You wouldn’t wait until it’s raining to fix your roof. The same logic should apply to the commercial aerospace industry, which has been enjoying a record-long expansion. BCG recently analyzed the industry and found that despite some questions about the likelihood of a contraction, an industry-wide downturn is not on the horizon. However, OEMs and suppliers have become accustomed to high growth rates in aircraft production and deliveries, and those rates will almost certainly slow in the years ahead. For many participants, the shift to decelerating growth will feel like a contraction, particularly given that aerospace OEMs and suppliers still face high expectations from investors. Moreover, the challenges could be more concentrated for certain participants, depending on their platforms and exposure to various regional markets.

For OEMs and suppliers, the current period of continuing—though slowing—growth provides a critical opportunity for assessing their portfolios, identifying programs and platforms that are at risk, and adjusting their sales strategies accordingly. All industry players should also continue to seek growth while it’s still readily accessible, conducting M&A in key adjacencies to integrate vertically, investing in digital initiatives, and expanding into the profitable aftermarket business.

For OEMs and suppliers, the current period of continuing—though slowing—growth provides a critical opportunity for assessing their portfolios, identifying programs and platforms that are at risk, and adjusting their sales strategies accordingly.

An Industry Still in Growth Mode—Even as Others Slow

The overall business cycle continues its expansion, but concerns of deceleration or even recession are spreading. This is particularly true in industries, such as automotive, that are feeling pain from, for example, trade wars, technology disruptions, and altered supply chains. Given this context, we recently analyzed the commercial aerospace industry’s prospects and compared its current situation with previous downturns.

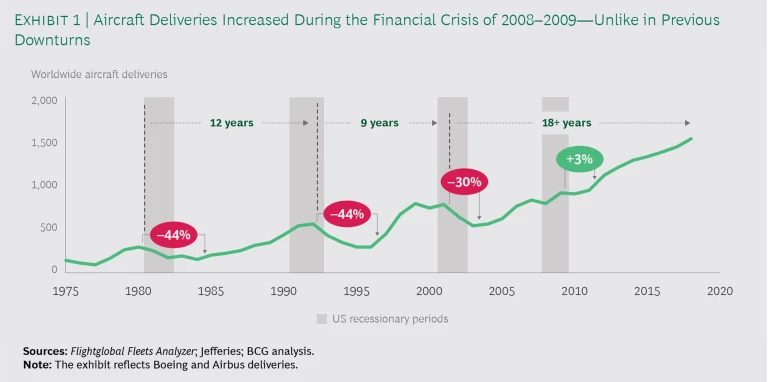

For the most part, our analysis yielded good news. The current expansion—an 18-year (and counting) supercycle of growth in commercial aircraft deliveries—is unprecedented in modern aviation history. The last major industry downturn was in the early years of this century following the dot-com bust and 9/11. Boeing’s and Airbus’s combined order backlog currently sits at approximately 14,000 units, higher than ever before, and represents nearly eight years of production, which is also very high by historical standards. Airlines’ revenue per passenger kilometers (RPK), a metric that is strongly correlated with aircraft orders, is forecast to grow from 4.5% to 6% a year for the next two decades as demand for air travel continues to grow worldwide. Both Boeing and Airbus have a healthy mix of exposure worldwide that insulates them from the impact of an outlier event in any one market. As Exhibit 1 shows, not even the 2008–2009 financial crisis was enough to stop the current expansion. (The recent grounding and subsequent production slowdown of the Boeing 737 MAX don’t represent a long-term, systemic issue for the industry.)

The current expansion—an 18-year (and counting) supercycle of growth in commercial aircraft deliveries—is unprecedented in modern aviation history.

