—typically by email. The bank chose to address these issues by introducing a credit journey made up of five closely connected digital tools: a data-driven model to assess credit quality, a portfolio tool to manage and monitor credit exposure, a shared online workspace, a digital credit analysis tool, and an automated back office.

To keep the transformation’s complexity low, the bank focused initially on simple cases for existing, low-risk corporate customers. In addition, the bank employed a cross-functional team of specialists in corporate banking, digitization, and risk—as well as data analysts, user experience and user interface designers, and IT architects and developers. It also involved critical stakeholders from the beginning from the relevant business lines, risk, compliance, and legal to IT infrastructure and brand and visual communications.

As a result, both the bank and its customers experienced radical improvement in the speed of the credit process and the response time to customer credit applications. Transparency improved as well, providing a better overview of the credit process both internally and externally. Documentation is also simpler, and document security has increased.

Perhaps most important, improvements in credit management will ultimately lead to reduced loan losses. And the changes empowered the bank’s RMs to preapprove credit for low-risk customers—expediting the credit process and allowing an immediate “yes” for the customer credit applications that fall within the new preapproved limits.

Taking the Customer Perspective

To reinvent their key customer journeys, banks should first understand and assess the experiences of current customers and then develop a comprehensive baseline of their most significant journeys. Full-service corporate banks typically find that they have around 30 such journeys.

Banks should be sure to consider each journey from the customer’s perspective rather than with an eye toward selling a product. For example, bringing a new customer into the bank might be framed as “Help me do business with you now and in the future,” while financing could be framed as “Help me finance my business in the best way.” In contrast, banks today tend to look at the customer experience purely through a product lens, such as, “How can I sell more cash management products?” or “How can I get the customer to do project finance with me?” Yet all product groups inherently link to an underlying customer journey.

Prioritize the journeys. Banks will need to prioritize the journeys to determine which to pursue first. They should do so on the basis of three primary goals: enhance the customer experience, increase revenues, and reduce personnel costs. (See Exhibit 1.) Banks will emphasize each of these goals differently according to their strategies, their starting points, and such factors as their resource constraints and target technology landscapes.

Given that each customer journey will have a different impact on each of the three goals, banks must first prioritize the goals themselves and then understand each journey’s impact on them, prioritizing the journeys on the basis of the results. For example, if a bank’s primary focus is cost reduction, the bank would do well to begin by understanding the number of personnel assigned to each of the journeys and generating an initial estimate of the share of personnel costs that could be saved.

Once a bank’s top-priority journey has been identified, it should become the subject of the first pilot in the transformation. Banks must take care to ensure that the scope of such a pilot is manageable. One way to do this is by sequencing elements of the pilot—addressing the customer interface, the decision logic, the automation of back-office processes, and other aspects one by one rather than simultaneously. Banks should then concentrate their resources on making this first pilot a success; if they spread their resources too thin, the transformation may stall.

Reinvent the journeys. The new journey must put the customer at the center: banks should ask themselves what their customers’ pain points are and how a future journey could resolve them. In addition, banks must address their own internal pain points, such as manual tasks that slow the transaction process, hurting customer service. To mitigate these pain points, banks will ultimately need to enhance their processes in a variety of ways. This may include making information more readily available, generating real-time responses, and eliminating a number of process steps.

For now, banks should reimagine the ideal customer journey by looking at different customers’ potential needs and then transforming these needs into requirements for the new journey. This effort should be cross-functional, bringing experts together from a variety of areas to ideate. Yet even as they envision ideal solutions, of course, banks must bear in mind any technical, organizational, or regulatory constraints, along with any guiding principles (such as target IT architecture) that may ultimately circumscribe the journey—working within, rather than around, these constraints.

Optimize processes. A customer journey reshaped to focus on customer needs will require radically new internal processes to support it. And defining, optimizing, and implementing these processes will require significant preparation. Banks must draw a picture of the desired customer journey that is detailed enough to then define the initiatives required to achieve that journey, address the identified root causes, and set up agile teams to carry out a pilot of the initiatives.

Initiatives might include, for example, one team working to build a new portal that will be accessible by the customer, the RM, and the back office; a second team developing a comprehensive data model that reflects all the information necessary to populate the back-end systems for each product and supports the integration of tools throughout the process in question; and a third team introducing a workflow solution that helps automate processes and create transparency. Once these pilot teams have been established, they should create a backlog of the features to develop for each piece of the journey, using agile development methods.

We note that banks must involve their second- and third-line functions, especially risk, as they shape these new processes. These functions will play a critical role in introducing important innovations, such as advanced risk analytics, for example, which will change the way credit risk management is conducted. Their approval will be essential to successful implementation.

