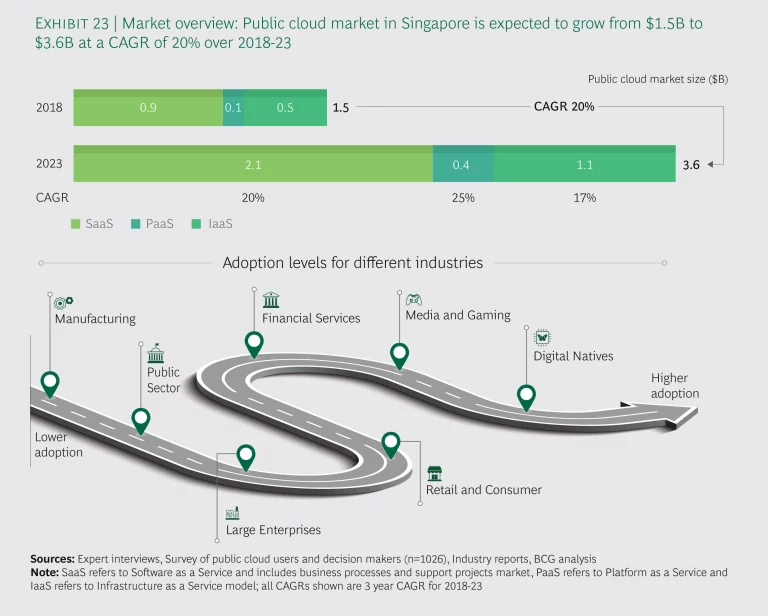

Singapore is one of the most advanced public cloud markets in the APAC region. Investment in the public cloud is expected to grow at a CAGR of 20% over the next five years, from US$1.5 billion in 2018 to about US$3.6 billion in 2023, which at 0.4% of the GDP is one of the largest public cloud spending-to-GDP ratios of all six markets (See Exhibit 23).

The government itself has adopted an active policy to promote use of public cloud for its systems, except the most sensitive, and there is significant traction across most industry verticals, especially digital native businesses. Financial services institutions, retailers, media companies and public sector organizations are also active users.

Most large enterprises in Singapore have begun to use some form of cloud storage or computing, and are starting to tap into more advanced use cases such as artificial intelligence and machine learning. The SaaS model currently has the largest share of the market, at 45%, but with interest growing in operating advanced applications over the cloud, the PaaS model is the fastest growing segment, projected to grow by about 25% between now and 2023.

