When B2B companies let technology drive their pricing governance models, they can lose sight of their strategic objectives. Smart pricing authority keeps them on course.

What is the “job” of pricing in a B2B company?

The answer depends on whom you ask. And that’s a symptom of a deeper problem faced by nearly every B2B company, regardless of sector or size: how to keep sales, pricing, and management teams aligned around a common objective. Put more precisely: what governance model will ensure that these teams work in harmony to maximize the value the company can derive from pricing?

Pricing governance may not be as sexy as pricing strategy, dynamic pricing, or anything connected to AI, but no sales operation works for long without it. Governance models determine how business intelligence, pricing authority, and negotiating agility are managed and distributed throughout an organization. These models have evolved in many industries as competition has intensified, analytical power has increased, and pricing science has become more advanced—but they inevitably create conflicts that often require uncomfortable tradeoffs.

We envision a new approach to B2B pricing governance, one that combines the best aspects of those that came before it without forcing the same tradeoffs. This model—which we call “smart pricing authority”—empowers talented sales individuals and teams to pursue the most attractive customer opportunities and strike deals that maximize value for the company and the customer.

Smart pricing authority combines the best aspects of previous models without the tradeoffs.

Smart pricing authority provides sales with considerably more freedom than prevailing governance models, expanding the pricing framework beyond a narrow “optimize price levels for profit” mandate. Based on our experience working with hundreds of companies across sectors, we believe price-to-quantity algorithms should be only one part of an overall framework, not its core. At a time when these pricing “black boxes” count as state of the art, smart pricing authority allows sales and pricing teams to focus on the full merits of a potential deal—and its contribution to overall company performance—rather than on the accuracy of a black box’s price output.

The Current Pricing Models—and Their Limitations

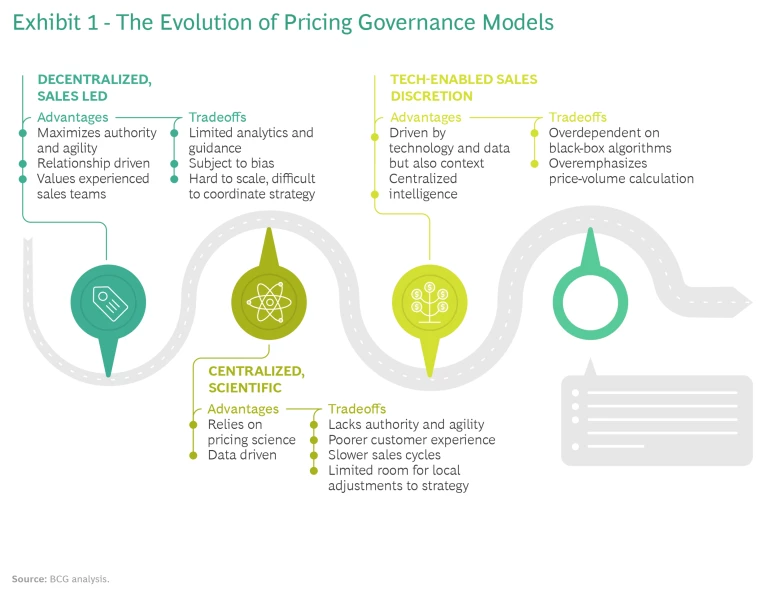

To understand the genesis of smart pricing authority, its advantages, and how to implement it, let’s first examine the strengths and weaknesses of the prevailing governance models. (See Exhibit 1.)

Decentralized, Sales Led. The classic “low tech” sales model was decentralized and mostly managed by the salespeople themselves, who established and nurtured relationships with their customers. B2B companies would grant significant price discretion to their sales organizations, who relied on the experience and gut feelings of their salespeople to make price decisions and close deals. They did not rely heavily on centralized information or insights, save for basic segmentations derived from easily observed parameters such as volume, geography, and industry.