There are differences between 2001 and 2008. The industry saw a contraction in deliveries in 2001 but not in 2008, owing to several factors. First, RPK declined by 11% in North America during the first decade of this century as travel demand fell off in the wake of the 9/11 attacks, but it increased by 7% annually in the rest of the world. Boeing had far more exposure to the North American airline market than did Airbus. The decline in demand and subsequent increase in airlines’ requests to cancel or delay airplane orders required a response from both OEMs. Airbus opted to change its mix of customers and advance deliveries to aircraft lessors in order to minimize the overall impact on production rates. Boeing, in contrast, responded with aggressive production cuts aimed at avoiding excessive supply. That move led to a much slower uptick in deliveries after the correction.

In 2008, by contrast, the aerospace industry experienced slow growth in aircraft deliveries but not a full-blown contraction. The economic impact of the crisis was relatively short—less than two years—and the industry’s backlog at that point was at an eight-year record-high level, giving OEMs a substantial cushion for maintaining production rates even with cancellations. And because the industry was also more diversified regionally, it was insulated from declines in mature markets. Perhaps most important, OEM management teams did not decrease production. Decreasing production can make sense during a crisis, but it can have cascading consequences that take years to play out.

Risks remain for some platforms and markets. Our analysis revealed also that although the overall commercial aerospace industry will not likely face a downturn, there are clear challenges for management teams. The 7% per year delivery growth rate that the industry has enjoyed since 2004 is projected to drop by more than half within the next three years to a compound annual rate of just 3%, owing, in large part, to limits on production capacity. In addition, the industry’s net book-to-bill ratio—firm orders booked, minus cancellations, divided by deliveries—has fallen below 1 for the first time since 2008.

More pressing, both OEMs and suppliers are vulnerable to risks in individual markets where they generate a significant portion of sales for an individual platform. For example, approximately two-thirds of Boeing’s order backlog for the 777X is from carriers in the Middle East, which is exposed to economic and geopolitical instability.

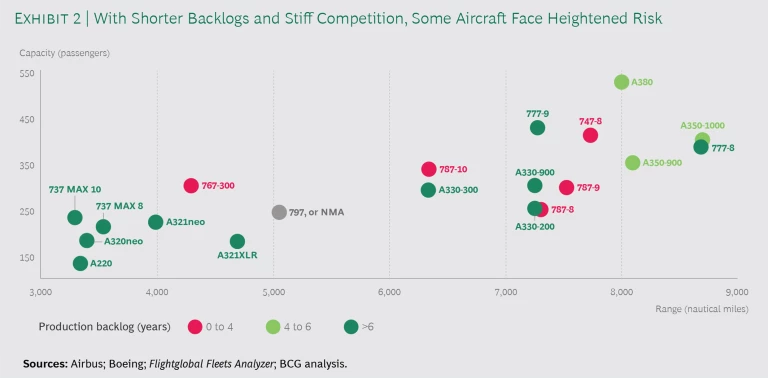

Furthermore, there is platform-specific risk, which can lead to increased competition and even cannibalization within a company’s portfolio, particularly for platforms that offer similar range and capacity. And some platforms with generally lower order backlogs could face problems due to economic instability. This could have spillover effects across the entire ecosystem—including suppliers and maintenance, repair, and overhaul providers—that supports that platform.

To identify the greatest risks, we segmented the order backlog by, for example, range and passenger capacity and production backlog. (See Exhibit 2.) That perspective shows that for several platforms—most notably the 787—the backlog is less than four years. In fact, Boeing recently increased its production of the 787 from 12 to 14 aircraft per month, subsequently announcing, however, that it would reduce production to 12 in late 2020. Given that a prolonged backlog cushioned the industry from economic stress during the 2008–2009 financial crisis, the much shorter backlog for this model could mean problems if the global economy and international air travel were to slip. To be clear, Boeing is well diversified across platforms, but any suppliers with concentrated exposure to the 787 should be concerned.

Investors are watching. Compounding these challenges, investor expectations—measured by valuation multiples for the stocks of aerospace OEMs and suppliers—are at historically high levels. In this environment, management teams face real pressure to continue creating value in order to meet those heightened expectations, especially as production growth rates are set to slow down. Companies need to find new ways to spur earnings growth—by expanding into adjacent markets and segments or increasing the efficiency and per-unit margins of products currently in the portfolio.