Industry adoption

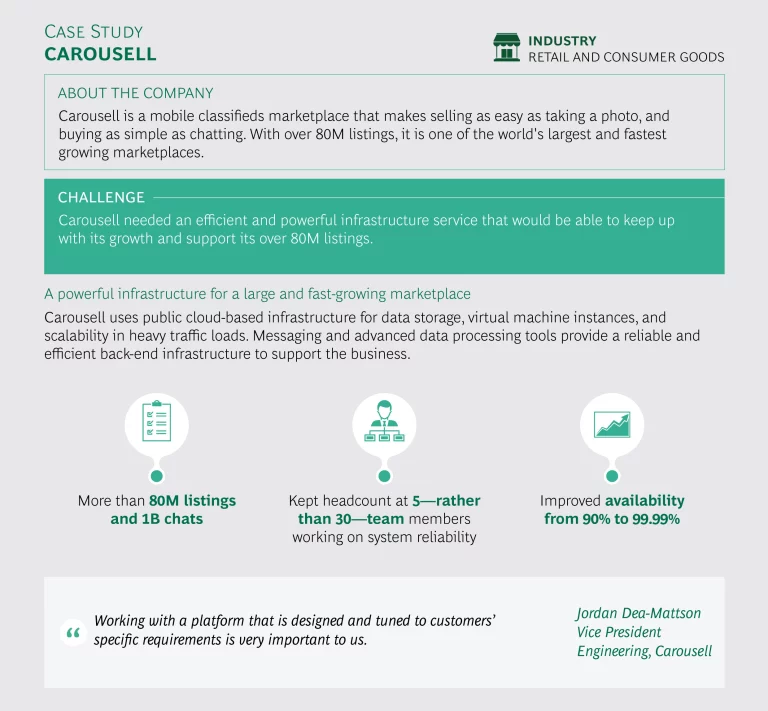

Digital native businesses are the largest users of the public cloud in the market. As businesses that are heavily dependent on having a reliable and scalable technology infrastructure, many started out using the public cloud from their incubation, and as they grow and expand into other markets in the region, have further developed the scalable infrastructure. Carousell, a large mobile marketplace for classified listings, is an example of a company using the public cloud to assure that it has the infrastructure to support continued growth (See Carousell case study).

Many DNBs say that the public cloud has allowed them to operate in an agile way because of the relatively low upfront capital expenditures and the infrastructure resources they get from the cloud service provider.

“If we’d had to build our own data centers, I would have needed an infrastructure operations team comparable in size to my current tech team.” —Head of Engineering, e-Commerce company

Prime Minister Lee Hsien Loong has encouraged the government sector to adopt public cloud-enabled technologies that will "re-engineer" and "re-design" the way the government operates. Singapore’s Government Technology Agency (GovTech) and Smart Nation and Digital Government Office (SNDGO) were created to drive the digital transformation of government, build the public sector's long term capabilities, and promote public cloud adoption in both the public and private sectors. These agencies are playing a significant role in orchestrating a cloud-first policy within all government departments.

To make public cloud adoption easy, there is the Singapore Government Technology Stack (SGTS), a platform that enables government agencies to build and test new applications with shared software and infrastructure services, and additional support from the Infocomm Media Development Authority (IMDA), which helps users clarify the security responsibilities of cloud service providers and sets standards for accountability and transparency.

Most government organizations are starting to move non-critical applications onto the cloud, as well as using it for citizen e-services. Although the government has a private government cloud (G-Cloud), it has developed a set of internal standards that enable interoperability between the G-Cloud and public cloud. The use of the public cloud by government agencies has had a positive signaling effect on industries.

DNBs and government agencies have been the main drivers of cloud adoption to date, but other active users include financial institutions, retail players, media companies, and large enterprises across industries.

Most of Singapore’s largest financial institutions are using the public cloud in some form. While there has been limited use of the public cloud for core banking applications so far, banks and financial institutions are using it to deliver web and mobile offerings for a better customer experience, deploy artificial intelligence and machine learning applications that help them personalize their customer engagement, and increase the efficiency of their business processes.

“By being a leader in adopting cloud technologies, we can iterate and deliver products to our customers at a much faster rate and increase our energy efficiency, as well as drastically reduce our carbon footprint.” —CIO, BFSI player

Large corporations, including traditional ones, are aggressively adopting public cloud to provide digital services, drive personalization, and run advanced analytics. It has made it possible for long-established companies to provide new services such as e-commerce, personalized in-flight entertainment, and automated logistics.

The public cloud has also gained traction in the manufacturing industry, especially for enterprise applications and customer-facing applications, with a growing interest in deploying it for core operations.

Smaller businesses have government support that has made it possible for them to adopt the public cloud at much faster rates than in the other five APAC markets. IMDA has a program in which it appoints partners to offer consultancy and training to equip DevOps teams at small businesses with cloud-native digital capabilities at subsidized fees. In a four to six month training period, the small business can work with an expert to develop a cloud plan, receive certification in cloud-native applications, and develop applications for their business.

Key benefits

The key benefits identified by users of public cloud include:

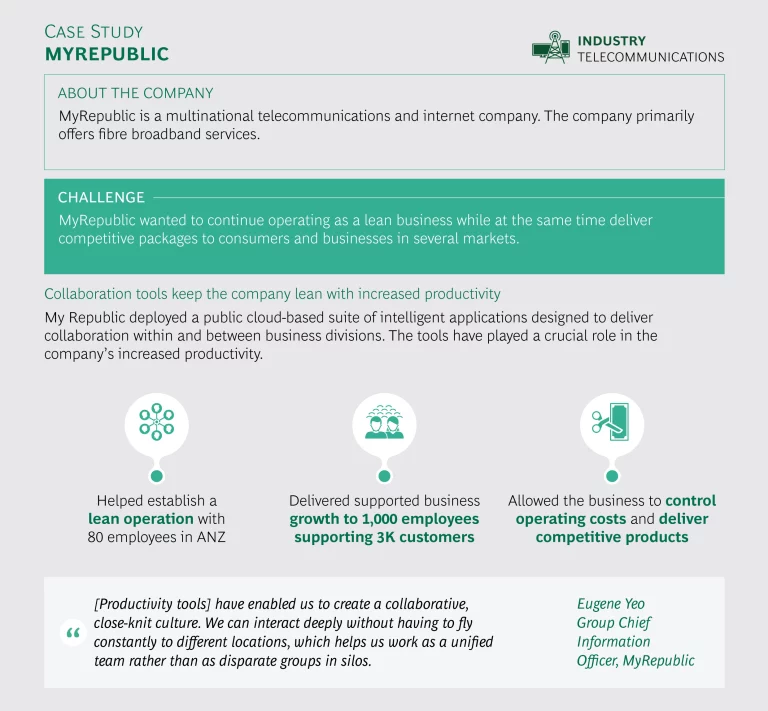

Higher team productivity. Numerous companies are using internal and external collaborative tools such as document sharing, communication apps, and other basic features of products based on public cloud that allow them to accomplish tasks more efficiently and focus on growing the core business.

The telecommunications company My Republic has found the public cloud invaluable in reducing operating costs while also developing competitive packages that have helped expand its customer base (See My Republic case study).

Faster time to market for products and services. The ability to try and ‘fail fast’ is invaluable to DNBs, large enterprises, and traditional companies alike. The public cloud allows faster iterations of prototypes, with launch costs which are generally lower than those that can be achieved with comparable on-premise architecture.

Enhanced ability to launch new products and services. Also important to users are the data analytics capabilities they can develop over the public cloud. Advanced data analysis is a key enabler in designing newer products and services for a targeted customer base in such areas as e-commerce, ride-sharing, and media content. Singapore Press Holdings, an established media company, is using the public cloud as it expands to online platforms in order to analyze audience data in ways that allow them to provide more relevant content for viewers alongside targeted advertising, thus driving audience engagement as well as advertisement revenues. The cloud has also made it possible for the company to increase collaboration internally between business units, thereby enhancing productivity (See Singapore Press Holdings case study).

Better security. Singapore is a fairly advanced market in which public cloud users understand the product well, and have easy access to transparent information about cloud security. Many told us they have no worries about security at all.

“A few years back when we were starting our journey, we evaluated security, and even then the public cloud was better. Today they have scaled up security features even more,” —CIO, Global manufacturing company

Scalability and flexibility of infrastructure. The scalability of the public cloud infrastructure is an important benefit, particularly to companies that have ebbs and flows in their server traffic, such as startups trying to meet customer demand. As more companies use artificial intelligence, machine learning, big data and other advanced technologies, they will need to have a scalable, flexible infrastructure in place to tap into all the possible uses of these advances.

“Scalable deployment of artificial intelligence and machine learning will be the biggest advantage of the public cloud in the coming days. This will significantly enhance decision making capabilities in businesses.” —Senior VP, Global manufacturing company

Key challenges

The key challenges identified by users of public cloud include:

Legacy migration cost and risk. This is a particularly fraught issue for large enterprises facing the task of migrating and integrating their existing databases and applications to the public cloud, including banks and other financial services players, large enterprises in all industries, and established public sector agencies.

Complexity of managing multi-cloud environment. A multi-cloud environment is important to users that have a wide range of applications to deploy on public cloud so that they can benefit from the expertise of a variety of providers. They want the flexibility to choose the best service providers for their needs, and avoid being locked in with any one vendor. Yet operating in a hybrid environment that includes on-premise architecture, private cloud and multiple public clouds is a complex undertaking. There are concerns about system compatibility across different providers, and there is a need for technology solutions to manage the environment more effectively.