This model tends to work best when customers have limited bargaining power, customer concentration is low, and companies have sufficient margins to tolerate profit leakage. Many industries prospered under this low-tech model, and many still use it today. But from a portfolio or company-wide perspective, the model can look undisciplined, if not chaotic. Whenever we help a company at this stage map its price realization by revenue or volume, the result is often a scatter plot with no visible rhyme or reason; our experience shows that the greater the apparent randomness, the further the company is from implementing better pricing governance.

Tighter revenue management discipline can stop revenue leakage and yield significant margin opportunities. We recently helped an enterprise telco company identify revenue leakage of as much as 550 basis points, well within the range of 400 and 800 basis points of margin opportunity we typically observe for companies at that maturity level.

Centralized, Scientific. The somewhat undisciplined nature of the decentralized model has prompted many companies to limit sales’ pricing authority and switch to centralized, data-driven price decisions. The logic was simple. A central staff of pricing professionals could ensure pricing consistency thanks to the availability of large data sets, advanced analytical power, and algorithms that set strategically optimal prices. This centralization would also take tedious administrative tasks away from salespeople, allowing them to spend more time with customers.

For many companies, this centralized, scientific governance fulfilled its objectives and led to sustainably higher margins. But it also created new problems. Decision making slowed down and deals took longer to close, often because the salespeople and pricing teams would negotiate internally about prices before negotiations with the customer even began. Tighter price corridors therefore came with longer lead-to-close times and higher overhead costs. While the ROI of this governance model is undeniable relative to the decentralized sales-led model, it is suboptimal from the perspectives of customer experience and organizational effectiveness. This model also struggled to provide the needed flexibility as markets became more fluid and companies needed to make strategic and tactical adjustments faster.

Tech-Enabled Sales Discretion. The pendulum started to swing away from the centralized command-and-control approach when companies moved to a model that we call tech-enabled sales discretion. Further advances in technology and pricing tools came to the rescue with a seemingly unbeatable solution to break the tradeoff between centralization and decentralization: software solutions that enabled sellers to create pricing and deal scenarios based on a standard set of parameters.

From our observations, this is currently the dominant governance model. The level of sophistication varies across companies, but the underlying logic is similar: define customer segments, then establish price corridors for each one, demarcating the range of acceptable prices for a given set of inputs (for example, volume of transaction, segment, and product mix). When salespeople input deal-specific information, they get back either a price point or a narrow range within the price corridor.

One weakness of tech-based pricing: sudden changes in market conditions can render the algorithms useless.

When implemented properly, this model drives both price effectiveness and efficiency and is considered a best practice. But like the previous models, it comes with its own set of problems: sales teams’ general distrust of the algorithms and their black-box solutions, a dramatic increase in escalations, and the natural compulsion of pricing teams and salespeople to override not only the output of the algorithms but also the data that feeds them. The COVID-19 pandemic exacerbated yet another weakness: sudden changes in market conditions can render the algorithms useless in some cases, as the historical data and established interrelationships no longer apply to current and future conditions.

Among some companies there is also the impression that their investment in these systems, which can cost millions of dollars, obviates the need to manage incentives and soft skills. Such a lapse risks turning sellers into mere order-takers who lack the training and the incentives to identify and exploit value tradeoffs. In the worst case, companies effectively regress to the results that the low-tech model yields: no apparent connection between the size of a deal or a customer and the price that customer receives.