Proactive Steps for OEMs and Suppliers

The key takeaway of our analysis: companies need to take the right measures when market conditions are positive—now, for example—to position themselves for a period of slower growth. We see three imperatives:

- Analyze and reduce risk. First, companies should analyze their platform-specific risk in terms of both shorter-than-average order backlogs and exposure to volatile regional markets. This is particularly important for suppliers that may have a sizable share of their revenues tied to a single program. While it’s impossible to anticipate every possibility, companies should have strong scenario-planning processes focused on determining risks to their business from, say, a major regional conflict, a change in political direction, or any other factor that could lead to significant backlog deterioration and changes in production rates. If the portfolio is highly concentrated, the company should consider changes to its go-to-market strategy. For example, it could target new bid opportunities on existing or future programs.

- Create more flexible production. The production systems and supply chains of commercial aerospace OEMs are extremely complex, and the industry is notoriously slow to change production rates. Managing such changes in the diffuse and global supplier base is very difficult. For example, the grounding of the Boeing 737 MAX could have provided Airbus with an opportunity to take business from Boeing, but Airbus hasn’t announced any change in production rates. The possibility of regional economic downturns is yet one more reason to develop an ability to inject more flexibility into production.

The possibility of regional economic downturns is yet one more reason to develop an ability to inject more flexibility into production.

- Identify new sources of growth. As delivery growth slows, companies that aim to maintain their current trajectory will need to pursue new growth opportunities. Companies have some key attributes in their favor. Most have solid cash flow, and there is very little downside risk to the industry, so they can be bold in how they take on the growth challenge.

One way to generate growth is through acquisitions. In the current environment of stable cash flow and little downside risk, companies can afford to be aggressive about M&A, and our analysis shows that dealmakers in aerospace and defense have posted outsize returns. Specifically, companies that have spent, on average, more than $1 billion on M&A each year over the past five years generate a considerably higher five-year average annual total shareholder return (14%) than companies that have opted to stay on the sidelines and invest less than $25 million per year during the same period (4%).

In the current environment of stable cash flow and little downside risk, companies can afford to be aggressive about M&A, and our analysis shows that dealmakers in aerospace and defense have posted outsize returns.

Vertical integration can lead to new growth as well. In particular, the aftermarket business is cycle neutral or even counter cyclical, offering high margins that allow companies to capture—or recapture—value across the entire life cycle of an asset. In contrast to OEMs and tier one suppliers, aftermarket providers are still highly fragmented and provide meaningful growth opportunities for players that can successfully identify, acquire, and integrate a number of smaller players to establish a strong position. Businesses that are engaged in parts, repairs, modifications, and used serviceable materials are all attractive possibilities. Investments in digital areas such as predictive maintenance will allow companies to provide greater transparency and improve maintenance, repair, and overhaul process planning to improve customer satisfaction and add value in new ways.

Companies should invest in digital initiatives both to unlock growth and to improve margins. Compared with other industries, commercial aerospace is a global leader in leveraging artificial intelligence and advanced analytics in areas such as predictive maintenance and improved aircraft operations. However, the industry is relatively immature in leveraging digital to address costs. To reduce unit costs, executives should explore opportunities such as digital supply chains, digital twins, and digital control. A crucial aspect of digital transformation is identifying, prioritizing, applying, and scaling up from the right use cases.

Even though geopolitical uncertainty and economic risks loom on the horizon, commercial aerospace will not likely see an industry-wide downturn in the near future. Some management teams may be tempted to let their guard down, but that would be a mistake. As our analysis shows, there are still pockets of risk for some platforms and regional markets, and the overall industry is shifting to decelerating growth—essentially, slowing down—in the face of accelerating investor expectations. This environment favors companies that proactively identify and mitigate risk in their portfolio and continue to seek growth wherever they can find it.

It’s not raining yet, but these no-regret moves will position a company to thrive, leaving it better equipped to handle the inevitable storm.