Businesses are examining what the appropriate strategies are for their partnerships with vendors, as well as how to train their internal teams so that they can optimize their use of the provider’s infrastructure over the long term.

Gaps in organizational capabilities. Businesses that use the public cloud or are planning to migrate will need an abundant supply of digital talent. Like other APAC markets, Singapore is facing a shortage of public-cloud trained IT professionals. In selecting a cloud provider, organizations look for one with services that are easy to use so as not to strain their internal team capabilities, but a provider that offers advanced training is also highly valued. What is particularly needed is a greater emphasis on practical hands-on training and certification programs so that Singapore has a pool of IT specialists who understand the day-to-day aspects of running applications on the public cloud, and how to utilize it to develop new capabilities.

The economic impact

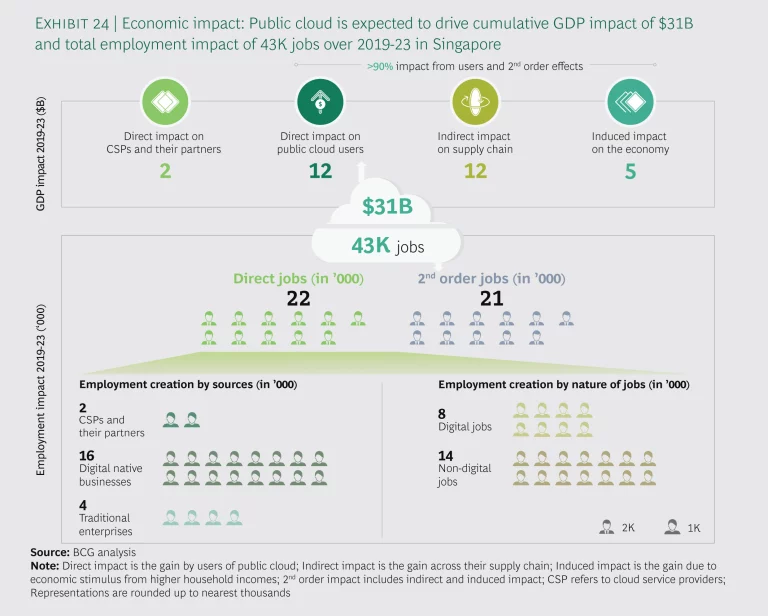

The overall cumulative impact from direct, indirect and induced sources between 2019 and 2023 is expected to be US$31 billion, if CSPs continue to launch new products and services, deployment continues to expand rapidly, and policymakers keep their existing stance on public cloud deployment (See Exhibit 24). When annualized, this is a sum equivalent to 1.7% of annual GDP, 70% of the annual impact from the hospitality industry, 20% of that from the logistics industry, and 15% of that from financial services.

An estimated 90% of the impact will come from the gains to industry verticals in Singapore, while only 10% of the impact will be from the direct gains experienced by cloud service providers and technology services. Enhanced business revenues will be the key driver of these gains.

Public cloud usage stands to create 22,000 direct jobs over the next five years. About 14,000 of those jobs will be in non-digital roles such as sales, marketing, human resources, finance, logistics and operations. Another 8,000 of those will be digital jobs, 2,000 of which will be with cloud service and IT system providers and the remaining 6,000 within industry verticals—representing approximately 4% of the current information and communications technology workforce.

The second order effects are expected to influence another 21,000 indirect and induced jobs, bringing the total potential jobs that are offshoots of public cloud use to 43,000, equivalent to 1.2% of the current workforce. A large proportion of these jobs will likely be taken up by the existing workforce after their retraining and upskilling.