How Smart Pricing Authority Resolves These Tradeoffs

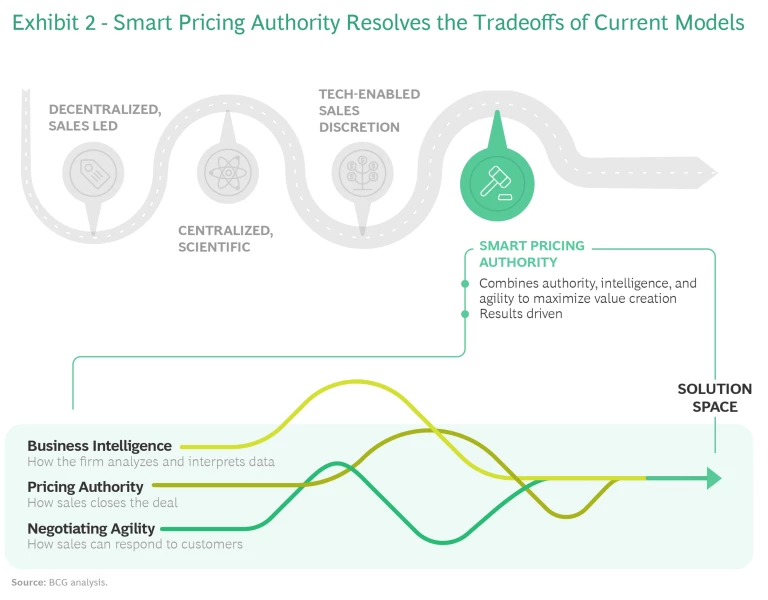

Each of the models above evolved as a technological response to the limitations of those that preceded it—and each created a new set of problems. The result has been an ongoing shift between centralized and decentralized pricing approaches. Smart pricing authority helps companies find the right balance, combining the advantages of previous governance models while avoiding their pitfalls.

Smart pricing authority is not a natural outcome of the technological and pricing science advancements that make it possible. Rather, it is a conscious strategic decision on how to combine business intelligence, pricing authority, and negotiating agility in ways that make them mutually reinforcing. (See Exhibit 2.)

The precise terms that we used to describe the pillars of smart pricing authority depart from conventional nomenclature in order to capture the broader mandates behind each one. We prefer “business intelligence” to “analytics” because advanced analytical horsepower is a necessary but not sufficient condition to feed pricing decisions with the right intelligence. “Negotiation agility” describes the wider benefit we envision for sales teams as opposed to the more narrow term “sales velocity.” Meanwhile, we refer to “pricing authority” rather than “price discretion,” the latter of which implies only a minimum level of freedom from algorithm-led decisions.

Business Intelligence. The “job description” of this pricing component includes setting up the framework by assigning and quantifying the roles that contextual segments and products play. Contextual segmentation in this case includes dynamic demographics, performance profiles, and behavioral tendencies. When product and market complexity increase, it becomes difficult to do a segmentation in a rigid, classical way. A company that might have four segments in a classical sense could have dozens of contexts that could match the deal at hand. Fast, detailed analyses allow internal pricing teams to put a potential deal into the right context and help salespeople make the right decisions.

The central function also serves as a bulwark against biases that can influence salespeople when they get swept up in the moment. Salespeople tend to remember their most recent successes or failures without taking the entire constellation of deals into account, while outlier bias prompts them to recall times when they overrode or “beat the system” without realizing those occasions were rare and most likely nonrepeatable.

Negotiating Agility. Agility is the seam that binds business intelligence and pricing authority, enabling the rapid flow of information between lean central pricing teams and sales teams. This goes beyond simply equipping the salespeople with a tool such as a handheld device—it also encompasses how that tool makes response times faster and responses themselves more credible.

Pricing Authority. The underlying principle of smart pricing authority is that talented salespeople are best positioned to understand—within a defined “solution space”—how to best position their offer and pull various levers without consultation or escalation. It gives sales individuals and teams more freedom within a broader strategy and profit framework, so that price level alone no longer determines whether a deal is good or bad. The technology solution informs and recommends, rather than taking the “inform only” or “inform and dictate” approaches of other governance models.

Three things stand out in the description above. First, we refer to the salespeople as “talented” because correctly using the degrees of freedom within a solution space requires specific skills and training. Second, we explicitly cite individuals and teams because companies need to plan the members of the negotiating teams to reflect the size and complexity of the deal. Not all situations can be handled optimally by an individual salesperson.

Finally, the term “solution space” offers a critical distinction from traditional sales guidance such as price corridors with floors, ceilings, and targets. In a solution space, price is one flexible parameter among many others, such as contract terms, service level, and portfolio. The success of the deal is measured along all of these dimensions, rather than placing a disproportionate focus on the price point. The agility to access a solution space and operate within it confers a sort of bionic power on B2B salespeople—who can now rely on their own experience, enhanced by real-time analytics best performed by AI applications rather than by humans.