Define a digital path. From day one, banks will need commitment from top management for the move to digitization and the acquisition of the necessary digital tools for transformation. These tools will include some basic requirements—such as API management, workflow technology, electronic file systems, and robotic process automation tools—as well as more cutting-edge technologies, such as data analytics, advanced data architecture and data models, and artificial intelligence platforms.

In addition, banks should work closely with the IT department early on, establishing a clear technology roadmap for the future. This roadmap should be established in parallel with the first customer journeys—because the journeys will have to adhere to it—and be flexible enough to adjust to new requirements or priorities as they emerge. Banks should set their ambitions high, following the efforts of such tech giants as Google and Amazon rather than those of their peer group.

Of course, there is no need to replace the bank’s legacy IT immediately. There will always be a tradeoff between building a modern IT architecture and simply bridging some of the gaps in the short term. Banks should therefore start the digitization process by integrating select technologies into existing systems. This might include, for example, implementing technology that relies on existing internal data pools rather than immediately overhauling the current data architecture. With an interim measure in place, banks can later install a new data platform next to the existing one and migrate to the new solution step by step.

Key Success Factors

Successful reinventions share some common factors. These include thinking big but starting small, attracting and retaining high-tech talent, and gathering diverse skill sets and expertise.

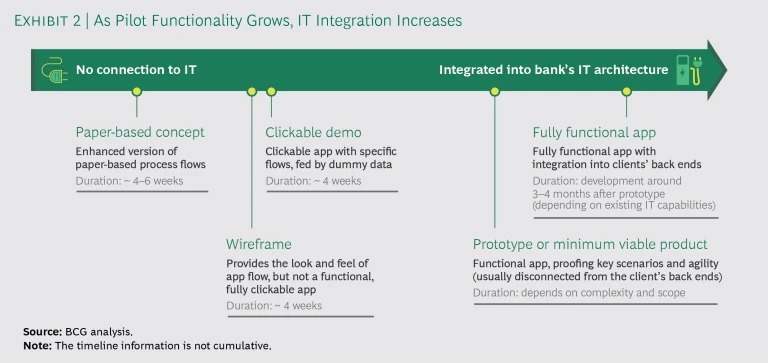

Think big, start small. The first pilot will serve as the lighthouse project for a bank’s transformation, giving the organization something to rally behind. It will also allow the bank to assess the effort on a small scale, developing it side by side with the core business in a test environment to create a minimum viable product (MVP). The MVP might be just a paper-based design at first, followed by a wireframe and, ultimately, a full prototype; banks should test each design with customers to be sure it resolves their pain points.

For example, rather than incrementally changing the current process for bringing new clients onboard, the bank could run a small pilot that introduces a new interface and technologies, developing the new process from scratch. The pilot team would design, program, test, iterate, and agree on any new apps—and then, as the pilot takes shape and functionality improves, integrate the fully functional apps into the existing IT infrastructure. (See Exhibit 2.)

Make high-tech talent a priority. Because banks compete with technology companies and others for scarce talent, such as data scientists and automation engineers, they must work to attract and retain digitally savvy employees. To succeed, banks must fight against the traditional mindset that views IT as a low-profile, back-office cost generator, rather than the critical element in generating new business that it is today. Note that essential digital talent, especially in IT, should not be outsourced. This is for two reasons: banks need continuity and, most important, IT staff are now a core part of the business team, generating tangible value together with the front office.

Gather know-how and capabilities. Reinventing and optimizing customer journeys takes more than hiring digitally savvy talent, of course. Banks will need to assemble multidisciplinary project teams that bring together a broad set of skills and know-how, including ethnographic researchers who can help understand what clients want; good user experience and user interface designers to build prototypes and ensure a visually appealing solution for users; and traditional client-facing bankers and risk analysts who understand the bank’s requirements. Simultaneously, banks will need to obtain commitment and early involvement from stakeholders across the bank. The success of these enormous transformation projects will depend on such buy-in because the changes will ultimately affect not only the front office but also the middle and back offices, including IT, finance, compliance, and risk.

Successful transformations will require two other fundamental shifts as well. First is a change in the corporate mindset, which will be core to the transformation. Effecting this change will require a combination of training and teamwork. Banks should start small and then roll out new skills and ways of working across the organization as the transformation expands.

One essential aspect of this shift will be the approach to the practice of banking itself. The use of tools such as advanced analytics for pricing, risk assessment, and customer prioritization, for example, will change the traditional ways of working for both RMs and risk management. Another aspect will be that of cultivating and inculcating an agile mentality—with development teams always thinking in terms of MVPs, creating an early feedback loop with clients, and instilling a fail-fast, fail-early mindset.

Second, corporate banks should begin to transform the organizational setup to accommodate these new and agile ways of working, ultimately transforming from a straightforward, classic, line organization to one that is structured around the new customer journeys.