Two alternative scenarios

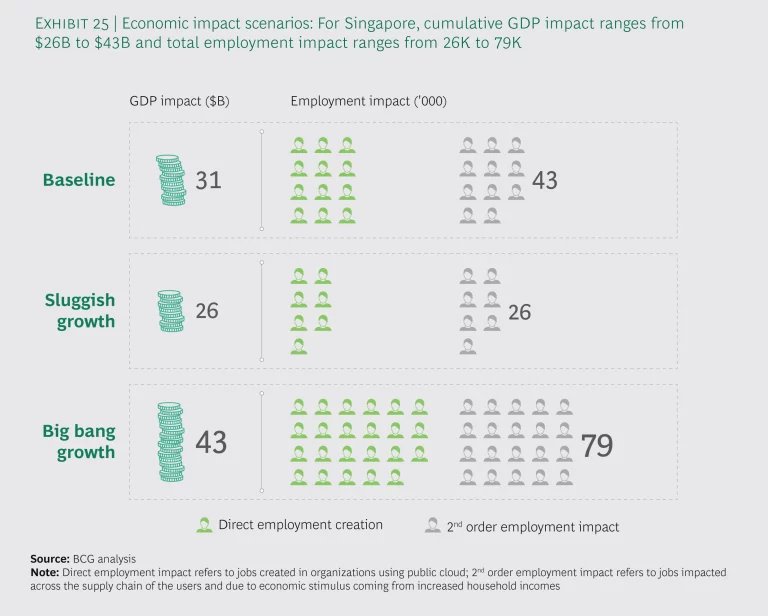

The economic impact we have assessed above is the Baseline Scenario, but we have drawn up two additional scenarios. The Big Bang Growth Scenario and the Sluggish Growth Scenario show the economic impact that would occur if the forces that shape the public cloud market cause growth to either speed up or slow down. If either of these scenarios were to unfold, the full cumulative economic impact of the public cloud could vary by a difference of US$17 billion between 2019 and 2023 (See Exhibit 25).

The Big Bang Growth Scenario. In this rapid-growth scenario, Singapore’s ‘Smart Nation’ initiative to achieve better living through technology would succeed in further transforming Singapore into a highly digitalized society, including in e-government services. The government’s success in enhancing its services through public cloud would continue to create a signaling effect that spurs new digital native businesses and digital transformation of larger enterprises. This growth would lead to heavy demand for cloud-savvy talent, but providers, users and government agencies will work together to create the training programs that are needed to effectively manage the talent pipeline.

If these factors come together, a CAGR of 23% would lead to a total economic impact as large as US$43 billion between 2019 and 2023, or 2.2% of GDP. About 42,000 jobs would result from the direct impact, with another 37,000 influenced by the second order effects.

The Sluggish Growth Scenario. This scenario would be the outcome if Singapore were to lose its present status and relevance as an important regional digital hub. That situation would arise primarily from neighboring countries increasing protections around their data flows, although Singapore’s business as a regional hub could also decline if neighboring countries improve their infrastructure. Within its own borders, too, there is a risk of growth slowing down if Singapore is unable to develop a digital talent force large enough to meet the demands of a rapidly growing public cloud market. The city-state needs to continue to address its cloud-native talent gap through a combination of university programs for newer graduates as well as retraining and upskilling existing workforce in advanced technologies.

If these circumstances were to drag down growth, a CAGR of 14% would bring the cumulative economic impact down as far as US$26 billion, or 1.4% of annual GDP. The jobs that arise directly from public cloud usage would amount to around 13,000, with another 13,000 influenced from the indirect and induced impact.

Although Singapore has an advanced public cloud market, it stands to gain significantly from a greater push on the part of government and industries to create an even more digitalized society. As a regional digital hub, Singapore has an important role to play in orchestrating frameworks around cross-border data sharing, thereby influencing the further development of regional standards on public cloud utilization of cloud. At the same time, as other countries in the region develop their public cloud use, Singapore will need to build the strength of its own market. Part of the push should involve extensive practical training so that Singapore’s business community can develop the next generation of talent to meet the growing demand for public cloud experts who can help drive digital transformation in their organization. A stepped-up effort to make it easier for all businesses, large traditional sectors and SMEs alike, to use the public cloud for transformative strategies would make a notable impact upon Singapore’s GDP and employment. These efforts would serve the additional purpose of mitigating the risks that come with being a regional public cloud hub. Optimal growth will make the market resilient, whether or not neighboring countries need Singapore’s public cloud infrastructure.