In a solution space, price is one flexible parameter among many others.

The accompanying value-centric incentives hold all parties accountable for explicit outcomes such as total customer profitability or total portfolio profitability rather than for weaker proxies for results such as price realization, deal size, or win rate. This harmonization marks an important shift, because most companies tend to see sales and executive incentives as distinct from pricing and from each other. While healthy tension is unavoidable—and, in fact, desirable—the smart pricing authority model unifies these incentives around a common objective: maximum value creation.

Beyond the direct financial benefits, smart pricing authority is a more powerful and lower-cost governance model. It requires a smaller central team and enhances the attractiveness of the sales role because salespeople can make more decisions autonomously within the solution space, without the need for time-consuming and conflict-prone internal consultations.

Implementing Smart Pricing Authority

Successful migration to smart pricing authority changes a company’s governance, technology, and incentives. It involves these steps:

- Articulate the role and intent of each segment, channel, and product in your portfolio. Pricing models should distinguish between core customers and outliers, the atypical customers that can serve as a significant source of value. A financial services company, for example, may conclude that its large key accounts form a profit center well protected from competition. Those profits will fund strategic investments in the e-payments space, where competition is more dynamic. The distribution of customers within segments also matters more than the segment’s average performance.

- Understand the solution space for each customer. This has several dimensions, starting with the customer’s current and potential total value, both in absolute terms and relative to other customers. It also reflects what you are willing to do to tap that potential: What alternatives does the customer have? What are you willing to trade in a negotiation in order to close a deal? This task requires strong diagnostic and scenario-building capabilities that go far beyond the traditional narrow focus on price-quantity tradeoffs.

- Set and manage the framework. This is the primary role of the central pricing team. That phrase might conjure up the image of an army of pricing specialists. But this new mandate requires a much smaller team to maintain tools and analytics at a state-of-the-art level. The team sets and manages the framework and defines the parameters for the solution spaces, but it does not run or control every activity. This team also ensures that software follows strategy and not vice versa. Software is a necessary component, but by no means is it sufficient.

- Define an integrated reporting system. Smart pricing authority requires much stronger reporting than prior models. Because decision making is widely distributed rather than concentrated in a central team, reporting needs to be integrated across multiple functions and have clear metrics that product, operations, manufacturing, sales, and marketing can understand and align on. Reporting also serves as the basis for sales incentives, which are linked to total customer value. Integrated reporting also exposes areas where the framework is off, allowing the central team to quickly identify the source of misalignment, make any needed adjustments, and communicate the changes.

Several factors can slow progress toward a more sophisticated model, including entrenched legacy systems, internal and market inertia, and the hard reality that pricing might not be a high corporate priority. An organization will struggle to follow the steps listed above unless the person with the ultimate profit-and-loss responsibility owns the process. In some companies this responsibility rests with the head of a business unit, while in others it rests with the CEO.

We have supported hundreds of clients in their efforts to evolve their revenue management practices, tools, and processes. The starting point is never the same and the exact end state may vary, but our experience has shown that companies can make a successful—and rapid—transformation to smart pricing authority regardless of their current governance model. Such transformations share two characteristics. First, they benefit from a test-and-learn approach, because there is neither perfect data at the beginning nor a perfect outcome from each step. Second, they tend to be self funded through a series of steps that put strategy ahead of tools and cross-functional coordination ahead of rigid processes.

Companies make the most of their investments in pricing teams and technology when they focus on the new job of pricing: maximizing customer value. That means creating the right solution spaces for salespeople rather than overemphasizing price points, and it means turning pricing professionals into revenue managers who advise sales teams based on models calibrated around product, promotion, contract terms, price, and service elements. With smart pricing authority, the eternal question of whether pricing should be centralized or decentralized becomes moot. When the focus of the organization is on achieving the best deal rather than the best price, the answer is a balance of both.